We& #39;re about 15 minutes from the welcome address. Adelyn and Rory will kick us off.

We begin in 2 minutes. I& #39;m excited for you all.

"Today is a true celebration of the Chainlink community." -- Rory

Warm and positive start to the conference from Adelyn and Rory.

Next up: Michael and Vance from Framework Ventures.

Next up: Michael and Vance from Framework Ventures.

Vance said it will take 20-30 years to fully play out, but he believes DeFi will overturn the world& #39;s largest market (finance).

"Chainlink has become the de facto security provider for DeFi."

DeFi today: $6B

Potential market: many trillions

Potential market: many trillions

Great summary of the history and future of the DeFi space from Vance and Michael.

Up now: John Wolpert (Consensys), Fernando Rebeiro (Oracle), Yorke Rhodes III (Microsoft), and Will Martino (Kadena)

Up now: John Wolpert (Consensys), Fernando Rebeiro (Oracle), Yorke Rhodes III (Microsoft), and Will Martino (Kadena)

Yorke said Microsoft wanted to be better prepared for the advent of the blockchain space than they were for the advent of the Internet.

Yorke, John, Fernando, and Will Martino all shared their expectations on how their respective companies will leverage blockchain and Chainlink specifically to enhance their product offerings. A casual chat among friends.

Next: AMA with John regarding Baseline Protocol

Next: AMA with John regarding Baseline Protocol

John Wolpert said about 700 companies are using Baseline.

John just hinted at a big news drop coming regarding Chainlink, Baseline, and Google. He hopes the news breaks in the next week or so.

John just hinted at a big news drop coming regarding Chainlink, Baseline, and Google. He hopes the news breaks in the next week or so.

"Why wouldn& #39;t you use Chainlink? Who else would you use?" (paraphrasing John& #39;s response when asked about Coca-Cola and Unibright and the need for oracle-style data)

I& #39;ll be watching John& #39;s AMA again when the video is uploaded -- full of crumbs and wisdom delivered in his trademark disarming style.

He& #39;s taking a few more questions but up next is a keynote from Fan Long, Founder of Conflux.

He& #39;s taking a few more questions but up next is a keynote from Fan Long, Founder of Conflux.

Side session going on about how to win in China with Adelyn and folks from IrisNet, Red Date, etc. Will watch when uploaded later.

Up next: a keynote from Gleb Dudka, discussing Web3 Infrastructure at T-Systems (Deutsche Telekom).

As we know, T-Systems recently joined the Chainlink Network as a node operator. T-Mobile is a subsidiary of Deutsche Telekom.

As we know, T-Systems recently joined the Chainlink Network as a node operator. T-Mobile is a subsidiary of Deutsche Telekom.

"By deciding to run a node/validator with exposure to a native digital asset as a corporate, we are essentially participating in the Mid-Late stages of the Network Lifecycle Investing."

In the late stage you find trading of big-cap liquid assets, application layer development, and driving adoption to existing customer base.

(Basically things are shifting to the late stage now. Expect fireworks.)

(Basically things are shifting to the late stage now. Expect fireworks.)

Spencer Dinwiddie on now to discuss putting his NBA contract on-chain.

Chainlink will be the oracle provider for the app Dinwiddie is building.

He gave a shout-out to the $LINK Marines. "Let& #39;s change the world."

He gave a shout-out to the $LINK Marines. "Let& #39;s change the world."

Dinwiddie is clearly a visionary and well-informed about the blockchain space. Expect a flood of athletes in the coming years catching this wave, driving public awareness and reinventing how we think of contracts and investment.

NFTs are one of those things that might seem unnecessary and silly early on but is likely to become a big deal.

"Would you rather have your basketball card in your hand, or would you rather have it on your phone?"

"Would you rather have your basketball card in your hand, or would you rather have it on your phone?"

It is slowly becoming understood that memes are the ultimate marketing strategy.

Zack Seward of Coindesk and Dinwiddie briefly discussed the power and energy of the Chainlink community.

Zack Seward of Coindesk and Dinwiddie briefly discussed the power and energy of the Chainlink community.

Dinwiddie asked about more details regarding his app:

"Stealth mode, baby."

"Stealth mode, baby."

Up next is Aaron Wright, co-founder of OpenLaw. This should be good.

Earlier Aaron tweeted out a demo of how Ethereum smart contracts and Chainlink nodes are being integrated into Microsoft Office.

