Banks funnelled over USD 150 Billion into companies driving deforestation since Paris Agreement, new @forests_finance data analyses shows.

Access the dataset here: https://forestsandfinance.org/data/

Follow">https://forestsandfinance.org/data/&quo... the tread to see graphs of the key findings

Access the dataset here: https://forestsandfinance.org/data/

Follow">https://forestsandfinance.org/data/&quo... the tread to see graphs of the key findings

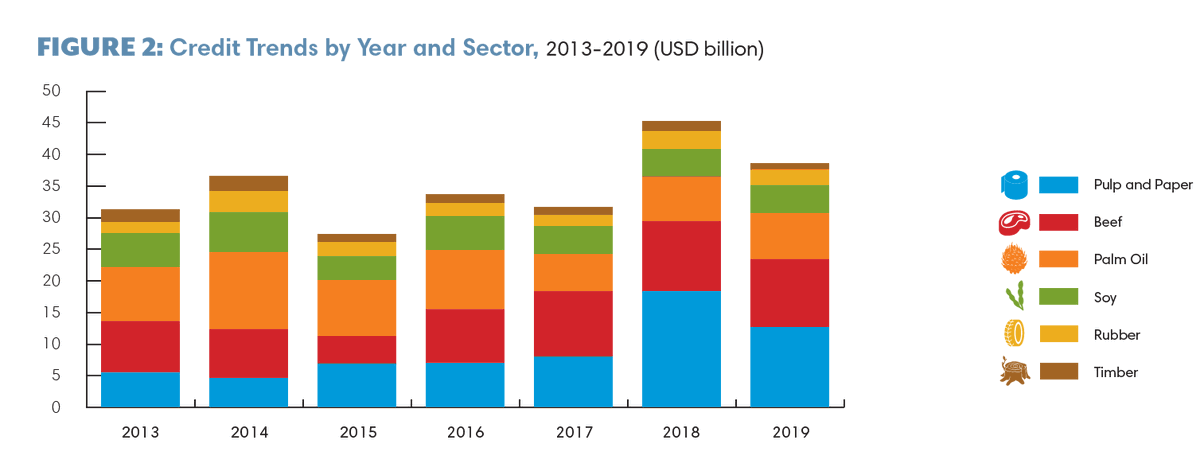

Despite multilateral and sector commitments, finance to the forest-risk sector only increased after the Paris Agreement was signed in late 2015.

