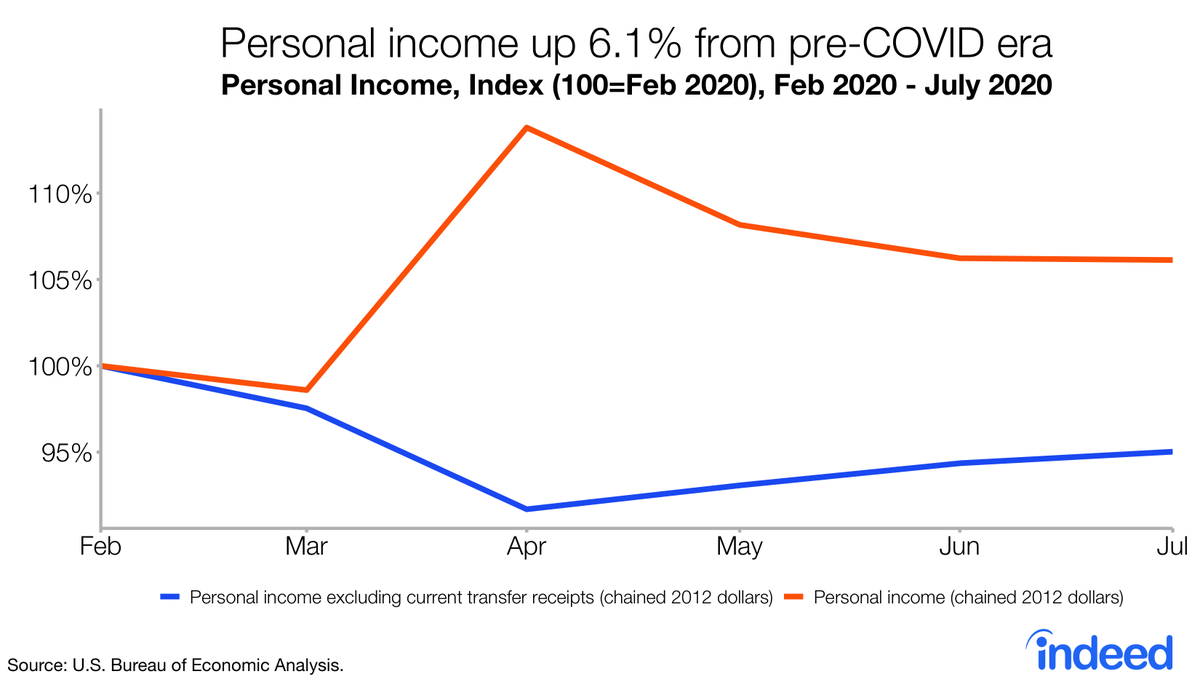

Personal income and outlays release! July data shows gov’t transfers make a difference. Without them, income would be below its pre-COVID level.

