Good morning!!! I& #39;m back to the office this week & pollution disappeared. I composed a haiku over the weekend on my Morning Trail hike & it goes like this:

After the big rain

Water bursts out of the earth

Washes away the pain.

Anyway, let& #39;s talk economics & of course politics https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">

After the big rain

Water bursts out of the earth

Washes away the pain.

Anyway, let& #39;s talk economics & of course politics

Politics: After the RNC, polls for Trump rose sharply. The betting odds have almost equalized from being sharply behind Biden. Don& #39;t count him out.

This is an election of Trump vs Trump not Trump vs Biden so whether he gets re-elected is up to his behavior. Biden doesn& #39;t excite

This is an election of Trump vs Trump not Trump vs Biden so whether he gets re-elected is up to his behavior. Biden doesn& #39;t excite

I personally think the Kamala pick is a cynical one & doesn& #39;t add to the ticket. If you notice, since she was nominated, Biden has slipped (partly because Trump has behaved better & the excitement for Kamala is meh, which we know from the primary).

Let& #39;s move on to economics.

Let& #39;s move on to economics.

Of course economics cannot be divorced from politics, which is about who owns what & who makes decisions about asset allocation/distribution. So I put US elections 1st b/c it has economic implications.

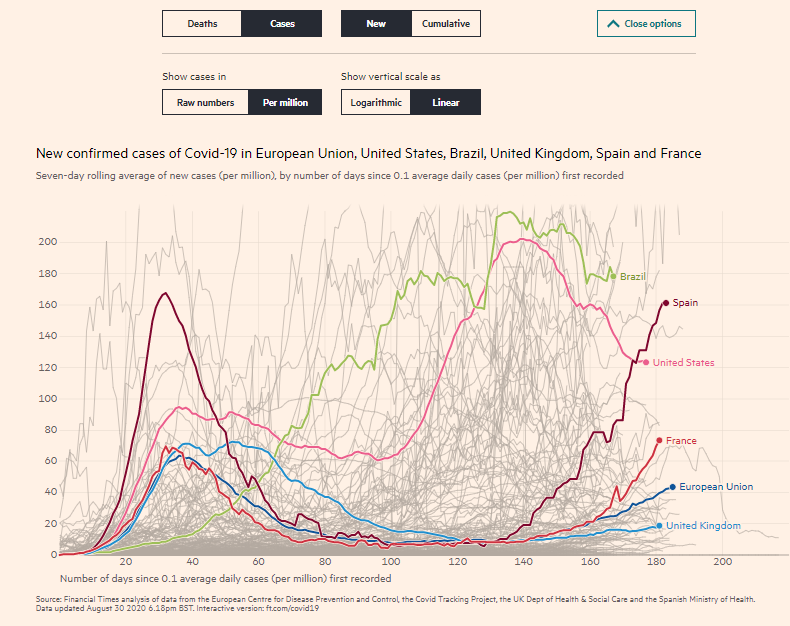

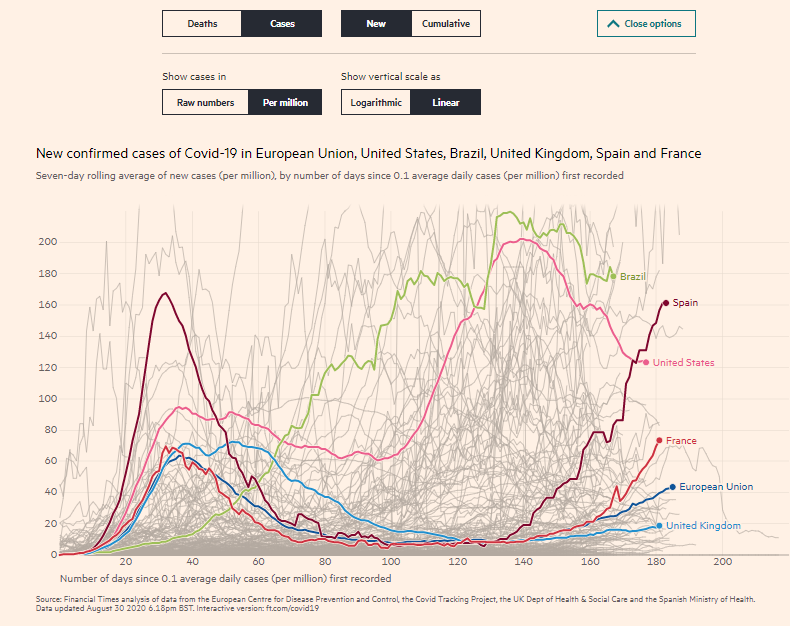

Covid is key b/c of measures to contain Covid (mobility suppression).

Covid is key b/c of measures to contain Covid (mobility suppression).

And Covid is political in that it depends on whether people view/tolerate the rise of cases vs the suppression measures.

As mentioned, as European cases rise, the coverage is less shaming & fearful vs the US case rise, which means that the appetite for lock-downs declined.

