5 months after launch...

How are Balancer metrics doing?

And how do I see $BAL supply evolving?

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> (spoiler:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> (spoiler:  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">)

How are Balancer metrics doing?

And how do I see $BAL supply evolving?

A thread

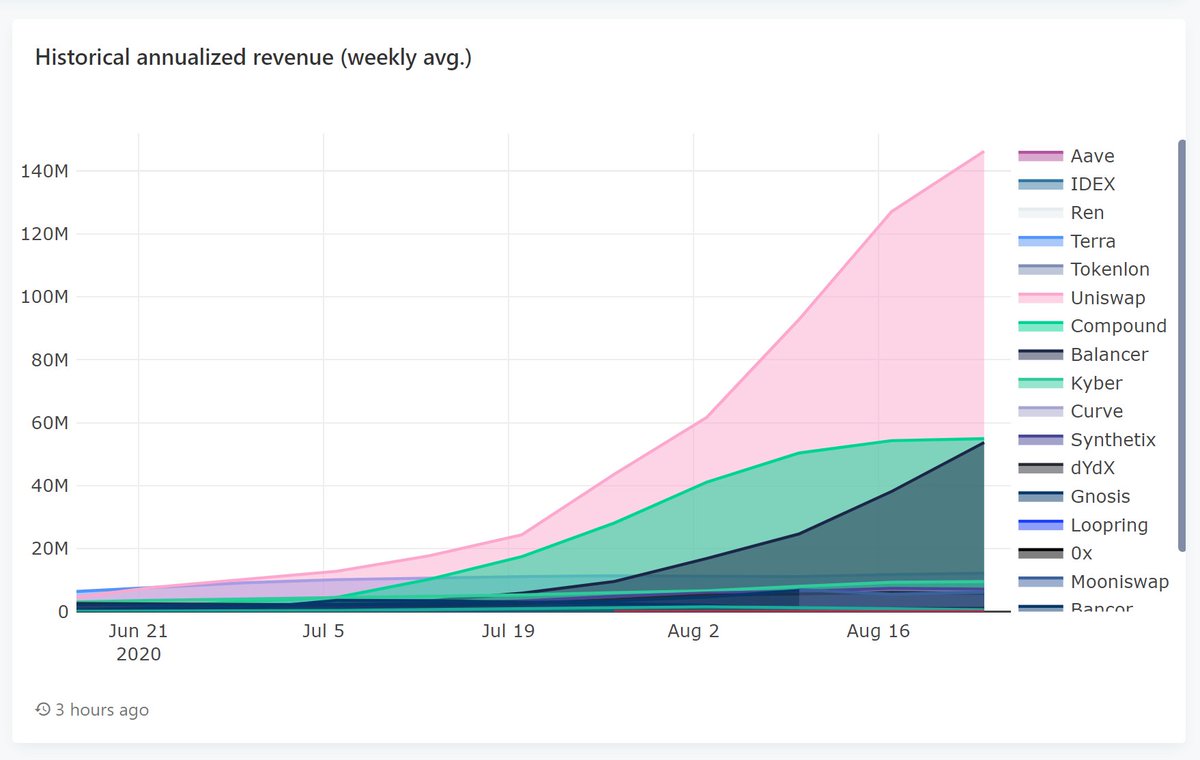

Let& #39;s start by comparing Balancer with other projects in terms of annualized revenue.

I& #39;m sure this graph will be a head scratcher for many...

Way above Synthetix, Curve and Kyber?

Flipped Compound??

I& #39;m sure this graph will be a head scratcher for many...

Way above Synthetix, Curve and Kyber?

Flipped Compound??

