1/35

This discussion is based on the numbers scraped from http://screener.in"> http://screener.in . It is purely a quantitative model.

Further, its merely initiation of a discussion, and should not be construed as any kind of recommendation.

This discussion is based on the numbers scraped from http://screener.in"> http://screener.in . It is purely a quantitative model.

Further, its merely initiation of a discussion, and should not be construed as any kind of recommendation.

2/35

Revenue has been growing at declining pace.

Revenue CAGR since:

~10 yrs - 8%

~5 yrs - 5%

~3 yrs - 4%

~1 yr - 2%

Near term growth is disappointing.

Revenue has been growing at declining pace.

Revenue CAGR since:

~10 yrs - 8%

~5 yrs - 5%

~3 yrs - 4%

~1 yr - 2%

Near term growth is disappointing.

3/35

Gross profit margins are healthy at approximately 60%. They are also very stable.

Gross profit margins are healthy at approximately 60%. They are also very stable.

4/35

Average EBITDA margins of last ten years are at approximately 40%.

They are not just stable but also growing.

Average EBITDA margins of last ten years are at approximately 40%.

They are not just stable but also growing.

5/35

Non-operating income averages to 4% of operating revenue. Since this is pretty low, I am ignoring its contribution in future for valuation purposes.

Non-operating income averages to 4% of operating revenue. Since this is pretty low, I am ignoring its contribution in future for valuation purposes.

6/35

Tax pay-out averages to a healthy at 31%

Last year saw a significant drop from 33% to 22% due to tax cuts.

Tax pay-out averages to a healthy at 31%

Last year saw a significant drop from 33% to 22% due to tax cuts.

7/35

NPAT Growth is higher than Revenue Growth.

NPAT CAGR since:

~10 yrs - 12%

~5 yrs - 10%

~3 yrs - 11%

~1 yr - 22%

Costs are well controlled.

NPAT Growth is higher than Revenue Growth.

NPAT CAGR since:

~10 yrs - 12%

~5 yrs - 10%

~3 yrs - 11%

~1 yr - 22%

Costs are well controlled.

8/35

NPAT Margins are increasing.

2011 - 22%

2020 - 31%

This is amazing for a company of this size!

NPAT Margins are increasing.

2011 - 22%

2020 - 31%

This is amazing for a company of this size!

9/35

Cumulative CFO of last 10 years: 96.9 thousand crores

Cumulative PAT of last 10 years: 96.2 thousand crores

Cash conversion ratio is a wonderful 101%

Cumulative CFO of last 10 years: 96.9 thousand crores

Cumulative PAT of last 10 years: 96.2 thousand crores

Cash conversion ratio is a wonderful 101%

10/35

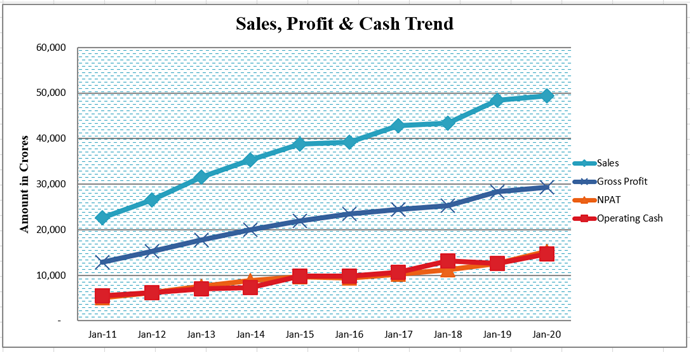

Here& #39;s a visual representation of Sales, profits & cash position of the company for last ten years. Note the orange line & red line representing NPAT & CFO have coincided with each other!

Here& #39;s a visual representation of Sales, profits & cash position of the company for last ten years. Note the orange line & red line representing NPAT & CFO have coincided with each other!

11/35

Depreciation & Interest are not classified under operating cash flow.

If we add back depreciation & interest to PAT & we get adjusted PAT of 1.07 lakh crores.

This still gives a cash conversion ratio of 90%

Working capital management is wonderful.

Depreciation & Interest are not classified under operating cash flow.

If we add back depreciation & interest to PAT & we get adjusted PAT of 1.07 lakh crores.

This still gives a cash conversion ratio of 90%

Working capital management is wonderful.

12/35

Debt Equity ratio has consistently been close to zero.

Operating profits are around 238 times its interest payment requirements!

No near term solvency risk.

Debt Equity ratio has consistently been close to zero.

