Initial Public Offerings (IPOs) are back in business. and with them, come tons of S-1. A short  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on how to read S-1s efficiently and effectively

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> on how to read S-1s efficiently and effectively  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

1/ A Form S-1 is the initial registration form that private companies file with the U.S. Securities and Exchange Commission (SEC) when they intend to go for IPOs.

3/ Now, whether you invest or not, I totally recommend reading an S-1 because it is a gold mine because it tells you:

1. How much the company intends to raise and how they plan to spend?

2. What do they believe their moat is?

1. How much the company intends to raise and how they plan to spend?

2. What do they believe their moat is?

4/

3. What is the risk they see in the future (no matter how hunky-dory the business looks like from outside)?

4. Competitive analysis of not just the company but also the industry they operate in

5. How is the company& #39;s financial performance?

3. What is the risk they see in the future (no matter how hunky-dory the business looks like from outside)?

4. Competitive analysis of not just the company but also the industry they operate in

5. How is the company& #39;s financial performance?

5/ Reading a complete S-1 of a company is extremely time consuming and to be honest, a waste of time. For example, @asana S-1 is more than 161 pages long!

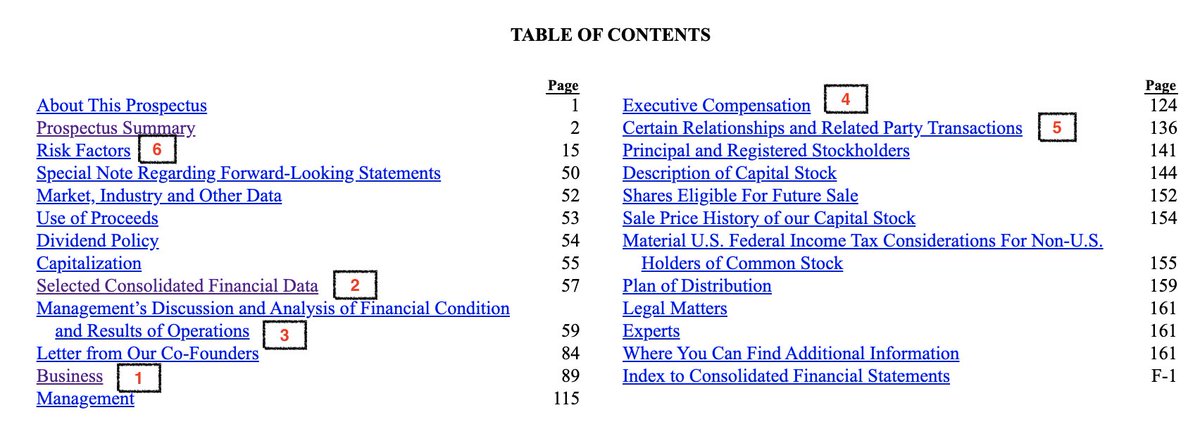

I have a framework on how to efficiently read an S-1, which I am sharing here. I hope it helps you read more S-1s!

I have a framework on how to efficiently read an S-1, which I am sharing here. I hope it helps you read more S-1s!

8/ Though every S-1 is enough in its own way, this framework will give you an effective and time-efficient way to read S-1s. I hope you enjoy this and sharpen your acumen about various business models by reading S-1s efficiently and making notes off them.

Happy Reading! (/fin)

Happy Reading! (/fin)

Read on Twitter

Read on Twitter