* THREAD ON IPO *

DISCLAIMER : MY PERSONAL OPINION.

1/13

It is the season of IPO& #39;s after a recent lull.

#IPO short for Initial Public Offering is a process wherein a Pvt Co goes public by issuing new shares or the existing shareholders sell their shares to new people .

+

DISCLAIMER : MY PERSONAL OPINION.

1/13

It is the season of IPO& #39;s after a recent lull.

#IPO short for Initial Public Offering is a process wherein a Pvt Co goes public by issuing new shares or the existing shareholders sell their shares to new people .

+

2/13

The price is decided with the help of a syndicate of investment bankers

via a book building process & the minimum subscription is ensured by the underwriters.

Since professionals decide the issue price , obviously the company is great ,duh https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">! Once listed will

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">! Once listed will  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

+

The price is decided with the help of a syndicate of investment bankers

via a book building process & the minimum subscription is ensured by the underwriters.

Since professionals decide the issue price , obviously the company is great ,duh

+

3/13

With such great dreams we set out & invest heavily .Imagine our happiness when we get allotted 2lots for all our efforts! Yay https://abs.twimg.com/emoji/v2/... draggable="false" alt="😃" title="Lächelndes Gesicht mit geöffnetem Mund" aria-label="Emoji: Lächelndes Gesicht mit geöffnetem Mund">!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😃" title="Lächelndes Gesicht mit geöffnetem Mund" aria-label="Emoji: Lächelndes Gesicht mit geöffnetem Mund">!

Oh the imaginary windfall gains ! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Woman dancing" aria-label="Emoji: Woman dancing">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💃" title="Woman dancing" aria-label="Emoji: Woman dancing">

Arrive listing day : 6%gains . (UNREALISED obviously! As company is really good .Deserves 30% gains !) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">

+

With such great dreams we set out & invest heavily .Imagine our happiness when we get allotted 2lots for all our efforts! Yay

Oh the imaginary windfall gains !

Arrive listing day : 6%gains . (UNREALISED obviously! As company is really good .Deserves 30% gains !)

+

4/13

A week into listing, to our horror , we find stock trading below IPO levels! How is this possible! Let me hold onto it .Ek saal main https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

We become long term investors BY FORCE, NOT CHOICE.

By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug">

An example (out of the many) to substantiate +

A week into listing, to our horror , we find stock trading below IPO levels! How is this possible! Let me hold onto it .Ek saal main

We become long term investors BY FORCE, NOT CHOICE.

By year end stock

An example (out of the many) to substantiate +

5/13

The biggest myth around IPO - One can make EASY money !!

These stocks are newly issued & hence not been traded prior. Thus they are less analysed than listed companies with a history. So the risk is considerably higher ,for what is well concealed may stay hidden ! +

The biggest myth around IPO - One can make EASY money !!

These stocks are newly issued & hence not been traded prior. Thus they are less analysed than listed companies with a history. So the risk is considerably higher ,for what is well concealed may stay hidden ! +

6/13

Also the liquidity in the primary market is less as compared to that of secondary market which helps companies package themselves easily to obtain a higher valuation - Hence if observed , IPO& #39;s happen at the peak of business cycle.

No prizes for guessing why ! :))

+

Also the liquidity in the primary market is less as compared to that of secondary market which helps companies package themselves easily to obtain a higher valuation - Hence if observed , IPO& #39;s happen at the peak of business cycle.

No prizes for guessing why ! :))

+

7/13

The projections & multiples of price to earnings shown are ridiculous at times ! Understanding the present & more importantly the future prospects of the Co. along with the sectoral headwinds & tailwinds is paramount !

Par apne ko sirf rokda chahiye , analysis nahi! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht"> +

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht"> +

The projections & multiples of price to earnings shown are ridiculous at times ! Understanding the present & more importantly the future prospects of the Co. along with the sectoral headwinds & tailwinds is paramount !

Par apne ko sirf rokda chahiye , analysis nahi!

