$NOVN DD Thread:

—> Title: A comparison of correlation between Aspire CF, Remark Holdings and Novan Inc - Investment choices, a network of hedge funds and the possibility of synchronicity.

(DISCLAIMER: This DD thread is for information purposes only.)

—> Title: A comparison of correlation between Aspire CF, Remark Holdings and Novan Inc - Investment choices, a network of hedge funds and the possibility of synchronicity.

(DISCLAIMER: This DD thread is for information purposes only.)

First of all, let me introduce you to a simple question: Would you agree to the idea that the cash inflow of an investment made by a big hedge fund can produce financial interest by other investing groups? If yes, then I welcome you to another intellectual game.

1. Investment choices

As you already know from other dd threads, Aspire CF is well known for their longterm investments in undiscovered, emerging growing companies with an established, strong management. Their financial strategies and interests are explicit.

As you already know from other dd threads, Aspire CF is well known for their longterm investments in undiscovered, emerging growing companies with an established, strong management. Their financial strategies and interests are explicit.

In my last dd thread about Aspire CF and their PAs (purchase agreement) with Novan Inc, I wrote about the intentions and possible outcomes of such lucrative agreements and how they can be used as a powerful tool to gain control over the price movement of a stock.

By comparing companies, which have done purchase agreements with Aspire CF, we are in the position to evaluate past, present or future trading strategies of institutional market participants. The conclusions thereof are often based on predictions and need confirmation by facts.

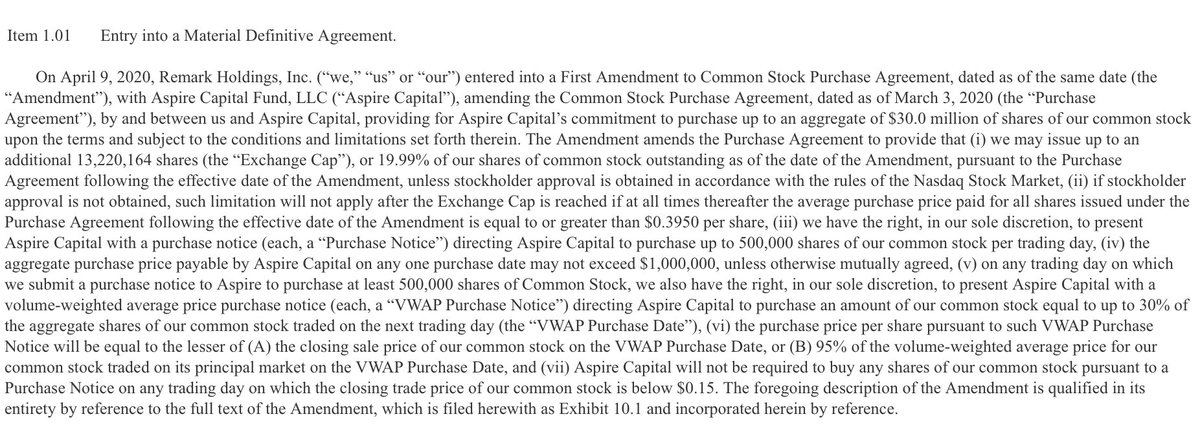

Our example will be Remark Holdings (MARK) and there purchase agreements with Aspire CF. The first PA of 2020 has been signed in March. It had the same investment value as the second PA with Novan ($30M). Here again, there was also an amendment to this PA. Synchronicity.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">

2. A network of hedge funds

The timing of these PAs, there correlation with price movement and the growing financial interest are the quintessence of what will now be unfold. This chart belongs to MARK. Look at the time frame from the beginning of March until now. Coincidence?

The timing of these PAs, there correlation with price movement and the growing financial interest are the quintessence of what will now be unfold. This chart belongs to MARK. Look at the time frame from the beginning of March until now. Coincidence?

But, what do I mean by "a network of hedge funds"? The following information only contains facts. Their interpretation can be variable and has a great scope for further research. After Aspire CF went on stage, many institutional investors bought or accumulated shares.

This fact applies precisely to Remark and Novan. Would you believe me when I tell you that both companies have the same institutional investors? Screenshots below are showing Novan’s institutional ownership. Convince yourself:

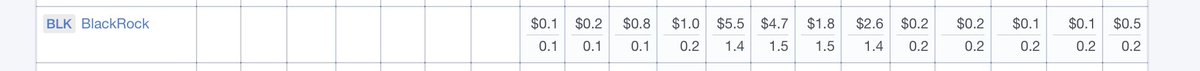

To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...

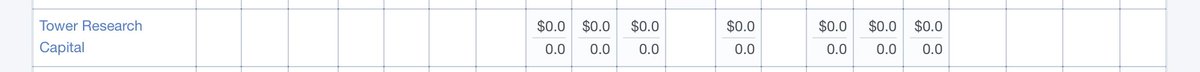

Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Final evaluation: Correlation isn’t always directly connected to causality. I can only offer you facts and the interpretation of this thread rests with you. Keep an open mind and try to ask yourself questions which no one else asks. Thanks for your attention.

Read on Twitter

Read on Twitter

" title="Our example will be Remark Holdings (MARK) and there purchase agreements with Aspire CF. The first PA of 2020 has been signed in March. It had the same investment value as the second PA with Novan ($30M). Here again, there was also an amendment to this PA. Synchronicity. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">">

" title="Our example will be Remark Holdings (MARK) and there purchase agreements with Aspire CF. The first PA of 2020 has been signed in March. It had the same investment value as the second PA with Novan ($30M). Here again, there was also an amendment to this PA. Synchronicity. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">">

" title="Our example will be Remark Holdings (MARK) and there purchase agreements with Aspire CF. The first PA of 2020 has been signed in March. It had the same investment value as the second PA with Novan ($30M). Here again, there was also an amendment to this PA. Synchronicity. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">">

" title="Our example will be Remark Holdings (MARK) and there purchase agreements with Aspire CF. The first PA of 2020 has been signed in March. It had the same investment value as the second PA with Novan ($30M). Here again, there was also an amendment to this PA. Synchronicity. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc..." title="To proof my thesis, I have browsed through a database to find the investment history of Remark Holdings. The results are remarkable. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht"> The next two pages are covering the remaining results of my research: Black Rock, Northern Trust, HRT Financial, tbc...">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">

" title="Tower Research Capital, ETRADE Capital Management, UBS. Their seems to be a direct connection between the appearance of Aspire CF and other financial interest groups. By looking at the development of Remark‘s stock price, we can assume that the overall sentiment was bullish. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">">