1/x Let’s talk about…monetary policy and The Fed *

*and central banks, hyperinflation, deflation, debt cycles, rates, bubbles, present-day, negative rates, and other thrilling concepts

*and central banks, hyperinflation, deflation, debt cycles, rates, bubbles, present-day, negative rates, and other thrilling concepts

2/x What to expect

To laugh, cry, and fall in love with international monetary systems all over again, as we attempt to breakdown down this complex topic and answer one question: when will we see hyper-inflation?

To laugh, cry, and fall in love with international monetary systems all over again, as we attempt to breakdown down this complex topic and answer one question: when will we see hyper-inflation?

3/x Disclaimer

I’ve never technically been chairman of the Fed, but my buddy @MonocleMan1 & I did meet Janet Yellen once, so close enough

I’ve never technically been chairman of the Fed, but my buddy @MonocleMan1 & I did meet Janet Yellen once, so close enough

4/x HISTORY 101

Our journey thus begins in 1944, a simpler time when WWII was ending, Bing Crosby dominated Billboard charts, and 730 delegates (maybe 400, depending on source) met in New Hampshire to negotiate the first world monetary order

I’m talking...Bretton Woods

Our journey thus begins in 1944, a simpler time when WWII was ending, Bing Crosby dominated Billboard charts, and 730 delegates (maybe 400, depending on source) met in New Hampshire to negotiate the first world monetary order

I’m talking...Bretton Woods

5/x After 3 weeks (and a lot of drama)

1. Exchange rates: USD pegged/convertible to gold at $35/oz., everyone else pegged to USD (note this is when became the reserve currency, more on this later…)

2. IMF and World Bank created

1. Exchange rates: USD pegged/convertible to gold at $35/oz., everyone else pegged to USD (note this is when became the reserve currency, more on this later…)

2. IMF and World Bank created

7/x FUN FACT

Bc by BW, US held 2/3rds of gold reserves...thx to FDR’s 1933 Exec Order 6102, which criminalized ‘hording’ /forced ppl to transfer gold wealth to gov& #39;t at 40% below ‘mkt price’ or risk fines ($200k in 2019$)...all bc the US needed to print money

Bc by BW, US held 2/3rds of gold reserves...thx to FDR’s 1933 Exec Order 6102, which criminalized ‘hording’ /forced ppl to transfer gold wealth to gov& #39;t at 40% below ‘mkt price’ or risk fines ($200k in 2019$)...all bc the US needed to print money

8/x ….The Fed.

If you think all your friendly, neighborhood central bank does is ignore asset bubbles its policies create & force nationalization of bad debt when things inevitably https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">, you’re wrong. It also made a New Keynesian dynamic stochastic gen equilibrium model ;)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">, you’re wrong. It also made a New Keynesian dynamic stochastic gen equilibrium model ;)

If you think all your friendly, neighborhood central bank does is ignore asset bubbles its policies create & force nationalization of bad debt when things inevitably

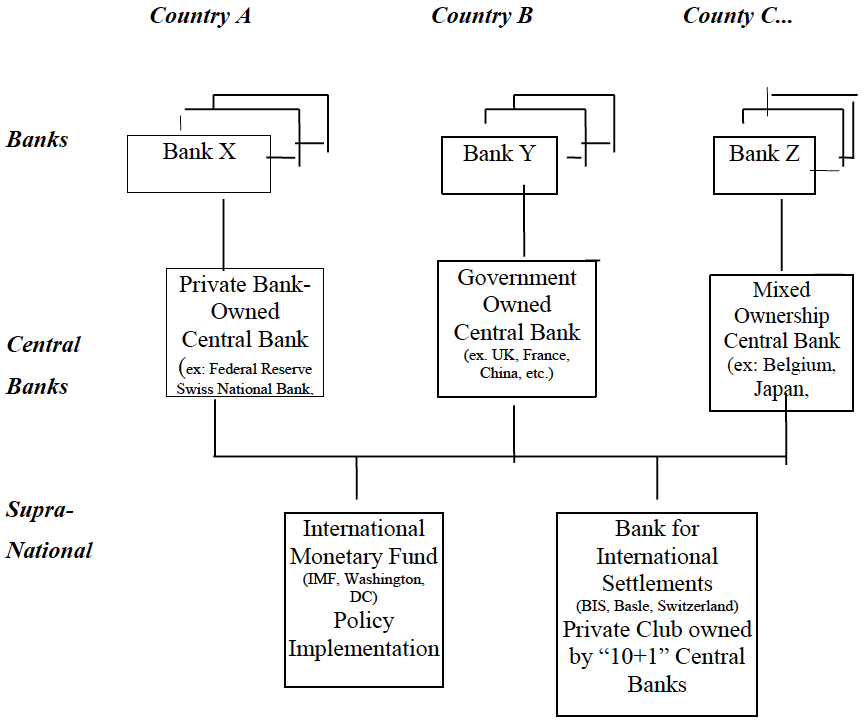

9/x in all seriousness The Fed does a lot, but mainly it& #39;s a privately owned system of 12 banks that conducts US monetary policy via 3 tools:

open market ops (FOMC)

discount rate & reserve req (Board of Govs)

