How does your startups revenue growth stack up?!

Ran across some interesting charts from @SaaSCapital the other day that breakdown benchmark growth rates of thousands of private bootstrapped and VC-backed companies.

TLDR - VC-backed grow WAY faster

Check them out below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Rückhand Zeigefinger nach unten (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittelheller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Rückhand Zeigefinger nach unten (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittelheller Hautton)">

Ran across some interesting charts from @SaaSCapital the other day that breakdown benchmark growth rates of thousands of private bootstrapped and VC-backed companies.

TLDR - VC-backed grow WAY faster

Check them out below

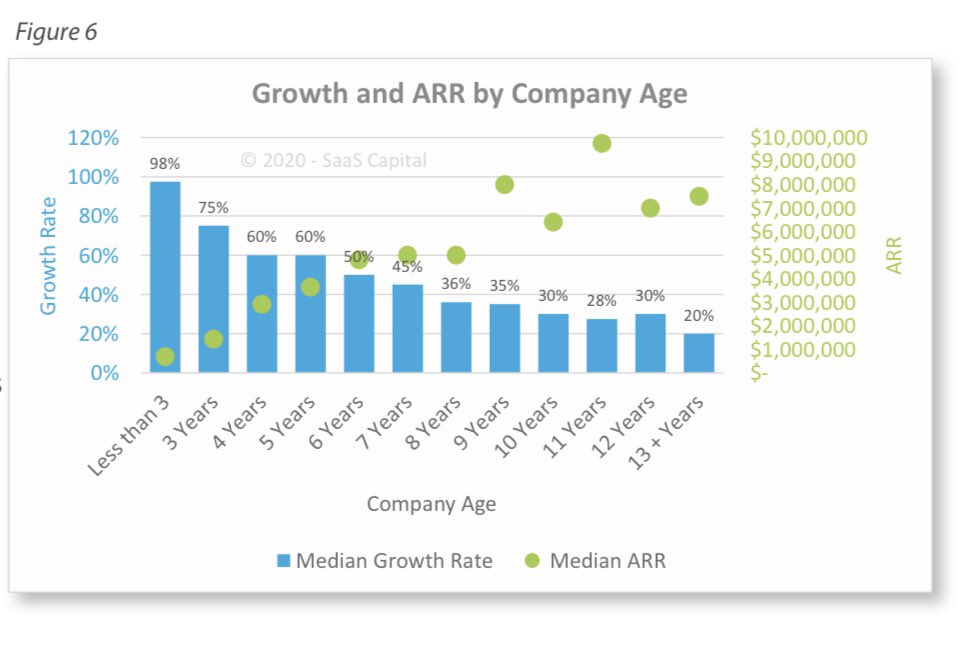

Chart 1 is pretty simple but it breaks down average and median growth rates of SaaS startups at different revenue levels

