Will we see a structural reset in the Indian Banking space.

For too long the banking system was dislocated with PSU banks doing the heavy lifting of putting the money on the table and the private sector banks doing the cream business of flows + float + fees.

For too long the banking system was dislocated with PSU banks doing the heavy lifting of putting the money on the table and the private sector banks doing the cream business of flows + float + fees.

In the bargain, the PSU banks who took the risk of funding India& #39;s 2 decades worth of capex were saddled with bad loans, fraud and depleted capital and consequently valued at lower end of the spectrum.

On the other hand the newer private sector banks armed with investments in technology made money without putting their balance sheet on the table.

This new RBI circular on current account changes all this.

Stay tuned.

Stay tuned.

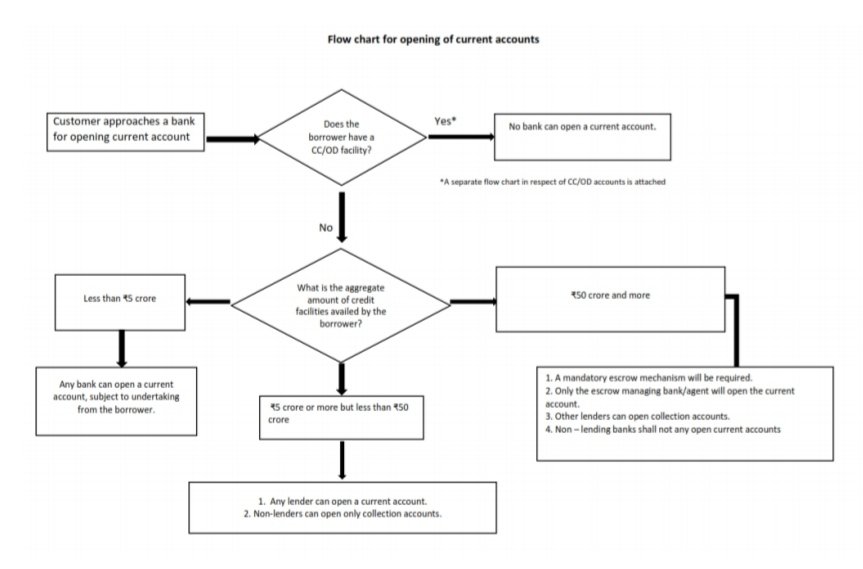

Opening of Current Accounts by Banks - Need for Discipline.

Essentially the circular says, those who have put money on the table, get to handle the cash flows of the borrower.

https://m.rbi.org.in//scripts/NotificationUser.aspx?Id=11945&Mode=0">https://m.rbi.org.in//scripts/...

Essentially the circular says, those who have put money on the table, get to handle the cash flows of the borrower.

https://m.rbi.org.in//scripts/NotificationUser.aspx?Id=11945&Mode=0">https://m.rbi.org.in//scripts/...

Eg: The road projects across the country have been funded primarily by the PSU banks. But when you swipe your card or use digital payments for tolls, they land up straight into the current account of a pvt sector bank.

This will change now.

This will change now.

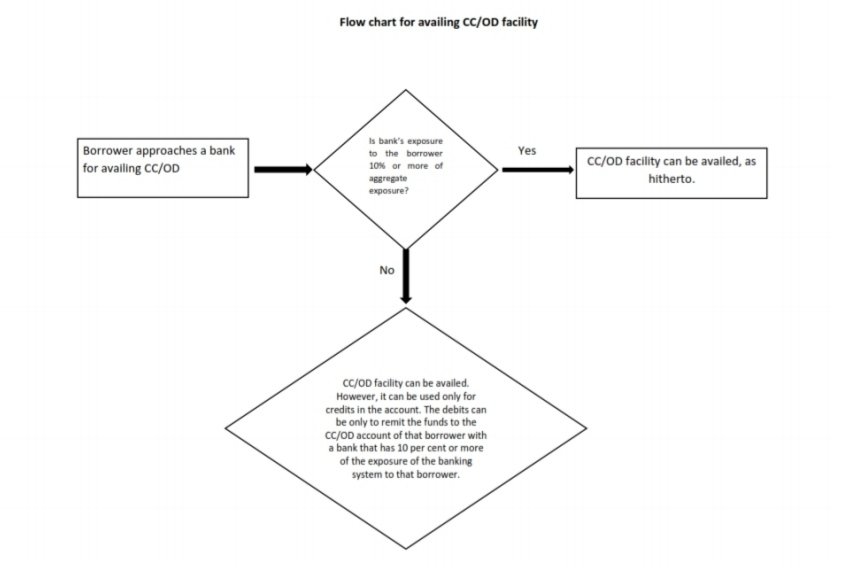

And the cash flow routing can happen only thru lenders having > 10% exposure.

Even amongst the ones having > 10% exposure, only 1 lender can make payments.

These charts make everything clear.

Even amongst the ones having > 10% exposure, only 1 lender can make payments.

These charts make everything clear.

Well how & why does it impact the private sector banks & foreign banks?

Will PSUs lap up the chance given by the regulator?

Stay tuned.

Will PSUs lap up the chance given by the regulator?

Stay tuned.

Read on Twitter

Read on Twitter