Operating profits are around 238 times its interest payment requirements!

No near term solvency risk.

13/35

Inventory cycles have increased from 4 to 6 ~ Positive.

Receivable days have been on an upward trend ~ Negative.

Inventory cycles have increased from 4 to 6 ~ Positive.

Receivable days have been on an upward trend ~ Negative.

14/35

Self Sustainable Growth Rate (SSGR) is the ability of a company to grow its sales organically through its internal accruals without requiring any outside cash influx.

ITC has an average SSGR of 16%

Self Sustainable Growth Rate (SSGR) is the ability of a company to grow its sales organically through its internal accruals without requiring any outside cash influx.

ITC has an average SSGR of 16%

15/35

SSGR is declining.

2011 - 20%

2020 - 14%

Since SSGR is greater than actual sales growth rate, the company has sufficient cushion.

SSGR is declining.

2011 - 20%

2020 - 14%

Since SSGR is greater than actual sales growth rate, the company has sufficient cushion.

16/35

On average, Free Cash Flow is 74% of Operating Cash.

Capex needs are low & the company is gushing with cash!

On average, Free Cash Flow is 74% of Operating Cash.

Capex needs are low & the company is gushing with cash!

17/35

Ten year average ROCE is 28% & ROE is 22%. While these numbers are good, their trend is negative.

Ten year average ROCE is 28% & ROE is 22%. While these numbers are good, their trend is negative.

18/35

Return on Capital Employed:

2011 - 42%

2020 - 27%

Return on Equity:

2011 - 30%

2020 - 23%

The declining trend is a cause of worry.

Return on Capital Employed:

2011 - 42%

2020 - 27%

Return on Equity:

2011 - 30%

2020 - 23%

The declining trend is a cause of worry.

19/35

Value creation is positive only when the company generates a return on capital in excess of cost of capital.

The lowest that ROCE has ever been in last ten years is 27%. Assuming cost of capital at 15%, the company has consistently added value.

Value creation is positive only when the company generates a return on capital in excess of cost of capital.

The lowest that ROCE has ever been in last ten years is 27%. Assuming cost of capital at 15%, the company has consistently added value.

20/35

Market Cap at 2011 - 1.40 lakh crores

Market Cap at 2020 - 2.44 lakh crores

Wealth creation - 1.03 lakh crores

Cumulative retained earnings in last ten years - 36.93 crores.

The company has created 2.8 times market value for every rupee retained.

Market Cap at 2011 - 1.40 lakh crores

Market Cap at 2020 - 2.44 lakh crores

Wealth creation - 1.03 lakh crores

Cumulative retained earnings in last ten years - 36.93 crores.

The company has created 2.8 times market value for every rupee retained.

21/35

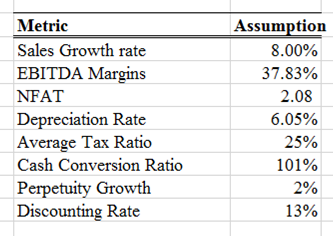

VALUATION:

Under the following assumptions, I value the company at Rs.138 per share by discounting forecasted opearting cash flows.

I feel these assumptions are pretty generous.

Please note I am discounting operating cash flows & not free cash flows.

VALUATION:

Under the following assumptions, I value the company at Rs.138 per share by discounting forecasted opearting cash flows.

I feel these assumptions are pretty generous.

Please note I am discounting operating cash flows & not free cash flows.

22/35

My Method:

~ Forecast sales using historical average.

~ Apply EBITDA margins to reach EBITDA figure

~ Apply Assets Turnover ratio to find Capex

~ Deduct Depreciation from FA requirement

~ Deduct average interest paid.

We arrive at profit before tax.

My Method:

~ Forecast sales using historical average.

~ Apply EBITDA margins to reach EBITDA figure

~ Apply Assets Turnover ratio to find Capex

~ Deduct Depreciation from FA requirement

~ Deduct average interest paid.

We arrive at profit before tax.

23/35

~ Apply average tax payout ratio to PBT - arrive at PAT

~ Apply average cash conversion ratio - arrive at operating cash flow

~ Value of perpetuity using Gordon& #39;s Formula.

~ Discount everything at 13% to find Present Value today!

~ Apply average tax payout ratio to PBT - arrive at PAT

~ Apply average cash conversion ratio - arrive at operating cash flow

~ Value of perpetuity using Gordon& #39;s Formula.

~ Discount everything at 13% to find Present Value today!

