One of the question i see lot of people asking in regards to PPFAS is " Where has return come from. Indian holding or foreign holding.

Lot of people have this high perception of only Nasdaq or tech stocks leading to it.

pretty baseless question though:)

A small thread

1/n

Lot of people have this high perception of only Nasdaq or tech stocks leading to it.

pretty baseless question though:)

A small thread

1/n

2/n

There is absolutely no right way or scientific way (except some complicated XIRR). I made some assumptions.

a. Portfolio, stock holding and assume no change in stocks during the duration.

b. 31st dec, 2019 as the stock holding

c. 27 august 2020 as the final value.

There is absolutely no right way or scientific way (except some complicated XIRR). I made some assumptions.

a. Portfolio, stock holding and assume no change in stocks during the duration.

b. 31st dec, 2019 as the stock holding

c. 27 august 2020 as the final value.

3/n

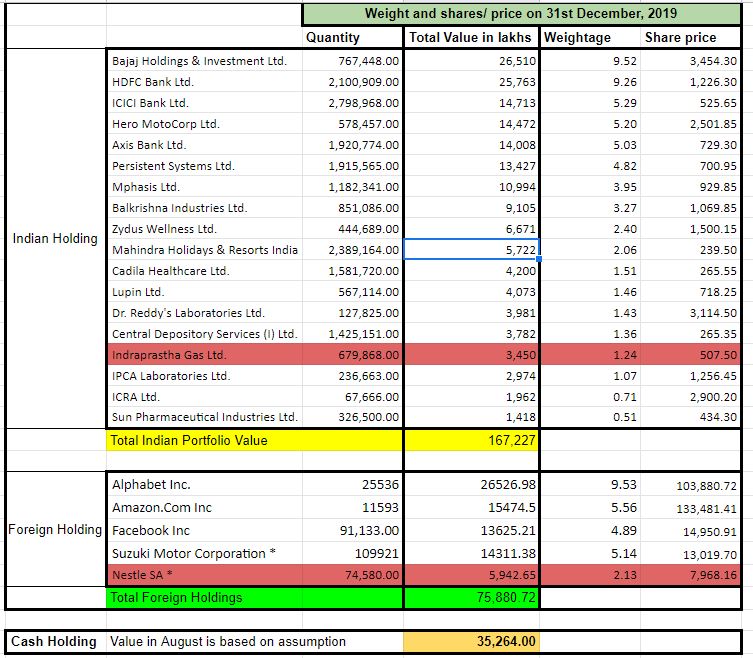

what were PPFAS value on 31st December.

they held about 12% cash. 26% in foreign stocks.

red indicate, they sold the position after dec 31st.

i have assumed, imagine they can not do any thing with their stock portfolio ( No change in existing stock) except cash)

what were PPFAS value on 31st December.

they held about 12% cash. 26% in foreign stocks.

red indicate, they sold the position after dec 31st.

i have assumed, imagine they can not do any thing with their stock portfolio ( No change in existing stock) except cash)

4/n

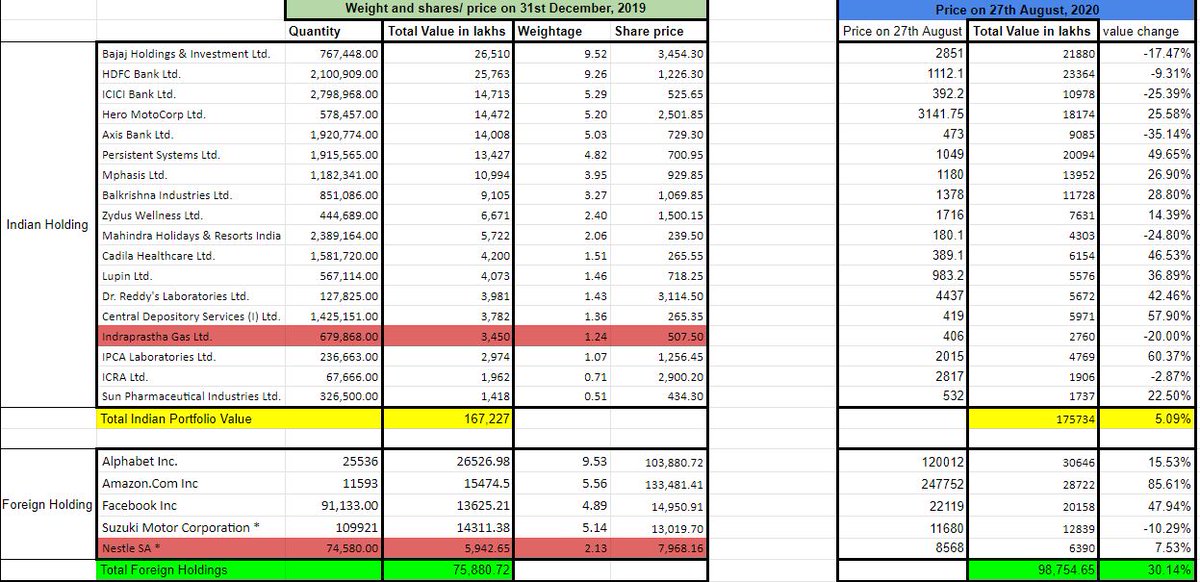

added share price value of all stock holding (assumption: No change, no stocks sold and nothing bought)

so how does did the value change with out cash component basis assumptions made

Indian holding: 5% growth

Foreign portfolio: 30% Growth

added share price value of all stock holding (assumption: No change, no stocks sold and nothing bought)

so how does did the value change with out cash component basis assumptions made

Indian holding: 5% growth

Foreign portfolio: 30% Growth

5/n

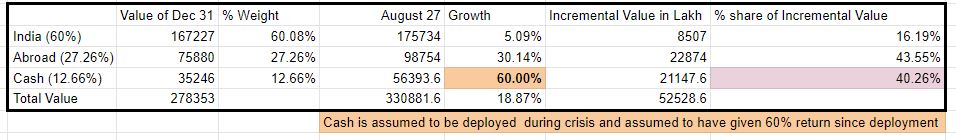

Now comes cash.

Assuming they deployed almost 10-11% of cash out of 12.66 in the crisis across various names ( new and odd) and that value is assumed to have grown at 60%.

this is how contribution of incremental return looks like by deploying the cash (Original PF is same)

Now comes cash.

Assuming they deployed almost 10-11% of cash out of 12.66 in the crisis across various names ( new and odd) and that value is assumed to have grown at 60%.

this is how contribution of incremental return looks like by deploying the cash (Original PF is same)

6/n

What happened?

Incremental cash deployment is what perhaps caused 45% of incremental returns on same portfolio since 31st December. Of-course the cash has been deployed between Indian and foreign stocks.

That is the REAL differentiation.

So it is not NASDAQ alone:)

What happened?

Incremental cash deployment is what perhaps caused 45% of incremental returns on same portfolio since 31st December. Of-course the cash has been deployed between Indian and foreign stocks.

That is the REAL differentiation.

So it is not NASDAQ alone:)

N/N

This is not the most scientific way but the things that matter is process/ ability to take cash calls and more importantly deploy when need comes:)

So give weightage to process of the fund:)

choices of stock is part luck part knowledge:)

This is not the most scientific way but the things that matter is process/ ability to take cash calls and more importantly deploy when need comes:)

So give weightage to process of the fund:)

choices of stock is part luck part knowledge:)

Read on Twitter

Read on Twitter