Price vs. Value

In Warren Buffet style,

(An important lesson for all investors)

A thread: -

In Warren Buffet style,

(An important lesson for all investors)

A thread: -

Imagine you’re in an auction to buy players for your IPL team. There are 8 other bidders.

You have a budget, a watchlist of players to buy, and another watch list of ‘must-buy’ players.

Let’s say there’s a bid going on for one of your must-buy player.

You have a budget, a watchlist of players to buy, and another watch list of ‘must-buy’ players.

Let’s say there’s a bid going on for one of your must-buy player.

Unfortunately, that player is also in the list of must-buy of other bidders.

What is likely to happen?

A bid war!

This is definitely not good for any of the buyers because they might end up paying extremely high.

What is likely to happen?

A bid war!

This is definitely not good for any of the buyers because they might end up paying extremely high.

That high price could be justified because only one team can have that player. If you don’t get him, he’s going to compete against you. It’s a dual loss.

But in stock market, there’s no competition.

Then why do people still buy overpriced stocks?

Due to certain myths & biases

But in stock market, there’s no competition.

Then why do people still buy overpriced stocks?

Due to certain myths & biases

I’ll cover myths today.

Myth 1: It’s a quality company; any price is a good price.

If a broker offers you a ‘good quality property& #39; for ₹1 Crore (which usually sell for ₹50 lakhs), will you buy it as an investment?

Myth 1: It’s a quality company; any price is a good price.

If a broker offers you a ‘good quality property& #39; for ₹1 Crore (which usually sell for ₹50 lakhs), will you buy it as an investment?

It’ll be hard to find a seller in short-term who’s willing to pay even more.

In the long-term, it& #39;ll reduce your overall gains because the initial years are just wasted.

(For traders: A well bought if half sold, it reduces your stress of where, whom and when to sell.)

In the long-term, it& #39;ll reduce your overall gains because the initial years are just wasted.

(For traders: A well bought if half sold, it reduces your stress of where, whom and when to sell.)

For ex, a company’s actual is worth ₹1000 Crore but is priced at ₹1500 Crore, unless the business grows making it worth ₹1500, at some point “the market” will realize the discrepancy & rerate the business lower or it’ll remain at same price for years.

“No matter how wonderful a business it is, there’s always is a risk that you will pay a price where it will take a few years for the business to catch up with the stock. That the stock can get ahead of the business.”

– Warren Buffett

– Warren Buffett

One of the reasons why value investors avoid popular stocks even if they& #39;re sure to become the next big thing.

If a growth stock actually turns out to be a good company, you& #39;ll not be able to get decent return as per the expectation because you& #39;ve already paid a high premium.

If a growth stock actually turns out to be a good company, you& #39;ll not be able to get decent return as per the expectation because you& #39;ve already paid a high premium.

An important fact to note here is: -

Higher the number of bidders in an auction, higher the likelihood of overpaying for a purchase.

So when a stock is becoming famous, media talks about it daily, a hot cake; you know what I’m talking about.

Higher the number of bidders in an auction, higher the likelihood of overpaying for a purchase.

So when a stock is becoming famous, media talks about it daily, a hot cake; you know what I’m talking about.

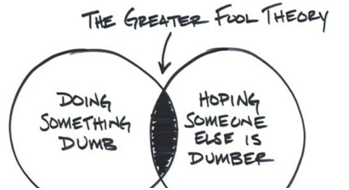

Myth 2: It’s overvalued but it’ll still rise.

There are things you know, and things you don’t know.

What you know: Company is overvalued

What you don’t know: The future; whether the market/stock will go up or down.

There are things you know, and things you don’t know.

What you know: Company is overvalued

What you don’t know: The future; whether the market/stock will go up or down.

Just because a company was overvalued from past 5 years doesn’t guarantee it’s going to continue till eternity.

It’s like tossing a coin, getting heads for 5 times in a row, and then assuming another heads for the 6th time.

It’s like tossing a coin, getting heads for 5 times in a row, and then assuming another heads for the 6th time.

It’s a classic example of greater fool theory. Buying high with a & #39;hope& #39; for selling at even higher price,

assuming there’s a bigger fool somewhere who’ll be willing to pay more.

assuming there’s a bigger fool somewhere who’ll be willing to pay more.

We all must have heard the famous lines of Warren Buffet:

“Price is what you pay.

Value is what you get

However, that’s incomplete....

Here’s the complete version.

“Price is what you pay.

Value is what you get

However, that’s incomplete....

Here’s the complete version.

“Price is what you pay.

Value is what you get.

And in the long run, price follows value.”

Read it again until you grasp it.

Value is what you get.

And in the long run, price follows value.”

Read it again until you grasp it.

To end, here’s a quote from father of value investor, Benjamin Graham: -

“If you are shopping for stocks, choose them the way you buy groceries, not the way you buy perfume.”

I hope this thread was ‘value’ for your time.

Thank you.

“If you are shopping for stocks, choose them the way you buy groceries, not the way you buy perfume.”

I hope this thread was ‘value’ for your time.

Thank you.

Read on Twitter

Read on Twitter