So?

As mentioned, as European cases rise, the coverage is less shaming & fearful vs the US case rise, which means that the appetite for lock-downs declined.

So?

As I argued before, this is the right decision & one that people are increasingly taking (although I did get a lot of heat for it for pointing out that fatality falling, treatment better etc). People are reacting more to facts vs fear. So containment vs lockdown is now in vogue.

Human lives & economic costs of this = less than before, yes both less. Why? Because we know now more than we did before & we are more equipped to deal w/ this virus & less fearful of the unknown as it becomes more known. Meaning, living with it.

Economic recovery more possible.

Economic recovery more possible.

Let& #39;s now move to the data, I& #39;ll do USA & Asia. Got a busy Monday so straight to it. Note that economic data is LAGGING & at best coincidental. So knowing that liquidity ample + less appetite for lock-downs = the economic future less scary than we thought (2nd wave).

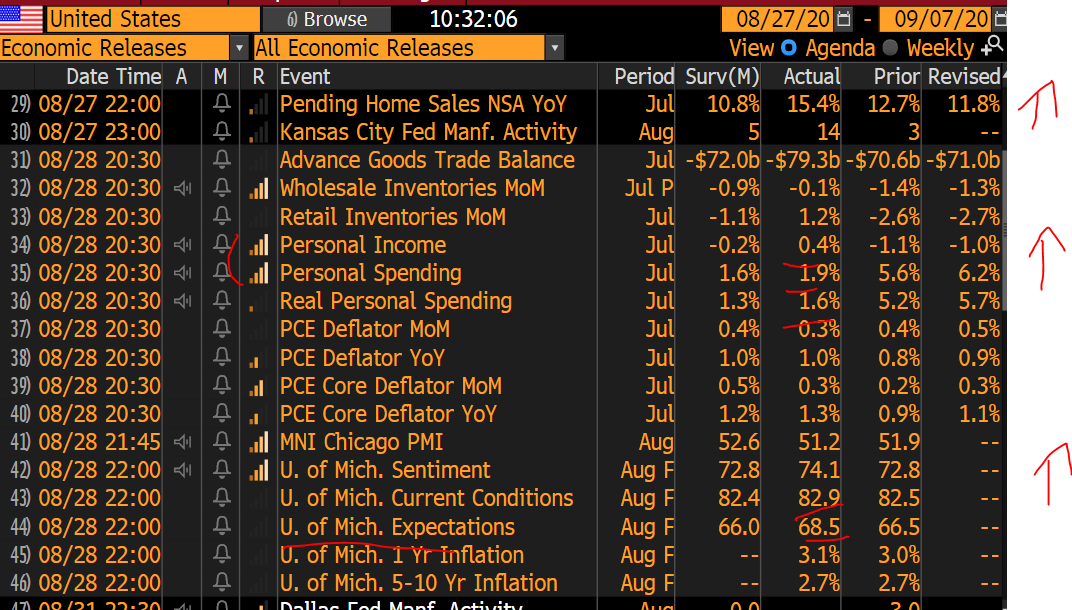

The USA https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

The USA

So what does US hard data in July tell you: Well, home sales up & consumer spending & income still up but by less than before.

Key of course is August & September & Q4 & that consumer confidence is up!

So expect recovery.

Key of course is August & September & Q4 & that consumer confidence is up!

So expect recovery.

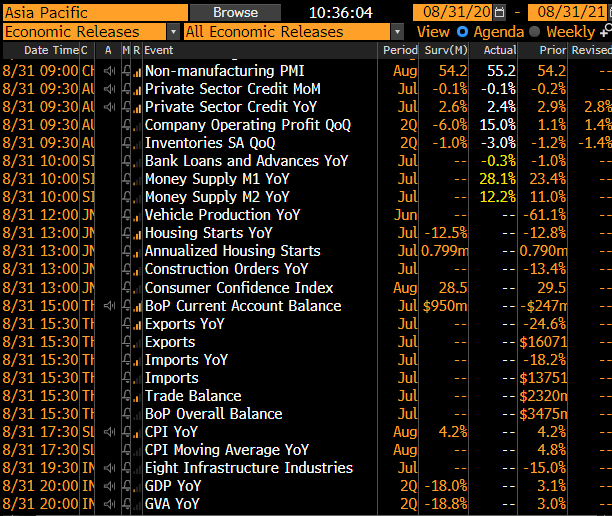

Asia: data that came out today. How do you read something like this?

Got plenty of lagging indicators here & July shows that industrial production on the mend for Japan & Korea vs June although still falling vs July last year. China PMIs show a bounce of services & manu leveling

Got plenty of lagging indicators here & July shows that industrial production on the mend for Japan & Korea vs June although still falling vs July last year. China PMIs show a bounce of services & manu leveling

This is China PMIs, which are soft indicators (sentiment of managers of firms of services & manufacturing). Services recovering faster than manufacturing & a reflection that China domestic is better than China external. Services tend to be non-tradeable. Recovering but uneven.

