1/ For giggles, let& #39;s take a quick look at these companies using @ycharts. $QRTEA vs. $ZM ... LOL, what a bet, firmly placing fintwit& #39;s value and growth investors against each other.

@BillBrewsterSCG name the suicide prevention charity and we& #39;ll promote the hell out of it. https://twitter.com/Matt_Cochrane7/status/1299084325133209602">https://twitter.com/Matt_Coch...

@BillBrewsterSCG name the suicide prevention charity and we& #39;ll promote the hell out of it. https://twitter.com/Matt_Cochrane7/status/1299084325133209602">https://twitter.com/Matt_Coch...

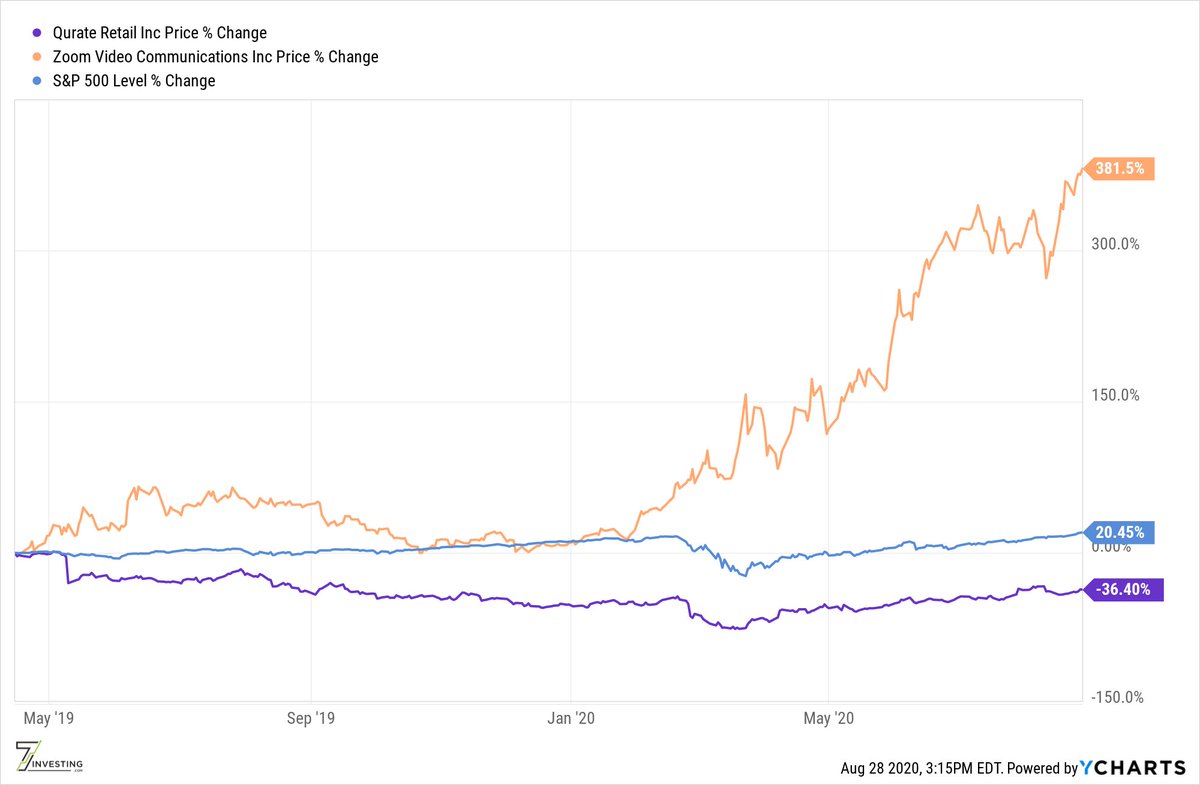

2/ Obviously, comparing these two vastly different companies like this is mostly silly. I& #39;m not going out on a limb when I say I& #39;m going to bet $ZM& #39;s growth rates and margins far exceed $QRTEA& #39;s, but Qurate Retail& #39;s valuation probably looks a tad more attractive too!