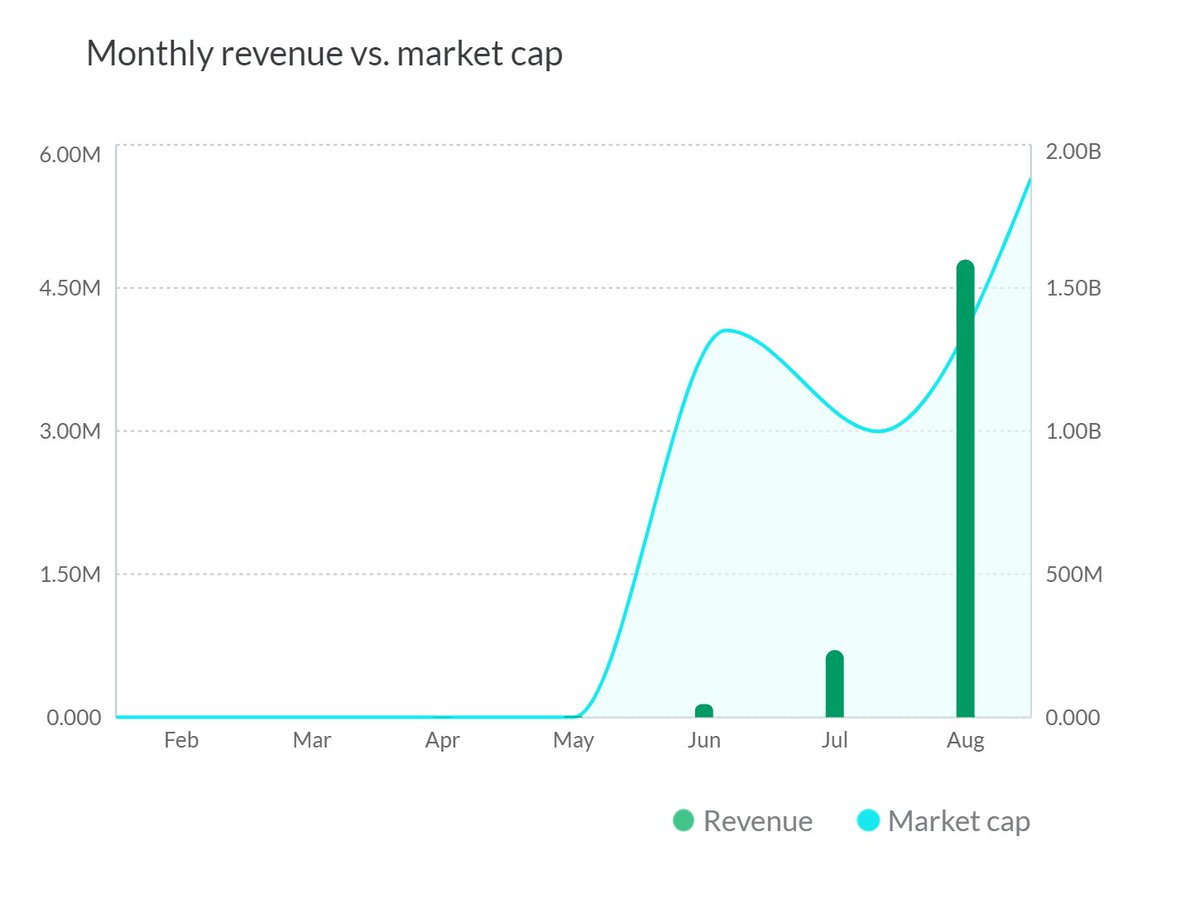

Q: WTH, how is Balancer already that big?!  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">

A: By consistently growing 5-10x EVERY MONTH! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏒" title="Eishockeyschläger und -puck" aria-label="Emoji: Eishockeyschläger und -puck">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏒" title="Eishockeyschläger und -puck" aria-label="Emoji: Eishockeyschläger und -puck">

( @tokenterminal ser, wen log graph? https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">)

A: By consistently growing 5-10x EVERY MONTH!

( @tokenterminal ser, wen log graph?

Of course DeFi as a whole is growing and had a strong Q2 as we apparently approach a bull market.