It’s rare to get this type and breadth of data from private companies

These are good benchmarks for planning growth and setting targets

It’s rare to get this type and breadth of data from private companies

These are good benchmarks for planning growth and setting targets

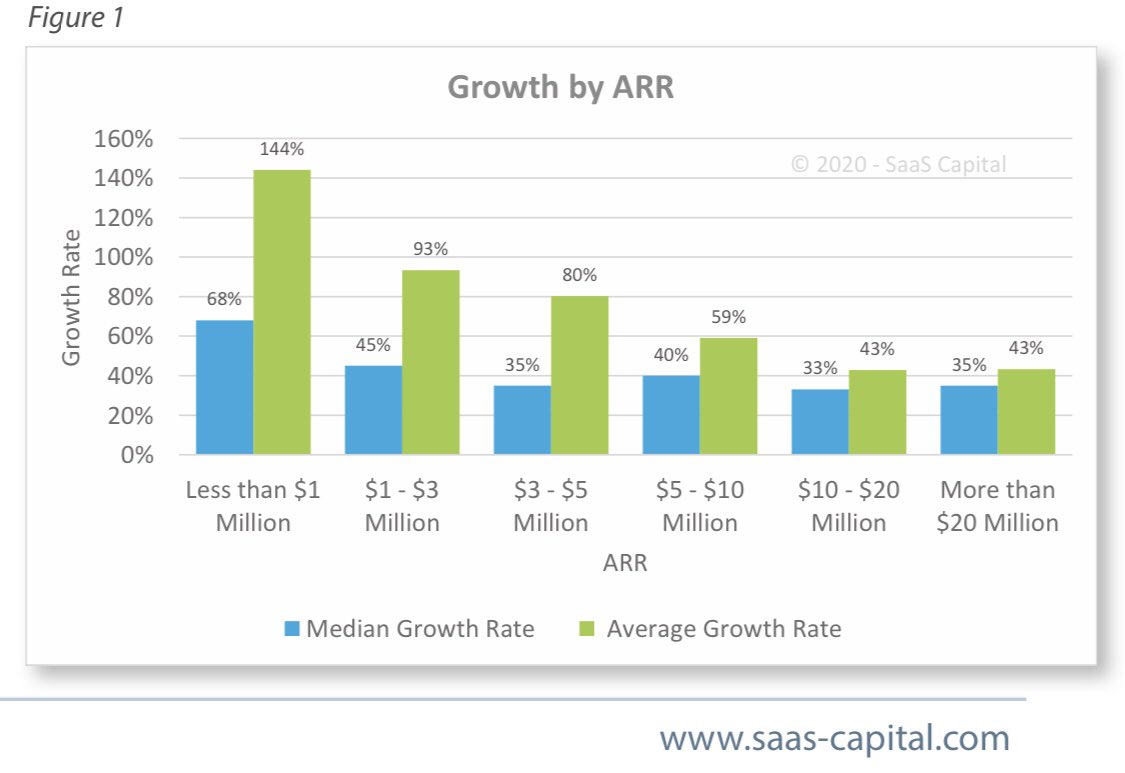

Chart 2 takes some same growth metrics and breaks them out further, allowing you to see what the benchmark for great performance looks like

If you’re SaaS is doing $1-3M in ARR you need be growing at 91% or more annually to be in the top quartile

If you’re SaaS is doing $1-3M in ARR you need be growing at 91% or more annually to be in the top quartile

