Case Study on Facebook $FB

-Business Model and Value-add to Advertisers

-Macro tailwinds

-The eCommerce Opportunity

-Call Options

-Business Model and Value-add to Advertisers

-Macro tailwinds

-The eCommerce Opportunity

-Call Options

Facebook develops products that enable people to connect with friends and family through mobile devices, personal computers, virtual reality headsets and in-home devices worldwide. Their ecosystem includes products such as Facebook, Instagram, Messenger, Whatsapp and Oculus.

FB is the largest social network in the world, with 2.6B monthly active users (MAUs). The great user engagement along with the data they generate makes Facebook attractive to advertisers. Facebook has increased user engagement by providing additional features.

And more users leads to more engagement, which leads to more accurate data collected on users, which leads to higher ROI for advertisers.

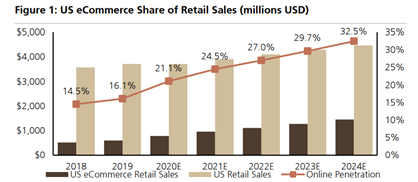

Facebook is also the most used social platform, which bodes well for advertisers.

Facebook is also the most used social platform, which bodes well for advertisers.

FB is clearly the leader in social media offerings. Facebook’s huge user base give it large network effects since all of its platforms become more valuable to its users as people both join the networks and use these services.

They also increase the switching costs for new social networks since existing users would have to leave behind friends, contacts, memories, etc. Users spend 65 minutes a day on average within the FB ecosystem, showing that the platforms have value to users.

On the other side of the equation, the willingness of advertisers to use Facebook’s platforms is shown through the 26% CAGR of the ARPU for the past 5 years. During the same period, MAUs have grown 12%. Advertisers can target based on age, location, interests and other factors.

Another lower-key moat is of regulatory nature. Privacy regulation is much more challenging for 3rd party advertising networks that rely on collecting user information across non-owned and operated sites than Facebook or Google.

These 2 target users on their own platforms, and this targeting capability is only going to increase, as Ben Thompson says.

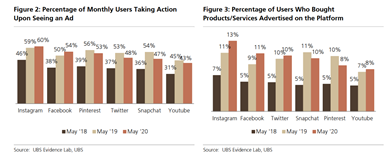

Macro tailwinds: Facebook benefits from the increased allocation of marketing and advertising dollars toward online advertising, more specifically social-network and video ads.

In 2019, less than 50% of global advertising dollars were spent online but this % is expected to grow to 60% within 3-4 years. In dollars, online ad spend could go from 300B$ today to 500B$ by 2023.

The push towards e-commerce also incentivizes companies to advertise more on digital mediums, the same medium consumers will be making purchases on. BofA sees ecommerce reaching 33% of total retail sales in 2024, up from 16% last year and

Facebook will be one of the benefactors of businesses coming online for the 1st time. They will be attracted to the ease of use and the low cost of a fully integrated platform (advertising, transaction, messaging and payments capabilities) as well as access to a large user base.

