There’s no company like Tencent.

It’s elements of Facebook, PayPal, Nintendo, Spotify, Netflix, and Shopify all rolled into one PLUS a 21st century Berkshire Hathaway.

But Americans know little about it. In prep for Part II tmrw, let’s break down Tencent’s history & portfolio https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

It’s elements of Facebook, PayPal, Nintendo, Spotify, Netflix, and Shopify all rolled into one PLUS a 21st century Berkshire Hathaway.

But Americans know little about it. In prep for Part II tmrw, let’s break down Tencent’s history & portfolio

This info comes from my Not Boring essay, Tencent: The Ultimate Outsider.

Full disclosure: I own some shares of $TCEHY after doing this research. https://notboring.substack.com/p/tencent-the-ultimate-outsider">https://notboring.substack.com/p/tencent...

Full disclosure: I own some shares of $TCEHY after doing this research. https://notboring.substack.com/p/tencent-the-ultimate-outsider">https://notboring.substack.com/p/tencent...

Pony Ma and Zhang Zhidong founded Tencent in 1998 as a pager-based internet service.

The name, Tengxun, means “galloping message.”

They quickly pivoted to a messaging service for Internet cafe computers, OICQ.

The name, Tengxun, means “galloping message.”

They quickly pivoted to a messaging service for Internet cafe computers, OICQ.

They hit 1 million users in 9 months, but servers were expensive and AOL sued them for the name OICQ (it owned ICQ), so Pony tried to sell the company for 3 million yuan (or $431k).

Luckily, no one bid that high. Today, it’s worth 1,454,929x its 3 million yuan asking price.

Luckily, no one bid that high. Today, it’s worth 1,454,929x its 3 million yuan asking price.

Instead, Ma sold 40% of the company for $2.2 million to IDG and Yingke, a fund led by Li Kashing’s son.

Then it lost its lawsuit with AOL, changed the name to QQ, and crossed 100 million users. With no revenue and growing costs, Tencent was back on the market.

Then it lost its lawsuit with AOL, changed the name to QQ, and crossed 100 million users. With no revenue and growing costs, Tencent was back on the market.

It approached Yahoo! and Sohu. They weren’t interested. At the last second, with only thousands left in the bank, South African fund Naspers (which was about to leave China bc lack of success), and bought 32.8% of the company for $19.7 million.

Today, its stake is worth $205bn!

Today, its stake is worth $205bn!

Tencent focused on monetization, borrowing a product from Korean company sayclub and launching QQ Show, selling personalized avatars for 5 yuan (< $1) per month.

It worked. Tencent hit $100 million in 2003 revenue.

It worked. Tencent hit $100 million in 2003 revenue.

The team also realized that a lot of its users were chatting on QQ while playing games in internet cafes, so it added games to the QQ platform, both by acquiring small studios and building games in-house. Within a year, games added another $50 million in annual revenue.

Tencent IPO’d in 2004 at a valuation of 6.22 billion HKD, or $790 million USD.

Cue Motley Fool headline: if you had invested $10,000 in Tencent at its IPO in 2004, you would have $7.9 million today!

Cue Motley Fool headline: if you had invested $10,000 in Tencent at its IPO in 2004, you would have $7.9 million today!

In 2005, it made two key hires:

- Martin Lau, its IPO banker from Goldman, as Chief Strategy Officer

- Allen Zhang, when they acquired his company, Foxmail.

- Martin Lau, its IPO banker from Goldman, as Chief Strategy Officer

- Allen Zhang, when they acquired his company, Foxmail.

Zhang developed (and still runs) WeChat and launched in 2011.