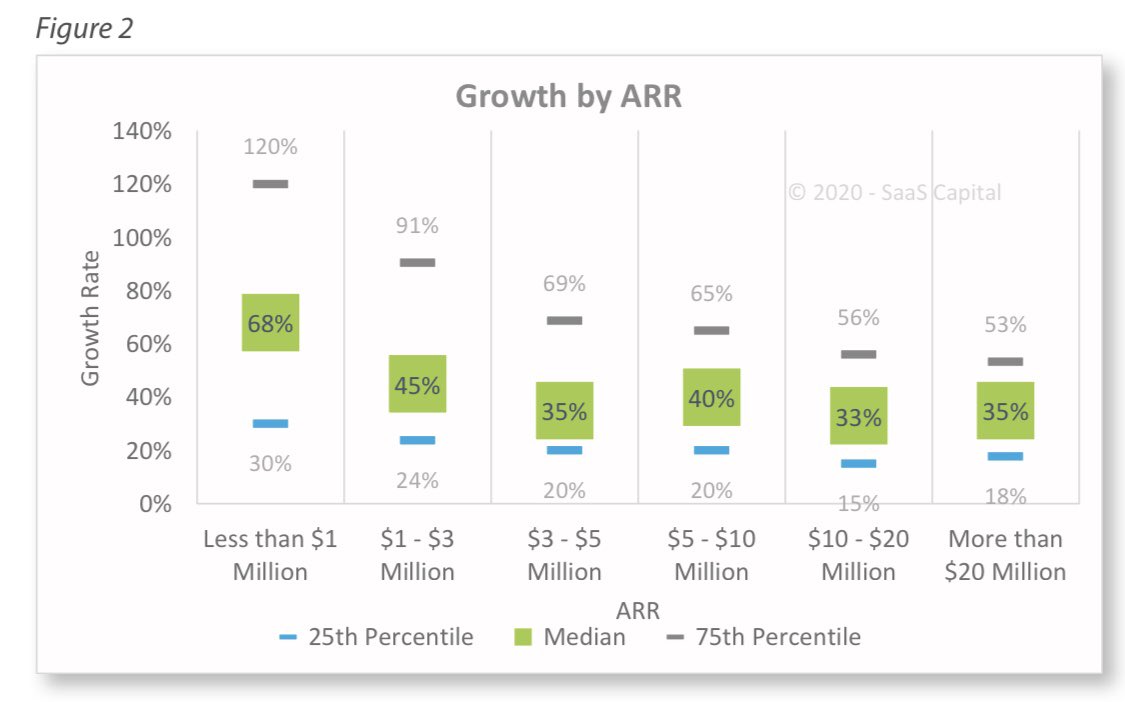

And here’s why world class performance looks like - if you’re hitting these annual ARR growth rates your startup is in the top 10%

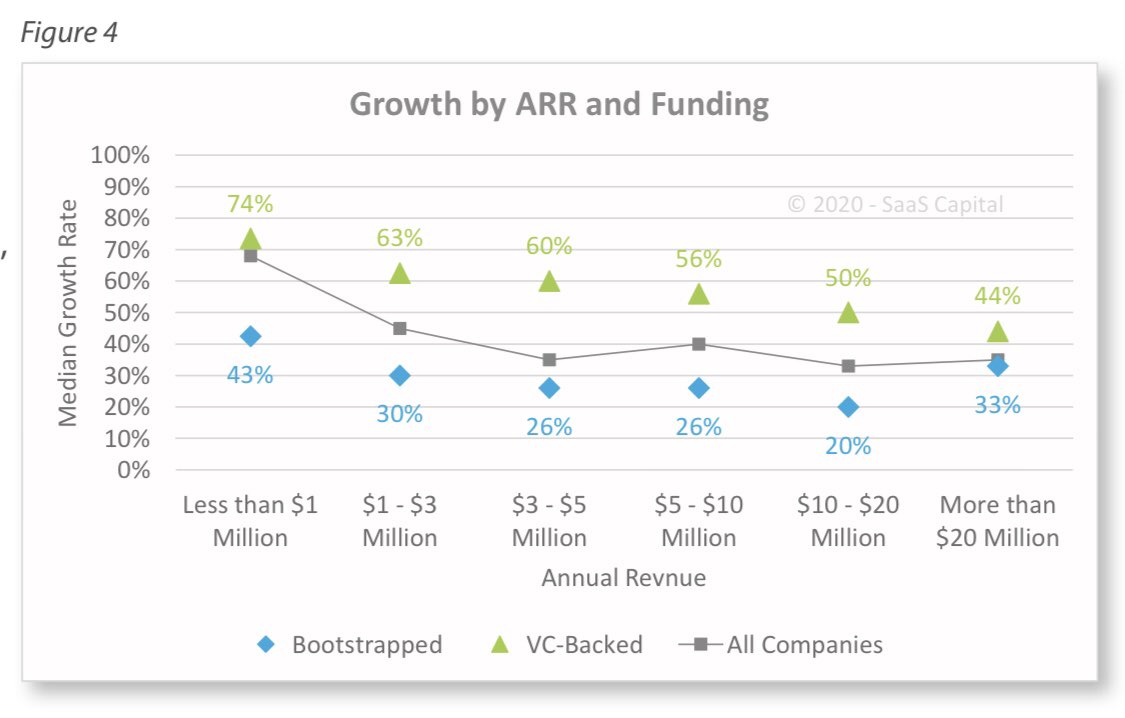

Here’s where it starts to get interesting

Chart 4 breaks down growth rates of VC-backed vs bootstrapped SaaS startups

At almost all stages, VC backed startups grow at more than 2X the rate of bootstrapped startups