But the way Uniswap https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦄" title="Einhorngesicht" aria-label="Emoji: Einhorngesicht"> and Balancer

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦄" title="Einhorngesicht" aria-label="Emoji: Einhorngesicht"> and Balancer  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage"> are growing is something entirely different.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage"> are growing is something entirely different.

Reminds me of Binance in H2/2017. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">

Their recent trajectories of annualized revenue are https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

But the way Uniswap

Reminds me of Binance in H2/2017.

Their recent trajectories of annualized revenue are

Why focus on revenue?

TVL and plain volume (for DEXs) are interesting, but they& #39;re means to an end.

Revenue is the metric that reveals potential for *protocol value capture*.

Revenue = volume * fees

TVL and plain volume (for DEXs) are interesting, but they& #39;re means to an end.

Revenue is the metric that reveals potential for *protocol value capture*.

Revenue = volume * fees

Let& #39;s explore fees.

Balancer has the highest take rate (weighted fee average) among DEXs: 0.44%

https://twitter.com/FollowTheChain/status/1175520925976027137">https://twitter.com/FollowThe...

Balancer has the highest take rate (weighted fee average) among DEXs: 0.44%

https://twitter.com/FollowTheChain/status/1175520925976027137">https://twitter.com/FollowThe...

5-10x/month growth isn& #39;t sustainable forever, of course.

But the team keeps on shipping...

Multi-path order routing, for instance, was just launched and is likely to boost volume and improve results for both traders and LPs: https://twitter.com/Daryllautk/status/1298266490450239499">https://twitter.com/Daryllaut...

But the team keeps on shipping...

Multi-path order routing, for instance, was just launched and is likely to boost volume and improve results for both traders and LPs: https://twitter.com/Daryllautk/status/1298266490450239499">https://twitter.com/Daryllaut...

Every new farming game using Balancer as a building block brings a wave of new users. Latest example is @FinanceYfv.

And so does every new token launch made on Balancer. Next up is: https://twitter.com/perpprotocol/status/1298290082672066561">https://twitter.com/perpproto...

And so does every new token launch made on Balancer. Next up is: https://twitter.com/perpprotocol/status/1298290082672066561">https://twitter.com/perpproto...

Now a closer look at incentives.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥕" title="Karotte" aria-label="Emoji: Karotte">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥕" title="Karotte" aria-label="Emoji: Karotte">

Q: Aren& #39;t degen farmers just dumping mined $BAL?

A: Not really. Liquidity Staking began recently, allowing LPs to compound their stack at a faster pace and to achieve a stronger position in protocol governance. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> https://twitter.com/FollowTheChain/status/1296473151610683398">https://twitter.com/FollowThe...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps"> https://twitter.com/FollowTheChain/status/1296473151610683398">https://twitter.com/FollowThe...

Q: Aren& #39;t degen farmers just dumping mined $BAL?

A: Not really. Liquidity Staking began recently, allowing LPs to compound their stack at a faster pace and to achieve a stronger position in protocol governance.

