The Fed revamped its policy framework today. Now that the stories are put to bed, I thought I& #39;d do a quick thread on the history that got us to this moment — and why the moment matters. (1/) https://www.nytimes.com/2020/08/27/business/economy/federal-reserve-inflation-jerome-powell.html?action=click&module=Top%20Stories&pgtype=Homepage">https://www.nytimes.com/2020/08/2...

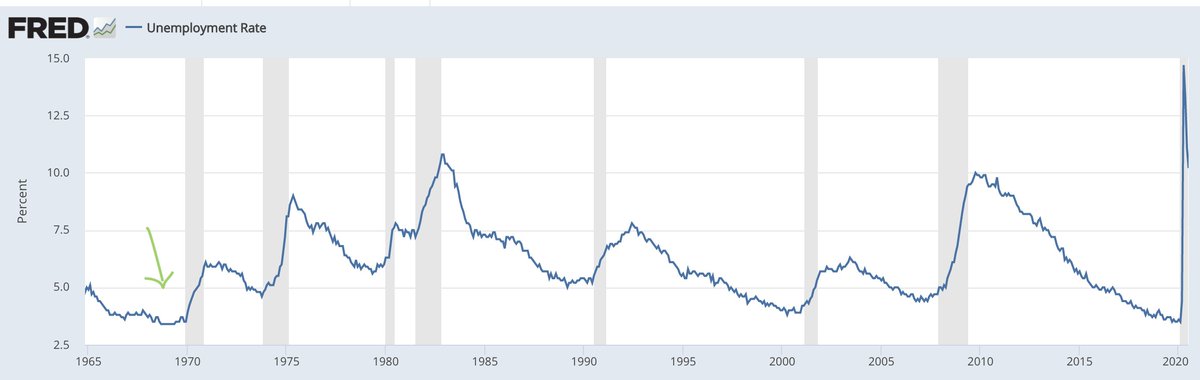

This story starts in the mid-1960& #39;s. The Great Depression loomed large in American memory, and the Fed was focused on maximizing employment, even if that meant pushing inflation higher. https://www.federalreservehistory.org/essays/great_inflation">https://www.federalreservehistory.org/essays/gr...

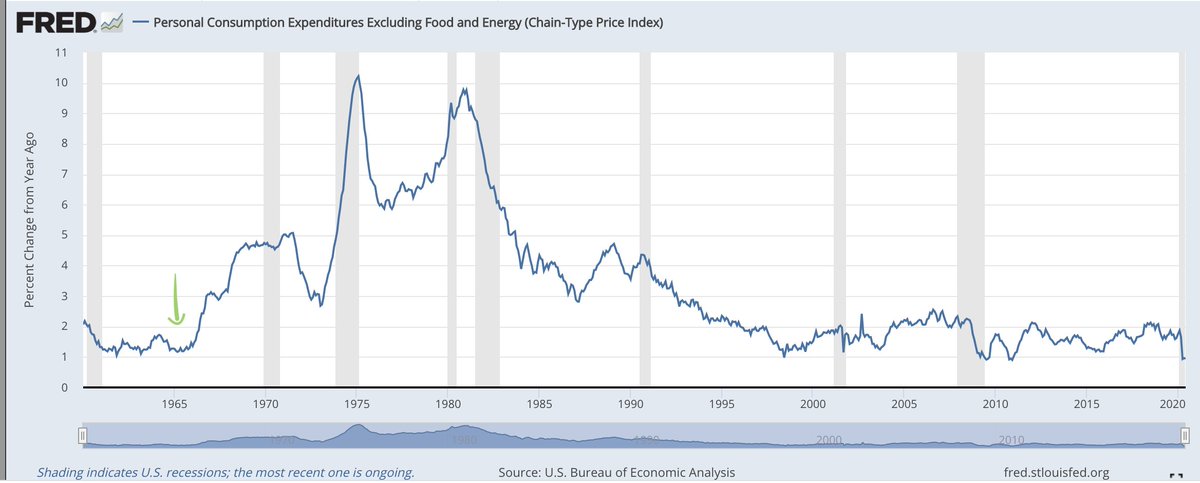

Unemployment dropped to 3.4%. Price increases, for a time, stayed low. But in the late 1960& #39;s, inflation began to nudge up. Folks expected that, so initially, no big deal.

Then came the 1970& #39;s. The Bretton Woods monetary system broke down. An oil crisis sent prices rocketing. The government had been spending heavily on Vietnam. Blame one, blame all, blame the Fed or blame something else entirely -- overall inflation spiraled upward.