2012: hit 100mm users in 433 days and 300mm by end of year

2013: launched WeChat Pay

2015: crossed 500mm users

2017: launched Mini Programs

Today: 1.2 billion users

2012: hit 100mm users in 433 days and 300mm by end of year

2013: launched WeChat Pay

2015: crossed 500mm users

2017: launched Mini Programs

Today: 1.2 billion users

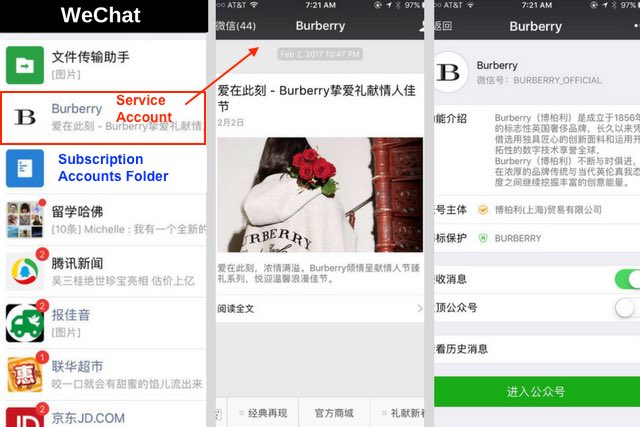

Chinese users do everything on WeChat.

Chat with friends, co-workers, & clients.

Biz communicate with customers and sell things through Official Accounts.

Thousands of biz, including Didi and Meituan Dianping launched on WeChat.

Monetize mainly through transactions, not ads

Chat with friends, co-workers, & clients.

Biz communicate with customers and sell things through Official Accounts.

Thousands of biz, including Didi and Meituan Dianping launched on WeChat.