Earlier Aaron tweeted out a demo of how Ethereum smart contracts and Chainlink nodes are being integrated into Microsoft Office.

For those not able to register and watch live, they are trying to get a live feed going on the official Chainlink YouTube channel.

Aaron Wright is speaking now.

Aaron Wright is speaking now.

Aaron has known Sergey and Steve Ellis since before Chainlink existed. Still waters run deep.

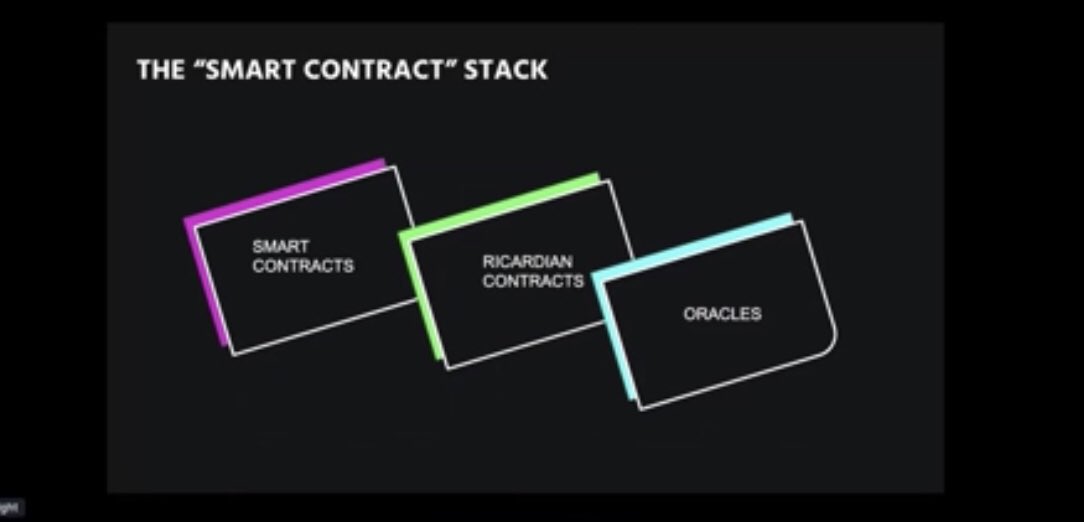

The OLE stack.

OpenLaw, Link, and Ethereum.

Code-based law, traditional legacy contracts, and oracle data.

OpenLaw, Link, and Ethereum.

Code-based law, traditional legacy contracts, and oracle data.

OpenLaw is really paving the way for the vision many Chainlink holders have anticipated for years:

Blockchain and oracles under the hood, but the same UI and UX people are already used to.

This is the way.

Blockchain and oracles under the hood, but the same UI and UX people are already used to.

This is the way.

Alex Mashinsky of Celsius Network is on now.

Alex& #39;s slideshow is a cornucopia of knowledge.

Total world assets and total world debt are almost the same. "The beauty of DeFi is that it only operates on real assets." He is basically hurling a harsh critique at fractional reserve banking.

Total world assets and total world debt are almost the same. "The beauty of DeFi is that it only operates on real assets." He is basically hurling a harsh critique at fractional reserve banking.

"Virtually all the profit in the last fifty years has been created in either tech or finance." (paraphrasing Alex)

"Crypto is here to replace middlemen with middleware."

"Living with banks is like living in a bad marriage."

Alex is finishing up. Highly recommend checking out his presentation when it& #39;s uploaded.

"Living with banks is like living in a bad marriage."

Alex is finishing up. Highly recommend checking out his presentation when it& #39;s uploaded.

Up next: Camila Russo with Kyle Kistner from bZx, Fernando Martinelli from Balancer Labs, and Matthew Finestone from Loopring.

Kyle Kistner of bZx just announced that their mainnet is deploying now.

Among other things, the panel discussed the various ways that each protocol raised funds. Lots of alpha thrown around.

Up next is Stani Kulechov, the founder of Aave.

Up next is Stani Kulechov, the founder of Aave.

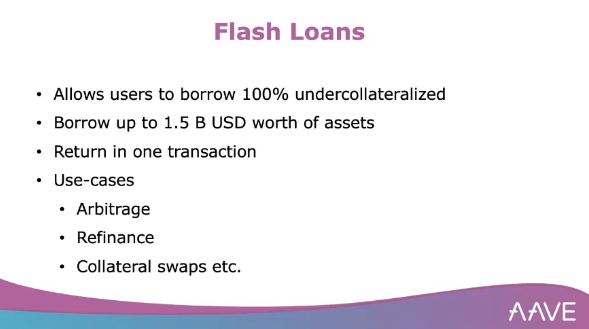

Stani is giving a rundown of all things Aave.