8/13

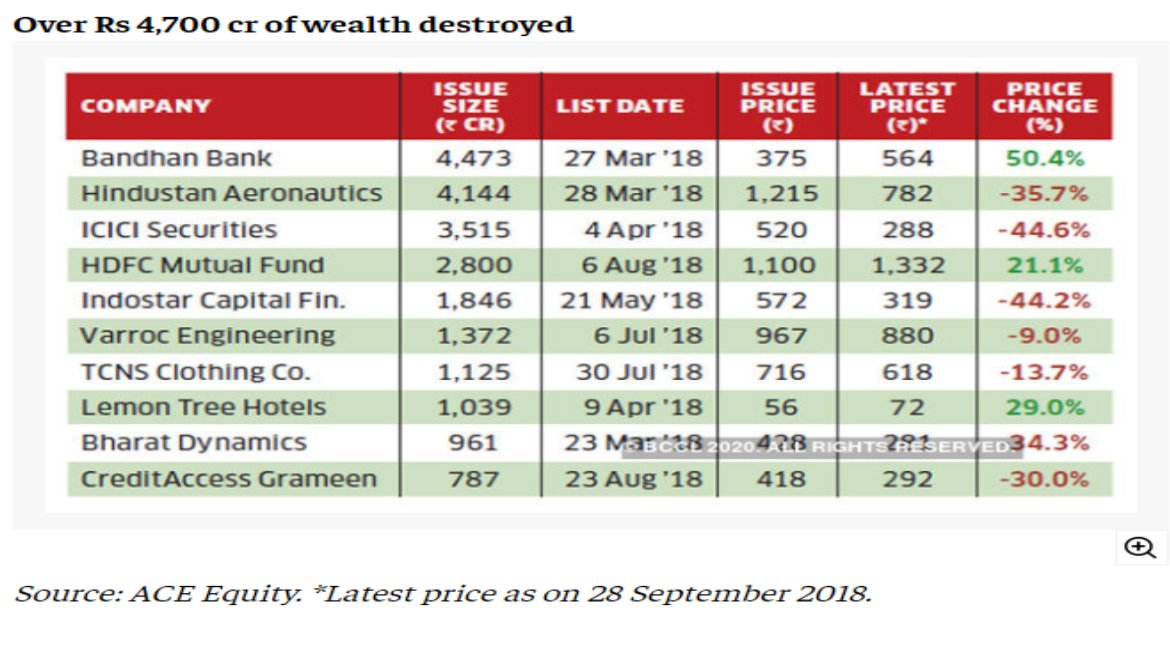

* WEALTH EROSION HAPPENS MORE OFTEN THAN WE KNOW *

The rally fizzles out sooner than expected.

Some 69 odd companies raised over ₹27,900crore through IPO in 2018 of which 60% of them were trading below their issue prices post the IPO.

Example of erosion given below .

+

* WEALTH EROSION HAPPENS MORE OFTEN THAN WE KNOW *

The rally fizzles out sooner than expected.

Some 69 odd companies raised over ₹27,900crore through IPO in 2018 of which 60% of them were trading below their issue prices post the IPO.

Example of erosion given below .

+

9/13

Now am not saying the above scrips are bad! The businesses may go on to do extremely well in long term .But from an IPO gain perspective?

Also let& #39;s just focus on the absolute returns + the opportunity cost + any borrowed cost for IPO !

Easy money ? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

I think not !

+

Now am not saying the above scrips are bad! The businesses may go on to do extremely well in long term .But from an IPO gain perspective?

Also let& #39;s just focus on the absolute returns + the opportunity cost + any borrowed cost for IPO !

Easy money ?

I think not !

+

10/13

Again many do manage to TIME THEIR EXITS TO PERFECTION & MINT MONEY https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen"> ( Almost in all IPO& #39;s that too !! )

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen"> ( Almost in all IPO& #39;s that too !! )

But I belong to that category of retail investor who doesn& #39;t get ANY allotment in good scrips / gets peanuts ! Large IPO gains happen in dreams only ! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Nachdenkliches Gesicht" aria-label="Emoji: Nachdenkliches Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Nachdenkliches Gesicht" aria-label="Emoji: Nachdenkliches Gesicht">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷" title="Person shrugging" aria-label="Emoji: Person shrugging">

+

Again many do manage to TIME THEIR EXITS TO PERFECTION & MINT MONEY

But I belong to that category of retail investor who doesn& #39;t get ANY allotment in good scrips / gets peanuts ! Large IPO gains happen in dreams only !

+

11/13

Other relevant pointers to my limited knowledge :

* Grey market influences the pricing & sentiments largely ( HYPE!)

* Expensive valuations pitched by IB leaving hardly any money on the table .

* Risk-Reward ratio seems skewed.