(also conducts nerd policy via its research papers https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤓" title="Nerd-Gesicht" aria-label="Emoji: Nerd-Gesicht">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤓" title="Nerd-Gesicht" aria-label="Emoji: Nerd-Gesicht">)

open market ops (FOMC)

discount rate & reserve req (Board of Govs)

(also conducts nerd policy via its research papers

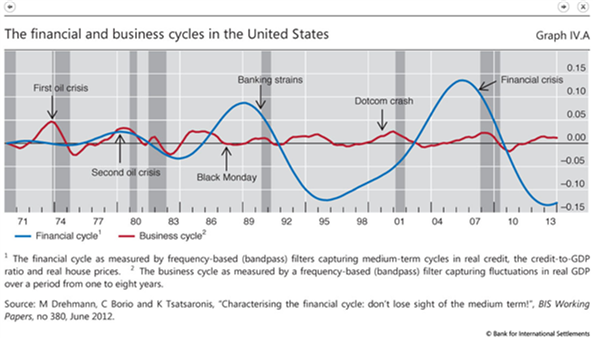

10/x The Fed& #39;s monetary policy can both contribute to & clean up debt cycles. A basic debt cycle in 5 phases:

*early

*bubble/peak (monetary policy typically stays loose)

*depression (ppl learn that their wealth is actually a lot of IOUs)

*deleveraging

*normalize

*early

*bubble/peak (monetary policy typically stays loose)

*depression (ppl learn that their wealth is actually a lot of IOUs)

*deleveraging

*normalize

11/x Fed& #39;s weapons against deflation...

(1) Rate reduction. most potent, until it hits 0%, then we move to...(2) Quantitative easing, which sounds fancier than "printing money" or "buying assets." Either way, effectiveness diminishes quickly, so to... (3) $$ in spenders& #39; hands

(1) Rate reduction. most potent, until it hits 0%, then we move to...(2) Quantitative easing, which sounds fancier than "printing money" or "buying assets." Either way, effectiveness diminishes quickly, so to... (3) $$ in spenders& #39; hands

12/x note, COVID-19 required helicopter money. And y& #39;all saved it/invested it in $AMZ instead of spending it like you were supposed to.

Bc of you the Fed now relies on (4) "forward guidance" and hopefully we never hit (5) negative rates

but where& #39;s inflation?!?!?

Bc of you the Fed now relies on (4) "forward guidance" and hopefully we never hit (5) negative rates

but where& #39;s inflation?!?!?

13/x Quick sidebar: a lot of ppl say hyperinflation when talking about the Fed printing money. #1: the definition requires rapid & excessive (i.e., 50%/month). #2: the Treasury Dept& #39;s Bureau of Engraving &Printing technically prints the $$

better: "unexpected inflation" https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

better: "unexpected inflation"

