1/ Thread on the US technology sector. $QQQ $XLK

Every man & his dog know tech is outperforming other sectors, the market cap of several tech companies has exceeded the GDP of many countries & the retail investors are jumping on the easy money bandwagon.

So, is tech a bubble?

Every man & his dog know tech is outperforming other sectors, the market cap of several tech companies has exceeded the GDP of many countries & the retail investors are jumping on the easy money bandwagon.

So, is tech a bubble?

2/ The short answer: I don& #39;t know.

The long answer?

Let us have a look at charts, data points & trends to decide whether the Tech sector — at this moment in time — is a good long term investment opportunity based on the "weight of evidence approach."

The long answer?

Let us have a look at charts, data points & trends to decide whether the Tech sector — at this moment in time — is a good long term investment opportunity based on the "weight of evidence approach."

3/ Before I start, it is worth noting that we aren& #39;t expert growth investor, nor married to this narrative alone.

So while we lack expertise & god-given status, we allocate capital to many different sectors (for diversification) based on a bit of common sense & objectivity.

So while we lack expertise & god-given status, we allocate capital to many different sectors (for diversification) based on a bit of common sense & objectivity.

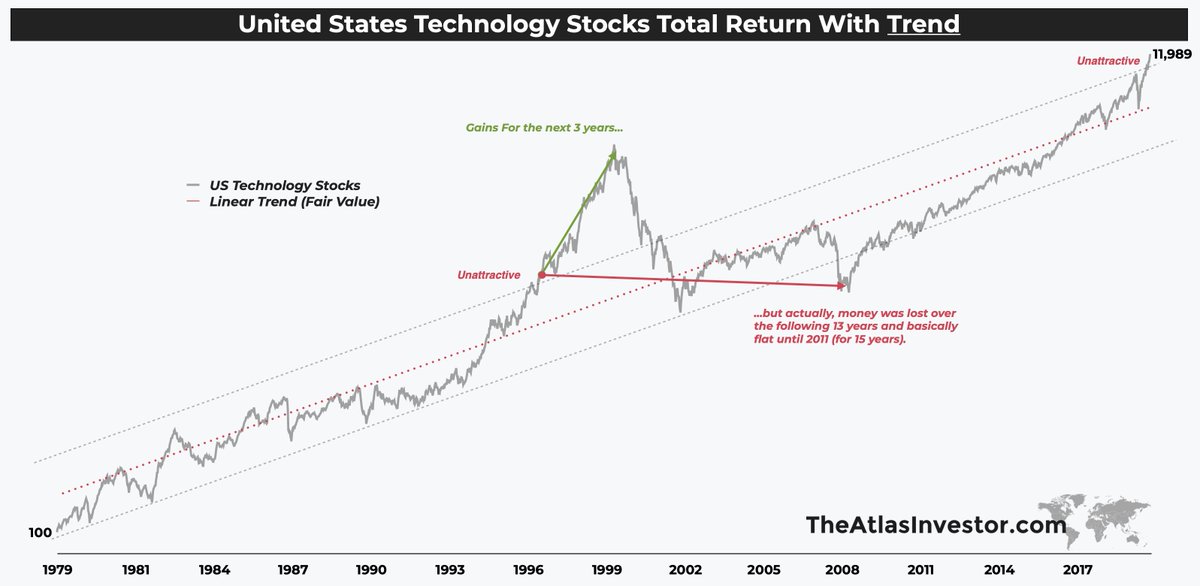

4/ Tech has done fantastically well over the last decade. However, most investors today believe "it& #39;s the only game in town" and the outperformance will continue indefinitely.

