On today’s “tax bombshell” stories.

Borrowing costs are ultra low. But *at some point* there will need to be a fiscal repair job. The timing of that is more likely in the second half of this Parliament than immediately.

The aim is likely to be to stabilise the debt ratio...

Borrowing costs are ultra low. But *at some point* there will need to be a fiscal repair job. The timing of that is more likely in the second half of this Parliament than immediately.

The aim is likely to be to stabilise the debt ratio...

... at around 100% of GDP rather than to reduce it.

But depending on how big the lasting hit to growth from the pandemic is, that will still be a big job.

But, it is unlikely to be like the 2010s.

But depending on how big the lasting hit to growth from the pandemic is, that will still be a big job.

But, it is unlikely to be like the 2010s.

Johnson’s political coalition is very different to Cameron’s. It points towards tax doing more of the lifting than spending cuts. Plus, we’ve already had a decade of spending side restraint. There is simply not much room to cut.

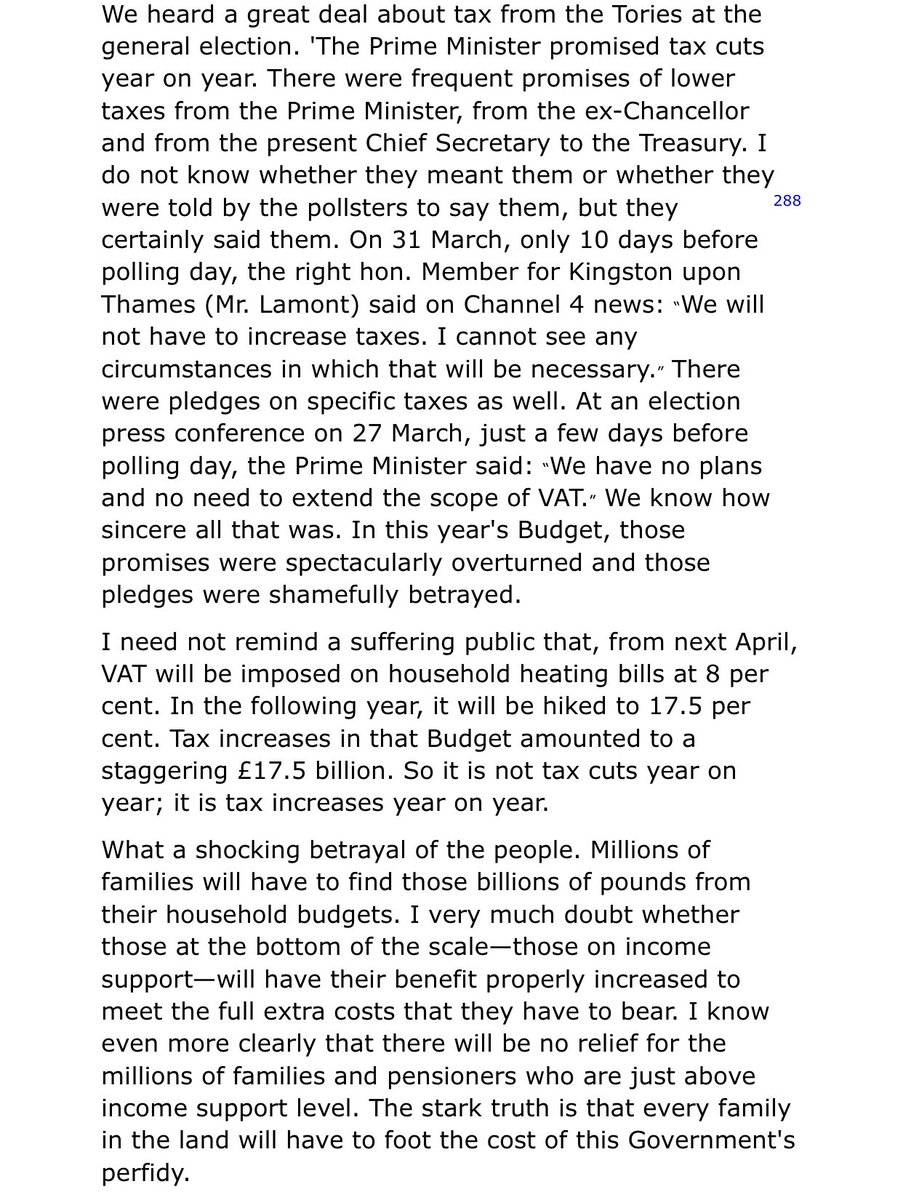

So, think of the 1990s rather than the 2010s as a guide. The big theme of the 2020s is going to be tax rises.

And given a widespread reluctance to touch the big three (NICS, basic rate of income tax and VAT), that means pension relief, CGT, fuel duty, corporation tax, etc.

And given a widespread reluctance to touch the big three (NICS, basic rate of income tax and VAT), that means pension relief, CGT, fuel duty, corporation tax, etc.

If you want to understand much of our political debate for the next few years... turn to early 1990s Hansard. https://api.parliament.uk/historic-hansard/commons/1993/jun/09/government-economic-and-social-policy">https://api.parliament.uk/historic-...

Read on Twitter

Read on Twitter