Monetize mainly through transactions, not ads

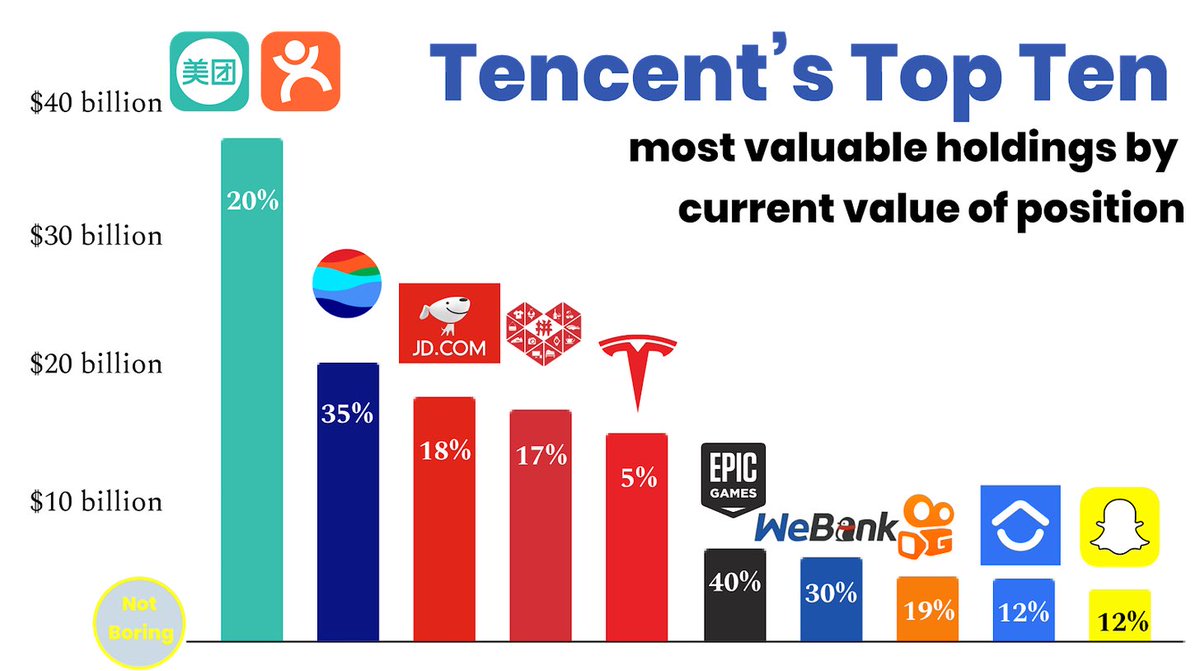

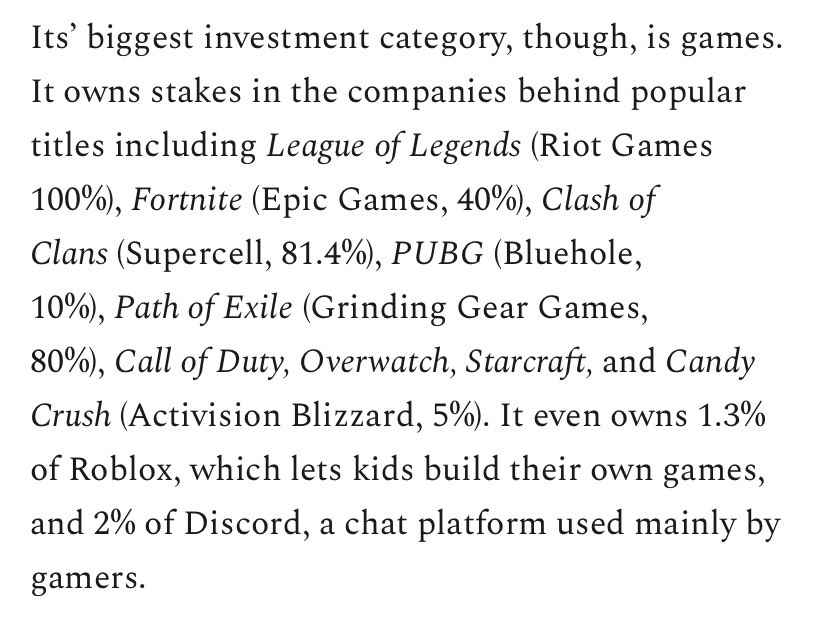

Lau, meanwhile, was investing in games.

2011: bought 92.8% of Riot Games (League of Legends)

2012: bought 40% of Epic Games (Fortnite and Unreal Engine)

Over the past decade, Lau and his team have acquired or invested in over 700 companies.

2011: bought 92.8% of Riot Games (League of Legends)

2012: bought 40% of Epic Games (Fortnite and Unreal Engine)

Over the past decade, Lau and his team have acquired or invested in over 700 companies.

So what is Tencent?

Tencent is a Chinese holding company, world leader in gaming, runs the largest messaging, social networking, and mobile payments platform in China. It uses the cash flow from those businesses to invest in the next generation of massive companies.

Tencent is a Chinese holding company, world leader in gaming, runs the largest messaging, social networking, and mobile payments platform in China. It uses the cash flow from those businesses to invest in the next generation of massive companies.

