New working paper just came out through @CESifo (joint w Steph Assad, Rob Clark and Lei Xu). We look at the effects of mass adoption of algorithmic pricing software on competition using data from the gasoline retail market in Germany. Time for a LONG thread!

Big recent debate whether price setting algos can tacitly-collude. “No” side claims algos can’t hold subtle off-eqbm beliefs necessary for collusion. But simulations in a forth. AER by @EmilioC_ show that algos can learn what looks like collusive strategies (also see @TimoKlein)

But even if algos can learn to collude IN THEORY (or simulation), can they do this IRL? Enter our paper! Gasoline retail is an early adopter of algo-pricing tech. Retailers were using non-AI-powered algos, the product is homogeneous and there’s LOTS of training data.

European firms are market leaders for AI pricing software. Especially a DK company called a2i is prominently mentioned in the WSJ story. There are other firms in this market, but a2i is unusually transparent re: rollout and even have an (admittedly vague) CS paper circulating

a2i advertised their software in German trade magazines around 2017, claiming that it’s available for any station starting summer 2017. Germany has incredible retail gas price data, so it’s a great setting to look for effects of mass-adoption of algo software on competition.

Before I really get going, here’s a LEGAL DISCLAIMER: to our knowledge, there is no direct evidence of anticompetitive behaviour on the part of any algorithmic-software firms or gasoline brands mentioned in this paper. Our analysis is from a strictly economic point of view.

Onto the paper. We face 3 main problems in trying to answer our question: (1) we don’t directly observe adoption in our data. (2) adoption is likely super endogenous. (3) showing that algo-pricing effects operate through COMPETITION rather than other channels

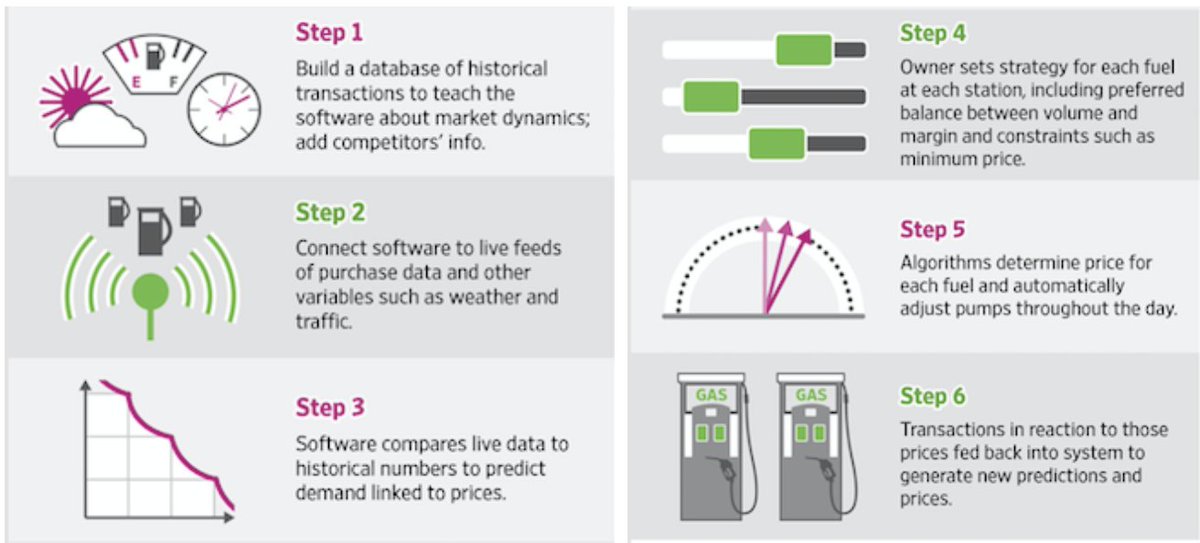

How we deal with problem (1): We know what algorithmic software providers PROMISE - fast and responsive changes to real-time events. Basically, a drastic break from past pricing patterns devised by rule-based (non-algorithmic) pricing algos.

