1) Portfolio summary - Aug-end

$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DOCU $ETSY $FSLY $MELI $OKTA $ROKU $SE $SHOP $STNE $SQ $TWLO $VRM $ZM http://1797.HK"> http://1797.HK

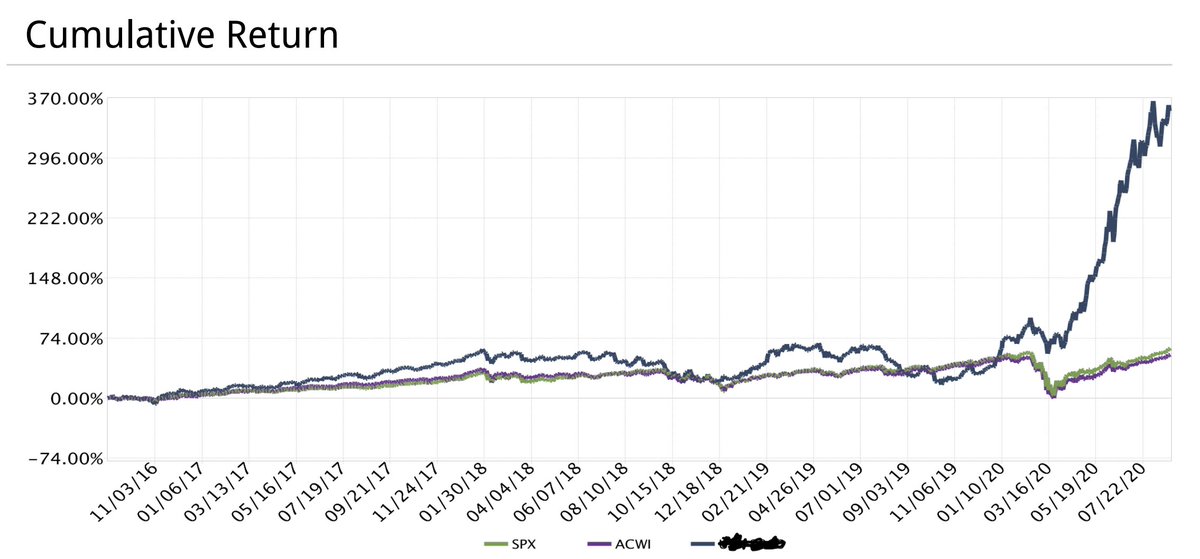

Return since 1 Sept & #39;16 -

Portfolio +364.41%

$ACWI +41.09%

$SPX +61.24%

Contd...

$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DOCU $ETSY $FSLY $MELI $OKTA $ROKU $SE $SHOP $STNE $SQ $TWLO $VRM $ZM http://1797.HK"> http://1797.HK

Return since 1 Sept & #39;16 -

Portfolio +364.41%

$ACWI +41.09%

$SPX +61.24%

Contd...