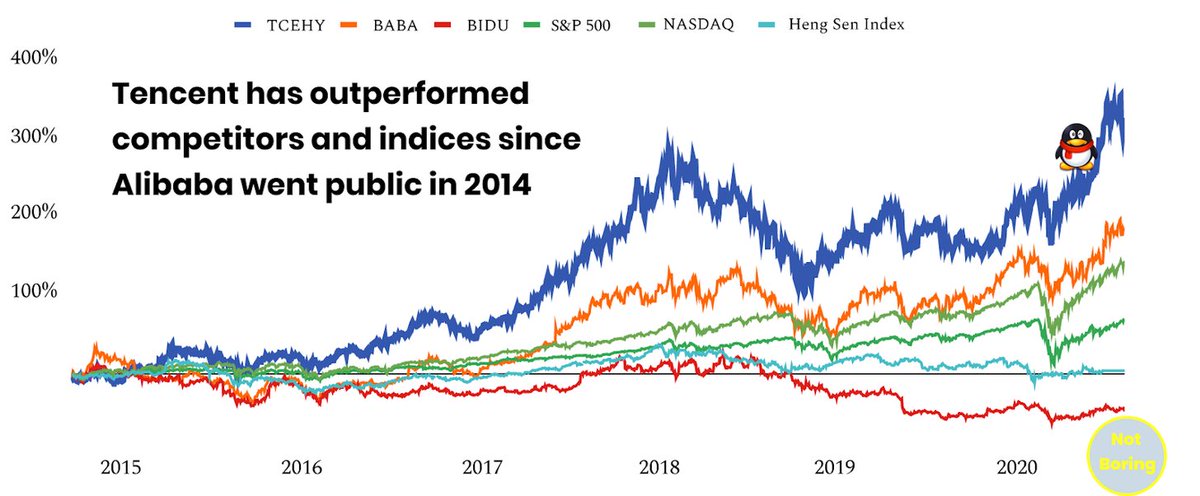

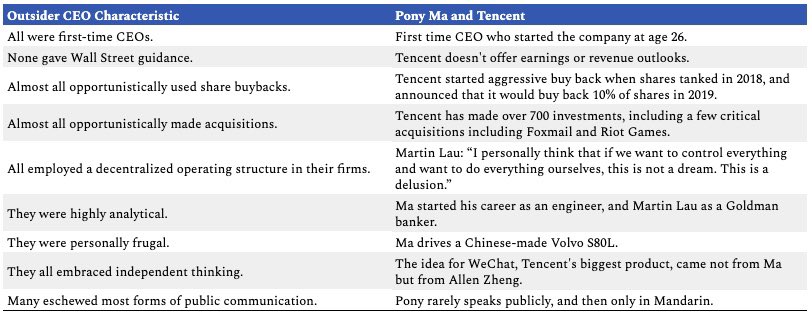

Pony Ma is a lot like the great CEOs in The Outsiders, a great capital allocator whose stock has outperformed competitors and indices.

He’s the ultimate Outsider! And China’s richest man, at $56.2 billion.

He’s the ultimate Outsider! And China’s richest man, at $56.2 billion.