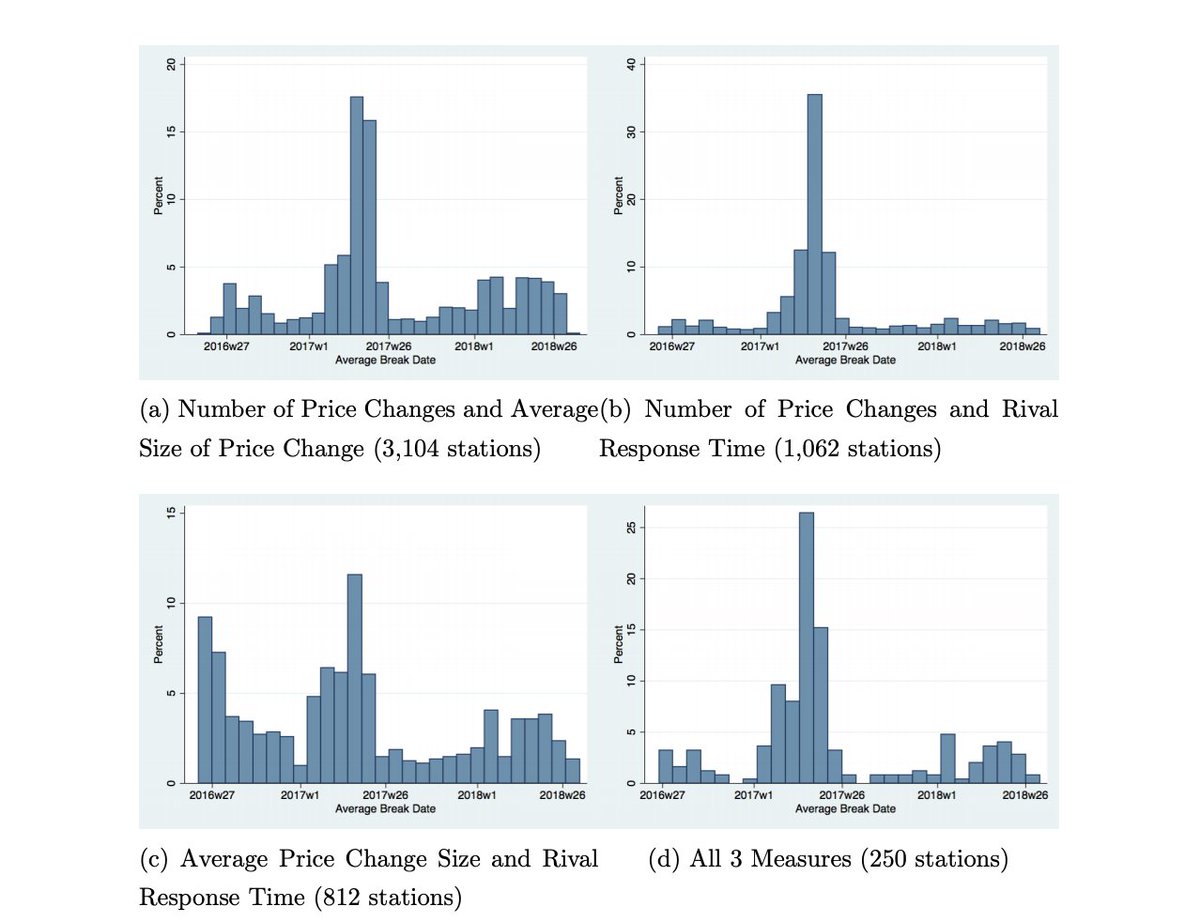

Germany has high-freq price data at 1min intervals. We use Quandt-LR to look for station-level structural breaks in 3 pricing measures: number of daily price changes, size of price changes, response time relative to nearby rivals. These directly reflect algo software promises.

