Macro update.

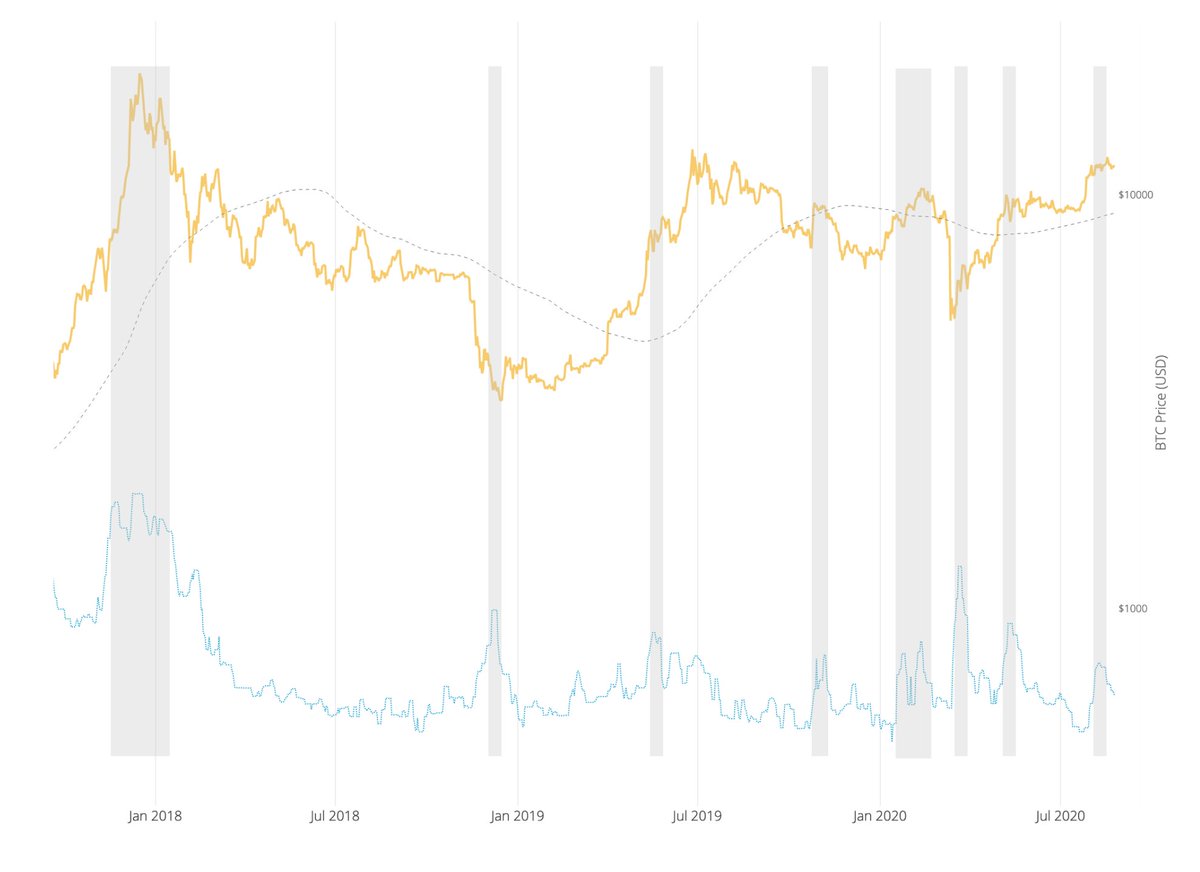

While the longer time frame on-chain structure is bullish, we are seeing a large number of coins being moved on-chain, which usually means a reversal of direction, we just peaked in coins moving, last move was bullish, suggests next move is bearish.

While the longer time frame on-chain structure is bullish, we are seeing a large number of coins being moved on-chain, which usually means a reversal of direction, we just peaked in coins moving, last move was bullish, suggests next move is bearish.

This is supported by on-exchange movements. OBV which tracks hidden accumulation/distribution via volume movements is showing a hidden sell-off.

I tweeted 2 weeks ago that dominance may reverse in coming weeks and I& #39;m seeing this may be taking place around now.

In other words. BTC pulls back. Alts pull back more. BTC dominance increases.

Trade with care if you& #39;re in alts for the next few weeks.

https://twitter.com/woonomic/status/1292353324147044352">https://twitter.com/woonomic/...

In other words. BTC pulls back. Alts pull back more. BTC dominance increases.

Trade with care if you& #39;re in alts for the next few weeks.

https://twitter.com/woonomic/status/1292353324147044352">https://twitter.com/woonomic/...

