Another Saturday. Another French hidden champion. Another 25x-bagger listed on the compartment C of Euronext Paris! A collaboration with the excellent @FoxCastlehold!

1980s. Bernard Tapie, the controversial and (in)famous French millionaire-raider is on a shopping spree in the weighing industry. His BTF holdco has already gobbled up Testud, Terraillon...He’s getting ready to make on offer for yet another small company in this sector...

But the man in front of Tapie will turn down his offer and assert his independence. This man is Jean Escharavil. The company he is leading has been owned by his family for 3 generations and he’s not about to let it go anywhere. This company is Precia: a thread!

Precia was founded in 1888 by Jean’s grandfather, also named in Privas, Ardèche. Started as a small workshop of scales maintenance and installation, Precia is going to become a leader in the French weighing industry.

In 1951, Jean and his brother decide to start manufacturing scales and over the years will incorporate more and more electronic components in their devices on top of the customary mechanical parts.

The company gets listed in 1985 on the French “second market” and acquires Molen in the Netherlands in 1993. But the 1990s will be a tough decade for the company then led by Francois Wendling.

Despite its position as a leader in France and Europe, Precia is facing tough competition and will lose a combined 50m francs (€8m) in 1996 and 1997. Francois Thinard, who replaced Wendling, will restructure the company and put it back on the profitability track.

In 1998, after a cash injection from the Escharavil family and the support of its bank group, Precia breaks even and is reorganized along 3 pillars: equipment, services and international (still limited to 12% of the revenues). Precia then generates ca. €61m in revenues.

Over the next two decades, Precia will accelerate its international development and presence in the services business organically and through multiple acquisitions in France and abroad. Its net income is going to grow from €1m in 2002 to €6.3m in 2019 (for €136m in revenues).

Rene Colombel, who joined the group in 2004 and was appointed its CEO in 2010, has been instrumental in boosting the share of international revenues (accounting for 40%) and services (50%). The recurring nature and very high margins of the latter are a key asset for Precia.

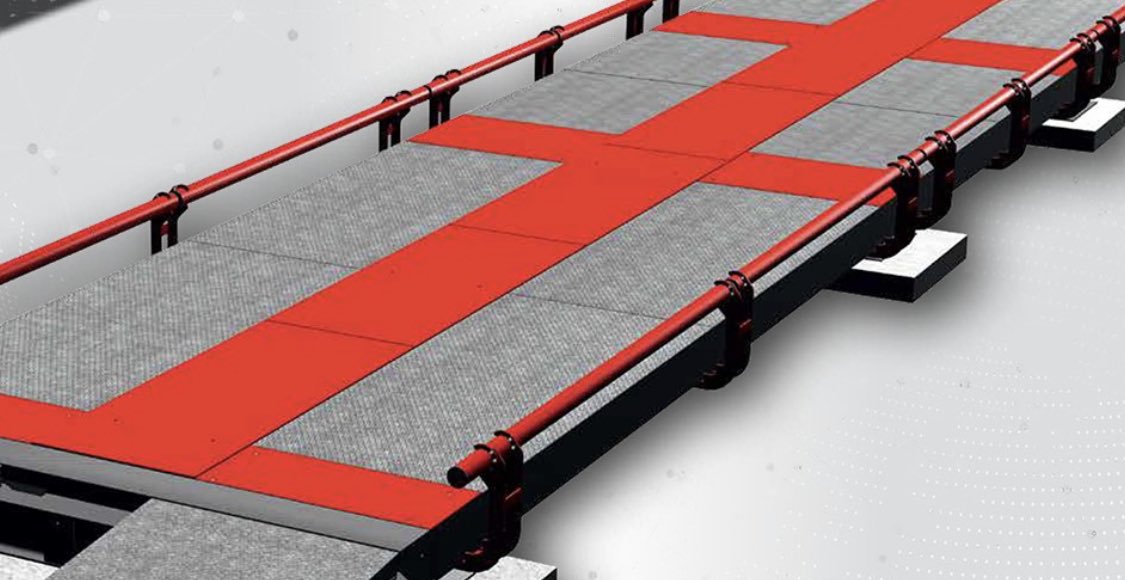

Precia is now the leader in France and number 5 globally in the industrial weighing industry. Its product range covers a vast spectrum of industries, clients and needs (grams to tons). It also enjoys a global presence through 21 international subs and manufacturing sites.

Its earnings growth (6% p.a. over the last 10 years) combined with a multiple re-rating have resulted in its share price soaring. It grew 25x from its low of 2000 to its high of 2018. It is now at 200€ (down 10% from its peak).

In terms of capital allocation, Precia has paid out an average 20% of its earnings over the past 10 years. Profits have been mostly reinvested in growing the business at an average ex-cash ROE of 12% while maintaining a fortress balance sheet (net cash position at ca. €10m).

The acquisition strategy targets small companies that can easily be integrated in countries with little/no presence. The recent deal in Lithuania epitomizes this approach. Founders are often retained as minority shareholders, providing them with a strong incentive to succeed.

Precia repurchased ca. 6% of its own shares over time, incl. in 2018 at prices ranging from 184€ to 190€. Surprisingly, it has not cancelled them yet or taken advantage of the March share price pull back to do more. That said, this cautious approach has worked well so far.

Precia is an attractive investment due to the recurring and mission-critical nature of their business coupled with a strong free cash-flow generation, a sound balance sheet and a growth potential that hasn’t been exhausted. At an EV/EBIT of 8x, the valuation remains reasonable.

The Escharavil family still owns a majority stake in Precia (now headquartered in Veyras, Ardèche) and employees’ well-being is a priority through stock ownership, top-notch infrastructures and the cautious stance taken during the COVID-19 pandemic.

You might have understood it by now: this is exactly the kind of well-run French family-owned companies we love and are proud to be shareholders in!

Read on Twitter

Read on Twitter