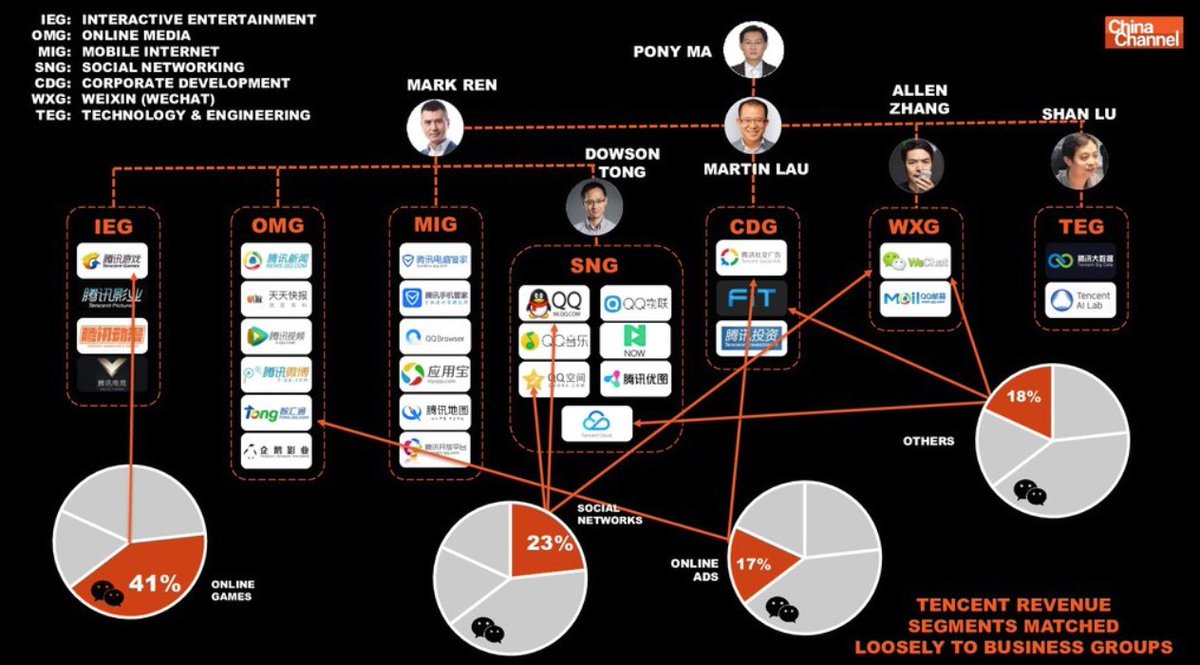

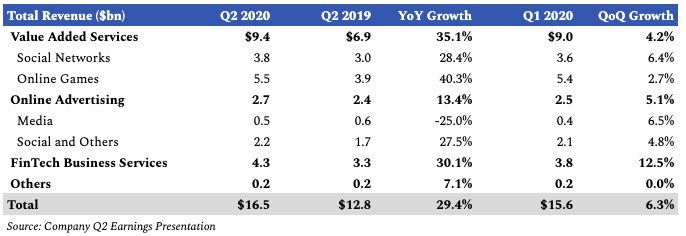

Tencent’s core business makes money in 6 main ways:

•Payments

•Subscriptions (video & music)

•Social ads

•Media ads

•Games

•Cloud

@mbrennanchina broke down where revenue streams live in 2017.

•Payments

•Subscriptions (video & music)

•Social ads

•Media ads

•Games

•Cloud

@mbrennanchina broke down where revenue streams live in 2017.