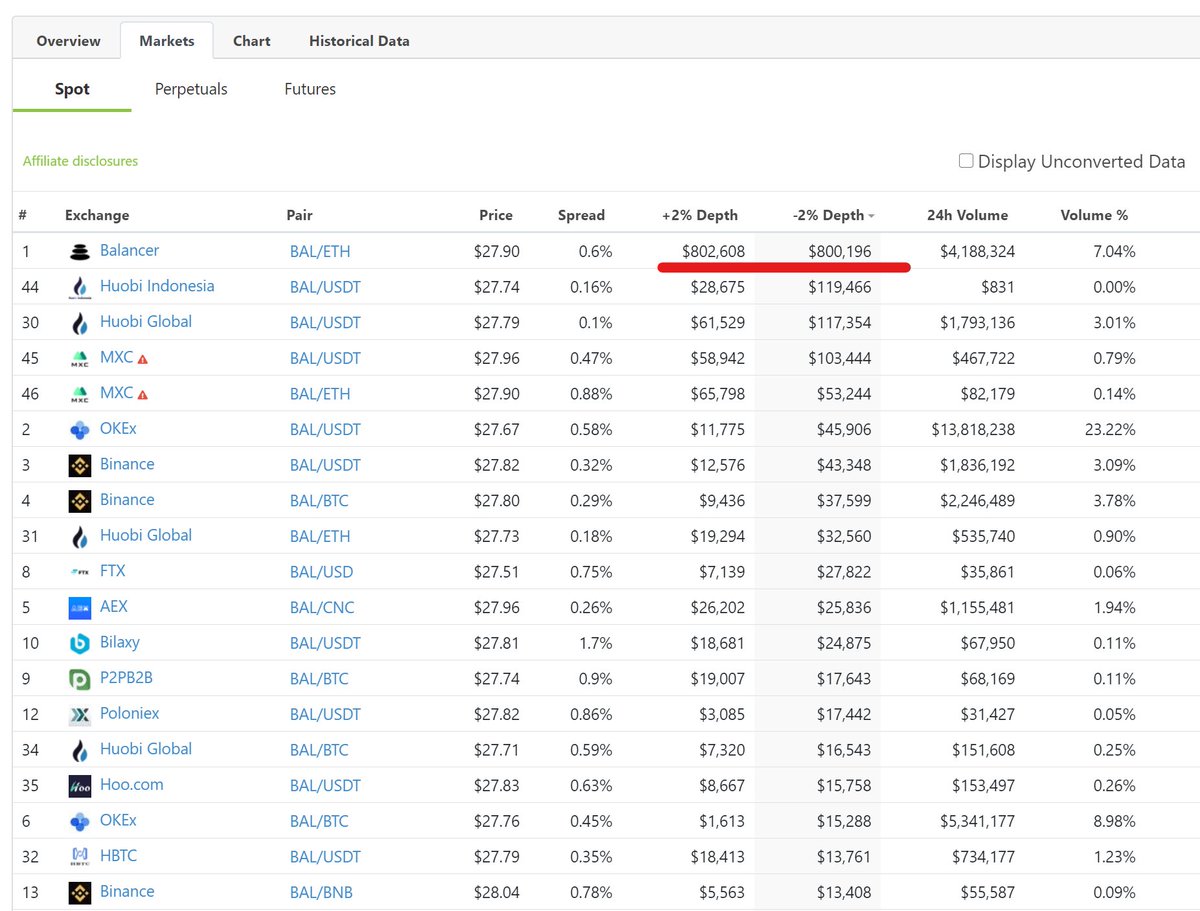

This week, $BAL distribution (yellow arrow @ BAL/ETH chart) created *no sell pressure* at all.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="☂️" title="Regenschirm" aria-label="Emoji: Regenschirm">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☂️" title="Regenschirm" aria-label="Emoji: Regenschirm">

The message from LPs is clear: owning a piece of Balancer governance is more valuable than dumping their mining proceeds.

LPs are now hodlers w/ compounding protocol ownership! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">

The message from LPs is clear: owning a piece of Balancer governance is more valuable than dumping their mining proceeds.

LPs are now hodlers w/ compounding protocol ownership!

Also, liquidity in BAL pools increased significantly, meaning Liquidity Staking is a great success so far.

This is the recent evolution of liquidity in the popular 67/33 BAL/ETH pool: 3x in 10 days. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

This is the recent evolution of liquidity in the popular 67/33 BAL/ETH pool: 3x in 10 days.

Q: But staking locks tokens, which artificially restricts supply and liquidity, right?

A: NO! In Balancer& #39;s Liquidity Staking, you provide liquidity with BAL, but there& #39;s *no locking*. https://twitter.com/FollowTheChain/status/1297975278308864006">https://twitter.com/FollowThe...

