Today I gave a speech on the @ecb’s negative interest rate policy (NIRP) at the @EEANews Annual Congress in a panel with @helene_rey, Tobias #Adrian & Rafael #Repullo. In the speech, I could draw on fantastic ECB research, featuring @AngelaMaddaloni , @fheider & many others. 1/6 https://twitter.com/ecb/status/1298584937147367424">https://twitter.com/ecb/statu...

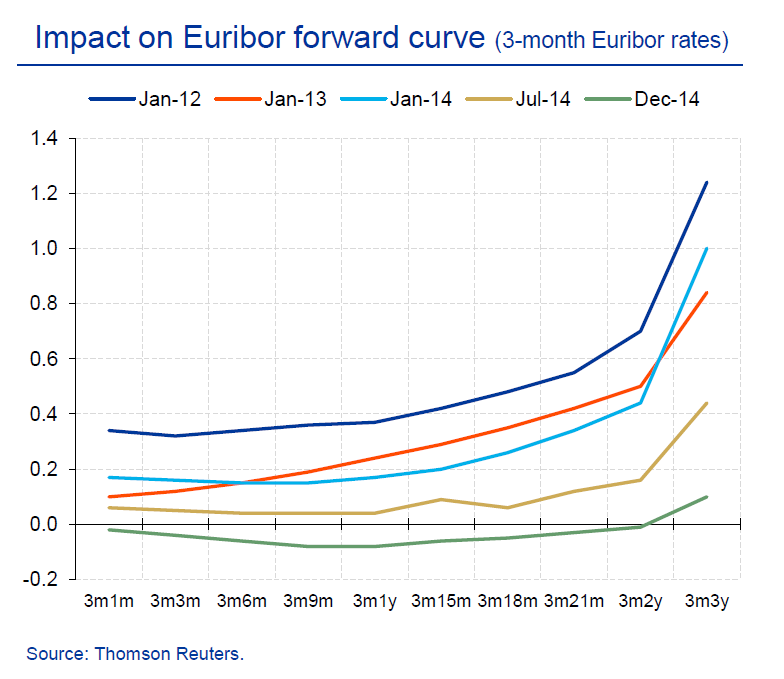

The NIRP helped to shift the perceived lower bound on interest rates into negative territory, supported by forward guidance that left the door open for further rate cuts. The zero lower bound was transformed into an effective lower bound below zero. 2/6

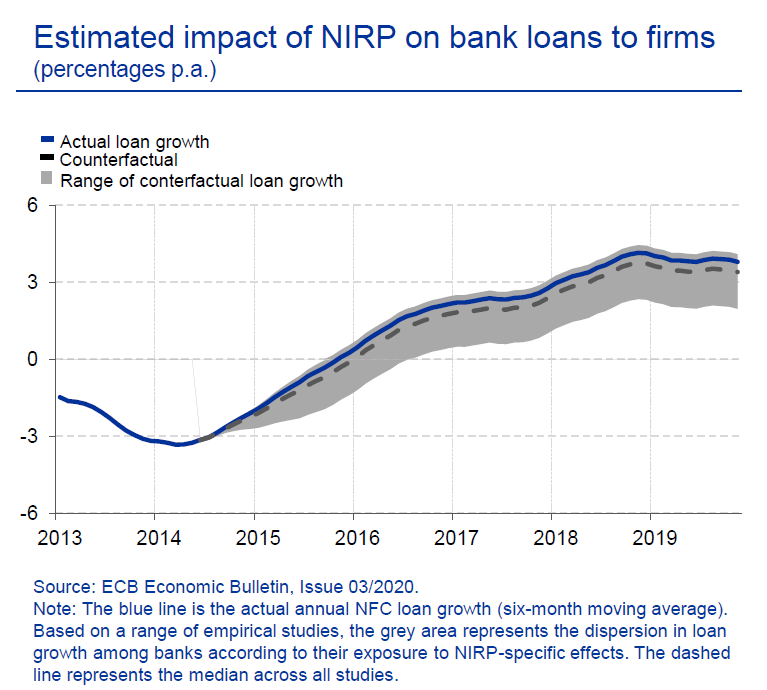

NIRP contributed to shifting € area sovereign yields down across the maturity spectrum. Due to a “hot potato effect”, NIRP compresses the term premium, reinforces the effects of asset purchases & supports bank lending. All these effects have improved monetary transmission. 3/6