Aave is a real success story. One of a handful of projects from 2017 that spent the bear market focusing on building a winning product. How’d they do? Check the chart. Congrats to them. I’m an Aave user myself.

Aave is a real success story. One of a handful of projects from 2017 that spent the bear market focusing on building a winning product. How’d they do? Check the chart. Congrats to them. I’m an Aave user myself.

Flash loans are one of the coolest things that I& #39;ve seen emerge. Complex transactions like the ones below are made unhackable because the entire Ethereum blockchain is briefly paused while all stages of the transaction are processed. No way for a bad actor to get in the middle.

Next up: Anthony Sassano and Eric Conner talk about yield farming.

"Can yield farming returns stay this high forever? No... but I think they can stay this high for the duration of this bull run." (paraphrasing Eric Conner)

I tend to agree with him.

I tend to agree with him.

Anthony Sassano tends to agree with him as well. He says these returns may stay this high for years.

Yield farming can be seen as the democratization of the VC-style tactics previously closed to most people.

Knowledge is the major barrier here, not connections.

Is this a superior model?

Knowledge is the major barrier here, not connections.

Is this a superior model?

Eric Conner thinks 20-40% APY is possible on ETH locked in yVault when it goes live. He believes this could drive value locked in DeFi way up.

Eric and Anthony discussed how yield farming may compete or not compete with ETH staking when that goes live.

Eric and Anthony discussed how yield farming may compete or not compete with ETH staking when that goes live.

Anthony Sassano: What& #39;s the easiest way to get into yield farming right now? Yearn& #39;s yVaults or lending on Compound and earning COMP.

The highest yields require much higher levels of expertise, but one-click simplicity is the biggest funnel.

The highest yields require much higher levels of expertise, but one-click simplicity is the biggest funnel.

Next up:

DeFi Dad, Anton Bukov from 1inch, Andrey Belyakov from Opium, and Brandon Iles from Ampleforth discuss the state of Automated Market Makers in DeFi.

DeFi Dad, Anton Bukov from 1inch, Andrey Belyakov from Opium, and Brandon Iles from Ampleforth discuss the state of Automated Market Makers in DeFi.

Plenty of high-level discussion from the last panel.

FYI, if you& #39;re interested in learning more about yield farming and DeFi, check out DeFi Dad& #39;s videos on YouTube. He does a good job making things understandable for newcomers.

FYI, if you& #39;re interested in learning more about yield farming and DeFi, check out DeFi Dad& #39;s videos on YouTube. He does a good job making things understandable for newcomers.

Up next: a panel on DeFi composability with Corey Caplan (Dolomite/DMM), Priyanka Desai (OpenLaw/The Lao), Aleksander Larsen (Axie Infinity), and Alex Russman (Enjin).

They& #39;ll be discussing Web3 design in gaming and DAOs.

They& #39;ll be discussing Web3 design in gaming and DAOs.

Aleksander Larsen said that earning an asset in a game which isn& #39;t initially sold anywhere could be looked at as a form of yield farming.

I expect that incentives, verifiable randomness, and real-world data (weather, etc.) will produce incredibly vivid gaming environments.

I expect that incentives, verifiable randomness, and real-world data (weather, etc.) will produce incredibly vivid gaming environments.

DMM (DMG) will be rolling out a proposal soon for yield farming on their platform.

Next session: a panel on privacy in the crypto space with Roman Storm (Tornado Cash), Steven Waterhouse (Orchid), and Priyanka Desai.

Next session: a panel on privacy in the crypto space with Roman Storm (Tornado Cash), Steven Waterhouse (Orchid), and Priyanka Desai.

Tornado Cash will enhance crypto privacy by masking sender and recipient addresses.

At the moment this is often done by sending an asset to an exchange first and then sending to the destination address from the exchange. This stopgap has many drawbacks.

At the moment this is often done by sending an asset to an exchange first and then sending to the destination address from the exchange. This stopgap has many drawbacks.

Imagine the privacy features of Zcash on the Ethereum blockchain.