1/

1/

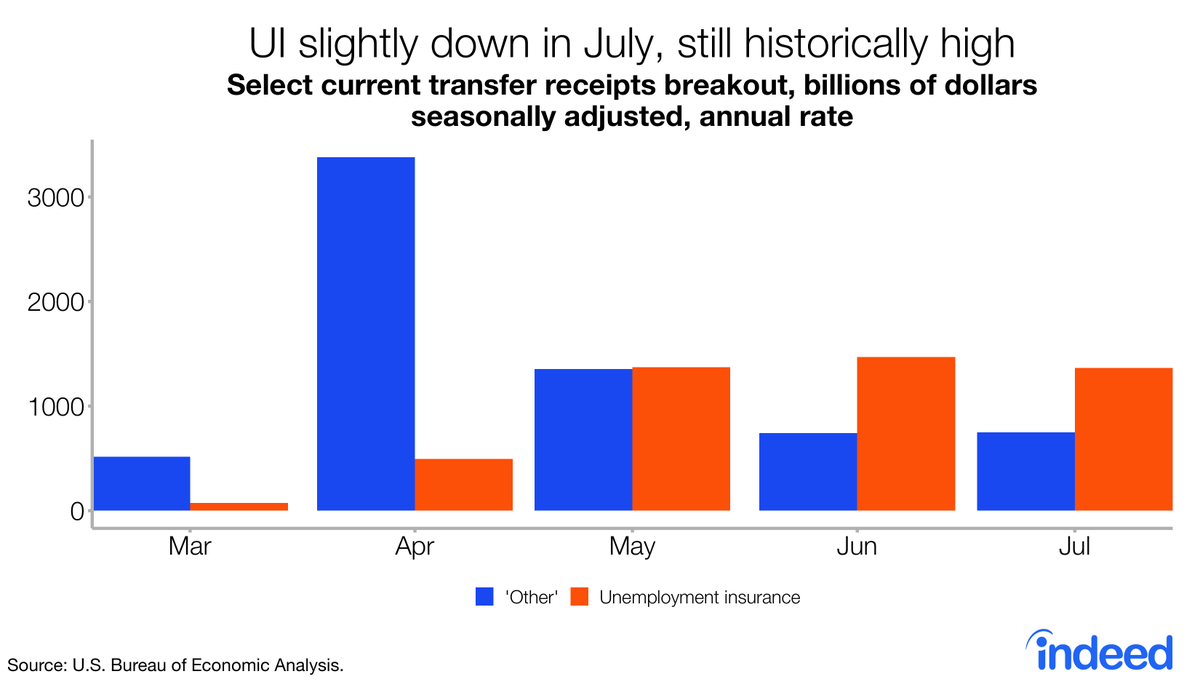

Looking at the two transfer programs that have been changing the most, UI slightly declined in July. Remember ‘Other’ jumped in April due to the one time stimulus checks.

2/

2/

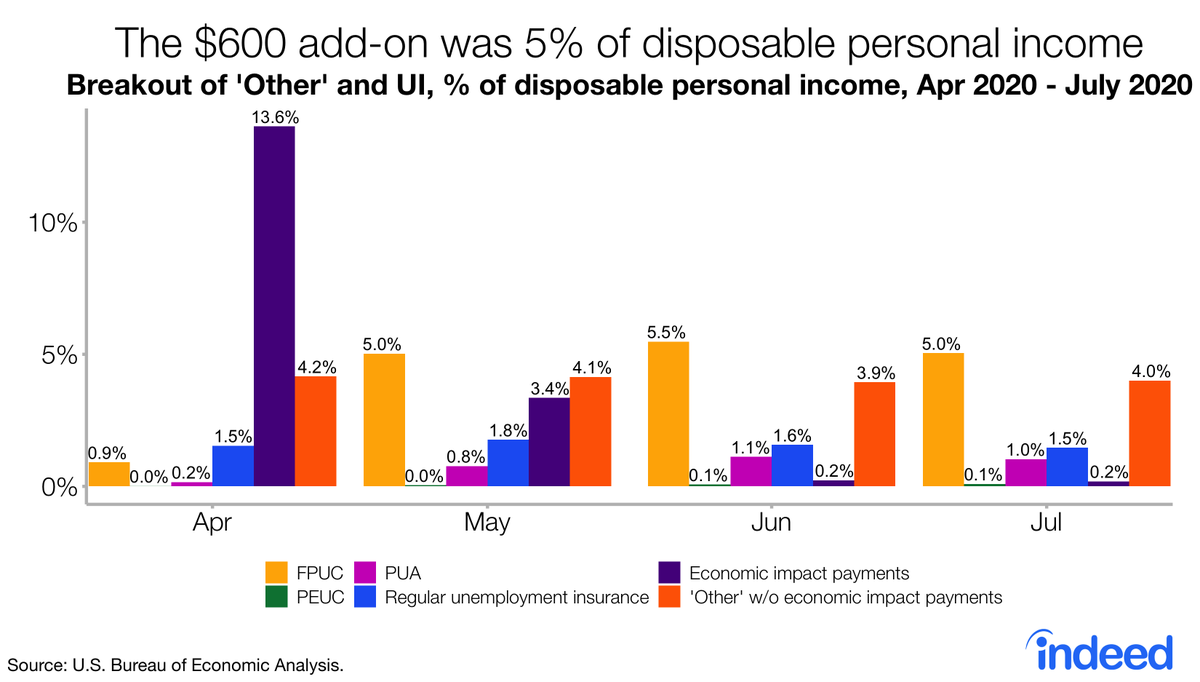

Breaking out UI and ‘Other’ further, the $600 expanded unemployment benefit made up 5% of disposable income in July. 3/

Let’s digest that % for a second: the 5% is of aggregate disposable income (ie total disposable income of both employed and unemployed people). For unemployed people, the $600 is likely a greater % of their disposable income. 4/

With the $600 add-on lapsed, unemployed people today are receiving less $ during high unemployment and a public health crisis. That leaves people to turn to their savings (if they have savings) and then credit cards if available. A precarious situation for many people. 5/