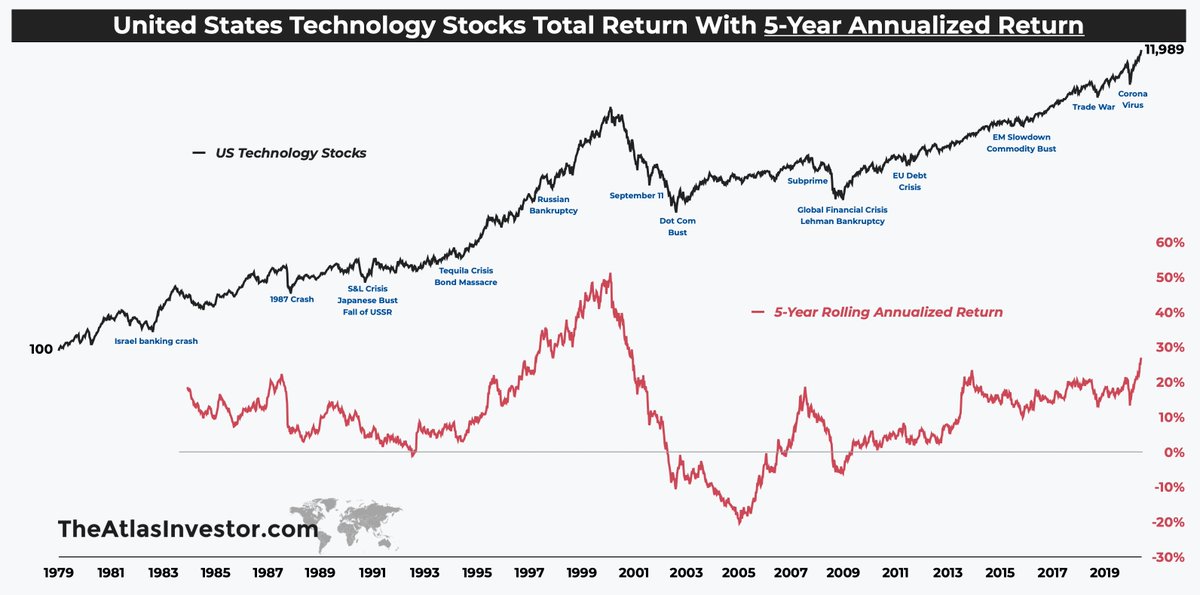

That doesn& #39;t rhyme well with history, with the chart below showing other periods when Tech struggled.

That doesn& #39;t rhyme well with history, with the chart below showing other periods when Tech struggled.

5/ Technology, probably more than any other sector, is extremely cyclical.

Yes, it& #39;s going through a secular uptrend, but...

The industry is changing rapidly, very high-profit margins attract huge competition & that in turn (eventually) reduces sector profitability.

Yes, it& #39;s going through a secular uptrend, but...

The industry is changing rapidly, very high-profit margins attract huge competition & that in turn (eventually) reduces sector profitability.

6/ Exponational improvement in Tech is here to stay & will continue to benefit both consumers & businesses.

However, markets discount growth ahead of time.

Microsoft from 1999 until 2013 is a great example of that — where the company kept growing but its share price did NOT.

However, markets discount growth ahead of time.

Microsoft from 1999 until 2013 is a great example of that — where the company kept growing but its share price did NOT.

7/ So the key question for us is — what does benefit investors?

We believe it is the price you pay or the valuation level you enter into an asset that matters the most.

Growth investors, of course, would disagree.

They are looking at revenue growth, future runway, etc, etc.

We believe it is the price you pay or the valuation level you enter into an asset that matters the most.

Growth investors, of course, would disagree.

They are looking at revenue growth, future runway, etc, etc.

8/ We do not believe Technology is a "great deal" today. Let& #39;s discuss this, from our perspective, which might be different to yours.

Obviously, all of this will depend on your risk tolerance, your time frame (short, medium, or long term) & your financial goals/targets.

Obviously, all of this will depend on your risk tolerance, your time frame (short, medium, or long term) & your financial goals/targets.

9/ The last time the Tech sector became all the rage was in 1996/97.

Just like today, legendary investors such as John Templeton & Warren Buffett were mocked for calling the spade a spade.

But bubbles run further than any of us can imagine & the gains continued for another...