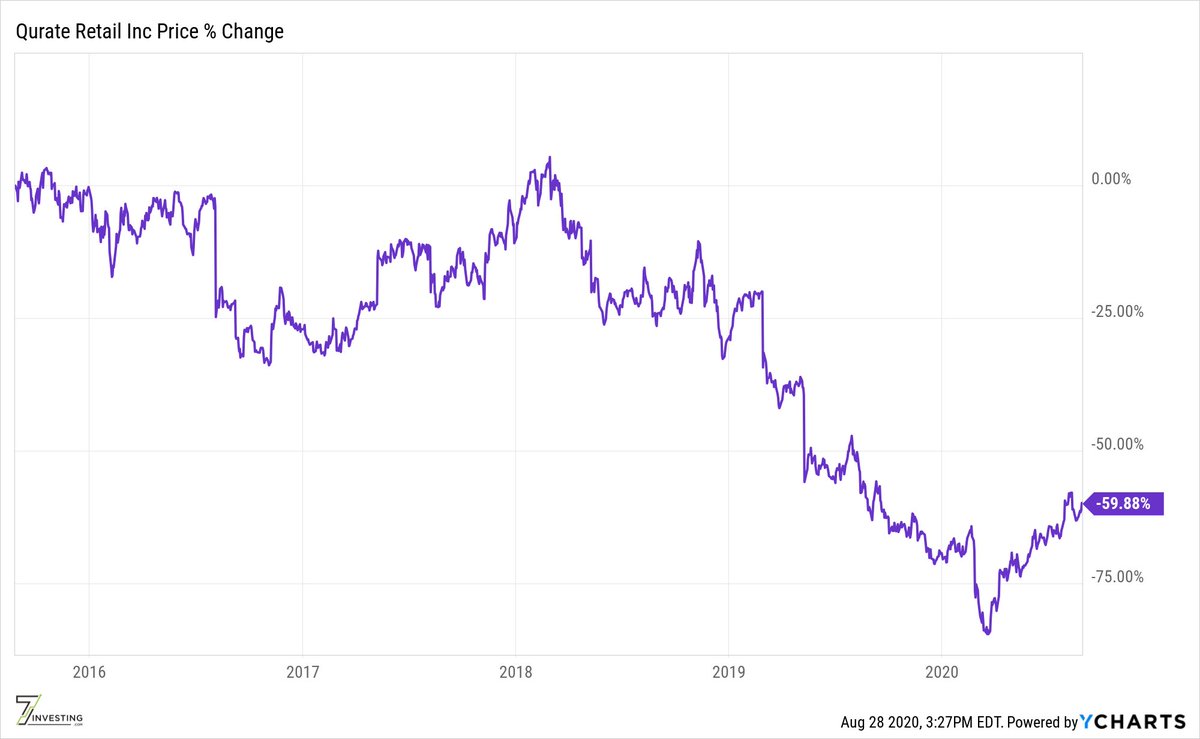

3/ Since going public, $ZM has vastly outperformed the market (to say the least, while $QRTEA has declined for the past 5-ish yrs).

Of course, this is why #QRTEATeam would say $ZM is overvalued now, and $QRTEA is undervalued.

Of course, this is why #QRTEATeam would say $ZM is overvalued now, and $QRTEA is undervalued.