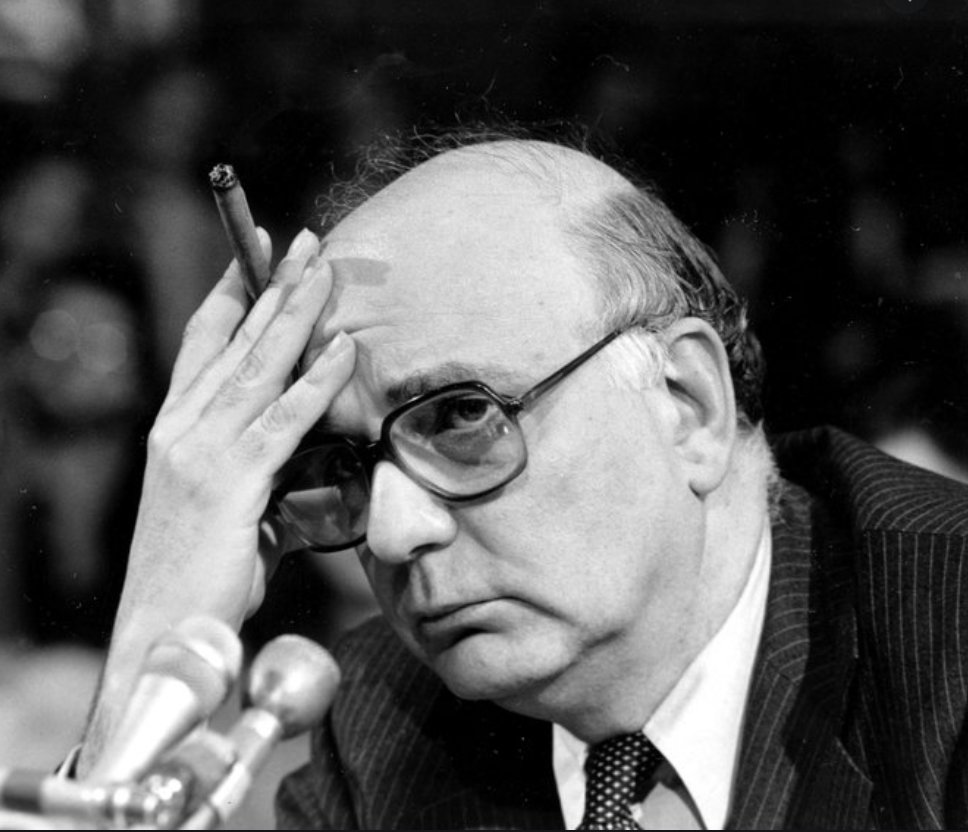

Then Jimmy Carter appointed this guy — Paul Volcker —as head of the Fed. He pushed interest rates painfully high to cool things off.

Unemployment shot up alongside rates, but price increases began to decline. The economic pain cost workers their jobs, homebuilders their business, and (at least in part) Carter his re-election.

A generation of central bankers swore: Never again.

A generation of central bankers swore: Never again.

And so the Fed adopted an approach in which it lifted rates whenever conditions looked a little hot. It took the economic temperature by looking at metrics including growth and the unemployment rate.

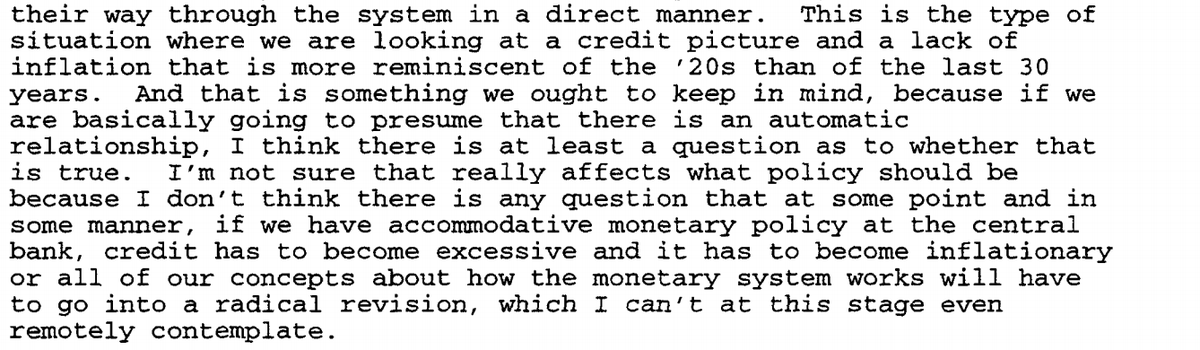

Fast forward to the 1990& #39;s. Inflation was actually a little lower than expected, but the idea that cheap credit would eventually beget higher prices still seemed logical, and the Fed stuck with it. Here& #39;s then-Chair Greenspan in 1994.

But Greenspan grew increasingly skeptical. He argued against rate increase in the late & #39;90& #39;s, and the committee slowed them down dramatically. Unemployment fell -- and so did prices.

The dot-com bubble killed the long & #39;90& #39;s expansion. During the one that followed, inflation be-bopped right around 2% without ever really getting out of line. Then came the housing bubble and the 2007-2009 recession.

In the wake of that crisis, with rates still at rock bottom, the Fed formally declared an inflation target -- 2%, like in many advanced economies. Why? Positive inflation gives a little room to cut rates, guards against deflation, etc. https://www.stlouisfed.org/open-vault/2019/january/fed-inflation-target-2-percent">https://www.stlouisfed.org/open-vaul...

But as the 20-teens wore on, prices were coming in shy of target. Despite that, the Fed started raising rates in December 2015, worried that low unemployment would eventually push them higher. Here& #39;s then-Chair Janet Yellen explaining the logic. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20151216.pdf">https://www.federalreserve.gov/mediacent...

Yellen + Powell& #39;s Feds made 9 hikes in total. Prices never took off. And from his early days as chairman, Powell gave the idea that there& #39;s a guessable "natural rate" of unemployment serious side-eye.

(U* is economics slang for the natural rate.)

https://www.federalreserve.gov/newsevents/speech/powell20180824a.htm">https://www.federalreserve.gov/newsevent...

(U* is economics slang for the natural rate.)

https://www.federalreserve.gov/newsevents/speech/powell20180824a.htm">https://www.federalreserve.gov/newsevent...

Today& #39;s move takes that skepticism and codifies it. Powell and his colleagues are saying:

*Inflation expectations definitely matter

*Re: inflation, the unemployment rate may not matter so much?

*Financial bubbles are really a thing to worry about

*Inflation expectations definitely matter

*Re: inflation, the unemployment rate may not matter so much?

*Financial bubbles are really a thing to worry about

Read on Twitter

Read on Twitter