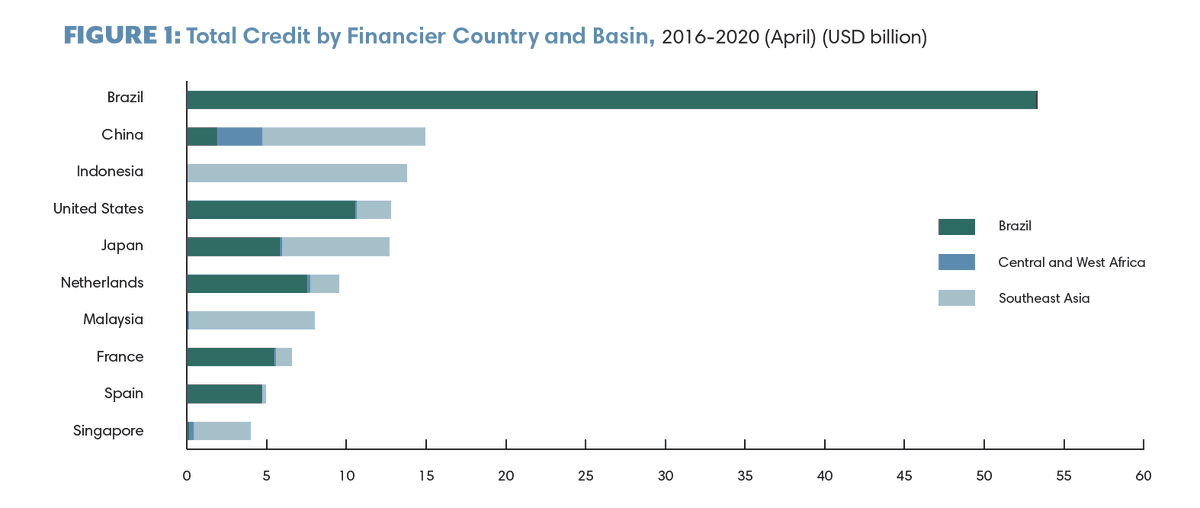

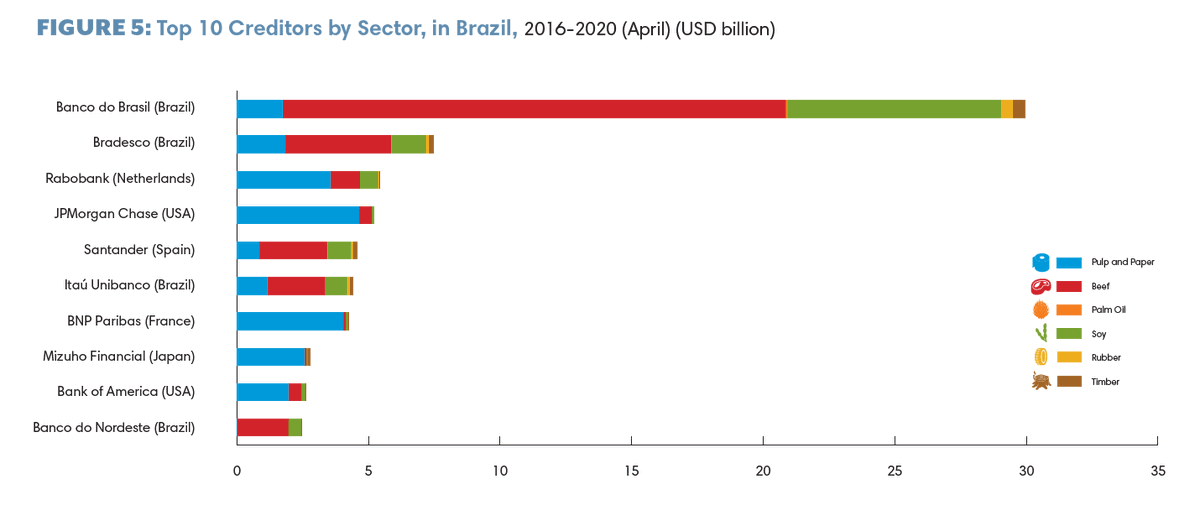

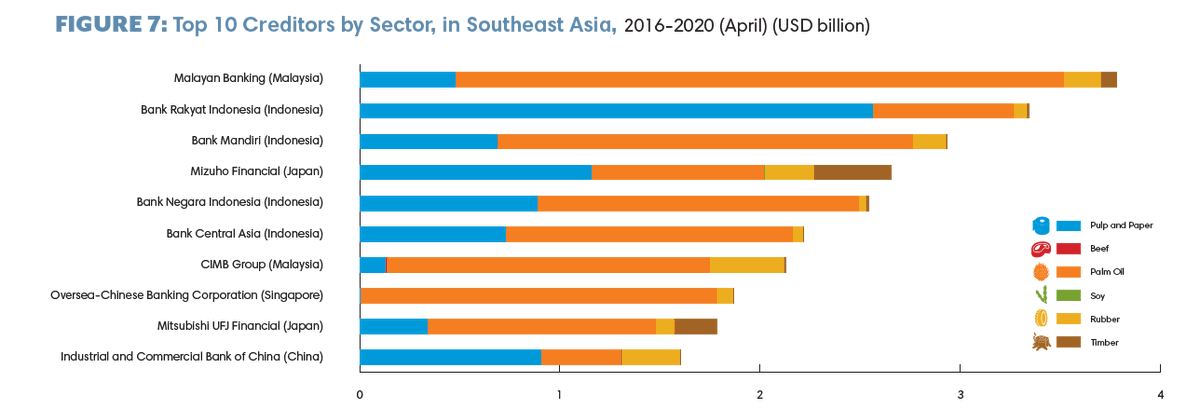

Brazilian and Indonesian banks finance almost exclusively their domestic markets. Chinese banks finance more companies in Southeast Asian, US banks more those operating in Brazil.