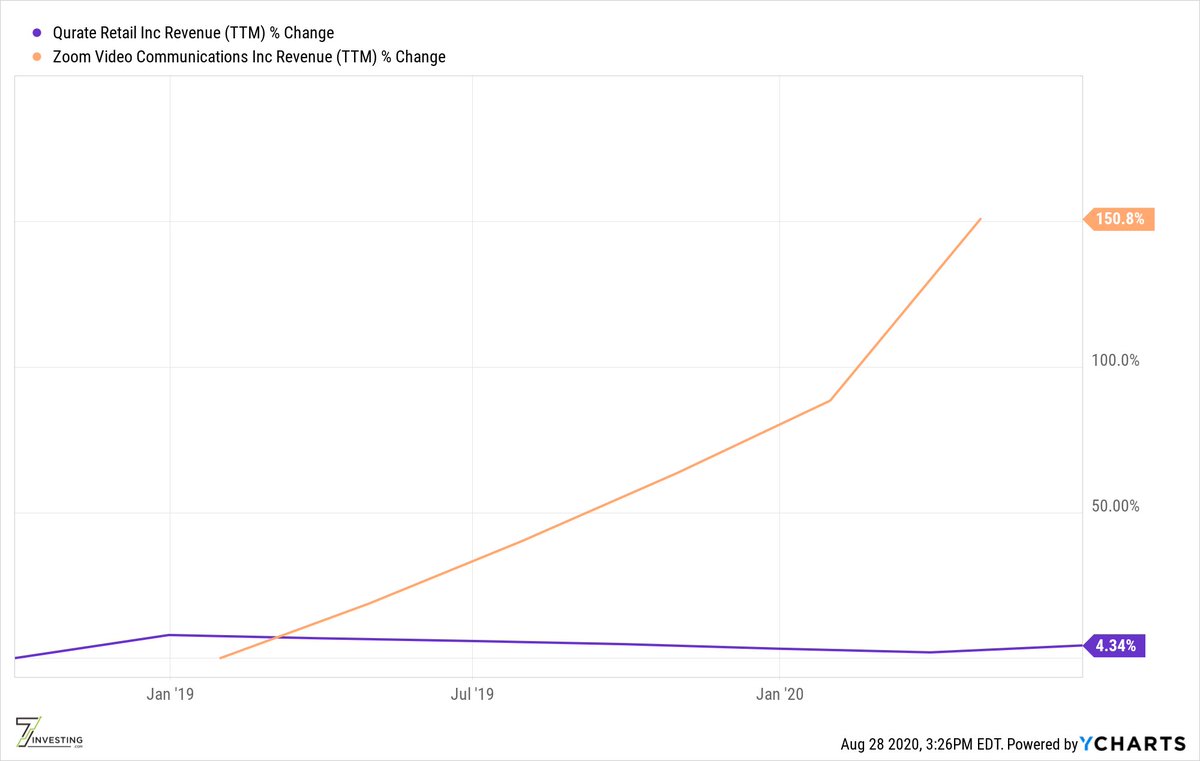

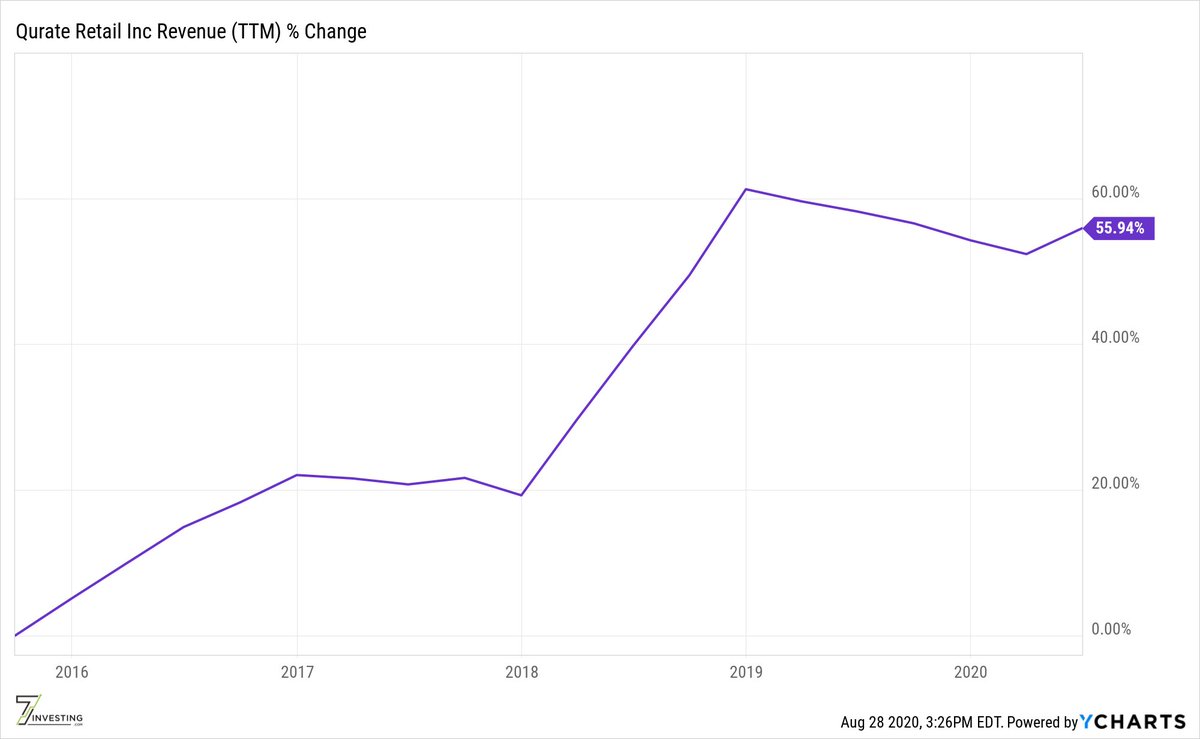

4/ You can& #39;t say anything bad about $ZM& #39;s performance, that& #39;s for sure. It somehow has incredibly more than doubled its revenue in a little over a year. I will admit, I was surprised at $QRTEA& #39;s revenue growth over the past 5 yrs.

