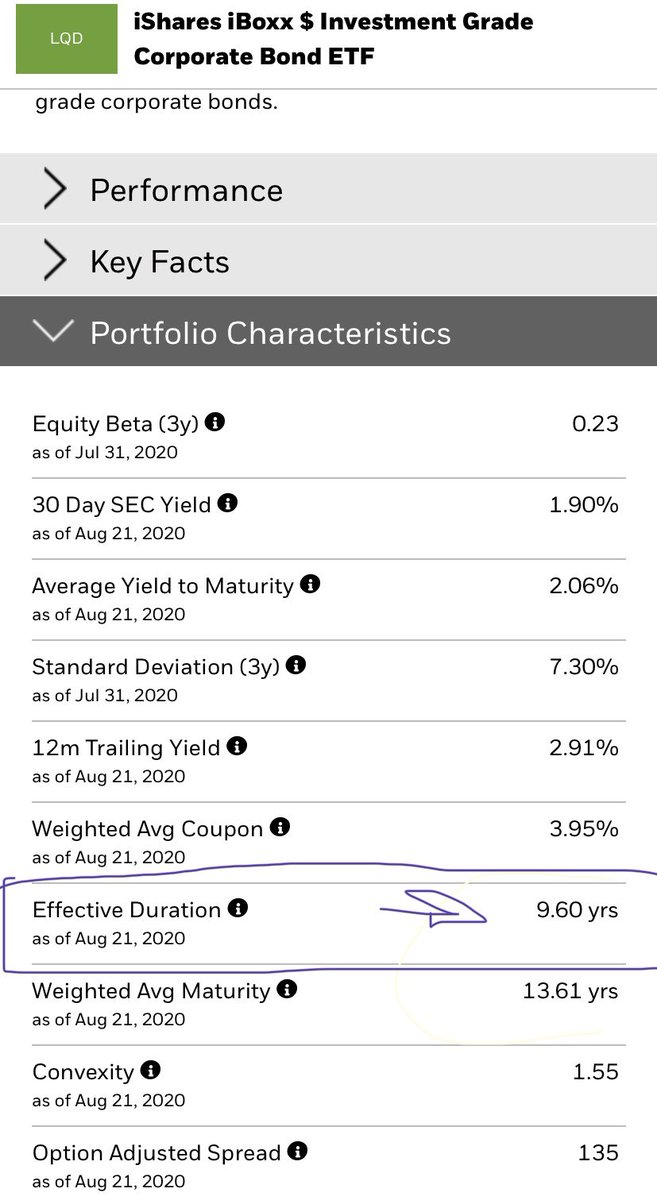

1/ This is LQD, an index fund of US investment grade bonds. It trades higher than before lockdown. How can credit be less risky than then? How can there be fewer defaults priced in ?

4/ Nearly half of the index is in BBB. The lowest rating of investment grade is BBB. Below that it falls under Junk bonds. The lower the rating, the higher the risk. How can it be so crowded (~50% BBB in IG)? Are rating agencies doing the same as explained in The Big Short?

5/ While the PF shows over 2300 different bonds (looks diversified), the top 10 issuers represent 22% of the holdings. Lots of bank bonds.

6/ summary: high duration + high BBB exposure has less credit risk priced in (and smaller risk reward) than before the lockdown. (GDP was down ~30%).

7/ The magic of money printing did that. The FED expanding its balance sheet. It is entirely manipulated and rewards bad borrowers.

8/ The market signal has been lost because bond prices are artificially maintained. Beware, credit spreads are now meaningless. They don’t reflect inherent risk levels.

9/ but wait, are these characteristics really providing a bid to the market?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen"> This is a new category to me. Don’t look at spread and duration, select investments based on virtue signalling. Those clever rating agencies, clever regulators, clever banksters.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen"> This is a new category to me. Don’t look at spread and duration, select investments based on virtue signalling. Those clever rating agencies, clever regulators, clever banksters.

/10 For me, the rational trade is to sell bonds and buy #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">. Even if I know the FED has limitless ability to print. Credit makes no sense to me. What am I not seeing?

https://abs.twimg.com/hashflags... draggable="false" alt="">. Even if I know the FED has limitless ability to print. Credit makes no sense to me. What am I not seeing?

Read on Twitter

Read on Twitter

This is a new category to me. Don’t look at spread and duration, select investments based on virtue signalling. Those clever rating agencies, clever regulators, clever banksters." title="9/ but wait, are these characteristics really providing a bid to the market? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen"> This is a new category to me. Don’t look at spread and duration, select investments based on virtue signalling. Those clever rating agencies, clever regulators, clever banksters." class="img-responsive" style="max-width:100%;"/>

This is a new category to me. Don’t look at spread and duration, select investments based on virtue signalling. Those clever rating agencies, clever regulators, clever banksters." title="9/ but wait, are these characteristics really providing a bid to the market? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Gesicht mit rollenden Augen" aria-label="Emoji: Gesicht mit rollenden Augen"> This is a new category to me. Don’t look at spread and duration, select investments based on virtue signalling. Those clever rating agencies, clever regulators, clever banksters." class="img-responsive" style="max-width:100%;"/>