Thread on Unity& #39;s S-1:

Unity is the company behind the Unity Real-Time Development platform, which competes with Epic Games& #39; Unreal Engine. It is a fascinating company with a very long runway for growth, would highly recommend reading the prospectus:

https://www.sec.gov/Archives/edgar/data/1810806/000119312520227862/d908875ds1.htm">https://www.sec.gov/Archives/...

Unity is the company behind the Unity Real-Time Development platform, which competes with Epic Games& #39; Unreal Engine. It is a fascinating company with a very long runway for growth, would highly recommend reading the prospectus:

https://www.sec.gov/Archives/edgar/data/1810806/000119312520227862/d908875ds1.htm">https://www.sec.gov/Archives/...

$U Unity& #39;s Real-Time Development platform is behind >50% of the games produced in 2019 and 53% of the top 1,000 mobile games.

The platform can be used to create 3D, 2D, VR, AR, Simulations, models and much more.

Unity powers 1.5 million active creators.

The platform can be used to create 3D, 2D, VR, AR, Simulations, models and much more.

Unity powers 1.5 million active creators.

The platform consists of two parts:

1. Creative Solutions helps creators develop and model games, films, animations, architecture, construction, manufacturing, cinematics and much more.

2. Operate Solutions include operational tools to help creators monetize & grow.

1. Creative Solutions helps creators develop and model games, films, animations, architecture, construction, manufacturing, cinematics and much more.

2. Operate Solutions include operational tools to help creators monetize & grow.

Unity monetizes its Creative Solution through a monthly subscription model. Pricing per seat:

- $400 a year for small companies (<$200k a year)

- $1,800 a year for <20 seat clients with >200k sales

- $2,400 a year for Enterprise clients >20 seats.

(Seems cheap?)

- $400 a year for small companies (<$200k a year)

- $1,800 a year for <20 seat clients with >200k sales

- $2,400 a year for Enterprise clients >20 seats.

(Seems cheap?)

The operational part of the platform monetizes through a revenue-sharing and usage-based model. Makes sense as it alligns incentives

36% of "Operate Solutions" revenue came from customers which were not a costumer of Unity& #39;s Creative Solutions

--> Why not? Room for growth?

36% of "Operate Solutions" revenue came from customers which were not a costumer of Unity& #39;s Creative Solutions

--> Why not? Room for growth?

The Opportunity:

- Gaming: $12 billion TAM with over 15 million potential creators.

- Other industries: $17 billion

Clearly a very long runway for growth

- Gaming: $12 billion TAM with over 15 million potential creators.

- Other industries: $17 billion

Clearly a very long runway for growth

"1.5 million monthly active creators, that developed over 8,000 games and applications per month"

Average Unity Pro user spends 5.1 hours per day on Unity& #39;s platform.

Comes down to about $1-2 dollar per hour, which feels extremely low?

Average Unity Pro user spends 5.1 hours per day on Unity& #39;s platform.

Comes down to about $1-2 dollar per hour, which feels extremely low?

Some interesting stuff in the Risk Section:

- 8 acquisitions in the past 18 months

- Strategic partnerships accounted for 15% of revenue in FY2019 but just 9% in 2020H1

- 24% of revenues in the U.S., 38% in Europe, 32% in Asia Pacific and 9% in Latin America & Canada

- 8 acquisitions in the past 18 months

- Strategic partnerships accounted for 15% of revenue in FY2019 but just 9% in 2020H1

- 24% of revenues in the U.S., 38% in Europe, 32% in Asia Pacific and 9% in Latin America & Canada

On Competition:

- Creative Solutions competes with Epic Games& #39; Unreal Engine, Cocos2d and in-house engines.

- Operate Solutions competes with all kinds of companies:

- Some competitors offer their solutions at a lower price or free (e.g. Unreal Engine& #39;s rev sharing pricing)

- Creative Solutions competes with Epic Games& #39; Unreal Engine, Cocos2d and in-house engines.