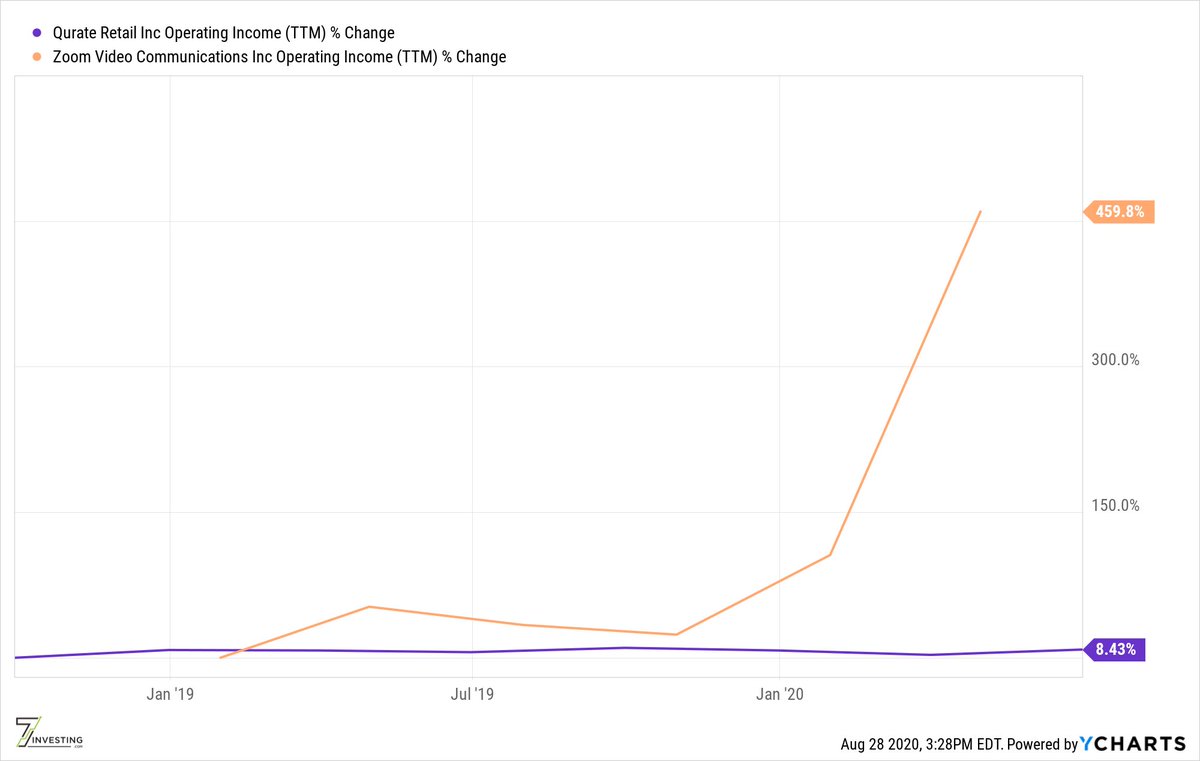

5/ When you look at operating income, $ZM& #39;s performance is even more impressive. Incredible growth!

$QRTEA& #39;s op income is more resilient than I would& #39;ve thought. Over past 5 yrs, it has gained a little ground, but I& #39;m mostly impressed it& #39;s been able to just not lose ground.

$QRTEA& #39;s op income is more resilient than I would& #39;ve thought. Over past 5 yrs, it has gained a little ground, but I& #39;m mostly impressed it& #39;s been able to just not lose ground.