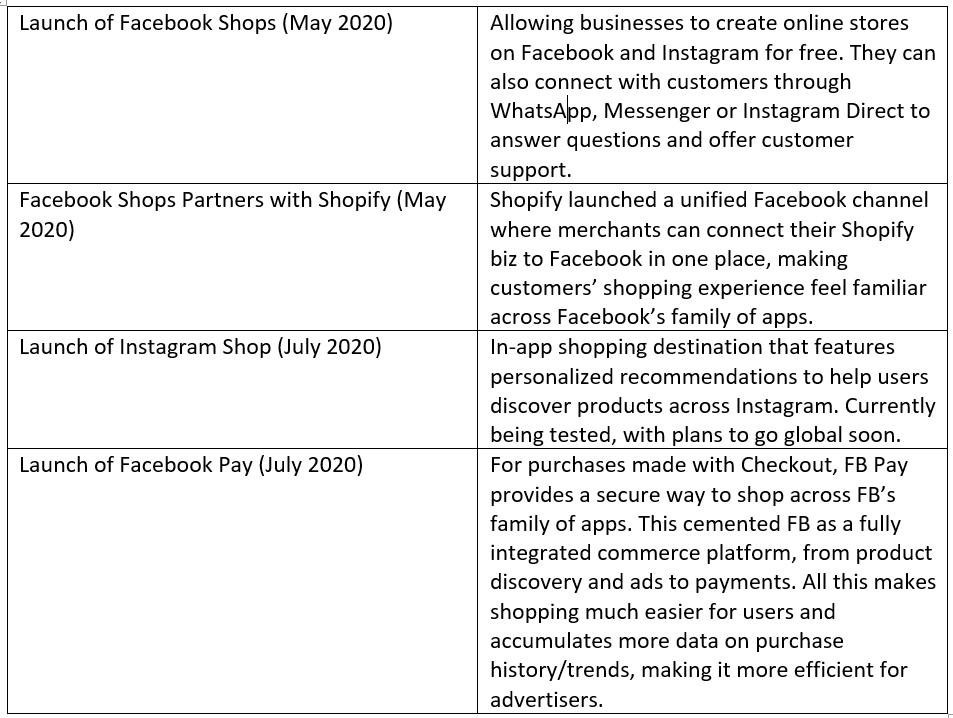

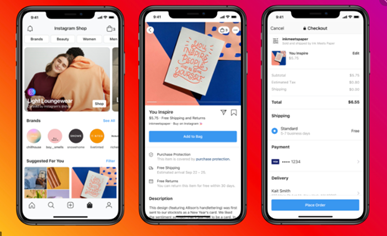

eCommerce opportunity: The launch of Facebook Shops (in partnership with Shopify and BigCommerce powering the backend) will retain SMBs that are advertising on the platform but will also attract many new ones. Which is why, like Gavin says, I think FB is the new, digital rent.

Shops seems like a smart evolution for the platform since FB was already helping businesses, small and large, grow their revenues while having transactions close outside of its ecosystem. Shops over time will allow millions more of additional SMBs to access to the 2.6B users

FB has, and transact & grow within the FB ecosystem. Over 90% of users on IG follow a business and can tap on ads and purchase directly. FB is also offering WhatsApp Business, which can be used to highlight various products and services and also as a customer support platform.

I’m quite bullish for ecommerce for Facebook, since the potential for a social network married to shopping is attractive. We have followers within social networks, which provides built-in distribution.

And FB provides live interaction and videos which make

And FB provides live interaction and videos which make

the shopping experience more random and closer to the traditional shopping experience malls provided, where you didn’t necessarily go in with specific purchase ideas in mind. FB will benefit since users will spend more time on the app, thus consuming more ads.

New shopping content and features will diversify FB’s content, make even organic posts from all users monetizable (ex: buy their outfit), provide better transaction data to FB and even put FB in direct competition with eCommerce platforms like Amazon, eBay and Etsy.

The massive network effects Facebook enjoys are its greatest asset and give it the potential to be the main player in several categories, beyond just photo and video. FB has several call options within it, including its ecommerce initiatives, in dating, in gaming, in virtual

reality, operational improvements within Reel, Libra, etc. I think if anyone can bring the Eastern concept of Superapps to the West, it’s Zuckerberg and Facebook. It’s already happening, with eCommerce (in-app shopping capabilities), messaging (Whatsapp/Messenger),

media consumption (Video & Watch) and VR (Oculus). A bit about some of these initiatives, beyond the social networks:

There’s something romantic about investing in disruptors. They reimagine the future and then make it, like when Facebook disrupts its own platforms constantly to keep users on them.

You can also read the full write-up here on my substack. Subscribe for weekly deep-dives. https://secretcapital.substack.com/p/facebook-building-the-western-superapp">https://secretcapital.substack.com/p/faceboo...

Read on Twitter

Read on Twitter