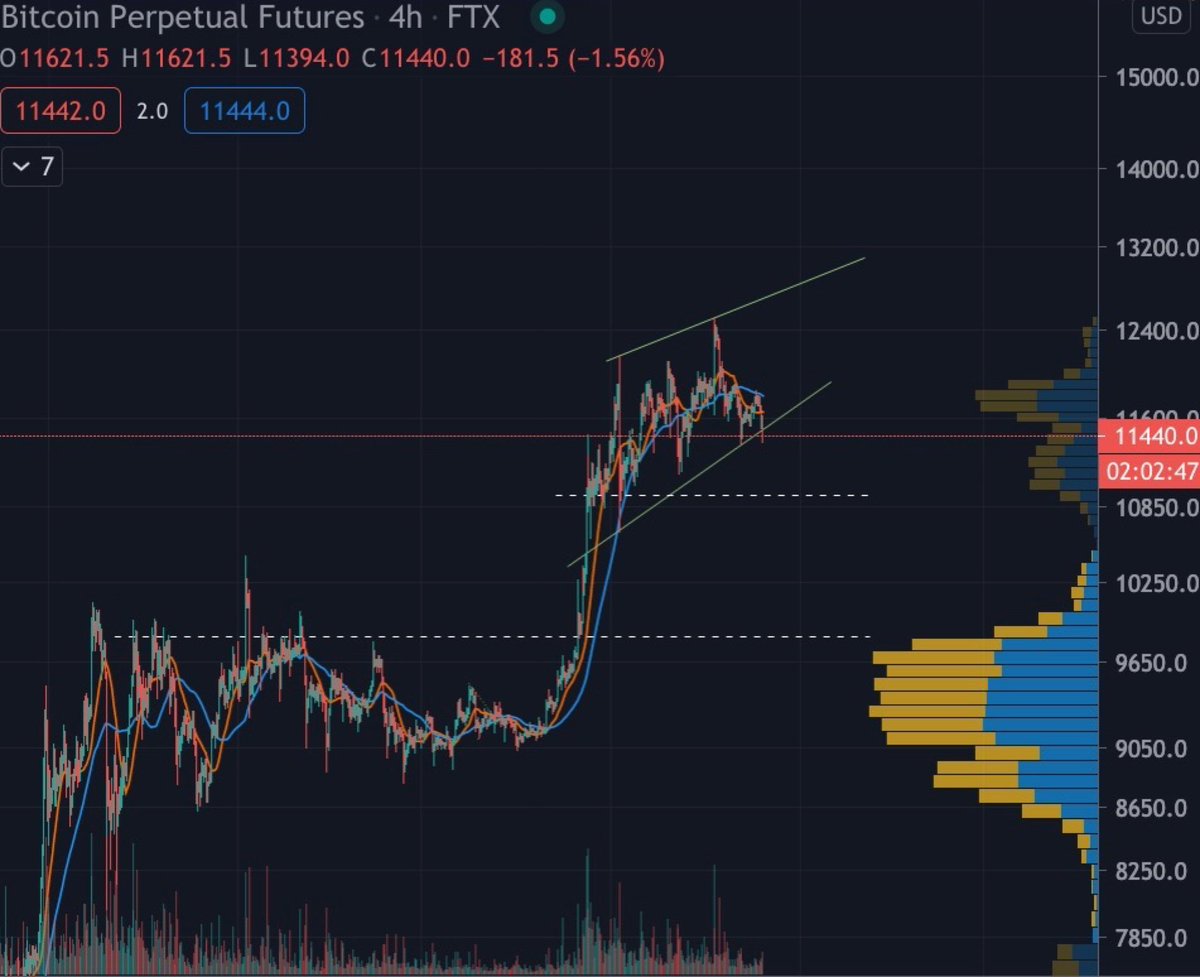

The channel we are in is being tested right now. I don& #39;t think it will hold.

I don& #39;t usually do price targets, as on-chain only does directionality. But here& #39;s my critical support levels based on TA.

BTW, if the 10900 level fails, the lower 9700 level would fill the CME gap

I don& #39;t usually do price targets, as on-chain only does directionality. But here& #39;s my critical support levels based on TA.

BTW, if the 10900 level fails, the lower 9700 level would fill the CME gap

This is the CME gap on the daily chart. It has so far had a 100% backtrace of filling.

But also note the CME is quite new and certainly was not around in 2016 when we had a similar stage in the macro cycle.

But also note the CME is quite new and certainly was not around in 2016 when we had a similar stage in the macro cycle.

Read on Twitter

Read on Twitter