Private equity firms have acquired a lot of commercial property in cities over the past decade or two. Due to the pandemic, lots of those properties, especially hotels, are basically producing zero cashflow.

You would think that would put PE firms in a bad position, but…

You would think that would put PE firms in a bad position, but…

…instead, they are skipping payments on the debt they hold on those properties. Some properties are already falling into default. https://www.bloomberg.com/news/articles/2020-08-24/real-estate-investors-skip-paying-loans-while-raising-billions">https://www.bloomberg.com/news/arti...

You would think that would upset the banks who provided mortgages for PE to acquire the properties, but that& #39;s not how this works. The banks make the mortgages and sell the debt to investors on the secondary market.

In some cases, the PE firms “buy” the debt back from the investors.

How? The mortgages aren’t taken out in the name of the PE firm that owns the building. Per standard real estate industry practice, it creates an LLC or some other legal entity to “own” one or more properties…

How? The mortgages aren’t taken out in the name of the PE firm that owns the building. Per standard real estate industry practice, it creates an LLC or some other legal entity to “own” one or more properties…

So:

1. PE firm creates an LLC

2. The LLC takes out a mortgage to buy one or more properties.

3. Then the bank slices up the mortgage and sells it on the secondary market to investors.

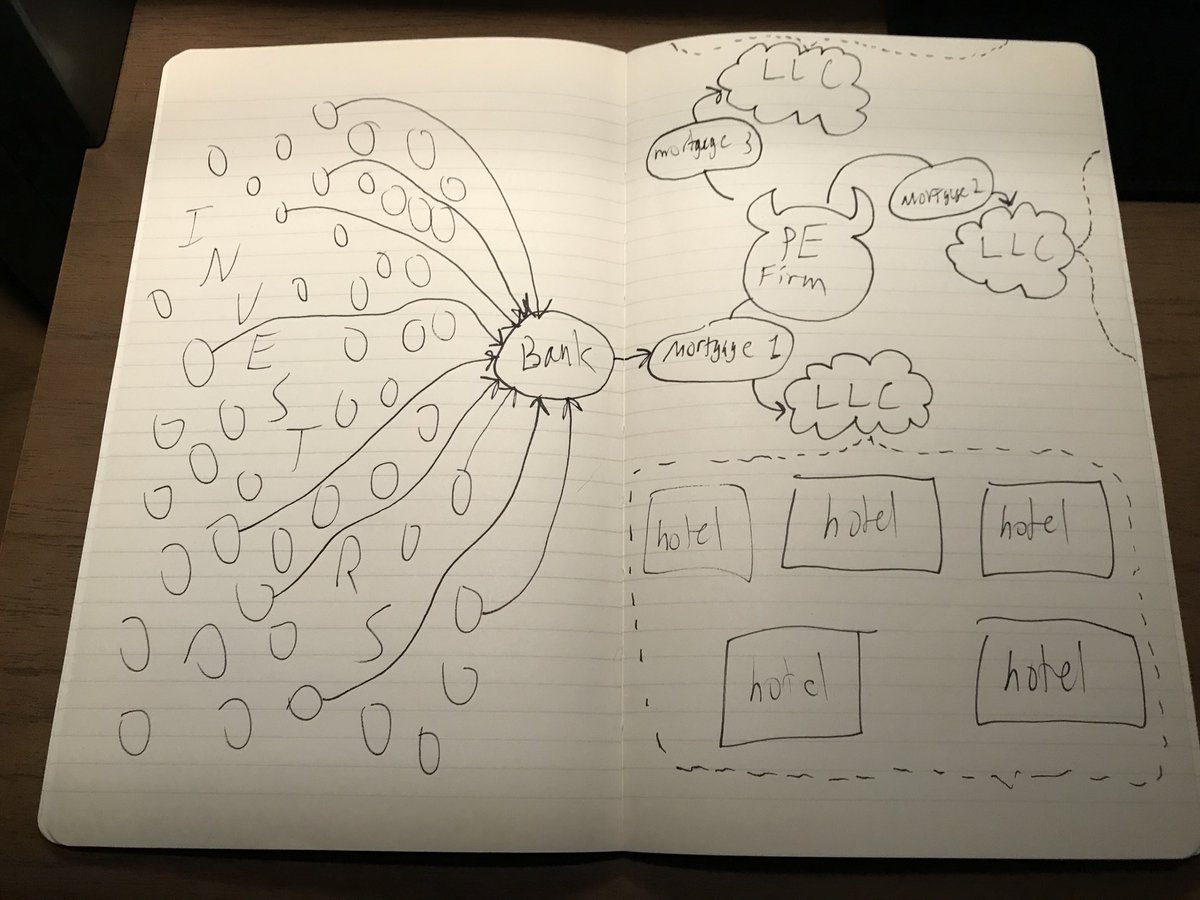

And you end up with something that kind of looks like this very over-simplified graph.

1. PE firm creates an LLC

2. The LLC takes out a mortgage to buy one or more properties.

3. Then the bank slices up the mortgage and sells it on the secondary market to investors.

And you end up with something that kind of looks like this very over-simplified graph.

So this very rudimentary graph is meant to indicate that the PE firm has created and controlled more than one LLC and each LLC may “own” more than one property. Maybe each property has an LLC of its own and there’s another LLC that owns multiple LLCs.

In real estate there are lots of LLCs and in certain places like New York it’s part of how the real estate industry has dominated electoral politics for so long. https://citylimits.org/2019/01/15/senate-vote-gives-state-a-chance-to-close-llc-campaign-finance-loophole/">https://citylimits.org/2019/01/1...

BUT ANYWAY back to the thing

With all the LLCs technically taking out the mortgages, the PE firms themselves never technically default, and they never lose money because why would they. The properties are rented out to cover costs, mortgage interest payments plus their profits…

With all the LLCs technically taking out the mortgages, the PE firms themselves never technically default, and they never lose money because why would they. The properties are rented out to cover costs, mortgage interest payments plus their profits…

The PE firms would never let money-losing properties eat away at their own cash piles, and clearly they won’t even pay the mortgage interest just to keep the secondary investors happy. They don’t need to. So they skip the mortgage payments and let the LLCs default.

As the Bloomberg article above notes, the debt is “non-recourse” meaning the investors don’t have any rights to go after the assets of the PE firm that controls the LLC, only the properties that the LLC owns. Standard practice.

And that’s how PE firms can cancel their own debt.

And that’s how PE firms can cancel their own debt.

It’s just another way that those with money can set things up so they never lose money even when everything else goes bad. Imagine saying this to your banker:

“Just because a prior investment didn’t work out doesn’t necessarily mean that should tarnish the reputation for future endeavors…It’s not like something was done in bad faith.”

That’s what Alan Todd, head of U.S. CMBS research for Bank of America Securities told Bloomberg. As a banker in the scheme, he’s effectively saying to the secondary market, look these things happen and you have no reason not to trust us in the future.

Who are secondary market investors, you might wonder?

Look no further than your own 401k or the nearest public pension fund or maybe an insurance company.

Look no further than your own 401k or the nearest public pension fund or maybe an insurance company.

PE firms pool cash from the wealthy and borrow from everyone else to make investments, and when the investments go bad, it’s everyone else that gets stuck holding the bag.

And that’s not even saying anything about what happens to communities where PE firms buy up properties.

And that’s not even saying anything about what happens to communities where PE firms buy up properties.

Read on Twitter

Read on Twitter