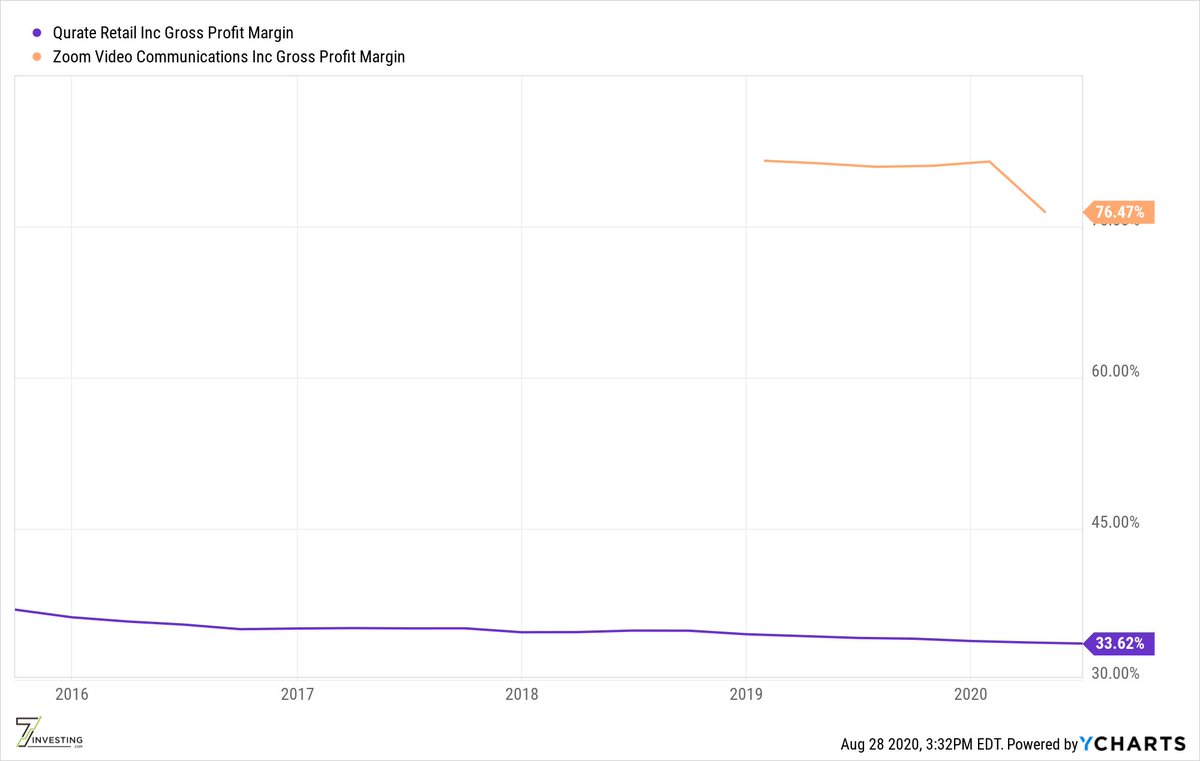

6/ How about gross profit margins?

$ZM& #39;s margins are great, what you would expect from an asset-lite video platform.

$QRTEA& #39;s though is ... respectable, but slowly eroding.

$ZM& #39;s margins are great, what you would expect from an asset-lite video platform.

$QRTEA& #39;s though is ... respectable, but slowly eroding.