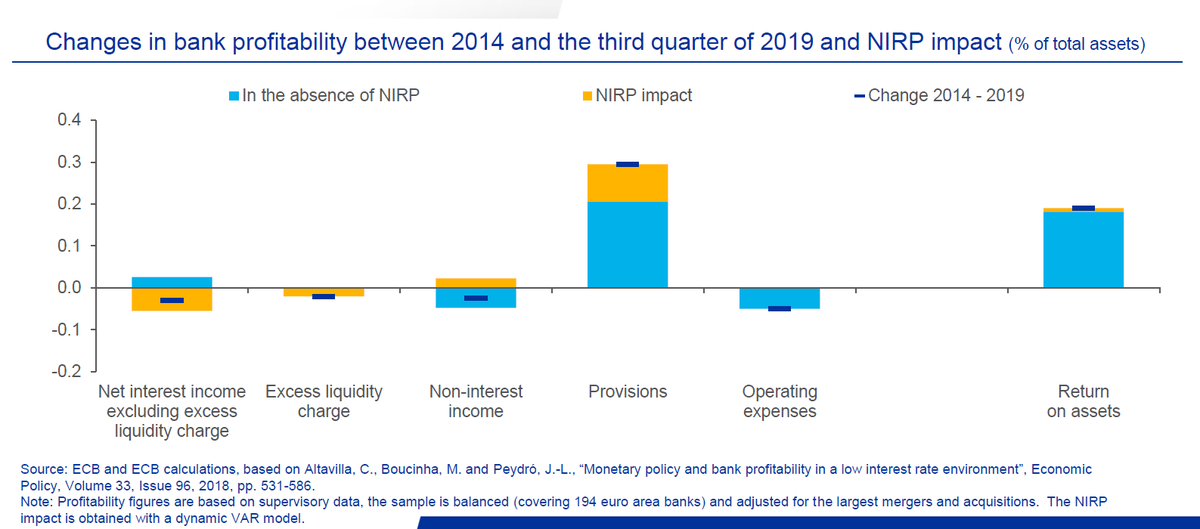

Due to the limited pass-through of negative rates to retail deposit rates, banks’ interest margins and profitability may shrink. But such negative effects were more than compensated by positive effects on loan quality, leaving banks’ overall profitability broadly unchanged. 4/6

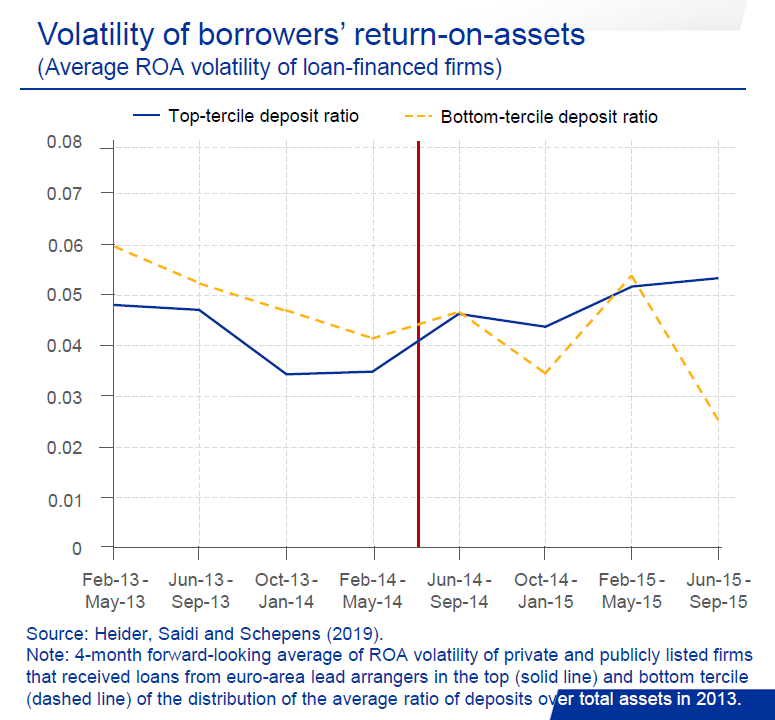

Negative rates have been shown to lead to higher risk-taking by banks. But as long as it does not endanger financial stability, this may be a feature rather than a bug because it supports monetary transmission by fostering investment and employment. 5/6

In the longer run, side effects may gain importance. As negative rates to a large extent reflect adverse macro trends outside the remit of central banks, a forceful response by governments to the pandemic is necessary & may pave the way for positive rates in the future. 6/6

Read on Twitter

Read on Twitter