A: NO! In Balancer& #39;s Liquidity Staking, you provide liquidity with BAL, but there& #39;s *no locking*. https://twitter.com/FollowTheChain/status/1297975278308864006">https://twitter.com/FollowThe...

Q: And how deep is BAL liquidity on Balancer then?

A: Already much deeper than CEXs, with no signs of slowing down.

A: Already much deeper than CEXs, with no signs of slowing down.

Q: Ok, metrics are amazing! But with a Fully Diluted Supply (FDS) of 100M BAL, I& #39;m not touching this thing.

A: If you don& #39;t unpack the nuance on FDS, you& #39;re doing it wrong. Unpack it we shall... https://twitter.com/mrjasonchoi/status/1294268780219002880">https://twitter.com/mrjasonch...

A: If you don& #39;t unpack the nuance on FDS, you& #39;re doing it wrong. Unpack it we shall... https://twitter.com/mrjasonchoi/status/1294268780219002880">https://twitter.com/mrjasonch...

Current circulating supply: 7.4M BAL

Current inflation: 145k BAL/week.

When the first year of inflation is over (on 2021-06-01, with 7.5M BAL mined), the community will revisit the inflation schedule. It& #39;s possible there& #39;ll be a reduction in issuance.

Current inflation: 145k BAL/week.

When the first year of inflation is over (on 2021-06-01, with 7.5M BAL mined), the community will revisit the inflation schedule. It& #39;s possible there& #39;ll be a reduction in issuance.

100M is a *theoretical* maximum FDS (guaranteed not to be exceeded). It could only be reached after 8+ YEARS of mining.

But before this crypto-eternity goes by, governance may decide to slow down on issuance, and/or even to end liquidity mining distribution altogether.

But before this crypto-eternity goes by, governance may decide to slow down on issuance, and/or even to end liquidity mining distribution altogether.

IMO the timing for issuance reductions/elimination will be predominantly a question of decentralization & moat:

The more decentralized BAL ownership is and the stronger Balancer& #39;s moat is, the lower the need for BAL dilution.

The more decentralized BAL ownership is and the stronger Balancer& #39;s moat is, the lower the need for BAL dilution.

Given this context, we can now better speculate around FDS...

My current PERSONAL impression (a guess) is that it would end up at around 60M BAL.

And it would take years to get there. Maybe more than one bull market away from today... https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐂" title="Ochse" aria-label="Emoji: Ochse"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💭" title="Gedankenblase" aria-label="Emoji: Gedankenblase">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💭" title="Gedankenblase" aria-label="Emoji: Gedankenblase">

My current PERSONAL impression (a guess) is that it would end up at around 60M BAL.

And it would take years to get there. Maybe more than one bull market away from today...

