At its peak, Ty Inc did $1 billion in sales.

The creator of the Beanie Baby also sparked an insane speculative bubble.

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

The creator of the Beanie Baby also sparked an insane speculative bubble.

A thread

This is a story about the rise and meltdown of Ty Warner& #39;s empire. It& #39;s also a lesson in building hype and the perils of viral products.

"Unbelievable ego."

That& #39;s how one of Ty Warner& #39;s old colleagues described him. A ladies& #39; man with a penchant for showmanship, Ty joined his father at Dakin Toys after dropping out of college.

He worked as a salesman.

That& #39;s how one of Ty Warner& #39;s old colleagues described him. A ladies& #39; man with a penchant for showmanship, Ty joined his father at Dakin Toys after dropping out of college.

He worked as a salesman.

It was a job he was suited for.

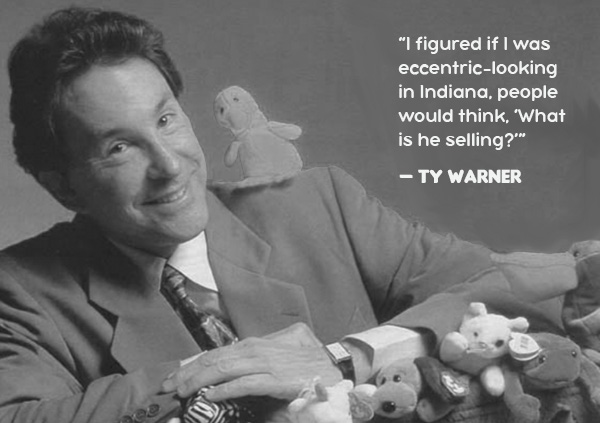

Ty had a talent for getting meetings with top toy buyers by building intrigue. One of the ways he did that was by showing up for sales calls in a white Rolls Royce, wearing a fur coat.

His supervisor called him "the best salesman I ever met."

Ty had a talent for getting meetings with top toy buyers by building intrigue. One of the ways he did that was by showing up for sales calls in a white Rolls Royce, wearing a fur coat.

His supervisor called him "the best salesman I ever met."

"It was all to get in to see the buyer,” Ty later explained. “I figured if I was eccentric-looking, people would think, ‘What is he selling?’ ”

Despite earning six-figures, Ty was restless. He started working on his own toy product on the side.

When Dakin found out, Ty was fired.

For a long time, Ty didn& #39;t know what to do.

When Dakin found out, Ty was fired.

For a long time, Ty didn& #39;t know what to do.

He moped around.

He went to Italy.

And he kept working on his pet project.

He thought there was something in it, even if everyone he showed the toys thought they looked like "roadkill."

He went to Italy.

And he kept working on his pet project.

He thought there was something in it, even if everyone he showed the toys thought they looked like "roadkill."

By filling animals with plastic pellets — beans, Ty called them — he believed they took on a life of their own.

"They looked real because they moved," Ty commented.

(Ed — really...?)

"They looked real because they moved," Ty commented.

(Ed — really...?)

Undeterred, Ty took his savings from Dakin and forged ahead. In 1993, "Ty Inc." was formed.

But even with his gargantuan ego, Ty must have been surprised by the reception his creations received.

The Beanie Baby took the industry by storm.

But even with his gargantuan ego, Ty must have been surprised by the reception his creations received.

The Beanie Baby took the industry by storm.

That was in part thanks to the tactics Ty employed. He saw a market opportunity and understood how to build hype.

First, Ty knew how to price his product. There were few decent quality toys on the market below $10. Ty priced the Beanie Baby at $5.

Second, Ty manufactured scarcity. Rather than selling his full inventory at big retailers, he sold partial inventory to speciality retailers.

Ty wanted customers to feel as if the toys were always running out.

Ty wanted customers to feel as if the toys were always running out.

Finally, Ty "retired" specific toys, starting in 1995. Once retired, Ty realized that customers became even more rabid in their pursuit.

Yet again, perceived scarcity drove impulse purchasing.

Yet again, perceived scarcity drove impulse purchasing.

It also drove an insane reseller& #39;s market.

Piggybacking off the rise of the internet, and secondhand marketplaces like Ebay, Beanie Babies saw their prices skyrocket after "retirement."

A $5 would sell for $10, $100, $300. Some sold as high as $13K.

