Businesses are pushing lawmakers to streamline income tax requirements so that workers and employers don& #39;t risk a double tax and taxation by different states as the months of telework persist. http://btaxgo.com/Clnei1N ">https://btaxgo.com/Clnei1N&q...

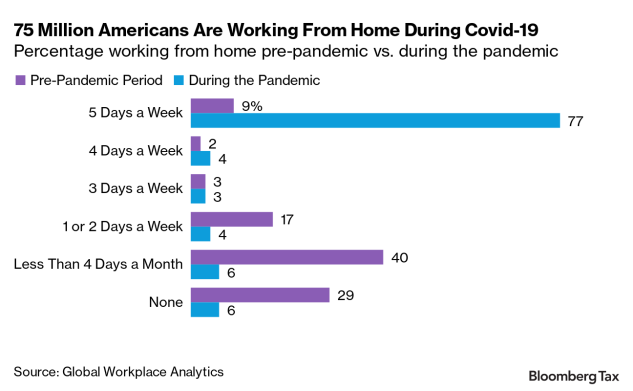

Before the pandemic, 31% of workers telecommuted at least once a week. At the height of the pandemic, 75 million people worked from home.

Payroll is used to handling tax withholding obligations for multiple states. But once workers fled cities, daunting questions arose.

Payroll is used to handling tax withholding obligations for multiple states. But once workers fled cities, daunting questions arose.

Three primary tax problems have emerged, said Alice Jacobsohn, director of government relations for the American Payroll Association  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Americans working from locations beyond the employer’s home state became subject to state and local income taxes in a second state.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="1⃣" title="Tastenkappe Ziffer 1" aria-label="Emoji: Tastenkappe Ziffer 1"> Americans working from locations beyond the employer’s home state became subject to state and local income taxes in a second state.

Many employers fear the arrival of mobile workers in new states will cause revenue departments in those jurisdictions to assess corporate income taxes.

Read more from @MJBologna  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://news.bloombergtax.com/daily-tax-report/employers-lean-on-congress-to-solve-work-from-home-tax-dilemma">https://news.bloombergtax.com/daily-tax...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://news.bloombergtax.com/daily-tax-report/employers-lean-on-congress-to-solve-work-from-home-tax-dilemma">https://news.bloombergtax.com/daily-tax...

https://news.bloombergtatwitter.com/daily-tax-report/employers-lean-on-congress-to-solve-work-from-home-tax-dilemma

Read on Twitter

Read on Twitter