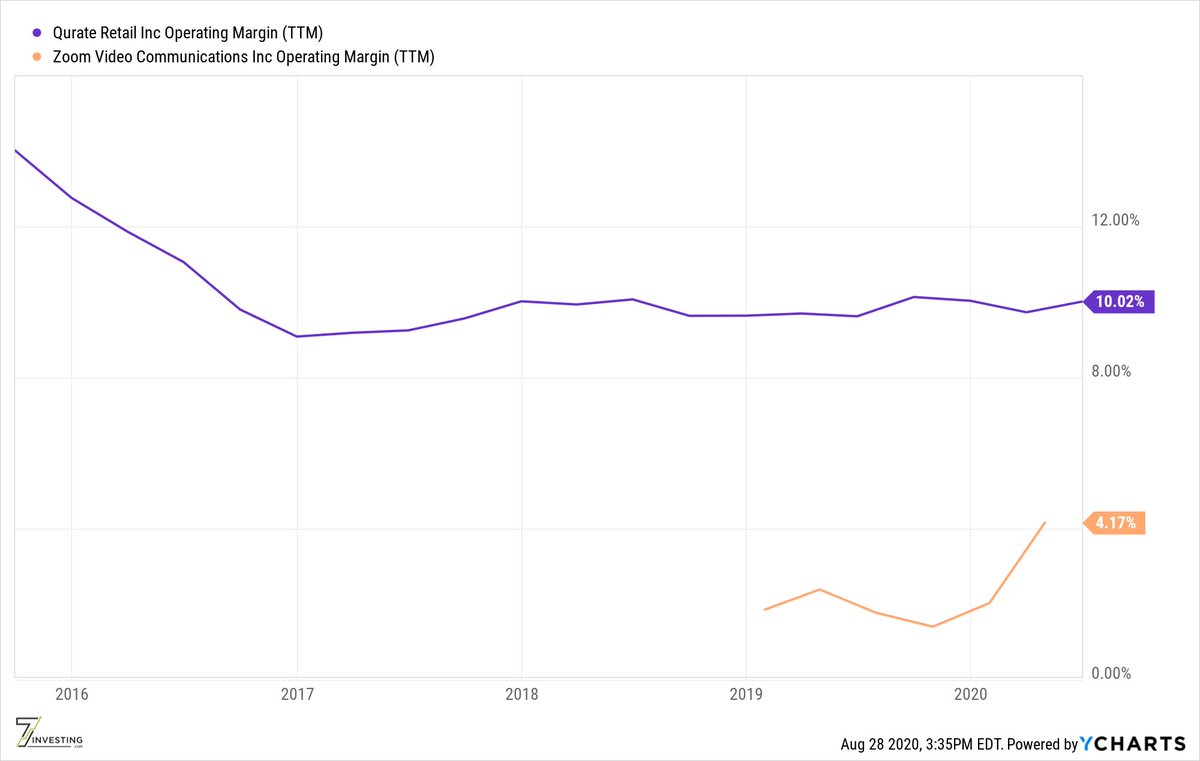

7/ As $ZM makes its way to profitability, its operating margin will obviously continue to climb. I expect we& #39;ll see that number explode over the next several years.

$QRTEA& #39;s operating margin? Gotta say it& #39;s better than I feared once I saw that falling stock price.

$QRTEA& #39;s operating margin? Gotta say it& #39;s better than I feared once I saw that falling stock price.