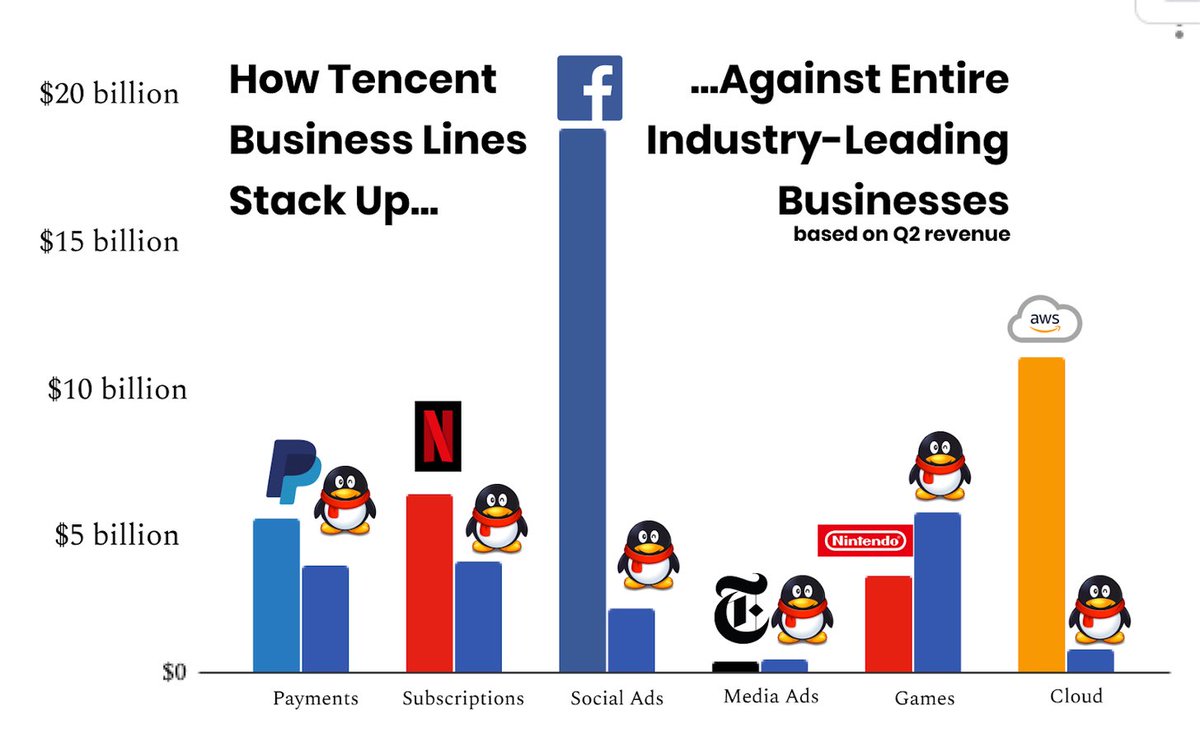

It’s more impressive when you compare Tencent’s business segments to ENTIRE INDUSTRY-LEADING BUSINESSES in those segments.

- Games bigger than Nintendo

- Payments & biz services almost as big as $PYPL and 5x $SHOP

- Small media ads biz bigger than the @nytimes https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">