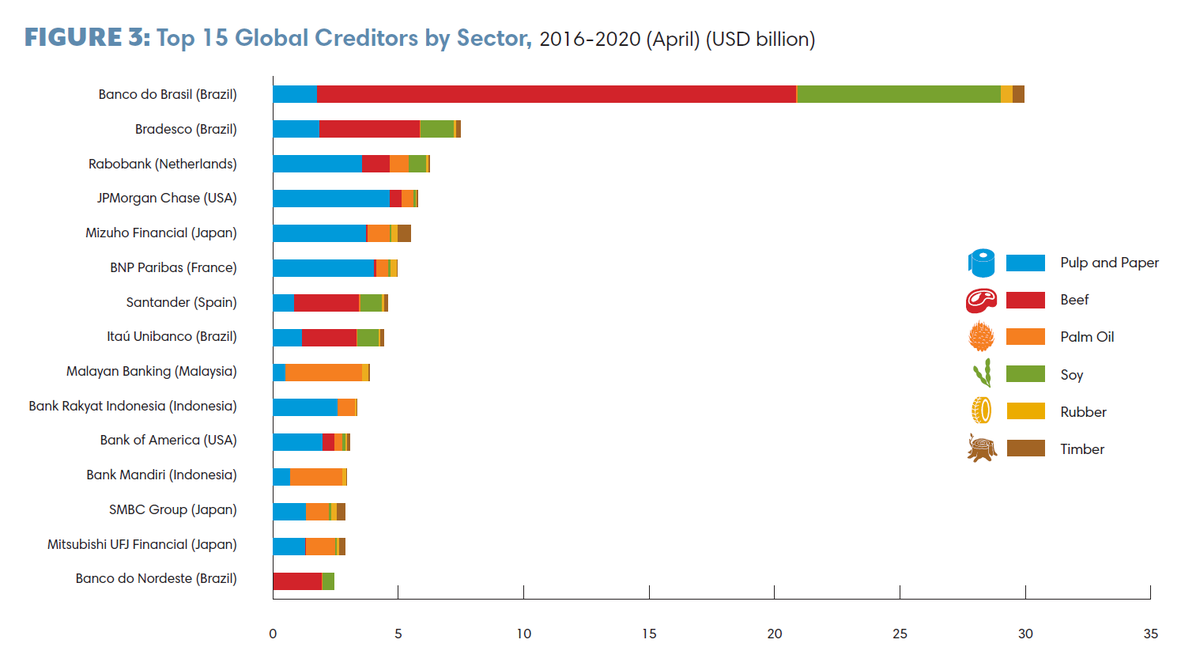

@BancodoBrasil is by far the largest credit provider to forest-risk commodity companies. It is a major financier of the beef and soy sectors.