* Dependant on external factors.

+

Other relevant pointers to my limited knowledge :

* Grey market influences the pricing & sentiments largely ( HYPE!)

* Expensive valuations pitched by IB leaving hardly any money on the table .

* Risk-Reward ratio seems skewed.

* Dependant on external factors.

+

12/13

*Absolute returns over time diminish due to high initial valuations . Secondary markets makes more sense.

* Applying in too many IPO& #39;s akin to gambling. We might get allotment in the bad ones! Moreover large amt of liquidity needed! Too subjective.

#InvestmentPointers +

*Absolute returns over time diminish due to high initial valuations . Secondary markets makes more sense.

* Applying in too many IPO& #39;s akin to gambling. We might get allotment in the bad ones! Moreover large amt of liquidity needed! Too subjective.

#InvestmentPointers +

13/13

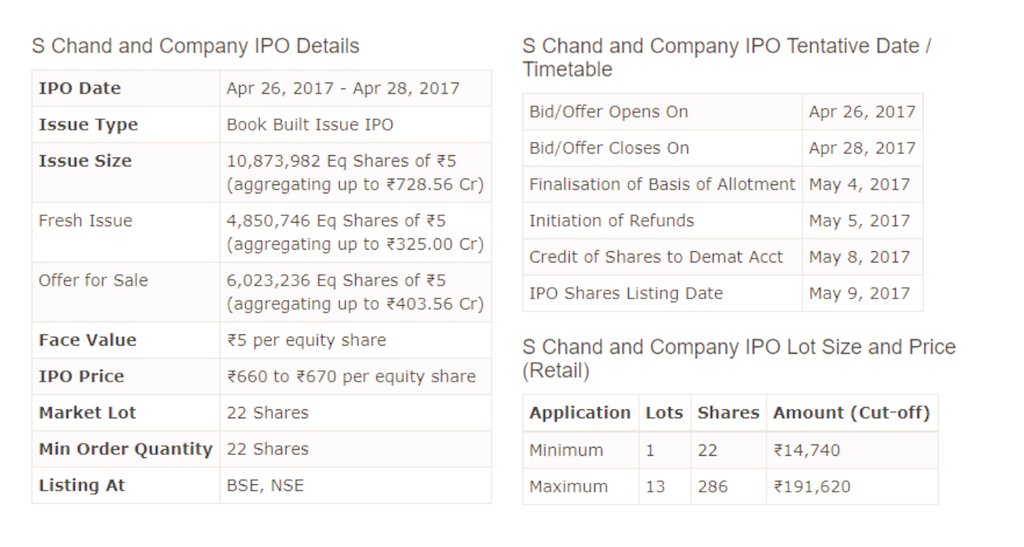

For every Dmart there is a Reliance Power , for every IRCTC there is a S Chand .

Thus a better definition of IPO would be "It& #39;s Probably Overpriced" !

Pls do take this with a bucket of salt! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😇" title="Lächelndes Gesicht mit Heiligenschein" aria-label="Emoji: Lächelndes Gesicht mit Heiligenschein">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😇" title="Lächelndes Gesicht mit Heiligenschein" aria-label="Emoji: Lächelndes Gesicht mit Heiligenschein">

@dmuthuk

@Vivek_Investor

@RichifyMeClub

@safalniveshak

For every Dmart there is a Reliance Power , for every IRCTC there is a S Chand .

Thus a better definition of IPO would be "It& #39;s Probably Overpriced" !

Pls do take this with a bucket of salt!

@dmuthuk

@Vivek_Investor

@RichifyMeClub

@safalniveshak

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +" title="4/13A week into listing, to our horror , we find stock trading below IPO levels! How is this possible! Let me hold onto it .Ek saal main https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +" title="4/13A week into listing, to our horror , we find stock trading below IPO levels! How is this possible! Let me hold onto it .Ek saal main https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +" title="4/13A week into listing, to our horror , we find stock trading below IPO levels! How is this possible! Let me hold onto it .Ek saal main https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +" title="4/13A week into listing, to our horror , we find stock trading below IPO levels! How is this possible! Let me hold onto it .Ek saal main https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">We become long term investors BY FORCE, NOT CHOICE. By year end stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛬" title="Ankommendes Flugzeug" aria-label="Emoji: Ankommendes Flugzeug"> An example (out of the many) to substantiate +">