Compounding https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">

The gap starts to close at scale though

Chart 4 breaks down growth rates of VC-backed vs bootstrapped SaaS startups

At almost all stages, VC backed startups grow at more than 2X the rate of bootstrapped startups

Compounding

The gap starts to close at scale though

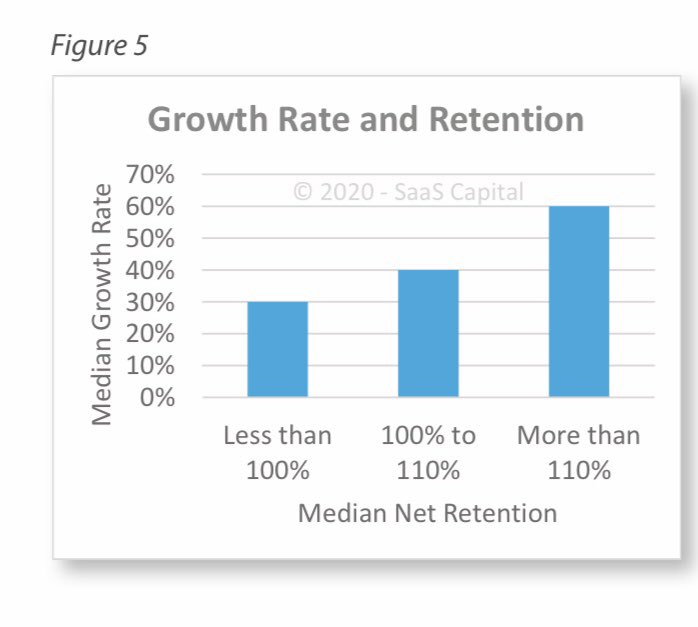

Retention is King  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤴" title="Prinz" aria-label="Emoji: Prinz">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤴" title="Prinz" aria-label="Emoji: Prinz">

Growth rates are tightly correlated with Retention and vice versa

Startups with more than 110% net retention grew at 2X the rate of those under 100%

Lesson: Stop filling a leaky bucket and make retention a priority!

Growth rates are tightly correlated with Retention and vice versa

Startups with more than 110% net retention grew at 2X the rate of those under 100%

Lesson: Stop filling a leaky bucket and make retention a priority!

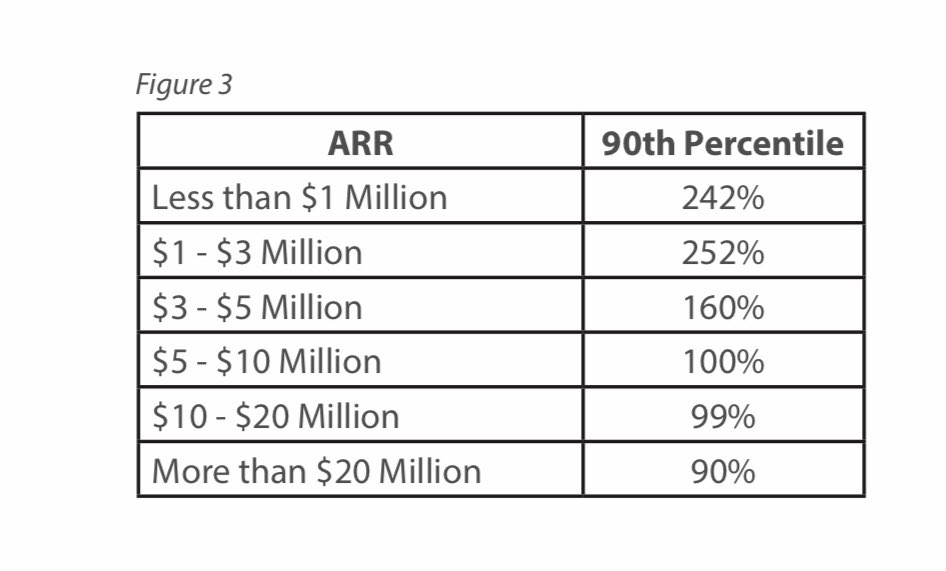

Lastly, chart 6 breaks down growth rates and ARR throughout the lifecycle of a startup