Just like today, legendary investors such as John Templeton & Warren Buffett were mocked for calling the spade a spade.

But bubbles run further than any of us can imagine & the gains continued for another...

10/ ...3 years into the March 2000 peak (chart).

During that period, every retail investor claimed the old sages lost their touch.

Remember, this is a classical period where "an idiot without a plan beats a genius with a plan" & where "common sense isn& #39;t so common" anymore.

During that period, every retail investor claimed the old sages lost their touch.

Remember, this is a classical period where "an idiot without a plan beats a genius with a plan" & where "common sense isn& #39;t so common" anymore.

11/ For short & medium term traders, the blow-off top was a fantastic ride.

But how many survived the subsequent crash of 80-90%?

In my opinion, not many.

You can see these gurus are still selling newsletters today (if you& #39;re so good, why are you selling me your ideas?)

But how many survived the subsequent crash of 80-90%?

In my opinion, not many.

You can see these gurus are still selling newsletters today (if you& #39;re so good, why are you selling me your ideas?)

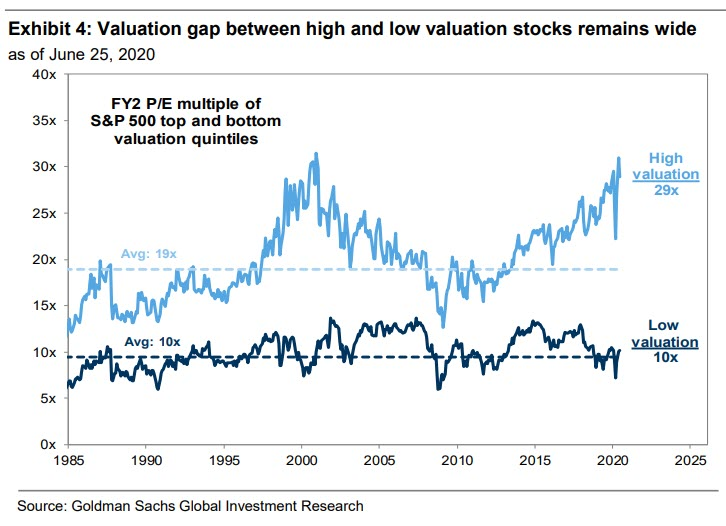

12/ When we look at the valuation of assets in the Tech sector, levels are ridiculously high for us.

Remember, that& #39;s for us & our risk tolerance.

Our common sense is telling us: in the long run, most investors will not be compensated for taking such risks here and now.

Remember, that& #39;s for us & our risk tolerance.

Our common sense is telling us: in the long run, most investors will not be compensated for taking such risks here and now.