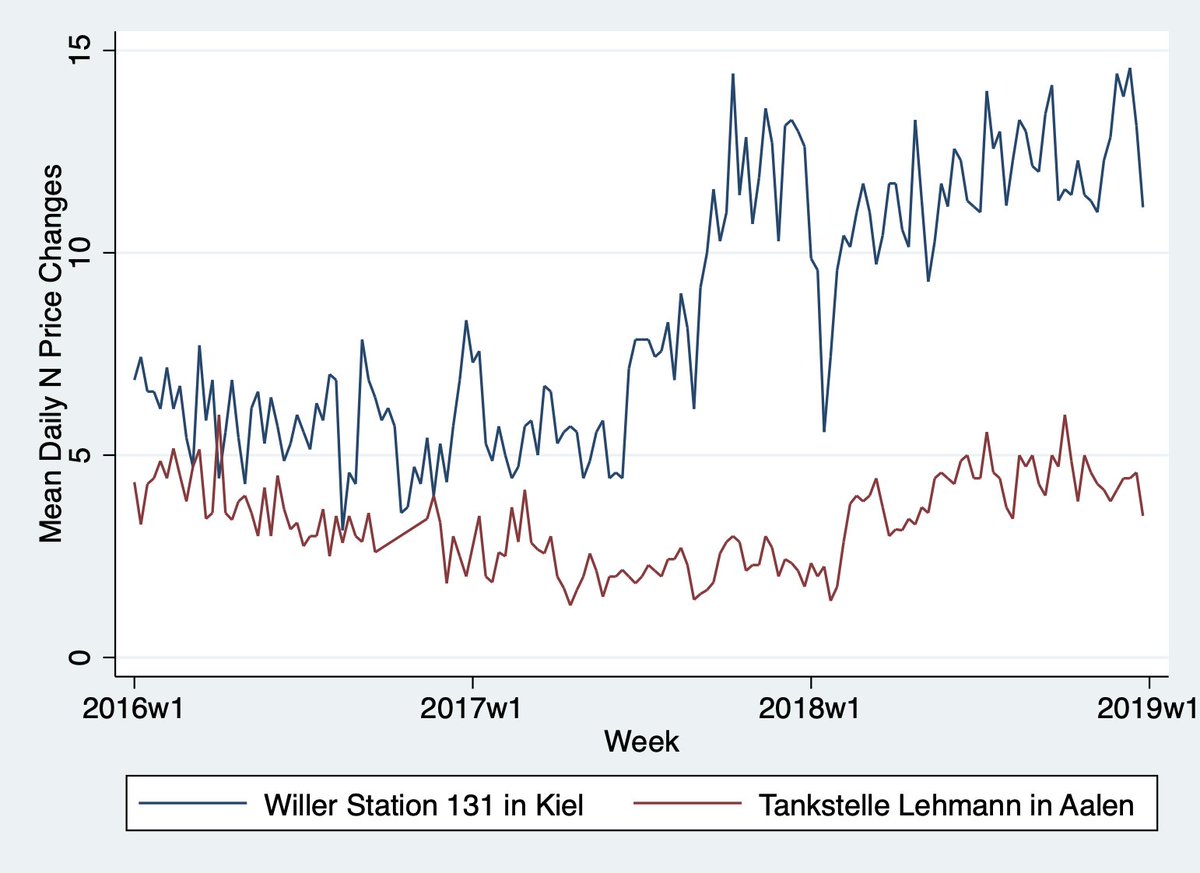

We find a lot of structural breaks in these measures (example in pic). To reduce N of false positives, we call a station an “adopter” only if they experience structural breaks in at least 2 out of 3 measures within a short period of time.

We find a large mass of structural breaks right around the period when software becomes widely available (summer 2017). So it looks like we’re actually picking up station-level adoption.

