Investment Portfolio

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">MONTH-END Update

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">MONTH-END Update https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht">

Attached tweet is last weeks thread...

‘Show this thread’ to see this MONTH’S update below

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/FiSavvyDad/status/1297102743195320320">https://twitter.com/FiSavvyDa...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://twitter.com/FiSavvyDad/status/1297102743195320320">https://twitter.com/FiSavvyDa...

Attached tweet is last weeks thread...

‘Show this thread’ to see this MONTH’S update below

What follows are some snap shots

Insights into the investment account I started from scratch

I started it to demonstrate how powerful the stock market can be as a tool to build wealth.

It’s been active just over 14 months

I deposit £200-300/month

These are the results...

Insights into the investment account I started from scratch

I started it to demonstrate how powerful the stock market can be as a tool to build wealth.

It’s been active just over 14 months

I deposit £200-300/month

These are the results...

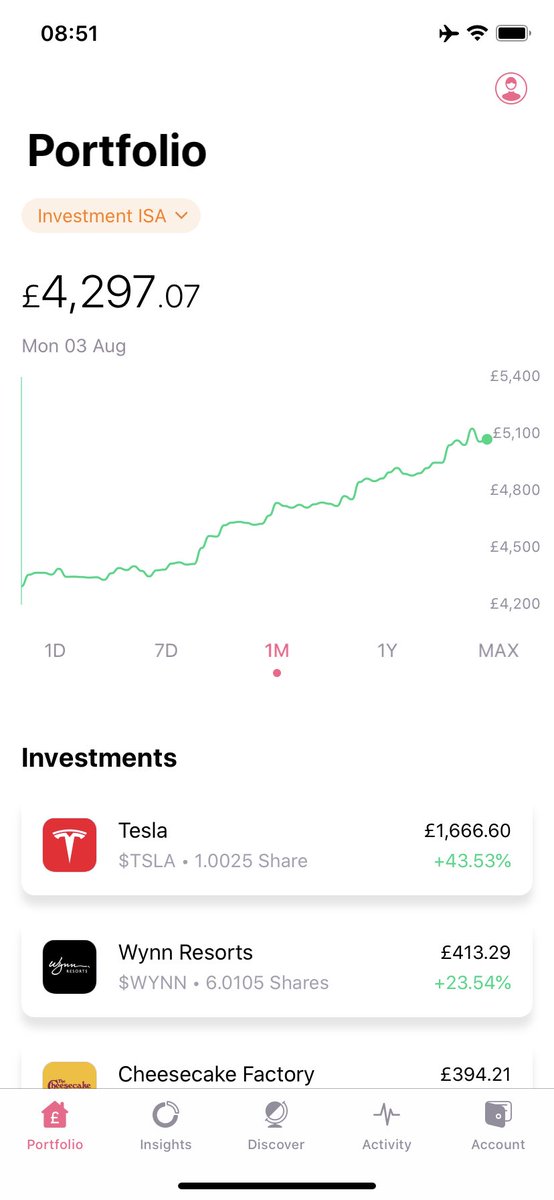

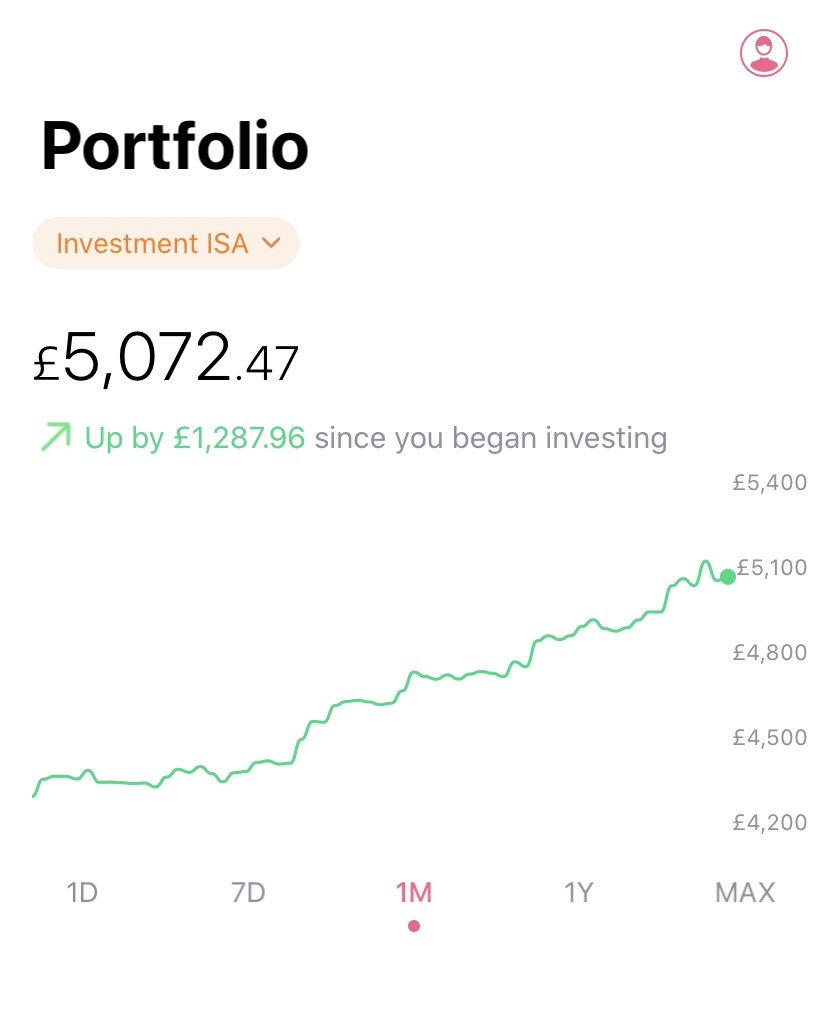

Monthly overview:

Starting point vs. End point

Up £775 in pure market growth... that’s an 18% gain THIS MONTH

Let’s take a look at some insights...

Starting point vs. End point

Up £775 in pure market growth... that’s an 18% gain THIS MONTH

Let’s take a look at some insights...

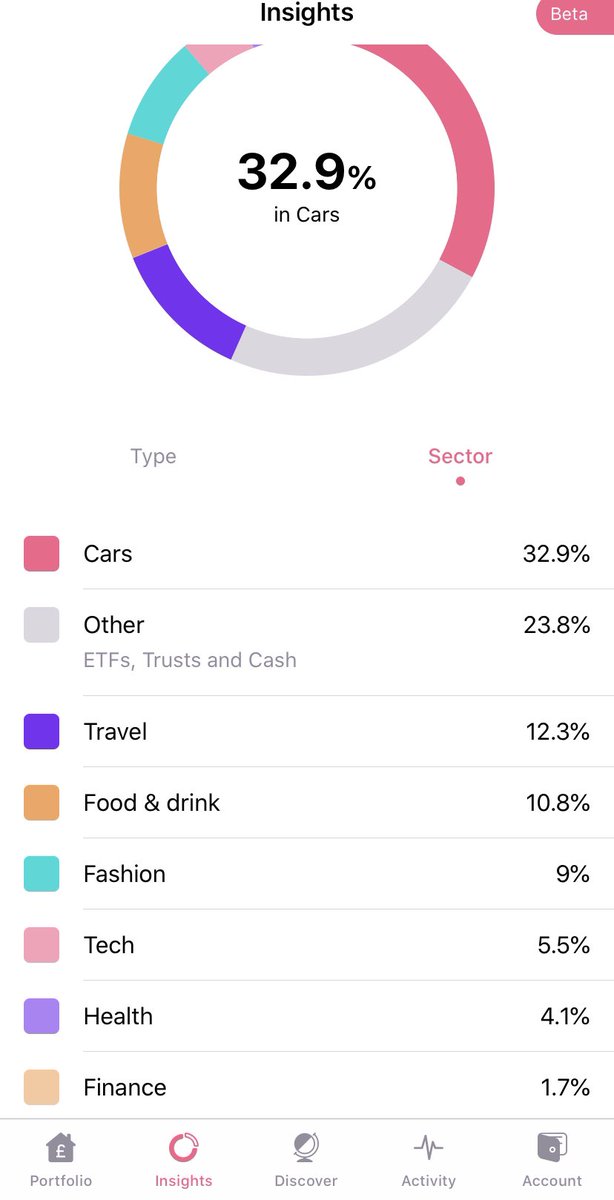

I’m currently at 10% cash which is as low as I’ll ever go.

It’s critical to ALWAYS have money on the sidelines to take advantage of market opportunities.

My rule:

- 10% minimum (when there’s deals to be had)

- 30% max (when the markets are volatile/overvalued)

It’s critical to ALWAYS have money on the sidelines to take advantage of market opportunities.

My rule:

- 10% minimum (when there’s deals to be had)

- 30% max (when the markets are volatile/overvalued)

Further breakdown:

I manage to stay well diversified and monitor this constantly to ensure I keep balance.