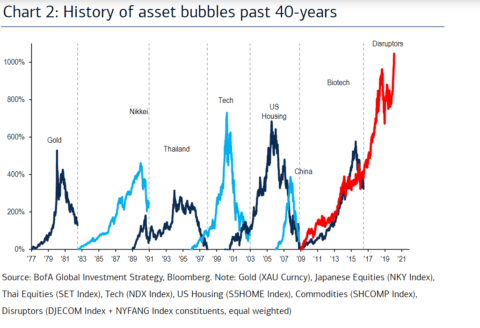

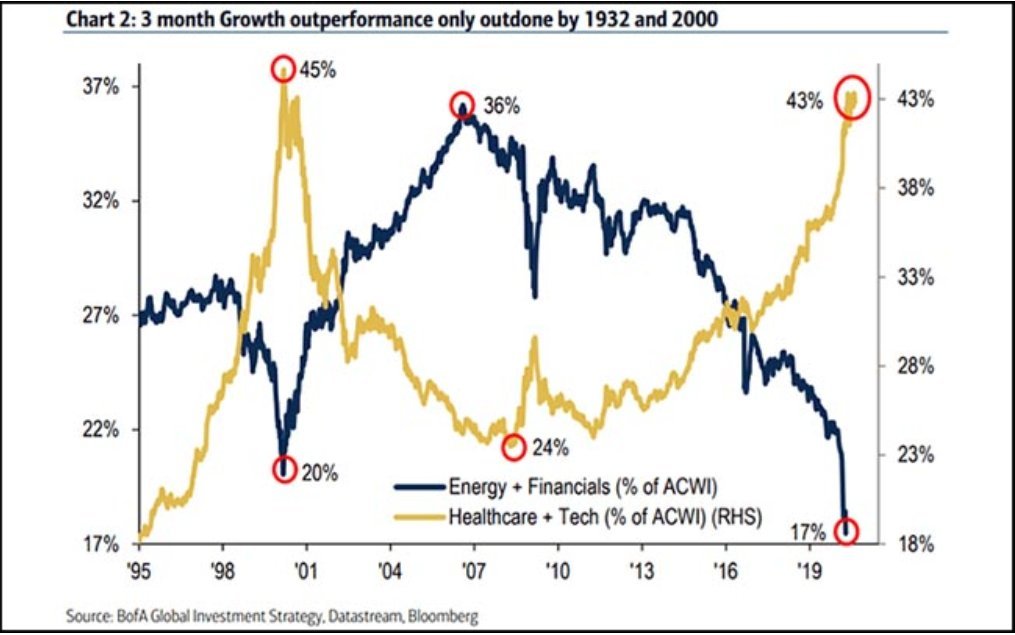

13/ Let& #39;s have a look at the valuations:

• Russell 3000 software EV/sales metric

• Apple& #39;s price/sales metric

• valuation gap between top & bottom (FANGs vs rest)

• tech & health care make up 43% of the global stocks*

*last time we saw that was 2000

• Russell 3000 software EV/sales metric

• Apple& #39;s price/sales metric

• valuation gap between top & bottom (FANGs vs rest)

• tech & health care make up 43% of the global stocks*

*last time we saw that was 2000

14/ The higher the prices (and valuations) go, the more fear of missing out (FOMO) the retail investor community feels.

As JP Morgan famously said: "Nothing so undermines your financial judgment as the sight of your neighbor getting rich."

As JP Morgan famously said: "Nothing so undermines your financial judgment as the sight of your neighbor getting rich."

15/ Looking at our own chart, data from Bloomberg, the Price to Sales of S&P 500 Info Tech sector is approaching mind-blowing 7 times revenue!

However, it did go as high as 8X back in March 2000.

There is no way in hell, we would pay 7X revenue and hold for the long run.

However, it did go as high as 8X back in March 2000.

There is no way in hell, we would pay 7X revenue and hold for the long run.

16/ For us, that makes no sense at all.

This is where investors will question the thesis: "What if you miss out?"

That assumption is made on a premise that we aren& #39;t investing anywhere else like real estate developments, single-family builds, private debt, agriculture, etc.

This is where investors will question the thesis: "What if you miss out?"

That assumption is made on a premise that we aren& #39;t investing anywhere else like real estate developments, single-family builds, private debt, agriculture, etc.

17/ In other words, it& #39;s about the risk to reward.

One could sell Apple & buy the Russell 2000 small-cap index at lower risk, too.

The 8 FANG stocks have a market cap where one could buy the whole global small-cap universe plus whole stock markets of respectable countries.

One could sell Apple & buy the Russell 2000 small-cap index at lower risk, too.

The 8 FANG stocks have a market cap where one could buy the whole global small-cap universe plus whole stock markets of respectable countries.

18/ Now, it is worth mentioning that the trend is NOT as overheated as it was in the late 1990s.

The chart below shows during late 1999 and into early 2000, an investor was averaging a 50% CAGR on a 5-year period holding Tech — while today we are only at half of those returns.

The chart below shows during late 1999 and into early 2000, an investor was averaging a 50% CAGR on a 5-year period holding Tech — while today we are only at half of those returns.

19/ The Tech sector is now trading at almost 30% above its 1-year moving average, the first time since the year 2000.

However, that happened quite regularly from 1995 until the peak of the bubble.