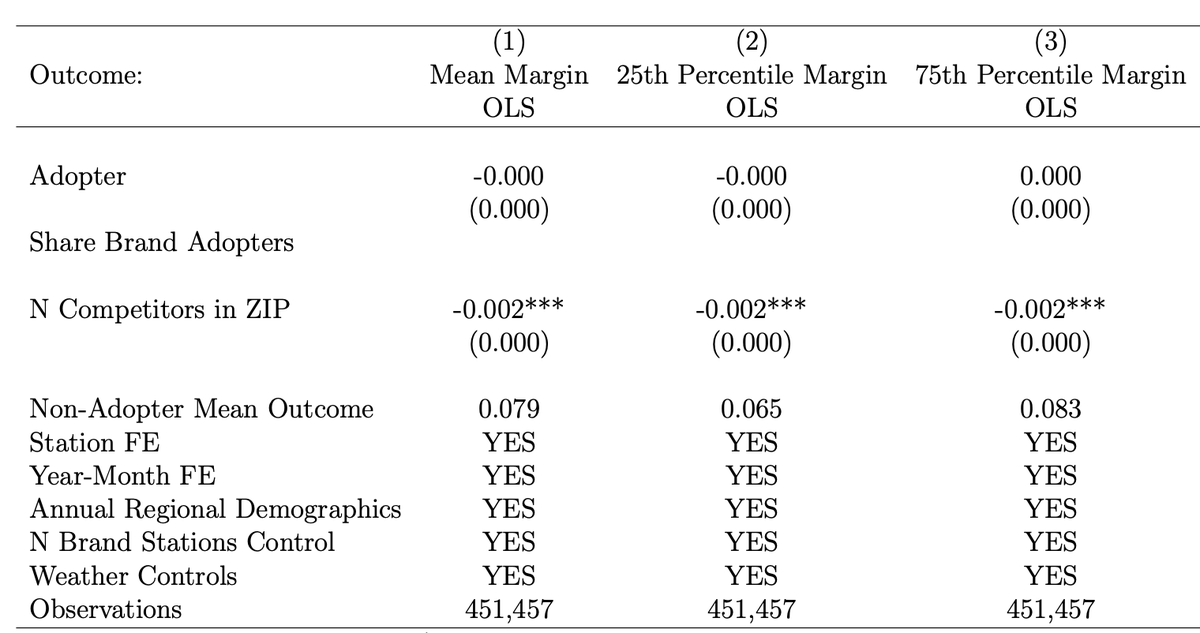

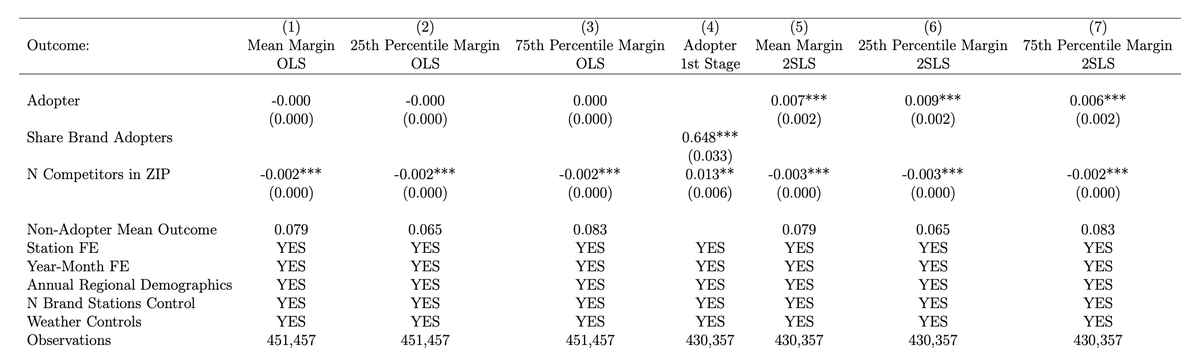

Next is problem (2) - adopting stations are observably different than non-adopters. VERY different. They’re probably also diff in unobservable ways that correlate with adoption decision. Unsurprisingly, OLS reg of price/margin on “adopter” indicator gives a big statistical zero

To deal with this problem we use an IV. We need smthng that changes costs but is uncorrelated with station-specific cost shocks/unobservables. One thing we know is which BRAND a station belongs to (Esso, Total,…). We use Brand-HQ level adoption decisions as an IV.

Why? A brand keen on its stations adopting new technology will directly subsidise their adoption costs or provide logistic or managerial support. Now, we don& #39;t observe brand-HQ adoption, so we use the FRACTION of each brand& #39;s stations that adopt by month "t" as an IV.

