1) A Lesson for CEOs: How to Attract an Activist Investor Into Your Shareholder Base. @Valvoline $VVV

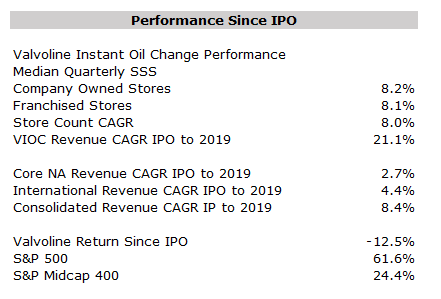

To start, have diverging between operational performance and share price performance.....

To start, have diverging between operational performance and share price performance.....

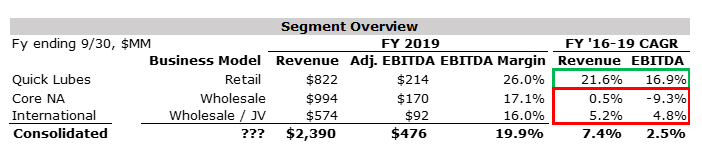

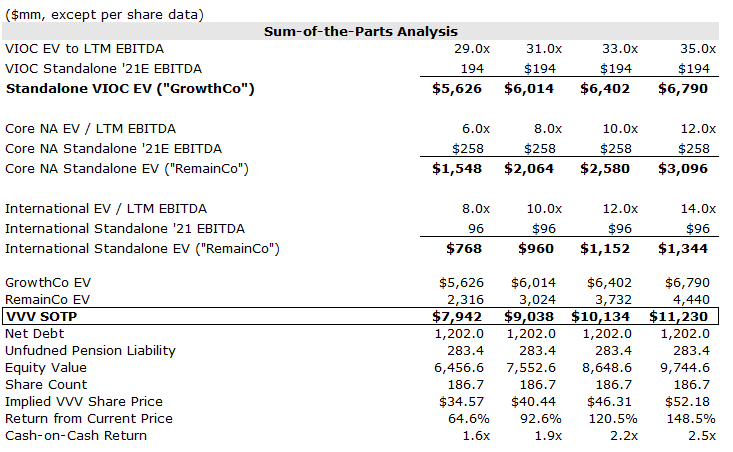

2) Own businesses with different business models, growth trajectories, and minimal strategic rationale for keeping them together......

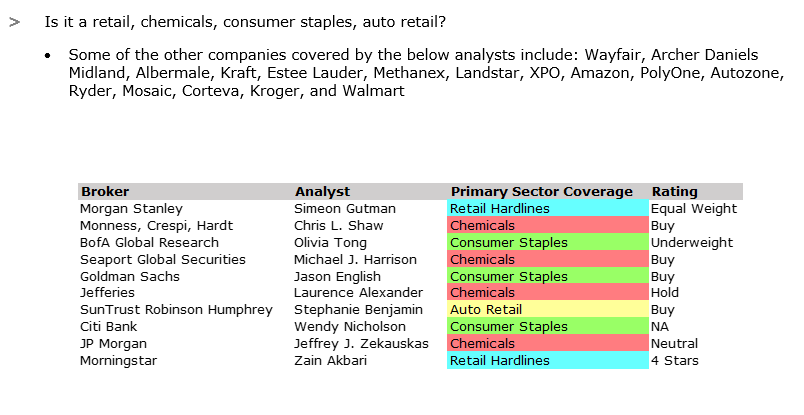

3) Find sell-side analysts who cover don& #39;t know how to cover you given your differing business models.....