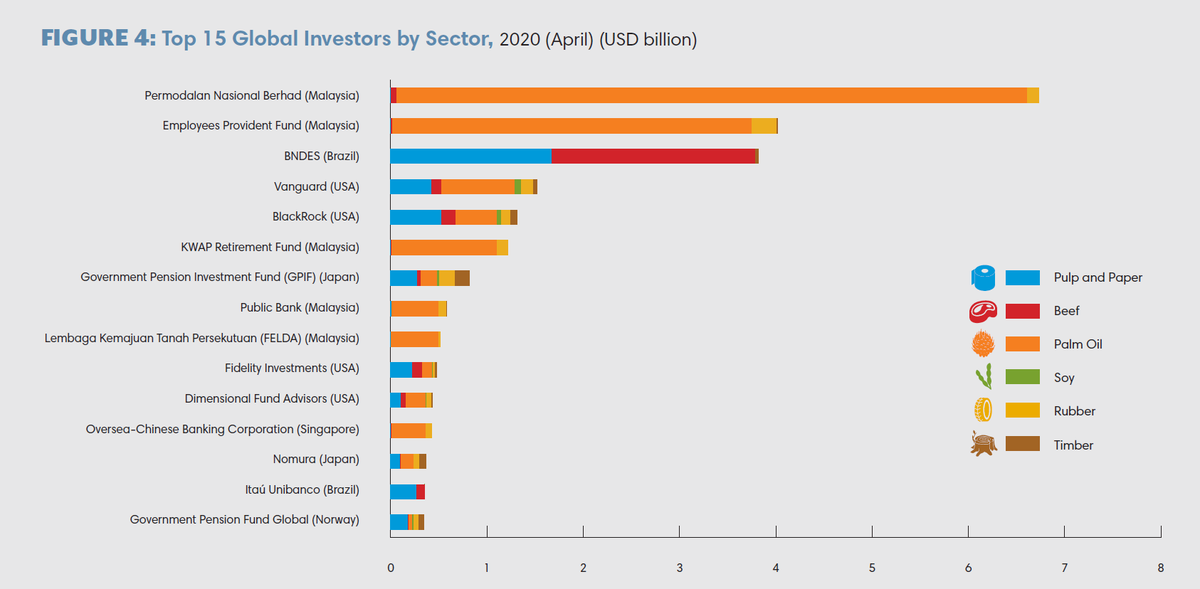

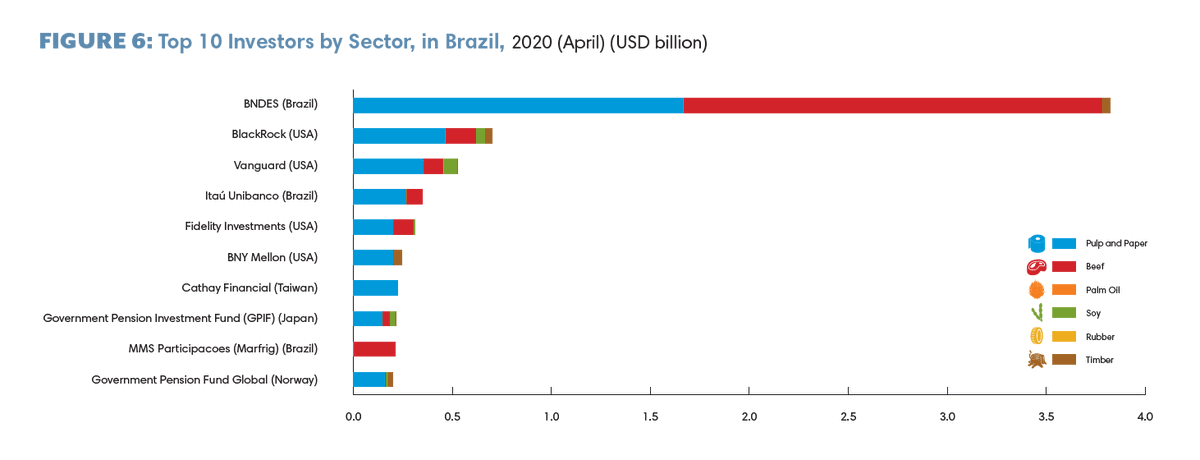

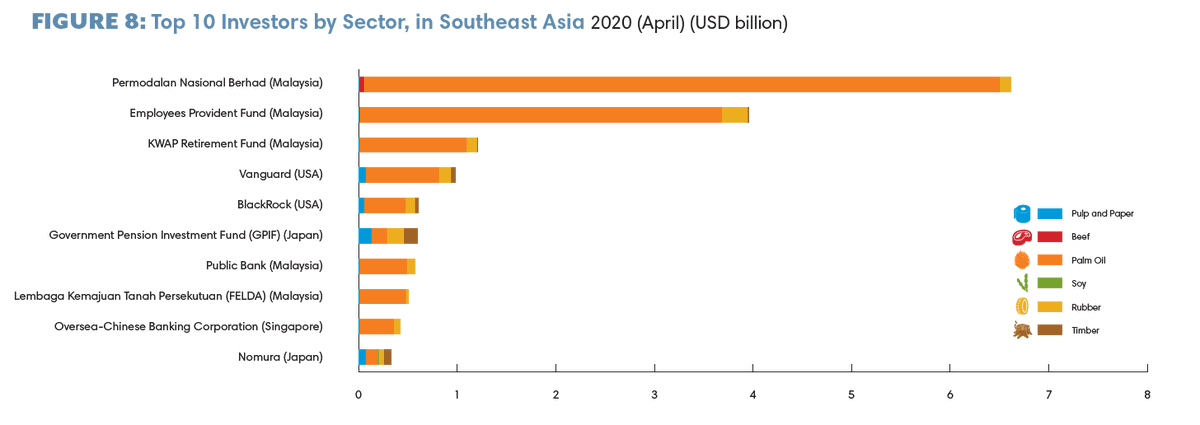

Malaysian governmental funds are among the largest investors in forest-risk commodity companies, especially in the palm oil sector. The Brazilian development bank @BNDES also plays a key role, as do the US based funds @Vanguard_Group and @blackrock

Brazilian banks @BancodoBrasil and @Bradesco are the largest financiers of forest-risk commodity companies in Brazil. Credit from foreign banks goes mostly to the pulp and paper sector, but @Rabobank and @bancosantander also play an important role in financing the beef sector.