If only a small fraction of a brand’s stations adopts, it& #39;s unlikely that the brand itself decided to adopt. If a large fraction adopts, the brand itself likely facilitated adoption by the stations. We support this with examples from past technology adoption events in gas retail

Our IV results show that adoption has a positive effect on retail prices and margins. How big? On avg, effect is around 1 c/litre. This is about a 9% increase in margins. Avg prices also go up by a similar amount.

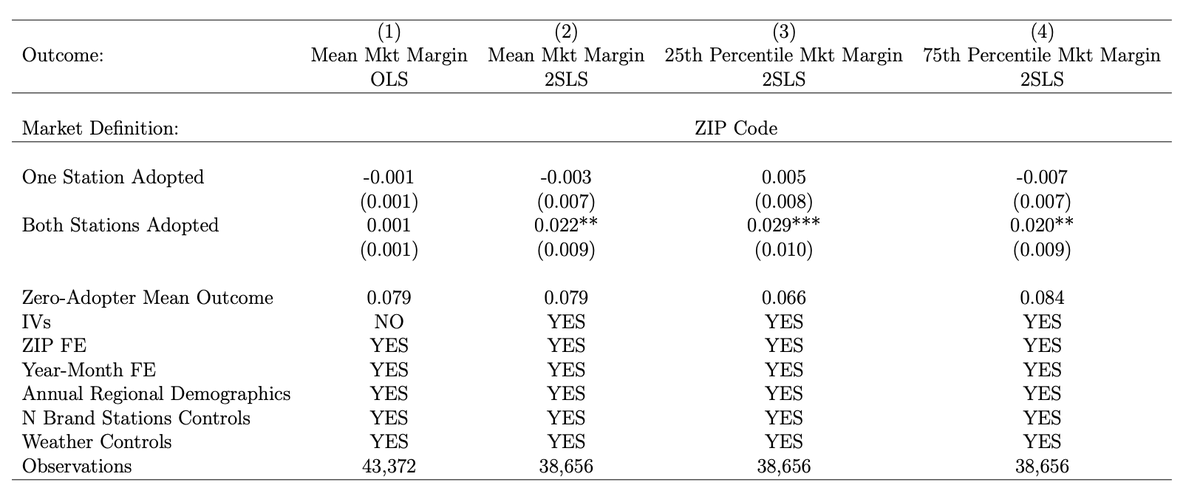

Does it mean that algorithms actually affect competition? This is problem (3). We do two things:(i) find a setting where competition doesn’t matter and compare adoption effects there and in a setting where it does.(ii) look at duopoly markets, comparing mkts with 0/1/2 adopters

Stations that are monopolists in their ZIP code have ZERO effects from adoption. Stations that are not monopolists are driving the average effects.

In duopoly markets, when one station adopts the effects are ZERO. When both stations adopt margins increase by 2 c/litre or 30%. re: TIMING of these effects, we find big increases in margins about 1 year after both stations adopt. This is VERY similar to @EmilioC_ ’s sim findings

Overall, we show that adoption of algorithmic pricing increases prices and margins. This is directly related to competition and especially algos competing against one another. It& #39;s suggestive of algorithms learning tacitly-collusive strategies over time.

Our results are troubling and personally bum me out! A lot of money is coming out of peoples pockets. I’m generally a real optimist when it comes to technology, #AI and #2ma, but there is a real risk to competition.

These issues should be investigated further by competition authorities. At the very least, there should be a pricing software census... we need to understand what software firms use and whether our results come from firms using the SAME or DIFF algorithms...

That’s it! If you want to know more, please read the paper! And don’t hesitate to contact me with comments/questions! We’re also presenting this paper at the upcoming NBER AI workshop on Sept 24-25 which should be streamed on YouTube.

http://conference.nber.org/sched/AIf20 ">https://conference.nber.org/sched/AIf...

http://conference.nber.org/sched/AIf20 ">https://conference.nber.org/sched/AIf...

And if you made it all the way here, here’s my favourite gas station related gif!

Read on Twitter

Read on Twitter