2) CAGR since inception (1 Sept 2016) -

Portfolio +46.80%

$ACWI +8.99%

$SPX +12.69%

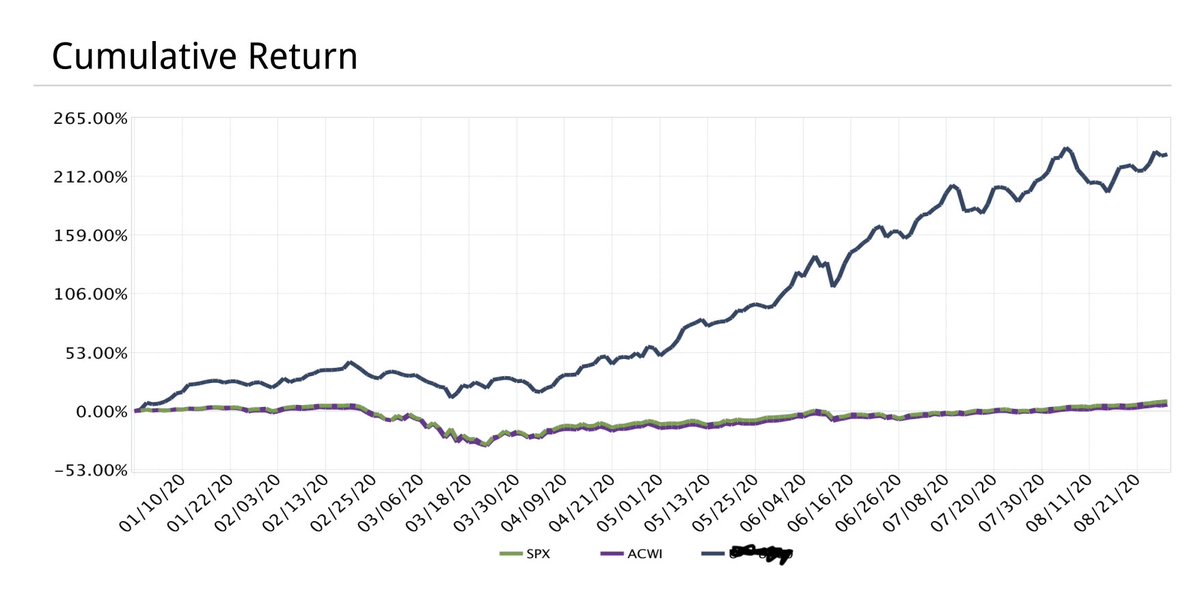

YTD return -

Portfolio +231.27%

$ACWI +3.75%

$SPX +8.34%

Contd...

Portfolio +46.80%

$ACWI +8.99%

$SPX +12.69%

YTD return -

Portfolio +231.27%

$ACWI +3.75%

$SPX +8.34%

Contd...

Commentary -

Despite my best effort to sabotage my returns, August turned out to be another strong month for my portfolio.

Earlier in the month, after the big run up off the March low, I decided to try out something new i.e. market timing.

Needless to say, the market gods...

Despite my best effort to sabotage my returns, August turned out to be another strong month for my portfolio.

Earlier in the month, after the big run up off the March low, I decided to try out something new i.e. market timing.

Needless to say, the market gods...

...had a different plan and after a brief consolidation, most of my stocks continued their advance.

Fortunately, I was able to put aside my own bias and when my stocks refused to decline meaningfully, I promptly re-invested my entire cash.

This market timing...

Fortunately, I was able to put aside my own bias and when my stocks refused to decline meaningfully, I promptly re-invested my entire cash.

This market timing...

...experiment cost me both mental energy and money; and in the process, I discovered two things about myself -

1) I am most comfortable when fully invested

2) Market timing is super hard (at least for me)

It goes without saying, I won& #39;t be raising cash again...

1) I am most comfortable when fully invested

2) Market timing is super hard (at least for me)

It goes without saying, I won& #39;t be raising cash again...

In terms of the portfolio, I made a few changes this month.

First, once the $LVGO $TDOC & #39;merger& #39; was announced, I immediately sold my shares and moved on.

Elsewhere, I invested in $FSLY, trimmed my software exposure and significantly increased my exposure to ecommerce...

First, once the $LVGO $TDOC & #39;merger& #39; was announced, I immediately sold my shares and moved on.

Elsewhere, I invested in $FSLY, trimmed my software exposure and significantly increased my exposure to ecommerce...

Currently, I& #39;m happy with my holdings but keenly waiting for two new listings (Ant Group and Snowflake). So, when they go public, I& #39;ll probably ditch two of my lower conviction stocks from the portfolio.

In terms of the stock market outlook, although we can have a near-term...

In terms of the stock market outlook, although we can have a near-term...

...pullback at any time, given the Fed& #39;s posture (QE and ZIRP for as far as the eye can see), it is highly likely that stocks will be much higher 12-18 months from now.

After all, we are still only 5 months into this new bull-mkt and it is my strong belief that this uptrend...

After all, we are still only 5 months into this new bull-mkt and it is my strong belief that this uptrend...

...will continue for several years. For sure, we& #39;ll get 10-20% declines along the way but if my assessment is correct, the next recession-induced/scary bear-market won& #39;t occur for several years.

For my part, I& #39;ll just remain fully invested and if needed, will simply hedge...

For my part, I& #39;ll just remain fully invested and if needed, will simply hedge...

...my book.

Finally, I am of the view that the leading companies from ecommerce, fintech and software will continue to generate outstanding operating results and although the ride may not be smooth, it will be very rewarding.

Hope this has been helpful.

THE END.

Finally, I am of the view that the leading companies from ecommerce, fintech and software will continue to generate outstanding operating results and although the ride may not be smooth, it will be very rewarding.

Hope this has been helpful.

THE END.

Read on Twitter

Read on Twitter