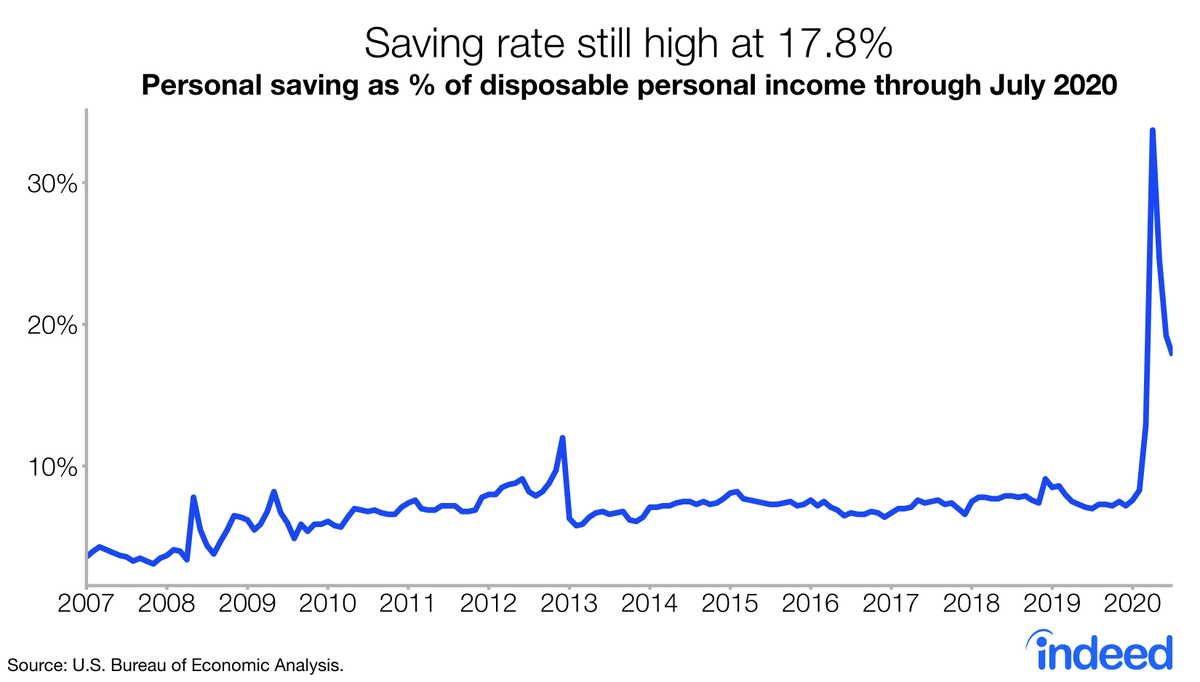

Speaking of savings, the savings rate is still high but is dipping back toward previous levels. This is expected given that compared to April, July saw many more shops and restaurants at least partially open. For those in a position to spend, there’s now more places to spend. 6/

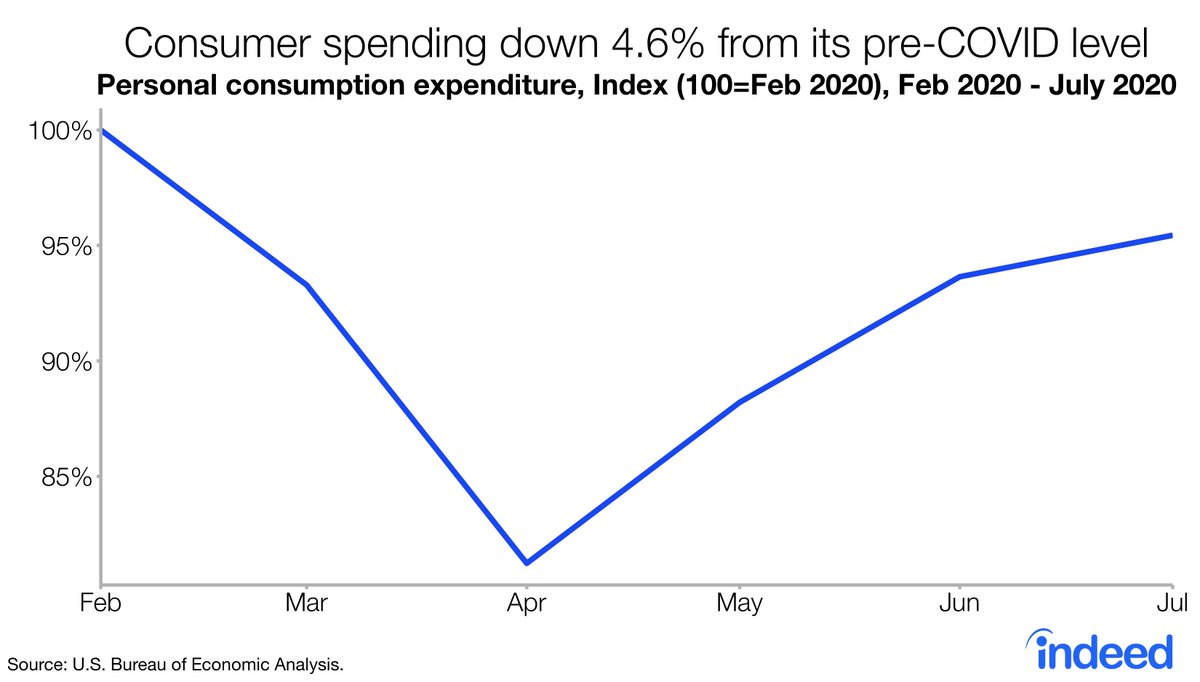

Consumer spending is still below its pre-COVID level, though there& #39;s def been improvement since April. Still below its pre-COVID level is expected given the virus is still unchecked. Coronavirus = economy uncertainty = people pausing before making a purchase. 7/