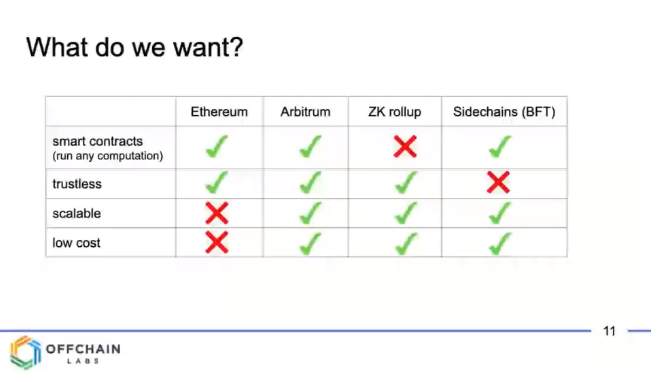

Time for a panel on ETH 2.0 featuring Chainlink advisor Hudson Jameson and Yaniv Tal of The Graph.

ETH 1 will become a shard on ETH 2.

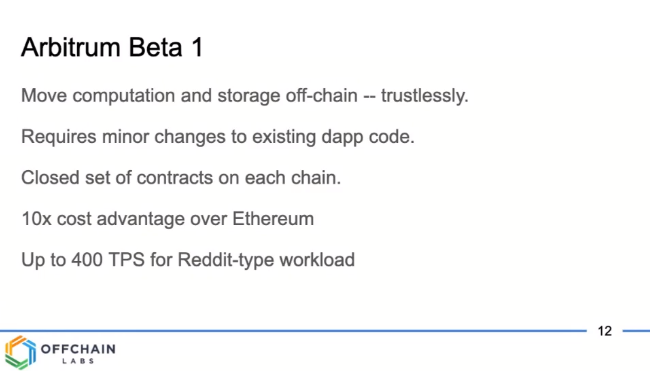

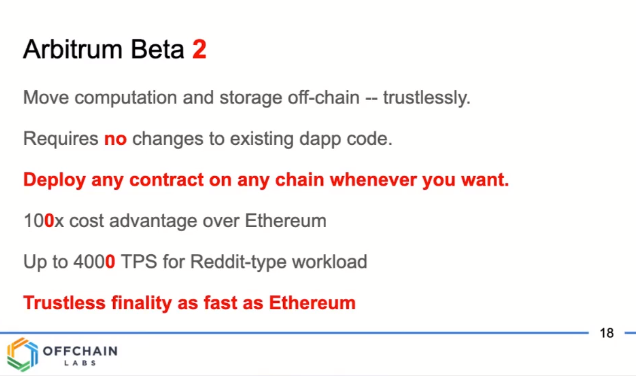

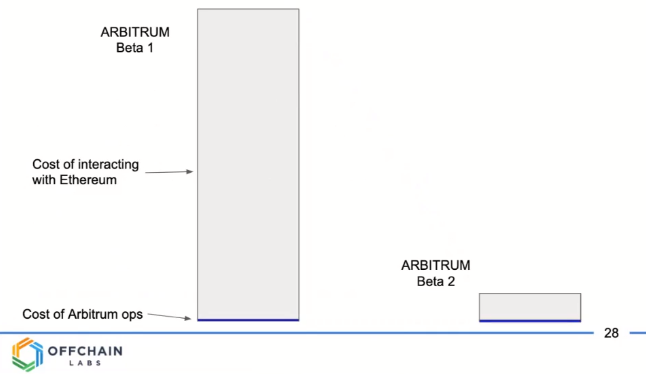

https://twitter.com/OffchainLabs/status/1299425124148555776?s=20">https://twitter.com/OffchainL...

"Ethereum is gonna be hella scalable."

Next up: a panel on the shift to digital business networks featuring Sophia Lopez (Kaleido), Antonio Senatore (Deloitte), and Steve Cerveny (Kaleido).

"We& #39;re huge fans of Chainlink& #39;s technology, not just the quality of it, but the problem they& #39;re solving." (paraphrasing Steve Cerveny of Kaleido)

He talks about leveraging the right partners to get to market faster and not getting "stuck in the plumbing."

He talks about leveraging the right partners to get to market faster and not getting "stuck in the plumbing."

Antonio Senatore of Deloitte sees supply chain as a major market opportunity over the next five years.

Steve Cerveny hears from companies that Covid-19 is accelerating adoption of new technology by about ten years.

It& #39;s Ed Felten time.

Read on Twitter

Read on Twitter