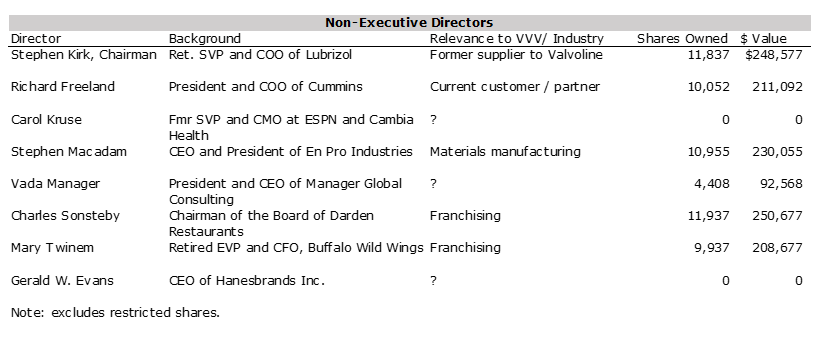

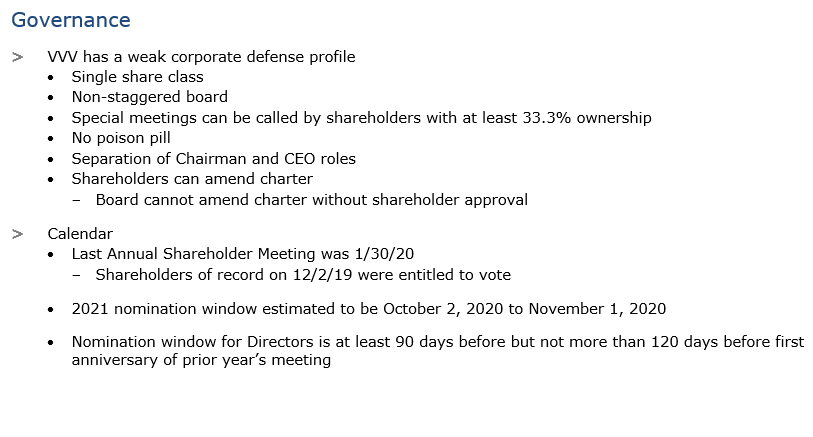

4) Find board members with little experience relevant to helping your company with its operational, strategic, and capital allocation issues. Find board members who won& #39;t invest a material amount of money into the company....

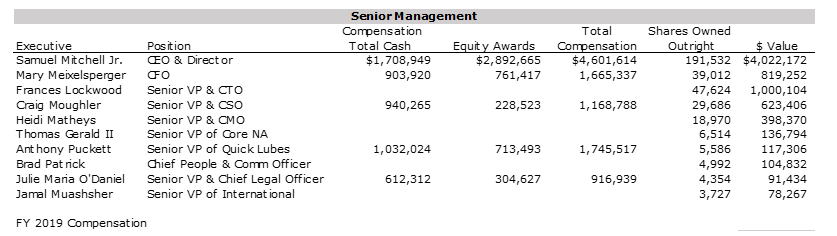

5) Make cash compensation for management more important than equity compensation and owning a material amount of stock in the company.....

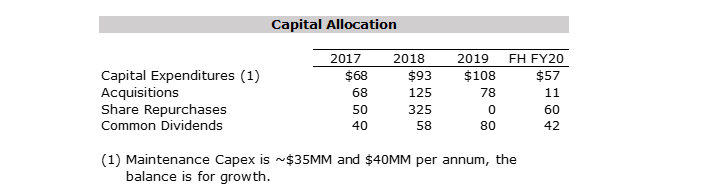

6) Pay a high dividend to reward legacy, pre-spin, shareholders, while stopping a share repurchase program, specifically during times your shares are materially undervalued......

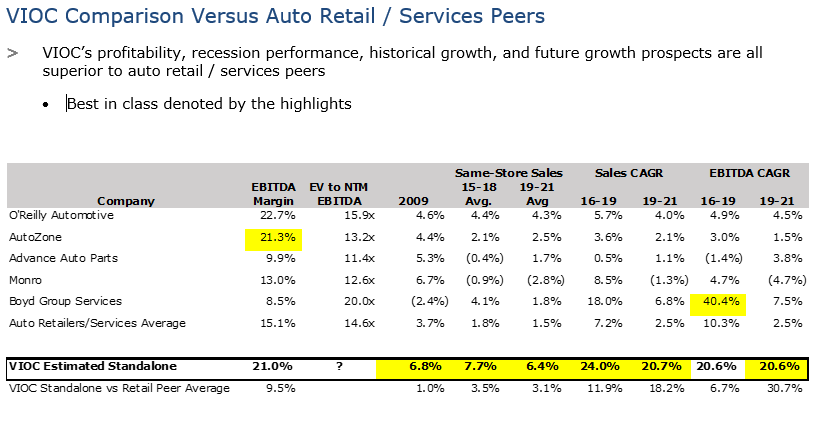

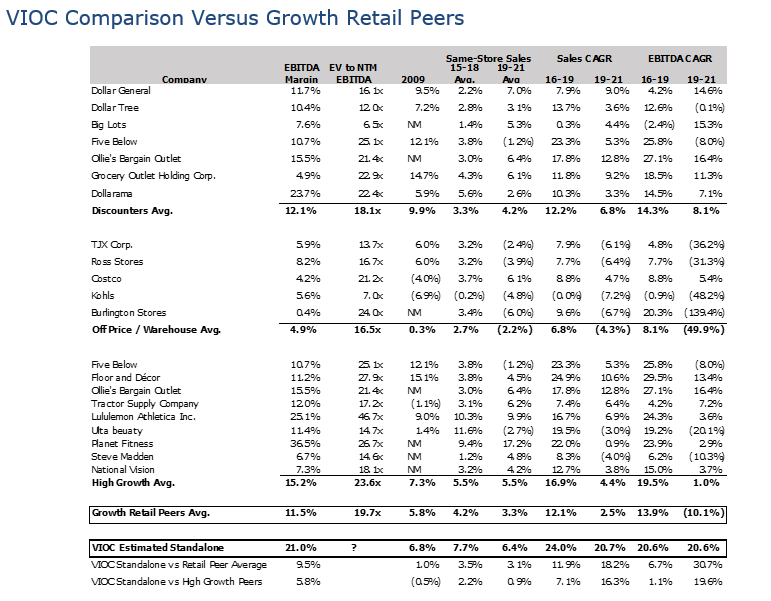

7) Own a business, in this case Valvoline Instant Oil Change (VIOC), that on a stand-alone basis, would crush its peers.....

Read on Twitter

Read on Twitter