1/ The 3rd consumer economy tracker by @CreditVidya is out! We& #39;re seeing the beginnings of a recovery in income and spending. Here are the highlights, but sign up on https://compass.creditvidya.com/ ">https://compass.creditvidya.com/">... for more details.

#thread

#thread

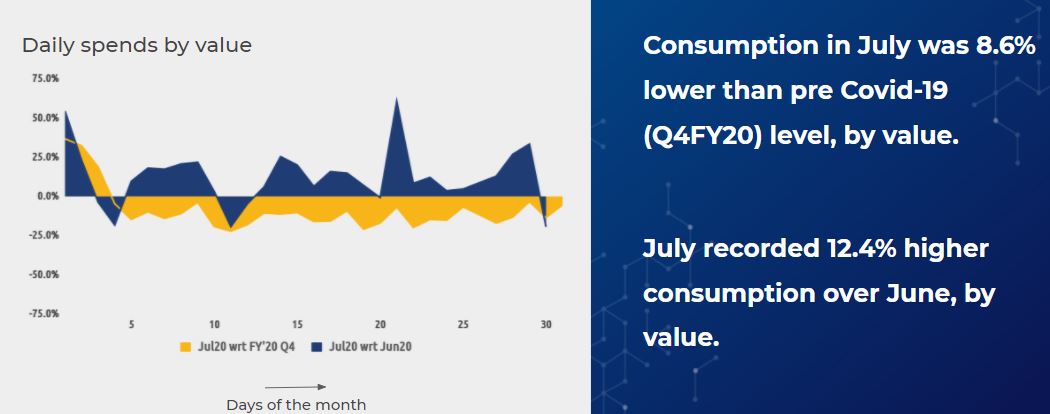

2/ Consumption increased by over 12% in July, thanks to easing of the lockdown and opening up of businesses, including non-essential ones.

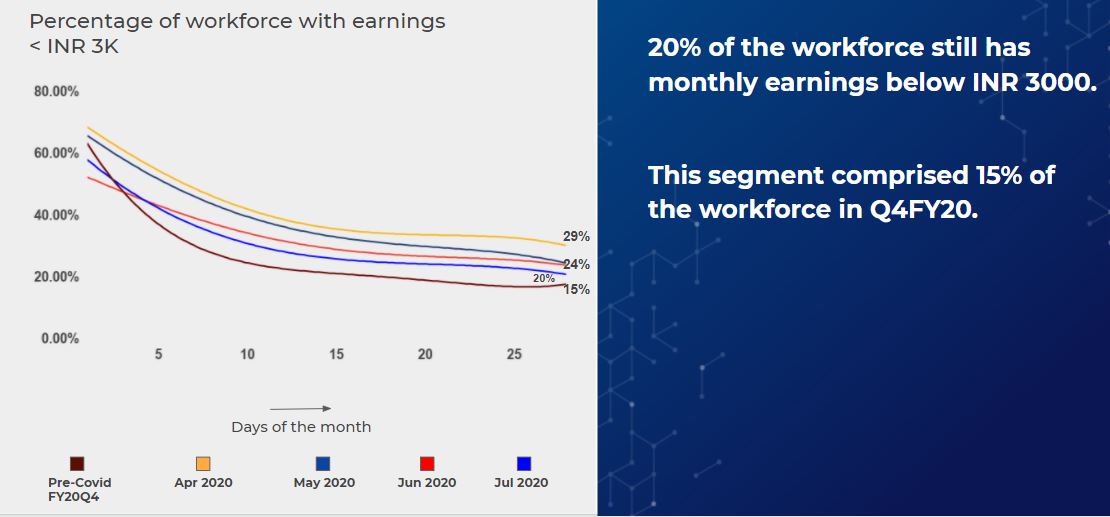

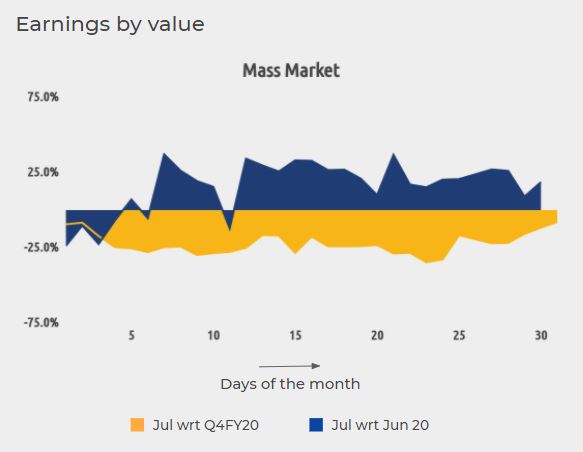

5/ Predictably, earnings went up in July... but employment is still sluggish. The share of those with 0 earnings through the month stood at 6.1% ...almost at pre- #COVID19 (Q4FY20) level.

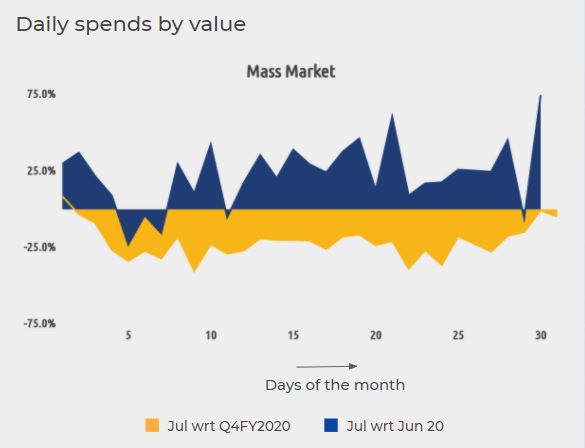

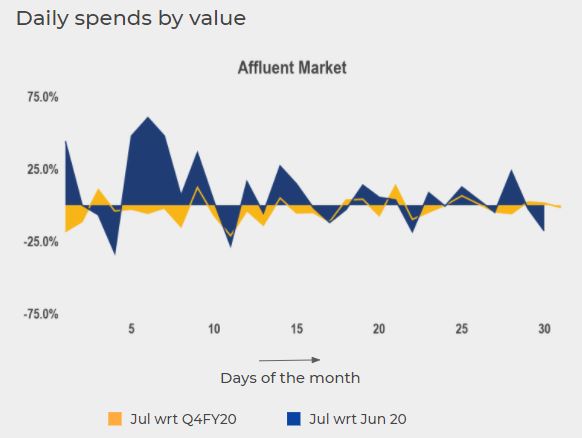

6/ The biggest difference between market segments is in Earnings. Mass Market earnings are still 22% below pre-Covid levels.

7/ @CreditVidya data on income matches #unemployment data from other sources. The higher increase in incomes in smaller towns is likely to be agri-related.

8/ We will soon be entering the peak festive season. This may help with recovery, but, it’s also likely to coincide with a peaking of #COVID19 cases in tier 2, 3 - where healthcare is less accessible.

Keep checking https://compass.creditvidya.com/ ">https://compass.creditvidya.com/">... for updates.

/end of thread

Keep checking https://compass.creditvidya.com/ ">https://compass.creditvidya.com/">... for updates.

/end of thread

Read on Twitter

Read on Twitter