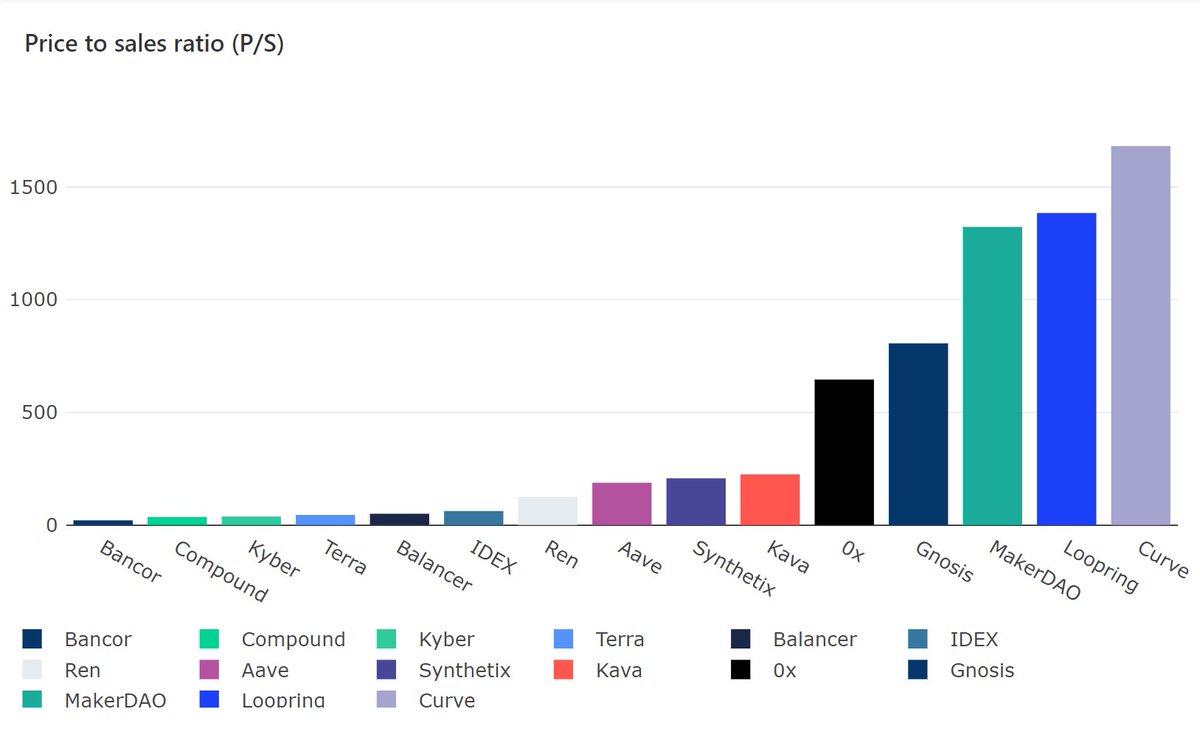

If I& #39;m right, you may apply a 0.6 factor to all Balancer metrics related to supply at:

https://app.redash.io/token-terminal/public/dashboards/yk0ptGeWBpfboaxOzJmCayiGtjWK5qu83hDWYFQc

(because">https://app.redash.io/token-ter... all metrics there consider FDS=100M)

h/t @tokenterminal

https://app.redash.io/token-terminal/public/dashboards/yk0ptGeWBpfboaxOzJmCayiGtjWK5qu83hDWYFQc

(because">https://app.redash.io/token-ter... all metrics there consider FDS=100M)

h/t @tokenterminal

So for instance its price-to-sales ratio (P/S) would be at a competitive 30 ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> is better) w/ the current $28/BAL, lower than other major DeFi protocols.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> is better) w/ the current $28/BAL, lower than other major DeFi protocols.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">

BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">

So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">

BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now!

So yes, this is my DeFi gem.

Special h/t @tokenterminal for the amazing metrics on DeFI.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

Bookmarked!

Bookmarked!

Read on Twitter

Read on Twitter

A: By consistently growing 5-10x EVERY MONTH! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏒" title="Eishockeyschläger und -puck" aria-label="Emoji: Eishockeyschläger und -puck">( @tokenterminal ser, wen log graph? https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">)" title="Q: WTH, how is Balancer already that big?! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">A: By consistently growing 5-10x EVERY MONTH! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏒" title="Eishockeyschläger und -puck" aria-label="Emoji: Eishockeyschläger und -puck">( @tokenterminal ser, wen log graph? https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">)" class="img-responsive" style="max-width:100%;"/>