Maybe there is room for another few blow-off tops, after this one?

However, that happened quite regularly from 1995 until the peak of the bubble.

Maybe there is room for another few blow-off tops, after this one?

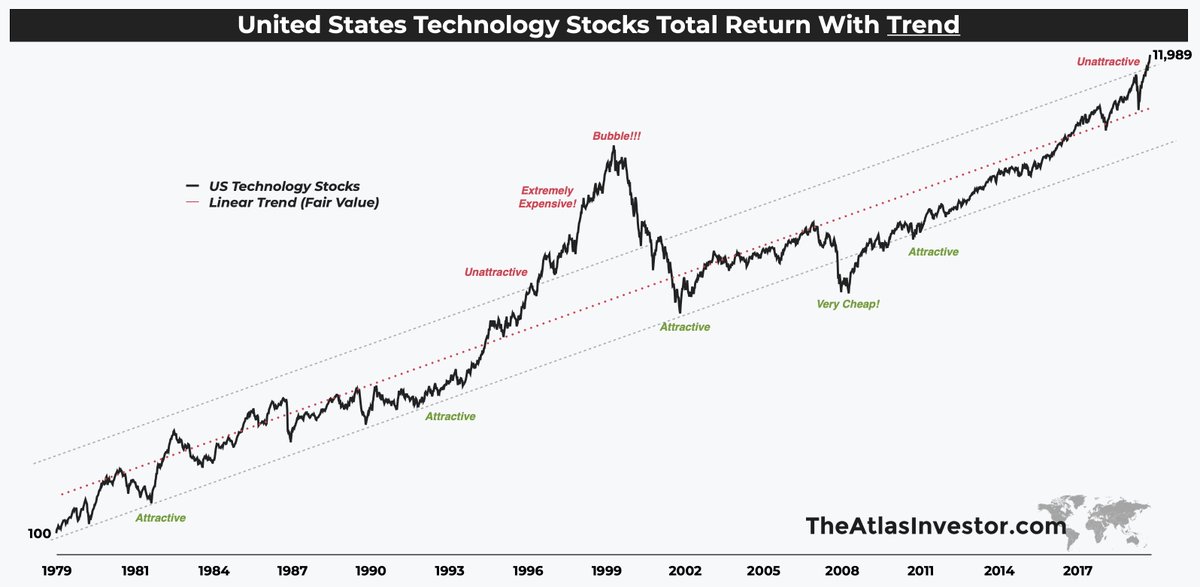

20/ In other words, it could still go on for a while.

Maybe some months, even years, as it was the case from 1997 until the final peak.

It went from unattractive, to extremely expensive to a total bubble!

Remember, those who bought in 2000 broke even only a few years ago.

Maybe some months, even years, as it was the case from 1997 until the final peak.

It went from unattractive, to extremely expensive to a total bubble!

Remember, those who bought in 2000 broke even only a few years ago.

21/ Does that make it a "great deal" today?

We don& #39;t think so. Not for OUR capital.

But maybe for yours, especially if all you do is trade on a shorter-term timeframe.

You might even get really rich, really quickly (people love the sound of that) if it keeps going higher.

We don& #39;t think so. Not for OUR capital.

But maybe for yours, especially if all you do is trade on a shorter-term timeframe.

You might even get really rich, really quickly (people love the sound of that) if it keeps going higher.

22/ Just remember to sell out at some point, before you lose everything the way those speculators did before you back in 2000-03 period.

“History doesn& #39;t repeat itself, but it often rhymes.” — Mark Twain

“History doesn& #39;t repeat itself, but it often rhymes.” — Mark Twain

23/ Finally, it’s worth being fully transparent & noting that I personally don& #39;t have #skininthegame on either the long or the short side.

Therefore, opinions do not carry as much weight the way someone’s with actual real money, energy & effort invested in these sectors does.

Therefore, opinions do not carry as much weight the way someone’s with actual real money, energy & effort invested in these sectors does.

Read on Twitter

Read on Twitter