24/35

As on 21st August 2020, current market price of the stock is Rs.195 per share. To justify this price, operating cash flow must grow at 13.2% for the next ten years. Presently 10 year CAGR of Operating cash is approximately 10.31%

As on 21st August 2020, current market price of the stock is Rs.195 per share. To justify this price, operating cash flow must grow at 13.2% for the next ten years. Presently 10 year CAGR of Operating cash is approximately 10.31%

25/35

PE BASED VALUATION

Since yield on 10 year G-Sec is 6.5%, the benchmark PE is 15.38. Owing to solid fundamentals, one could pay PE of 20.

This gives a valuation bandwidth of Rs.209 to 232 per share

PE BASED VALUATION

Since yield on 10 year G-Sec is 6.5%, the benchmark PE is 15.38. Owing to solid fundamentals, one could pay PE of 20.

This gives a valuation bandwidth of Rs.209 to 232 per share

26/35

Valuation isn& #39;t an exact science.

The valuation bandwidth ranges from Rs.138 to 232 per share. Personally, I am not comfortable with multiples based valuation and would rather stick to discounted cash flows.

Valuation isn& #39;t an exact science.

The valuation bandwidth ranges from Rs.138 to 232 per share. Personally, I am not comfortable with multiples based valuation and would rather stick to discounted cash flows.

27/35

PRICING:

Historically the Company has traded, at an average of 29 times its earnings. By that metric, the stock could rise to Rs.307 per share.

PRICING:

Historically the Company has traded, at an average of 29 times its earnings. By that metric, the stock could rise to Rs.307 per share.

28/35

In the past ten years,

Stock price CAGR - 5.65%

Average Dividend yield - 2%

Total returns to Shareholder ~ 7.65%.

However, presently the dividend yield has been pushed up to 5.1% resulting in an opportunity to earn upto 10.7% p.a

In the past ten years,

Stock price CAGR - 5.65%

Average Dividend yield - 2%

Total returns to Shareholder ~ 7.65%.

However, presently the dividend yield has been pushed up to 5.1% resulting in an opportunity to earn upto 10.7% p.a

29/35

SPECULATION:

In the best case scenario, PE would rise to 29, pushing price to Rs.307 per share. Assuming the stock grows at 5.6% thereafter, the price 10 years hence could be Rs.502 per share.

Returns to shareholder - 9.80%

SPECULATION:

In the best case scenario, PE would rise to 29, pushing price to Rs.307 per share. Assuming the stock grows at 5.6% thereafter, the price 10 years hence could be Rs.502 per share.

Returns to shareholder - 9.80%

30/35

The dividend yield is 5.1% presently. Thus an investor who enters the stock now could make returns of 15.41% p.a. compounded.

That means the wealth could grow by five times in the next ten years. Note that this is the best case scenario.

The dividend yield is 5.1% presently. Thus an investor who enters the stock now could make returns of 15.41% p.a. compounded.

That means the wealth could grow by five times in the next ten years. Note that this is the best case scenario.

31/35

Theoretically, worst case scenario for any equity investment is absolute erosion of capital. However that seems highly unlikely with a company of this size & such fundamentals.

Theoretically, worst case scenario for any equity investment is absolute erosion of capital. However that seems highly unlikely with a company of this size & such fundamentals.

32/35

Practically, the worst case scenario appears to be low return on capital. That is, the market could never re-rates the PE, and the only returns that an investors would generate is through dividends.

Practically, the worst case scenario appears to be low return on capital. That is, the market could never re-rates the PE, and the only returns that an investors would generate is through dividends.

33/35

I haven& #39;t considered any qualitative aspect of the company such as people, products, geographies, segments, macro view, consumer preferences, business economics, management execution, etc.

I haven& #39;t considered any qualitative aspect of the company such as people, products, geographies, segments, macro view, consumer preferences, business economics, management execution, etc.

34/35

I view a business as a cash generating machinery.

From a purely quantitative perspective, the fundamentals are solid and the pricing is fair. This could be an ideal bet for a conservative investor.

No recommendations.

I view a business as a cash generating machinery.

From a purely quantitative perspective, the fundamentals are solid and the pricing is fair. This could be an ideal bet for a conservative investor.

No recommendations.

35/35

Disclaimer:

I don& #39;t own the stock.

I am not a SEBI registered investment advisor.

This is not a recommendation.

END.

Disclaimer:

I don& #39;t own the stock.

I am not a SEBI registered investment advisor.

This is not a recommendation.

END.

Read on Twitter

Read on Twitter