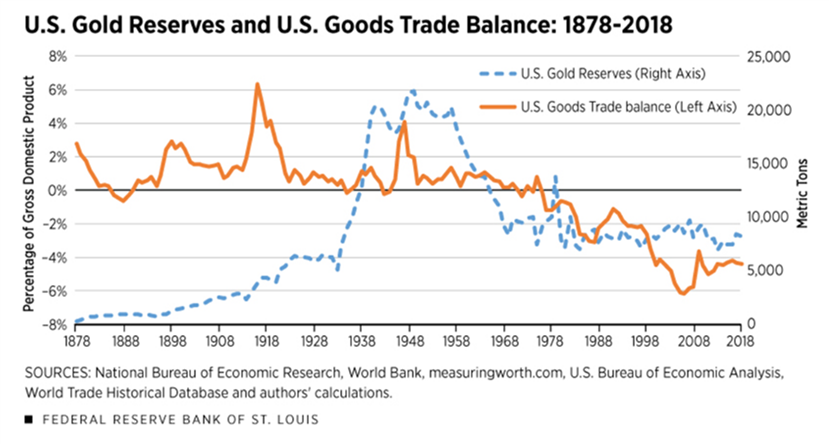

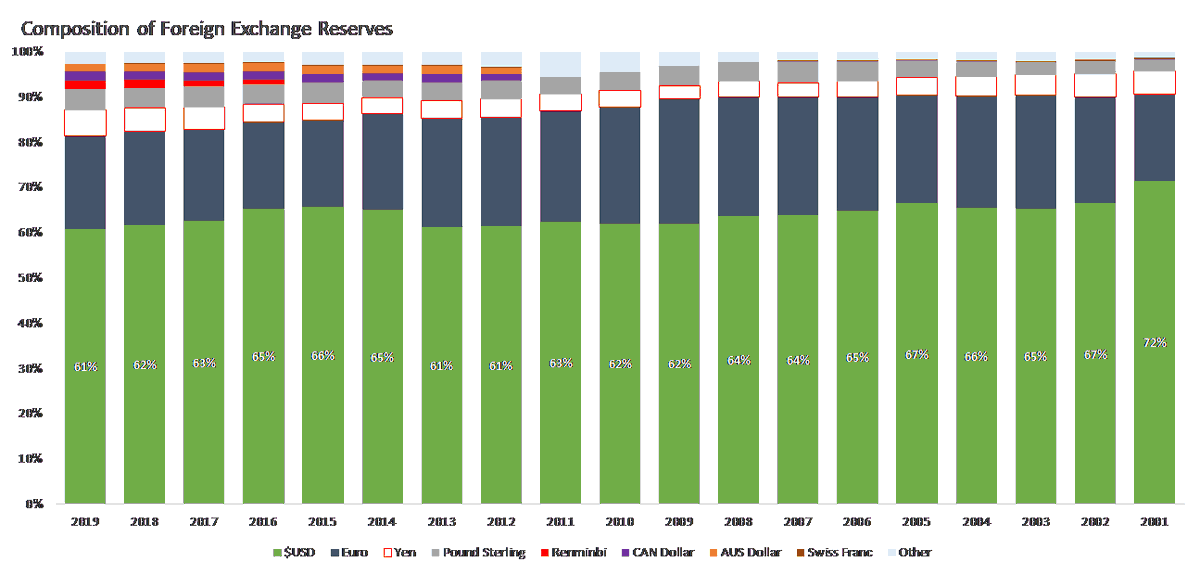

14/x: So tying this back to history!

Hyperinflation is nearly impossible because... RESERVE STATUS (carry over from an old monetary system we broke in 1971), bc 60% of foreign reserves are USD and it& #39;s the official currency of commodities pricing everywhere (for now)

Hyperinflation is nearly impossible because... RESERVE STATUS (carry over from an old monetary system we broke in 1971), bc 60% of foreign reserves are USD and it& #39;s the official currency of commodities pricing everywhere (for now)

15/x #Triffindilemma

USD’s status has effectively required a perpetual trade deficit so there are enough https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">floating (esp when ex-US growth>US). This confers what de Gaulle once coined “exorbitant privilege” to issue all this cheap debt and in our currency (inflation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💸" title="Geld mit Flügeln" aria-label="Emoji: Geld mit Flügeln">floating (esp when ex-US growth>US). This confers what de Gaulle once coined “exorbitant privilege” to issue all this cheap debt and in our currency (inflation https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚫" title=""Betreten verboten!"-Zeichen" aria-label="Emoji: "Betreten verboten!"-Zeichen">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚫" title=""Betreten verboten!"-Zeichen" aria-label="Emoji: "Betreten verboten!"-Zeichen">)

USD’s status has effectively required a perpetual trade deficit so there are enough

16/x closing thoughts, not fully covered above

a. fiscal & monetary levers create wealth imbalances

b. printing $$ isn& #39;t inflationary when it offsets evaporating credit

c. inflationary https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">is still possible if USD& #39;s reserve status is undermined

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">is still possible if USD& #39;s reserve status is undermined

a. fiscal & monetary levers create wealth imbalances

b. printing $$ isn& #39;t inflationary when it offsets evaporating credit

c. inflationary

Read on Twitter

Read on Twitter

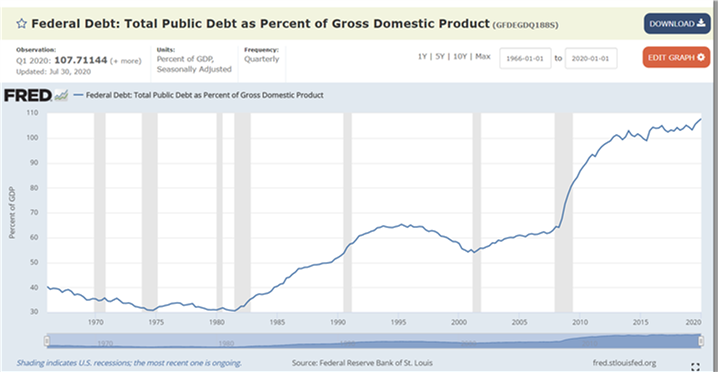

) #USA" title="17/x Also, read a JPM report written in & #39;09 that referenced US debt projected to hit 100% of GDP by 2040. Congrats on making it 20 years early America (https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Errötetes Gesicht" aria-label="Emoji: Errötetes Gesicht">) #USA" class="img-responsive" style="max-width:100%;"/>

) #USA" title="17/x Also, read a JPM report written in & #39;09 that referenced US debt projected to hit 100% of GDP by 2040. Congrats on making it 20 years early America (https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Errötetes Gesicht" aria-label="Emoji: Errötetes Gesicht">) #USA" class="img-responsive" style="max-width:100%;"/>