Anyone with $TSLA in their portfolio will tell you how much of a pain this can be https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

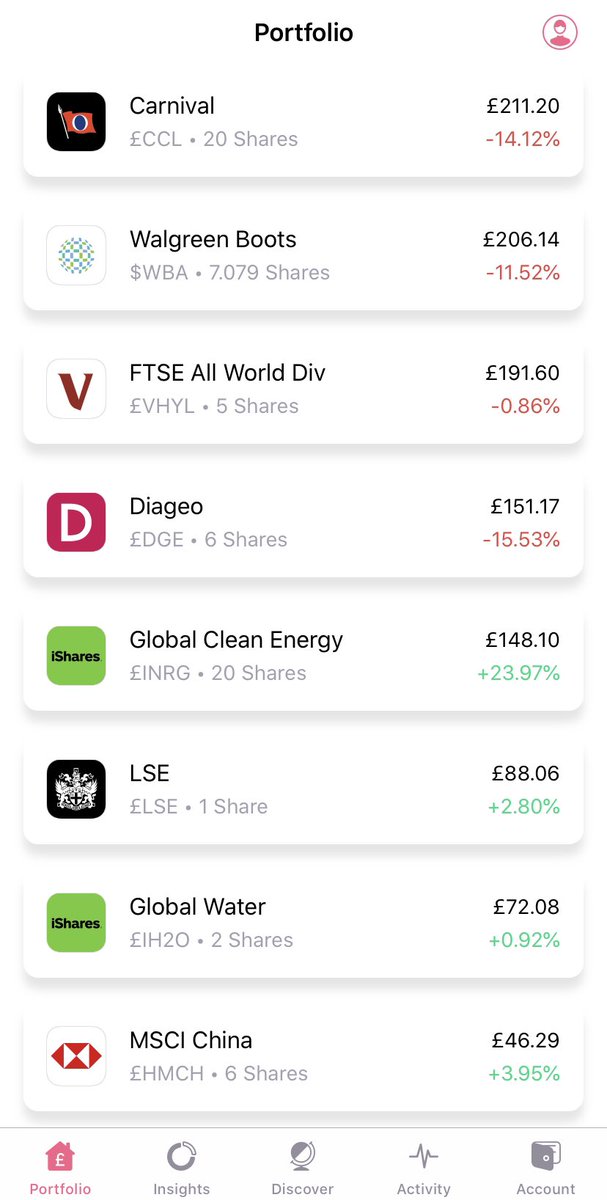

Let’s look at my positions...

I manage to stay well diversified and monitor this constantly to ensure I keep balance.

Anyone with $TSLA in their portfolio will tell you how much of a pain this can be

Let’s look at my positions...

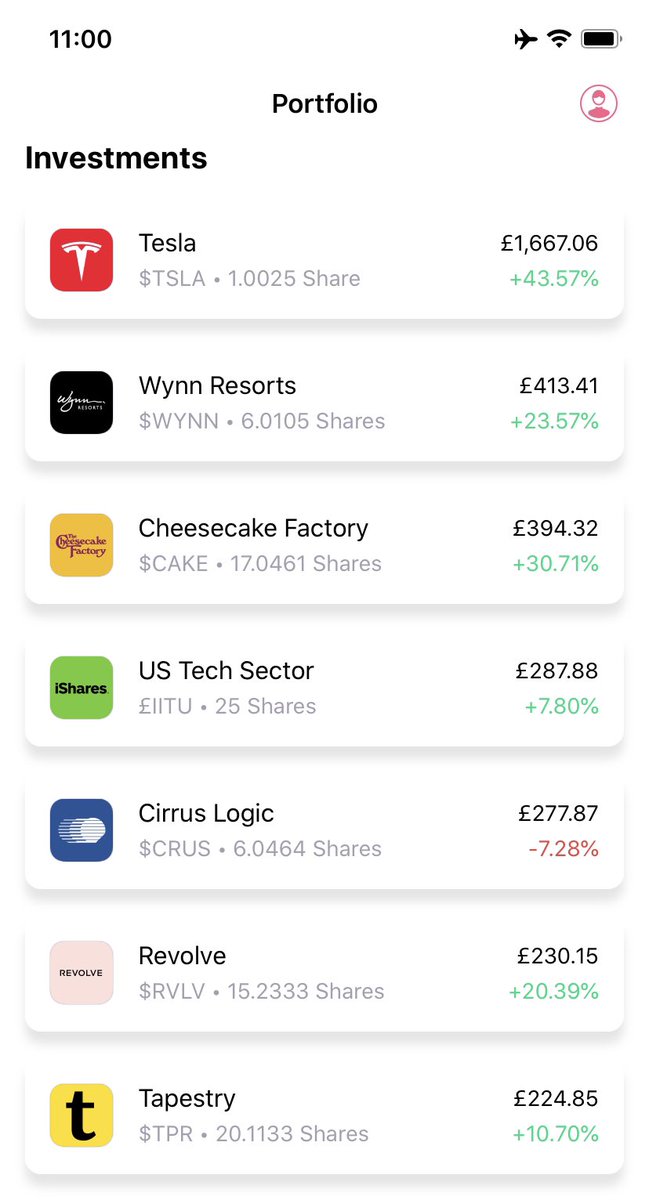

News of $TSLA 5:1 split and continued S&P addition rumours sent their share price soaring.

