Good morning. Jackson Hole. Was it what you thought it would be? So meh in so many ways years after years. Central bankers can& #39;t do too much. What has Kuroda done for Japan other than just continuing low rates + NIRP + plenty of QE? Meanwhile Abe& #39;s 3 arrows missing targets.

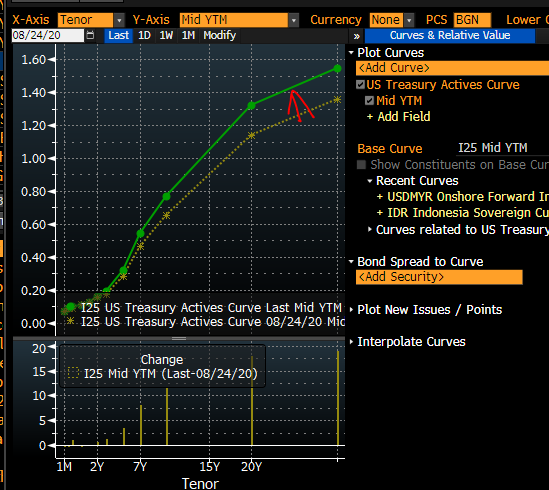

Here we are again w/ markets disappointed or maybe it wasn& #39;t & another buy the rumours & sell the facts day. Longer rates moved up after Jackson Hole. What did Jerome Powell say exactly? Promised low rates for a long time even w/ occasional overshoot of CPI & unemployment.

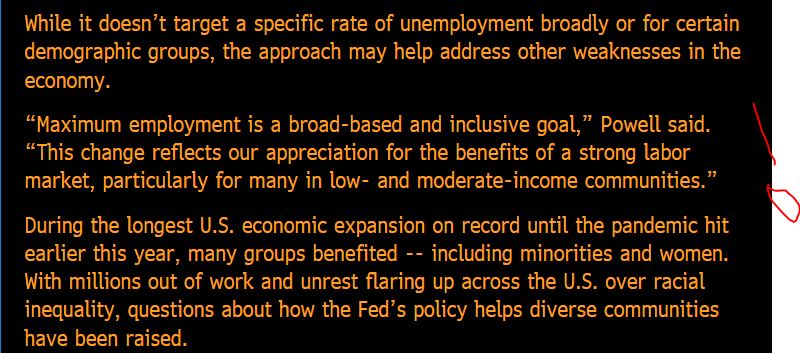

Markets have been expecting more from Jerome Powell (yield curve control, negative rates) & are all desperate measures & do more harm than good so good on him to avoid. I hope he continues the course. What irks me is the way they frame this low rates for a long time narrative...

First, if u know how monetary policy work (operationally & theoretically), then you know it has nothing to do with low & moderate income & minorities & women.

Yet, here they are, saying that they keep rates low for all these groups. How do women & poor people of color benefit?

Yet, here they are, saying that they keep rates low for all these groups. How do women & poor people of color benefit?

the Fed & all central banks do one thing that NO ONE CAN DO: they create the supply of money. The multiplier & demand are up to the markets/economy.

And by creating this supply (via interest rates & QE & regulations), they also do the following:

Decide ACCESS to this supply.

And by creating this supply (via interest rates & QE & regulations), they also do the following:

Decide ACCESS to this supply.

It is the ACCESS & the supply of money & the price of which that create INEQUALITY because theoretically, according to them, a bank/fund/rich person/corporate that get access to this relatively FREE money via inflation of assets (financial & hard) will then SPEND/INVEST/HIRE.

While that may happen, we know that the people that SPEND & STIMULATE the economy are the middle class vs the rich. Why? Rich people have everything they need. They spend excess capital on investing. So by continuing low rates & inflating one area of the economy, the Fed thinks..

...it& #39;s helping poor people, low income people, people of color, women etc but it doesn& #39;t.

History shows it doesn& #39;t. Look at the data from the GFC to 2019 (pre Covid).

Asset inflation = rising inequality = relative wage deflation. And yes, wage DID rise eventually but too slow.

History shows it doesn& #39;t. Look at the data from the GFC to 2019 (pre Covid).

Asset inflation = rising inequality = relative wage deflation. And yes, wage DID rise eventually but too slow.

Why? Because just look at the price of AVERAGE HOUSING/AVERAGE INCOME.

It has risen. And housing is a basic fundamental need.

If that is not an attack on the American middle class, then I don& #39;t know else is.

U say demand > supply. Whatever it is, people relative worse off.

It has risen. And housing is a basic fundamental need.

If that is not an attack on the American middle class, then I don& #39;t know else is.

U say demand > supply. Whatever it is, people relative worse off.

So the American people are becoming more desperate, fearful & sad.

Whatever the Fed is doing, and I am not an anti-central banker, but it is not helping w/ inequality or poor people.

By definition, poor people don& #39;t get cheap credit & access to finance the way others do. So no

Whatever the Fed is doing, and I am not an anti-central banker, but it is not helping w/ inequality or poor people.

By definition, poor people don& #39;t get cheap credit & access to finance the way others do. So no

If people write reports about the Fed, they must ask why these central bankers DO THE SAME THING EXPECTING DIFF RESULTS? We know their actions don& #39;t work for their "stated purpose." They work to inflate asset prices.

Just say it for what it is. What& #39;s Congress gonna do about it.

Just say it for what it is. What& #39;s Congress gonna do about it.

My issue isn& #39;t central bankers out of control, which they are. But that what is Congress doing???

I wonder if they understand how central banks work? I wonder if whenever they shout from the top of their lungs about the RISING INEQUALITY & INJUSTICE that they are IN CHARGE.

I wonder if they understand how central banks work? I wonder if whenever they shout from the top of their lungs about the RISING INEQUALITY & INJUSTICE that they are IN CHARGE.

When they go on political campaigns, they say something like this:

IF YOU VOTE FOR ME TO BE UR REP OR SENATOR, I WILL SOLVE XY&Z.

And then they get to DC & they just complain about the system being unfair, unjust blah blah.

YOU ARE THE SYSTEM. FIX IT.

IF YOU VOTE FOR ME TO BE UR REP OR SENATOR, I WILL SOLVE XY&Z.

And then they get to DC & they just complain about the system being unfair, unjust blah blah.

YOU ARE THE SYSTEM. FIX IT.

Btw, here is what I think about Jackson Hole & these meetings, simple thing is this:

Don& #39;t spend to much time on it. Yes it matters but what matters is the change of economics + politics.

JPO has changed his tunes many times regarding rates. He never promised u a rose garden.

Don& #39;t spend to much time on it. Yes it matters but what matters is the change of economics + politics.

JPO has changed his tunes many times regarding rates. He never promised u a rose garden.

Read on Twitter

Read on Twitter