Of course, today, we& #39;re waiting for an important lagging indicator (India Q2 GDP which is April - June) & also Brazil as well. India is one of the laggards of Asia due to its sharp & prolonged lock-downs.

Markets expecting -18% fall of GDP. Ouch.

Markets expecting -18% fall of GDP. Ouch.

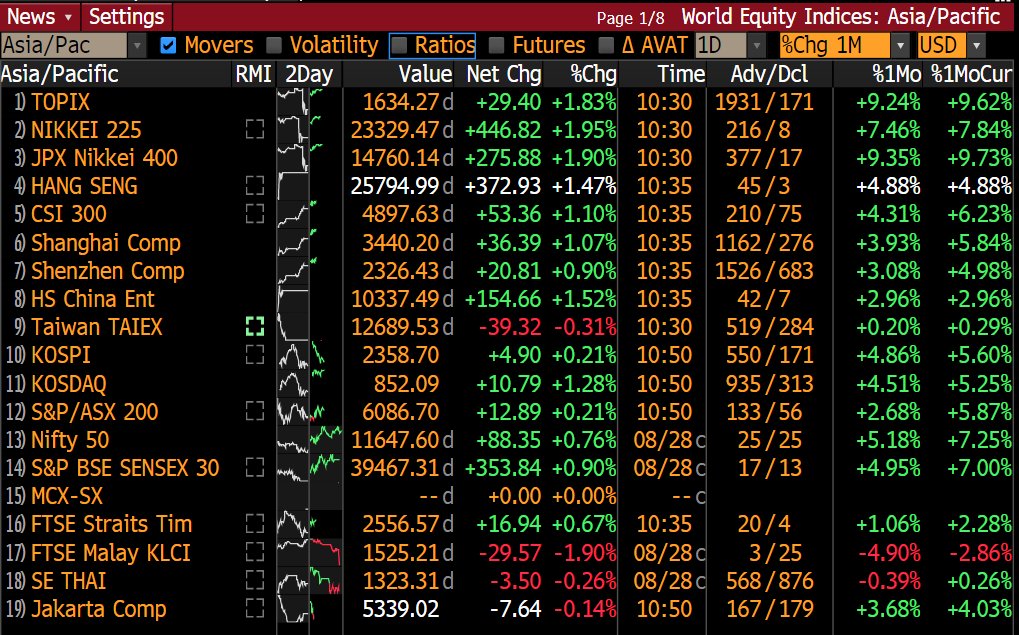

Here is markets today based on everything discussed. Nikkei rebounding after the Abe dump (Suga jumping in is seen as continuation + encouraging data).

I know many of u are upset as Covid & even before it Fed easy monetary policy has deepened the divide of haves/have not.

But..

I know many of u are upset as Covid & even before it Fed easy monetary policy has deepened the divide of haves/have not.

But..

If you are a student of markets, which I am, don& #39;t fight it.

Never fight Mr. Markets. He is irrational. Keynes said it right, it can remain irrational longer than u can be solvent.

So don& #39;t let ur emotion, whether warranted/not, cloud your objective, which is to make $$$.

Never fight Mr. Markets. He is irrational. Keynes said it right, it can remain irrational longer than u can be solvent.

So don& #39;t let ur emotion, whether warranted/not, cloud your objective, which is to make $$$.

I speak w/ many people, either hedge fund friends, or just people that like to get involved in markets, that are bitter. And they spend a lot of time focusing on bashing the system & the collapse.

But the reality is this: the only relevant question is: What is the risk & reward?

But the reality is this: the only relevant question is: What is the risk & reward?

If u have excess cash & wanting it not to be deflated away relative to asset prices: HOW LONG WILL THE RALLY GO ON FOR, A DAY, A WEEK, A MONTH, A YEAR? What risks am I taking for being involved and can I afford it? Bashing the Fed but not taking advantage of what it does, is well

Have a great day! No matter how hard life is, it is a wonderful thing to be alive.

Goal on Twitter has always been to share/learn/network w/ like minded people so I welcome feedback.

That said, if u are a negative force, I won& #39;t respond & may block u, as I would in real life.

Goal on Twitter has always been to share/learn/network w/ like minded people so I welcome feedback.

That said, if u are a negative force, I won& #39;t respond & may block u, as I would in real life.

Read on Twitter

Read on Twitter

" title="Let& #39;s now move to the data, I& #39;ll do USA & Asia. Got a busy Monday so straight to it. Note that economic data is LAGGING & at best coincidental. So knowing that liquidity ample + less appetite for lock-downs = the economic future less scary than we thought (2nd wave). The USAhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Let& #39;s now move to the data, I& #39;ll do USA & Asia. Got a busy Monday so straight to it. Note that economic data is LAGGING & at best coincidental. So knowing that liquidity ample + less appetite for lock-downs = the economic future less scary than we thought (2nd wave). The USAhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>