Hospitality and restaurant stocks $CAKE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍰" title="Teekuchen" aria-label="Emoji: Teekuchen"> & $WYNN moving higher off vaccine hopes and promising recovery signals... I’m sceptical though

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍰" title="Teekuchen" aria-label="Emoji: Teekuchen"> & $WYNN moving higher off vaccine hopes and promising recovery signals... I’m sceptical though  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤨" title="Gesicht mit hochgezogener Augenbraue" aria-label="Emoji: Gesicht mit hochgezogener Augenbraue">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤨" title="Gesicht mit hochgezogener Augenbraue" aria-label="Emoji: Gesicht mit hochgezogener Augenbraue">

$RVLV Q2 results were dope too

Hospitality and restaurant stocks $CAKE

$RVLV Q2 results were dope too

Down positions:

£CCL.L is FINALLY recovering, as anticipated, due to announcements of cruises restarting next month in Europe https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

£DGE.L is not doing well at all! They’ve been annihilated by current circumstances, unfortunately.

But I see a mid to long-term recovery on the way

£CCL.L is FINALLY recovering, as anticipated, due to announcements of cruises restarting next month in Europe

£DGE.L is not doing well at all! They’ve been annihilated by current circumstances, unfortunately.

But I see a mid to long-term recovery on the way

Let me know your thoughts!

What are you buying/selling/holding right now?

Drop your comments below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

If you have any questions about investing, want to know how to get started or want to chat investing

My DMs are always open! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

Have a great week!

Invest wisely https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

What are you buying/selling/holding right now?

Drop your comments below

If you have any questions about investing, want to know how to get started or want to chat investing

My DMs are always open!

Have a great week!

Invest wisely

Read on Twitter

Read on Twitter

Let’s look at my positions..." title="Further breakdown:I manage to stay well diversified and monitor this constantly to ensure I keep balance.Anyone with $TSLA in their portfolio will tell you how much of a pain this can be https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">Let’s look at my positions..." class="img-responsive" style="max-width:100%;"/>

Let’s look at my positions..." title="Further breakdown:I manage to stay well diversified and monitor this constantly to ensure I keep balance.Anyone with $TSLA in their portfolio will tell you how much of a pain this can be https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">Let’s look at my positions..." class="img-responsive" style="max-width:100%;"/>

& $WYNN moving higher off vaccine hopes and promising recovery signals... I’m sceptical though https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤨" title="Gesicht mit hochgezogener Augenbraue" aria-label="Emoji: Gesicht mit hochgezogener Augenbraue"> $RVLV Q2 results were dope too" title="News of $TSLA 5:1 split and continued S&P addition rumours sent their share price soaring.Hospitality and restaurant stocks $CAKE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍰" title="Teekuchen" aria-label="Emoji: Teekuchen"> & $WYNN moving higher off vaccine hopes and promising recovery signals... I’m sceptical though https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤨" title="Gesicht mit hochgezogener Augenbraue" aria-label="Emoji: Gesicht mit hochgezogener Augenbraue"> $RVLV Q2 results were dope too" class="img-responsive" style="max-width:100%;"/>

& $WYNN moving higher off vaccine hopes and promising recovery signals... I’m sceptical though https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤨" title="Gesicht mit hochgezogener Augenbraue" aria-label="Emoji: Gesicht mit hochgezogener Augenbraue"> $RVLV Q2 results were dope too" title="News of $TSLA 5:1 split and continued S&P addition rumours sent their share price soaring.Hospitality and restaurant stocks $CAKE https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍰" title="Teekuchen" aria-label="Emoji: Teekuchen"> & $WYNN moving higher off vaccine hopes and promising recovery signals... I’m sceptical though https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤨" title="Gesicht mit hochgezogener Augenbraue" aria-label="Emoji: Gesicht mit hochgezogener Augenbraue"> $RVLV Q2 results were dope too" class="img-responsive" style="max-width:100%;"/>

£DGE.L is not doing well at all! They’ve been annihilated by current circumstances, unfortunately.But I see a mid to long-term recovery on the way" title="Down positions:£CCL.L is FINALLY recovering, as anticipated, due to announcements of cruises restarting next month in Europe https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">£DGE.L is not doing well at all! They’ve been annihilated by current circumstances, unfortunately.But I see a mid to long-term recovery on the way" class="img-responsive" style="max-width:100%;"/>

£DGE.L is not doing well at all! They’ve been annihilated by current circumstances, unfortunately.But I see a mid to long-term recovery on the way" title="Down positions:£CCL.L is FINALLY recovering, as anticipated, due to announcements of cruises restarting next month in Europe https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">£DGE.L is not doing well at all! They’ve been annihilated by current circumstances, unfortunately.But I see a mid to long-term recovery on the way" class="img-responsive" style="max-width:100%;"/>