A: By consistently growing 5-10x EVERY MONTH! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏒" title="Eishockeyschläger und -puck" aria-label="Emoji: Eishockeyschläger und -puck">( @tokenterminal ser, wen log graph? https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">)" title="Q: WTH, how is Balancer already that big?! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧐" title="Gesicht mit Monokel" aria-label="Emoji: Gesicht mit Monokel">A: By consistently growing 5-10x EVERY MONTH! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏒" title="Eishockeyschläger und -puck" aria-label="Emoji: Eishockeyschläger und -puck">( @tokenterminal ser, wen log graph? https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">)" class="img-responsive" style="max-width:100%;"/>

and Balancer https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage"> are growing is something entirely different.Reminds me of Binance in H2/2017. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> Their recent trajectories of annualized revenue are https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" title="Of course DeFi as a whole is growing and had a strong Q2 as we apparently approach a bull market.But the way Uniswap https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦄" title="Einhorngesicht" aria-label="Emoji: Einhorngesicht"> and Balancer https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage"> are growing is something entirely different.Reminds me of Binance in H2/2017. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> Their recent trajectories of annualized revenue are https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>

and Balancer https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage"> are growing is something entirely different.Reminds me of Binance in H2/2017. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> Their recent trajectories of annualized revenue are https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" title="Of course DeFi as a whole is growing and had a strong Q2 as we apparently approach a bull market.But the way Uniswap https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦄" title="Einhorngesicht" aria-label="Emoji: Einhorngesicht"> and Balancer https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Waage" aria-label="Emoji: Waage"> are growing is something entirely different.Reminds me of Binance in H2/2017. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein"> Their recent trajectories of annualized revenue are https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>

The message from LPs is clear: owning a piece of Balancer governance is more valuable than dumping their mining proceeds.LPs are now hodlers w/ compounding protocol ownership!https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">" title="This week, $BAL distribution (yellow arrow @ BAL/ETH chart) created *no sell pressure* at all. https://abs.twimg.com/emoji/v2/... draggable="false" alt="☂️" title="Regenschirm" aria-label="Emoji: Regenschirm">The message from LPs is clear: owning a piece of Balancer governance is more valuable than dumping their mining proceeds.LPs are now hodlers w/ compounding protocol ownership!https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">" class="img-responsive" style="max-width:100%;"/>

The message from LPs is clear: owning a piece of Balancer governance is more valuable than dumping their mining proceeds.LPs are now hodlers w/ compounding protocol ownership!https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">" title="This week, $BAL distribution (yellow arrow @ BAL/ETH chart) created *no sell pressure* at all. https://abs.twimg.com/emoji/v2/... draggable="false" alt="☂️" title="Regenschirm" aria-label="Emoji: Regenschirm">The message from LPs is clear: owning a piece of Balancer governance is more valuable than dumping their mining proceeds.LPs are now hodlers w/ compounding protocol ownership!https://abs.twimg.com/emoji/v2/... draggable="false" alt="💪" title="Angespannter Bizeps" aria-label="Emoji: Angespannter Bizeps">" class="img-responsive" style="max-width:100%;"/>

" title="Also, liquidity in BAL pools increased significantly, meaning Liquidity Staking is a great success so far.This is the recent evolution of liquidity in the popular 67/33 BAL/ETH pool: 3x in 10 days. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">" class="img-responsive" style="max-width:100%;"/>

" title="Also, liquidity in BAL pools increased significantly, meaning Liquidity Staking is a great success so far.This is the recent evolution of liquidity in the popular 67/33 BAL/ETH pool: 3x in 10 days. https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">" class="img-responsive" style="max-width:100%;"/>

is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">" title="So for instance its price-to-sales ratio (P/S) would be at a competitive 30 (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">">

is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">" title="So for instance its price-to-sales ratio (P/S) would be at a competitive 30 (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">">

is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">" title="So for instance its price-to-sales ratio (P/S) would be at a competitive 30 (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">">

is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">" title="So for instance its price-to-sales ratio (P/S) would be at a competitive 30 (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> is better) w/ the current $28/BAL, lower than other major DeFi protocols. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😋" title="Face savouring food" aria-label="Emoji: Face savouring food">BTW, assumption for that P/S to NOT keep falling: Balancer stops growing right now! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">So yes, this is my DeFi gem. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💎" title="Edelstein" aria-label="Emoji: Edelstein">">