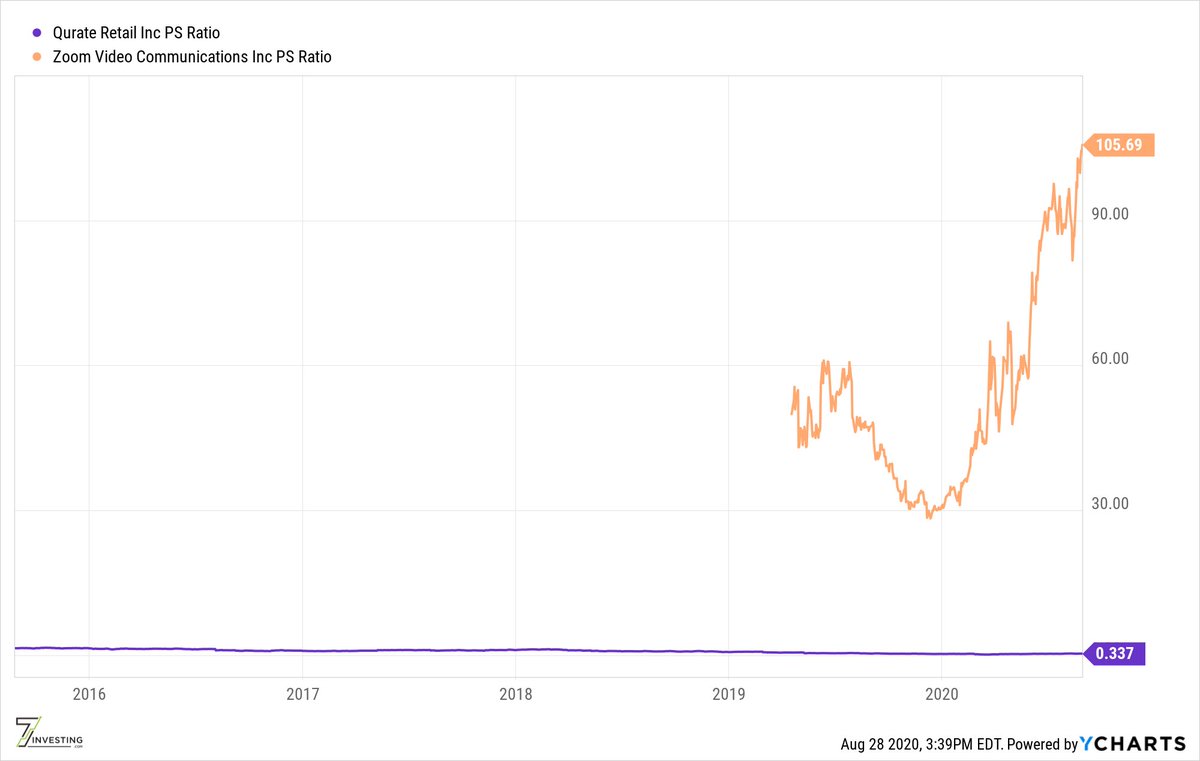

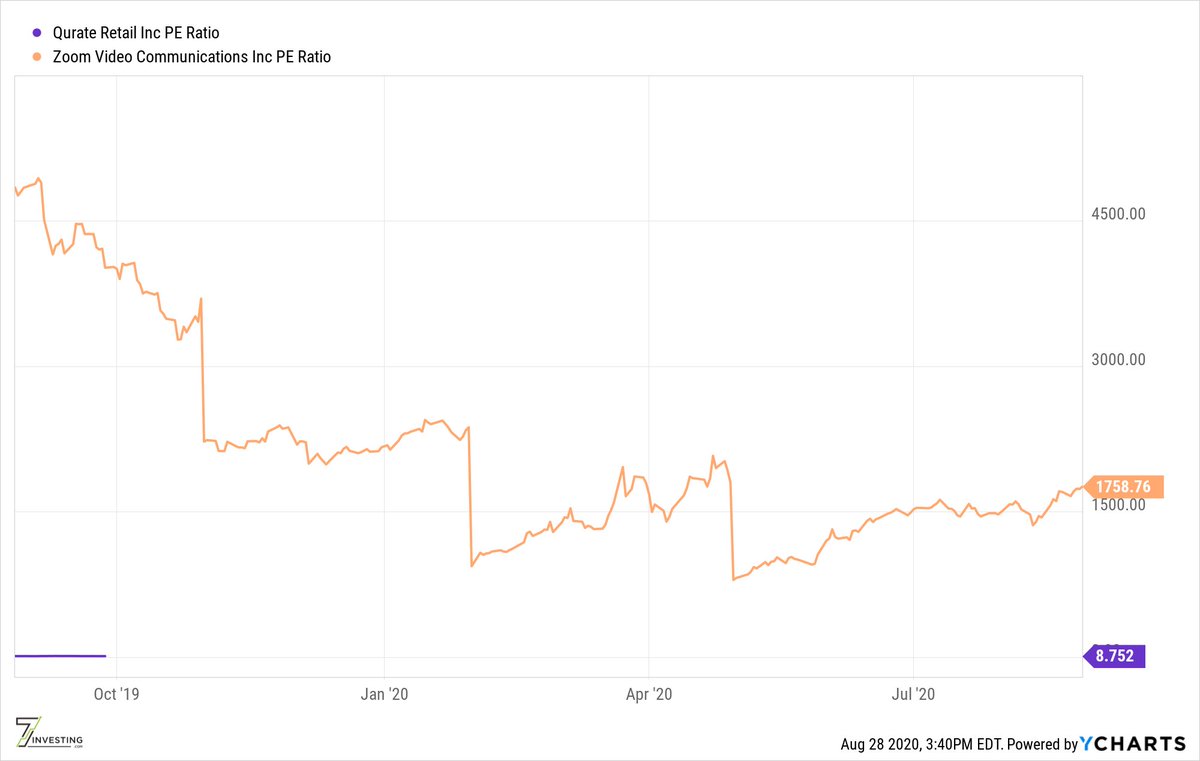

8/ How about valuation?

As we knew, $ZM& #39;s valuation is stratospheric while $QRTEA& #39;s has been beaten into a pulp.

This P/S ratio chart is ... priceless.

As we knew, $ZM& #39;s valuation is stratospheric while $QRTEA& #39;s has been beaten into a pulp.

This P/S ratio chart is ... priceless.

10/ I& #39;m not making any prediction on who wins this bet. I have no position and have no plans to start one in either.

What I will say is that I expect both will do better than the other side thinks, but the definitive stopping point might throw a wrench into that line of thought.

What I will say is that I expect both will do better than the other side thinks, but the definitive stopping point might throw a wrench into that line of thought.

Read on Twitter

Read on Twitter