In Brazil, the Brazilian development bank is by far the largest investor in forest-risk commodity companies. However, on second and third place are US based @BlackRock and @Vanguard_Group

In Southeast Asia, @MyMaybank remains the largest credit provider to forest-risk commodity companies. Also in the top 5 are @BANKBRI_ID , @bankmandiri , #Mizuho and @BNI.

In Southeast Asia, Malaysian governmental funds are among the largest investors in forest-risk commodity companies, especially in the palm oil sector. Also in the top 5 are US based @Vanguard_Group and @blackrock BlackRock.

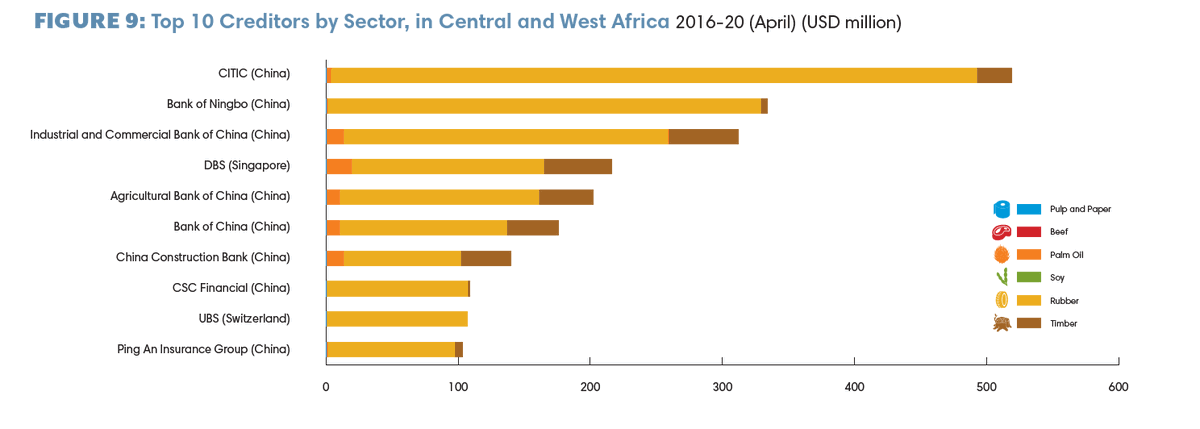

In Central and West Africa, Chinese banks are the main credit providers: 9 of the top 10 banks are Chinese.

Read on Twitter

Read on Twitter