Is Covid-19 or Brexit a bigger shock to UK economy?

In terms of present value of GDP, Brexit impact is forecast to be 2-3 times bigger than Covid-19 effect

Thread below.

Or read the @UKandEU blog: https://ukandeu.ac.uk/the-uk-economy-brexit-vs-covid-19/">https://ukandeu.ac.uk/the-uk-ec... 1/

In terms of present value of GDP, Brexit impact is forecast to be 2-3 times bigger than Covid-19 effect

Thread below.

Or read the @UKandEU blog: https://ukandeu.ac.uk/the-uk-economy-brexit-vs-covid-19/">https://ukandeu.ac.uk/the-uk-ec... 1/

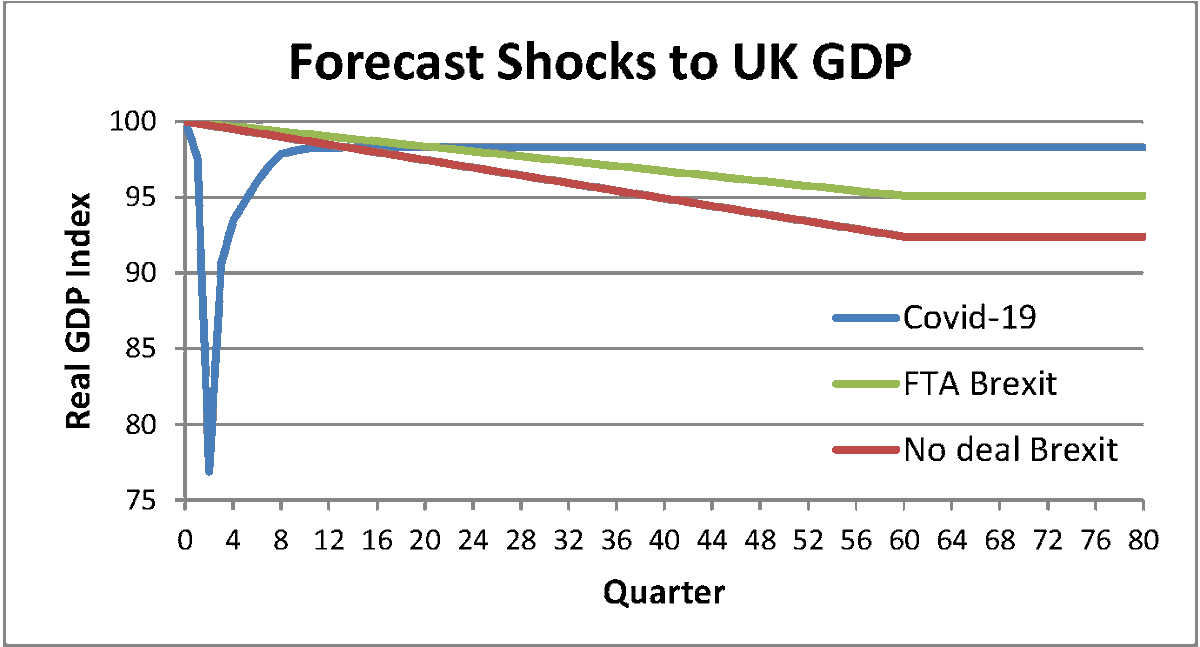

Covid-19 is a huge short-run shock, but likely to have smallish long-run effects

Brexit will matter less in the short-run, but have bigger permanent output costs

Figure below shows output forecasts based on government & Bank of England projections 2/

Brexit will matter less in the short-run, but have bigger permanent output costs

Figure below shows output forecasts based on government & Bank of England projections 2/

How can we compare the size of the Covid-19 & Brexit shocks?

One approach from economics is to compute their impact on the present discounted value of output, i.e. add up output in all future quarters, but giving less weight to output further in the future 3/

One approach from economics is to compute their impact on the present discounted value of output, i.e. add up output in all future quarters, but giving less weight to output further in the future 3/

Doing this* implies Covid-19 reduces present value of output by 2.1%.

By contrast, Brexit reduces present value by 3.7% with an FTA or 5.7% if there& #39;s no deal.

Based on this measure, Brexit is a much bigger shock than Covid-19

* Assuming an annual interest rate of 4%. 4/

By contrast, Brexit reduces present value by 3.7% with an FTA or 5.7% if there& #39;s no deal.

Based on this measure, Brexit is a much bigger shock than Covid-19

* Assuming an annual interest rate of 4%. 4/

Of course, this is not the only way to compare Covid-19 vs Brexit, e.g. Covid-19 is likely to lead to more job

losses

But the numbers do not support the assertion that Covid-19 is obviously a bigger shock to the UK economy than Brexit 5/

losses

But the numbers do not support the assertion that Covid-19 is obviously a bigger shock to the UK economy than Brexit 5/

In cash terms, no deal Brexit corresponds to a £3.3 trillion decline in the present value of output, even assuming no future GDP growth.

Government may wish to reflect on this before concluding that the shadow cast by Covid-19 makes no deal a small cost to bear. End/

Government may wish to reflect on this before concluding that the shadow cast by Covid-19 makes no deal a small cost to bear. End/

Read on Twitter

Read on Twitter