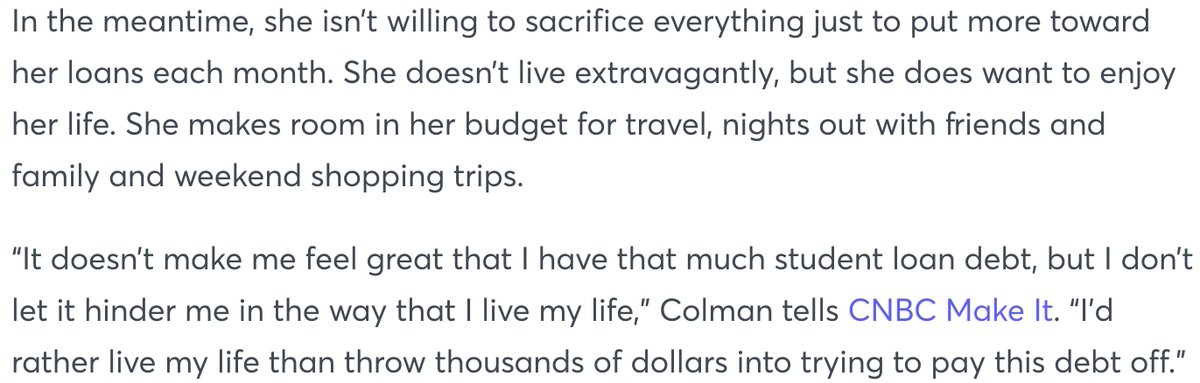

An interesting case study. Lots to critique here, but I think this quote is probably the mindset I try to help high income professionals get over quickly: https://www.cnbc.com/2020/08/27/this-30-year-old-has-over-230000-in-student-loan-debt.html">https://www.cnbc.com/2020/08/2...

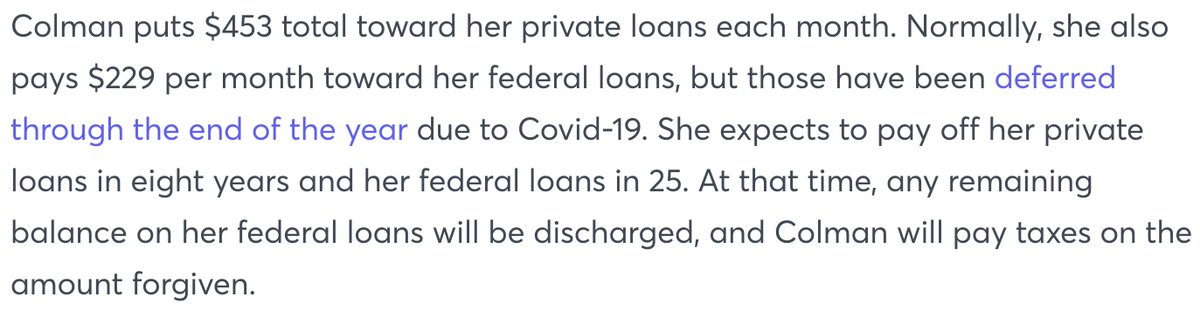

No mention of how much she is putting into an investing account to save up for the tax bomb she will have in 25 years, so presumably nothing. If she thinks owing $200K to the Department of Education is uncomfortable, wait until she owes that much to the IRS.

It& #39;s not like it is just the student loans either. There& #39;s credit card debt and an auto loan too. It& #39;s the classic "I deserve all this despite the fact that I borrowed 3+ years of net earnings to get my job." What happens when she gets sick of working 7 days a week?

What will drop out of her budget then? The problem with the article is that it makes it sound like these decisions are okay and that things are going to work out for her just fine if she stays on this path. They aren& #39;t.

Read on Twitter

Read on Twitter