A 3,000x mark-up.

Piggybacking off the rise of the internet, and secondhand marketplaces like Ebay, Beanie Babies saw their prices skyrocket after "retirement."

A $5 would sell for $10, $100, $300. Some sold as high as $13K.

A 3,000x mark-up.

Suddenly, a new asset class had been born.

Really.

Beanie Baby "gurus" told customers how to incorporate toys into their "investment strategy." Infommercials touted the "unbelievable" opportunity buyers had.

Really.

Beanie Baby "gurus" told customers how to incorporate toys into their "investment strategy." Infommercials touted the "unbelievable" opportunity buyers had.

When there is money to be made, mayhem inevitably follows.

As Beanie Babies achieved eye-watering values, a spate of toy-related crimes erupted.

As Beanie Babies achieved eye-watering values, a spate of toy-related crimes erupted.

The "Beanie Baby bandit" stole $1.2K worth of product from stores.

Children were trampled as speculators sought to buy "Garcia," a rare tie-dye bear.

A security guard in West Virginia was killed over a disputed collection.

This was a period of madness.

Children were trampled as speculators sought to buy "Garcia," a rare tie-dye bear.

A security guard in West Virginia was killed over a disputed collection.

This was a period of madness.

A sign of the times:

In a Las Vegas courtroom, divorce proceedings saw a couple spread their collection across the floor, each taking a turn to pick a Beanie Baby.

In a Las Vegas courtroom, divorce proceedings saw a couple spread their collection across the floor, each taking a turn to pick a Beanie Baby.

It couldn& #39;t last.

In late 1999, the year after Ty Inc. brought in $1B in sales, the bubble popped.

Ty Inc. released a new set of Beanie characters and this time? Nothing.

No frenzied lines. No runs on local stories. No ludicrous mark-ups. No cashiers held at gunpoint.

In late 1999, the year after Ty Inc. brought in $1B in sales, the bubble popped.

Ty Inc. released a new set of Beanie characters and this time? Nothing.

No frenzied lines. No runs on local stories. No ludicrous mark-ups. No cashiers held at gunpoint.

Almost overnight, no one wanted Beanie Babies.

Sellers flooded Ebay with their goods. Prices spiraled.

Ty scrambled, declaring that *all* Beanie Babies would go out of production in 1999. He& #39;d hoped to spark a run.

Nothing worked. The spell had been broken.

Sellers flooded Ebay with their goods. Prices spiraled.

Ty scrambled, declaring that *all* Beanie Babies would go out of production in 1999. He& #39;d hoped to spark a run.

Nothing worked. The spell had been broken.

Ty Warner is still a rich man.

An investor in NYC& #39;s Four Seasons hotel, he is believed to be worth $2.4B or so.

But his rise left behind quite a wreckage.

An investor in NYC& #39;s Four Seasons hotel, he is believed to be worth $2.4B or so.

But his rise left behind quite a wreckage.

Many were left bankrupted by the craze. During its peak, people like Chris Robinson poured their life savings into Beanie Babies, hoping to get rich.

Robinson spent $100K, hoping to pay for his children& #39;s college education.

Robinson spent $100K, hoping to pay for his children& #39;s college education.

All bubbles look insane in retrospect, this one more than most.

There& #39;s both a lesson and a warning in the chaos Ty created. The tactics Ty used to incentivize buyers are a case-study in building hype. But founders must also be wary of the world they create.

There& #39;s both a lesson and a warning in the chaos Ty created. The tactics Ty used to incentivize buyers are a case-study in building hype. But founders must also be wary of the world they create.

If you enjoyed this story, I& #39;d be grateful if you& #39;d like and share it.

And if you& #39;d like to read more of my writing, please subscribe to my newsletter The Generalist. I& #39;d love to welcome you aboard. https://www.readthegeneralist.com/ ">https://www.readthegeneralist.com/">...

And if you& #39;d like to read more of my writing, please subscribe to my newsletter The Generalist. I& #39;d love to welcome you aboard. https://www.readthegeneralist.com/ ">https://www.readthegeneralist.com/">...

Read on Twitter

Read on Twitter " title="At its peak, Ty Inc did $1 billion in sales. The creator of the Beanie Baby also sparked an insane speculative bubble. A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="At its peak, Ty Inc did $1 billion in sales. The creator of the Beanie Baby also sparked an insane speculative bubble. A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>