The median age for bootstrapped companies is 10 years while VC-backed SaaS co’s was just 6 years

On avg VC backed startups hit $1M ARR in 4 years, bootstrapped in 7.5 years

The median age for bootstrapped companies is 10 years while VC-backed SaaS co’s was just 6 years

On avg VC backed startups hit $1M ARR in 4 years, bootstrapped in 7.5 years

All in all there’s a ton of interesting data points in the full report (linked below)

Keep these in mind as you look ahead to the future of your startup, but always know you are competing with yourself, not benchmarks, you know what you and your team are capable of

Keep these in mind as you look ahead to the future of your startup, but always know you are competing with yourself, not benchmarks, you know what you and your team are capable of

Here’s the full report

https://www.saas-capital.com/wp-content/uploads/2020/08/RB-22-2020-Benchmarking-Private-SaaS-Company-Growth-Rates.pdf">https://www.saas-capital.com/wp-conten...

https://www.saas-capital.com/wp-content/uploads/2020/08/RB-22-2020-Benchmarking-Private-SaaS-Company-Growth-Rates.pdf">https://www.saas-capital.com/wp-conten...

Sooo....How does your startup stack up? Comment below  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Rückhand Zeigefinger nach unten (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittelheller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Rückhand Zeigefinger nach unten (mittelheller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittelheller Hautton)">

Also, thanks @robertmclaws found this from your LinkedIn  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙌🏼" title="Raising hands (mittelheller Hautton)" aria-label="Emoji: Raising hands (mittelheller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙌🏼" title="Raising hands (mittelheller Hautton)" aria-label="Emoji: Raising hands (mittelheller Hautton)">

Read on Twitter

Read on Twitter

The gap starts to close at scale though" title="Here’s where it starts to get interesting Chart 4 breaks down growth rates of VC-backed vs bootstrapped SaaS startupsAt almost all stages, VC backed startups grow at more than 2X the rate of bootstrapped startups Compounding https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">The gap starts to close at scale though" class="img-responsive" style="max-width:100%;"/>

The gap starts to close at scale though" title="Here’s where it starts to get interesting Chart 4 breaks down growth rates of VC-backed vs bootstrapped SaaS startupsAt almost all stages, VC backed startups grow at more than 2X the rate of bootstrapped startups Compounding https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend">The gap starts to close at scale though" class="img-responsive" style="max-width:100%;"/>

Growth rates are tightly correlated with Retention and vice versaStartups with more than 110% net retention grew at 2X the rate of those under 100%Lesson: Stop filling a leaky bucket and make retention a priority!" title="Retention is King https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤴" title="Prinz" aria-label="Emoji: Prinz"> Growth rates are tightly correlated with Retention and vice versaStartups with more than 110% net retention grew at 2X the rate of those under 100%Lesson: Stop filling a leaky bucket and make retention a priority!" class="img-responsive" style="max-width:100%;"/>

Growth rates are tightly correlated with Retention and vice versaStartups with more than 110% net retention grew at 2X the rate of those under 100%Lesson: Stop filling a leaky bucket and make retention a priority!" title="Retention is King https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤴" title="Prinz" aria-label="Emoji: Prinz"> Growth rates are tightly correlated with Retention and vice versaStartups with more than 110% net retention grew at 2X the rate of those under 100%Lesson: Stop filling a leaky bucket and make retention a priority!" class="img-responsive" style="max-width:100%;"/>