The consumer pause is complex: some people are concerned whether they’ll still have a job in the coming weeks, others are concerned about whether a trip to the mall could mean catching the virus. But it all ties back to COVID-19 and its multifaceted turmoil. 8/

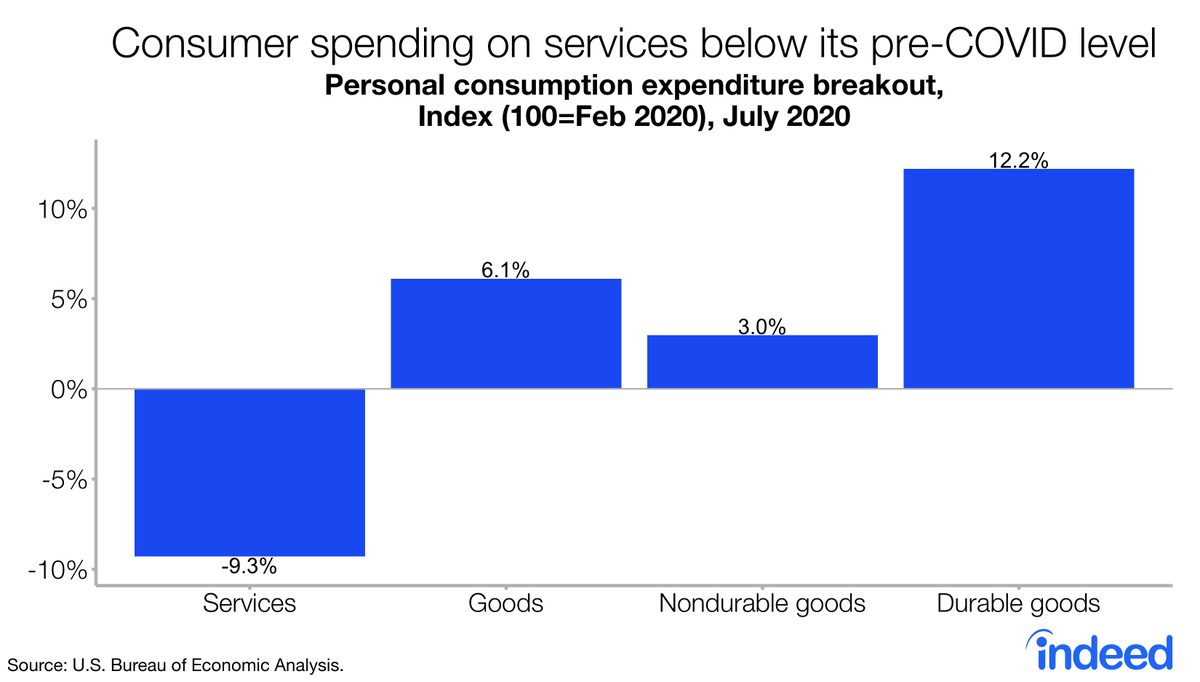

Compared to the pre-COVID era, consumer spending in the service sector was hurting the worst, down 9.3 % in July. That being said, it is an improvement from last month. June saw spending on services down by 11.5% compared to its pre-COVID era. 9/

So what does this mean? July saw personal income being backstopped by gov’t transfers. Case in point, the $600 expanded benefit made up 5% of aggregate personal disposable income. 10/

Additionally, the savings rate is high but trending back toward its typical level. Consumer spending is still below it pre-COVID era level but is not as bad as earlier this year. 11/

But the bigger picture? While the July report points to improvement, we’re currently see some economic slippage. 12/

Yesterday was the second week of initial unemployment claims (NSA) ticking up. On http://Indeed.com"> http://Indeed.com , our job posting trend is in its 2nd week of decline after 14 weeks of improvement. 13/ https://www.hiringlab.org/2020/08/25/job-postings-through-august-21/">https://www.hiringlab.org/2020/08/2...

Overall, we’re not remotely out of this crisis yet. The virus needs to be in check. Without that, a full recovery is out of reach. 14/

End.

End.

Read on Twitter

Read on Twitter