One of my favorite dividend growth stocks is $ABBV

The company owns the #1 selling drug in the world, Humira, which has US patent protection into 2023

This year, the company closed on its acquisition of Botox inventor Allergan

The company maintains not only a trong portfolio of current products, but also has a strong line of up and coming products and a VERY strong pipeline

3 top selling drugs include the following + Q2 revenues:

Humira $4.8B

Imbruvica $1.3B (produced with $JNJ)

Skyrizi $330M

3 top selling drugs include the following + Q2 revenues:

Humira $4.8B

Imbruvica $1.3B (produced with $JNJ)

Skyrizi $330M

The Allergan acquisition is huge because it expands and diversifies the company& #39;s portfolio, which was management& #39;s goal with the acquisition knowing Humira was losing patent protection in 2023

However, many of $ABBV drugs, including Imbruvica, have been growing at a strong clip

However, many of $ABBV drugs, including Imbruvica, have been growing at a strong clip

Imbruvica grew sales 17% in Q2

The company is still trading at very cheap levels and the recent declines is giving investors another opportunity to pick up shares of this pharma stock

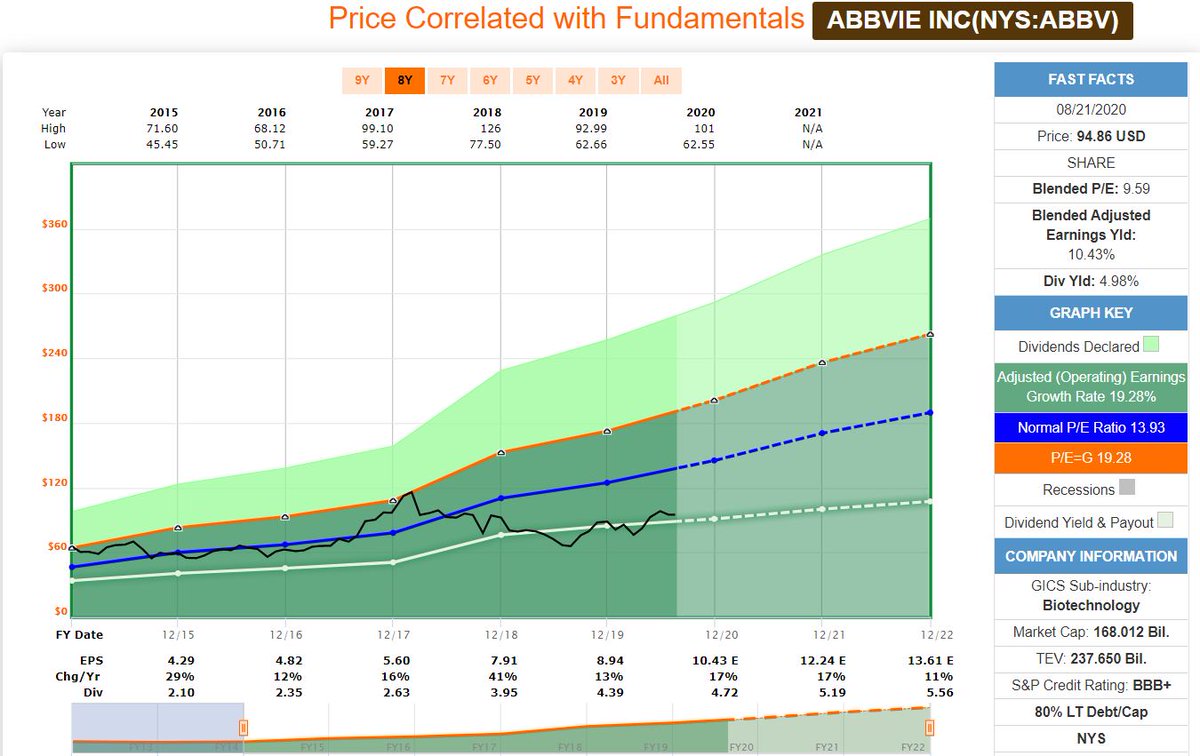

2021 EPS estimates are $12.24

2022 EPS estimates are $13.61

The company is still trading at very cheap levels and the recent declines is giving investors another opportunity to pick up shares of this pharma stock

2021 EPS estimates are $12.24

2022 EPS estimates are $13.61

Those estimates equate to a Fwd P/E of 7.7x in 2021 and 6.9x in 2022. Those are ABSURDLY low valuations

Over the past 5yrs, shares of $ABBV have traded at a P/E of 13.9x

Dividend Yield of 5.0%

5yr Avg Div Yield of 3.9%

Payout Ratio = 51%

FCF Payout Ratio = 60%

Over the past 5yrs, shares of $ABBV have traded at a P/E of 13.9x

Dividend Yield of 5.0%

5yr Avg Div Yield of 3.9%

Payout Ratio = 51%

FCF Payout Ratio = 60%

5yr Avg Dividend Growth = 21% per year

Plenty of room from a cash flow perspective to continue raising the dividend at a strong clip

Looking at the current chart the stock trades at an RSI of 45

Next support level is $92, after that $89

Resistance level is $98

Plenty of room from a cash flow perspective to continue raising the dividend at a strong clip

Looking at the current chart the stock trades at an RSI of 45

Next support level is $92, after that $89

Resistance level is $98

Read on Twitter

Read on Twitter