- Operate Solutions competes with all kinds of companies:

- Some competitors offer their solutions at a lower price or free (e.g. Unreal Engine& #39;s rev sharing pricing)

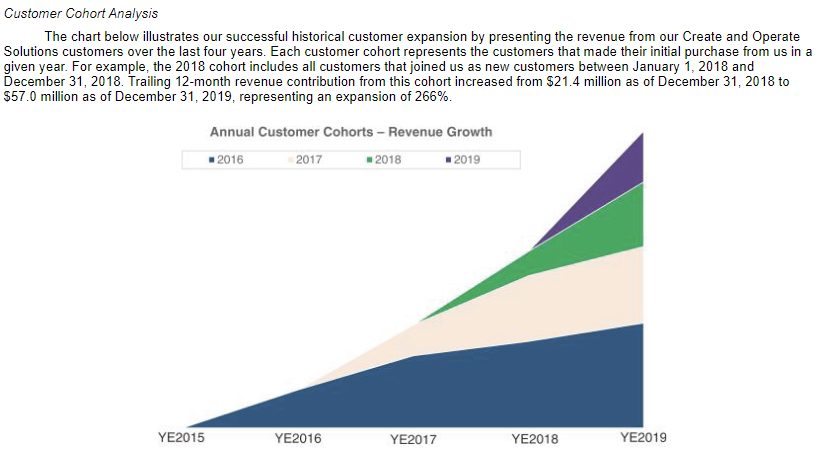

- 142% Dollar-Based Net Expansion

- Customers > $100,000 revenue increased 39% to 716 in 2020H1

- 74% of revenues from > $100,000 customers

- Gross Retention Rate of 99%

- Small clients usually subsribe to one-year plans

- Larger clients usually One- to three-year plans

- Customers > $100,000 revenue increased 39% to 716 in 2020H1

- 74% of revenues from > $100,000 customers

- Gross Retention Rate of 99%

- Small clients usually subsribe to one-year plans

- Larger clients usually One- to three-year plans

- Customer Cohort Analysis, sheesh:

- 8% of >$100,000 customers were in industries outside gaming

- More than 750 customers beyond gaming

- Snapshot of some customers:

- 8% of >$100,000 customers were in industries outside gaming

- More than 750 customers beyond gaming

- Snapshot of some customers:

Summary Executive Compensation Table:

Major Shareholders:

- Sequoia 24.1%

- Silver Lake Partners 18.2%

- CEO John Riccitiello 3.4%

Major Shareholders:

- Sequoia 24.1%

- Silver Lake Partners 18.2%

- CEO John Riccitiello 3.4%

Summary of financials:

- 39% H1 revenue growth, 42% FY2019

- 79% Gross Margins vs 75% in 2019H1

- R&D nearly 50% of Revenue (56% of employees)

- Negative 10% FCF margin vs 12% in 2019H1

- SBC about 6% of revenue

- 12% of sales from China in FY2019

- 39% H1 revenue growth, 42% FY2019

- 79% Gross Margins vs 75% in 2019H1

- R&D nearly 50% of Revenue (56% of employees)

- Negative 10% FCF margin vs 12% in 2019H1

- SBC about 6% of revenue

- 12% of sales from China in FY2019

Revenue Mix:

- Creative Solutions up 31% Y/Y. 29% of sales

- Operate Solutions up 58% Y/Y, 62% of sales

- Strategic Partnerships and other down 14% Y/Y, 9% of sales.

By geography in 2020H1: 19% in Americas, 52% in EMEA and 48% in APAC.

- Creative Solutions up 31% Y/Y. 29% of sales

- Operate Solutions up 58% Y/Y, 62% of sales

- Strategic Partnerships and other down 14% Y/Y, 9% of sales.

By geography in 2020H1: 19% in Americas, 52% in EMEA and 48% in APAC.

Some large acquisitions in 2019:

- Vivox: $123.4 million

- DeltaDNA: $53.1 million

- Artomatix $48.8 million

- Vivox: $123.4 million

- DeltaDNA: $53.1 million

- Artomatix $48.8 million

Fascinating company, would love to own at some point. Obviously the type of company that would be valued at an insane sales multiple.

Prob many other (read: better) threads on Unity& #39;s S-1, but for this is a very fun way to go through a prospectus.

Thoughts?

Prob many other (read: better) threads on Unity& #39;s S-1, but for this is a very fun way to go through a prospectus.

Thoughts?

Read on Twitter

Read on Twitter