- Games bigger than Nintendo

- Payments & biz services almost as big as $PYPL and 5x $SHOP

- Small media ads biz bigger than the @nytimes

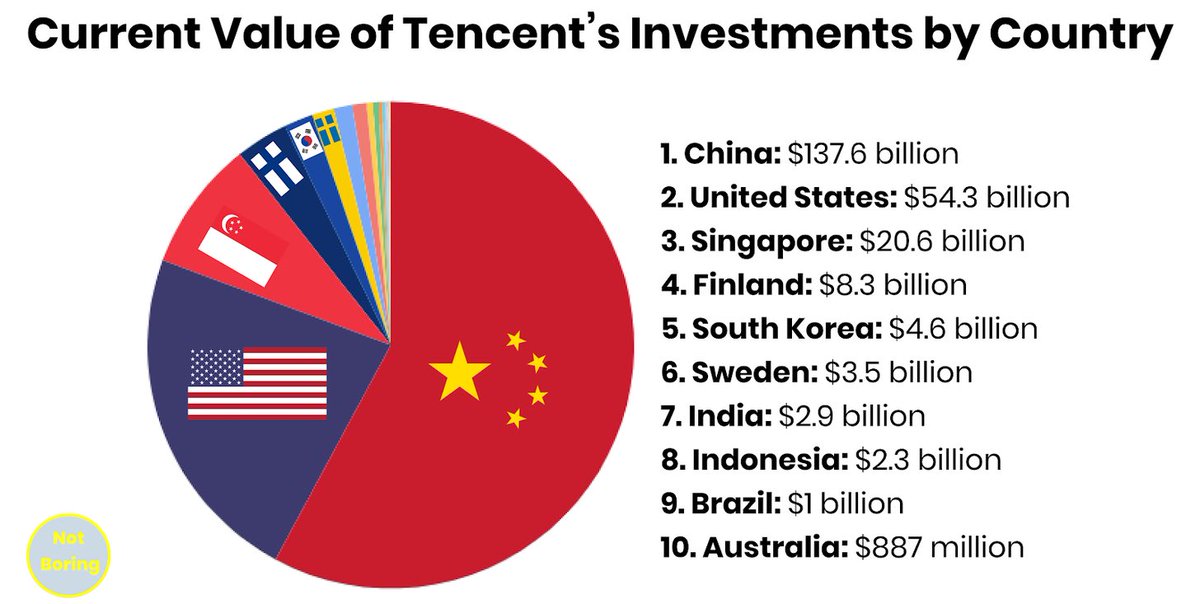

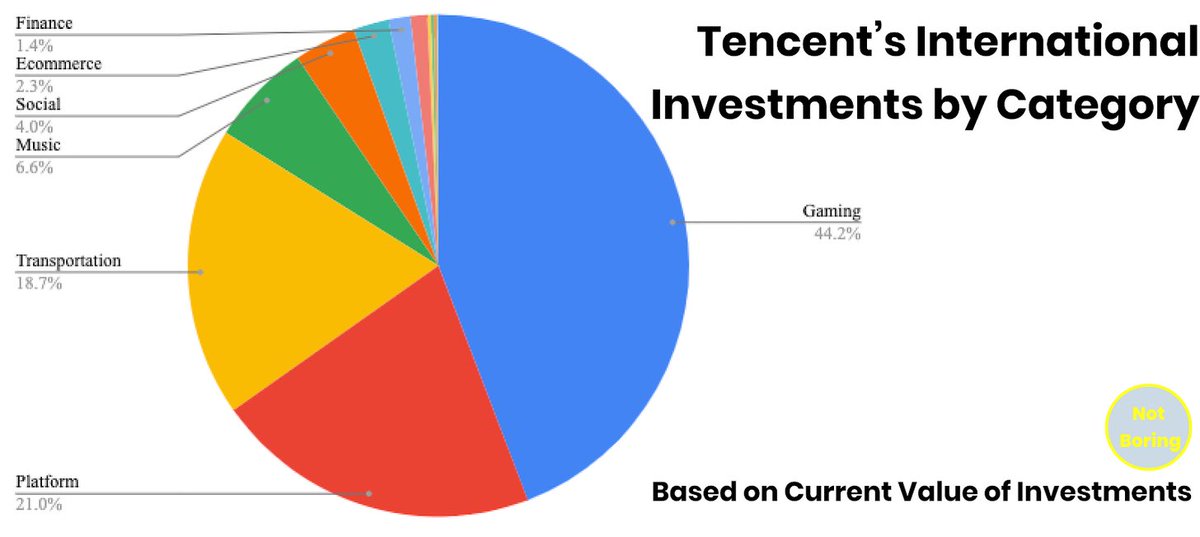

Tencent’s investment portfolio is the real gem though.

Did you know that it owns 12% of $SNAP, 5% of $TSLA, and 9% of $SPOT?

Did you know that it owns 12% of $SNAP, 5% of $TSLA, and 9% of $SPOT?

I built a sheet with 103 of the biggest if its 700+ investments, and get a current value of nearly $200 billion! This includes private companies, which company earnings reports do not. https://docs.google.com/spreadsheets/d/1owpL6WmMK30X19Kw3BziAw39rGJbsfIMOOexdtvAkxU/edit?usp=sharing">https://docs.google.com/spreadshe...

Adding just these back to a rough estimate of the core business based on multiples of competitive standalone businesses, Tencent looks undervalued.

Tencent’s top 10 holdings span countries and industries, and feature Chinese ecommerce, US tech cos, and a Singaporean mini-Tencent.

Its biggest international investment category is games. At $5.5 bn, it does more gaming revenue than anyone in the world, without counting the revenue from most of its game investments, the ones of which it owns <50%.

It owns so many of the world’s major titles.

It owns so many of the world’s major titles.

Tomorrow, we’ll pull all of this evidence together to figure out what Tencent’s future holds...

Hint: it rhymes with petaberse.

Subscribe now to get it delivered to your inbox in the morning https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥳" title="Partying face" aria-label="Emoji: Partying face"> https://notboring.substack.com/subscribe ">https://notboring.substack.com/subscribe...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🥳" title="Partying face" aria-label="Emoji: Partying face"> https://notboring.substack.com/subscribe ">https://notboring.substack.com/subscribe...

Hint: it rhymes with petaberse.

Subscribe now to get it delivered to your inbox in the morning

Read on Twitter

Read on Twitter " title="There’s no company like Tencent.It’s elements of Facebook, PayPal, Nintendo, Spotify, Netflix, and Shopify all rolled into one PLUS a 21st century Berkshire Hathaway.But Americans know little about it. In prep for Part II tmrw, let’s break down Tencent’s history & portfoliohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="There’s no company like Tencent.It’s elements of Facebook, PayPal, Nintendo, Spotify, Netflix, and Shopify all rolled into one PLUS a 21st century Berkshire Hathaway.But Americans know little about it. In prep for Part II tmrw, let’s break down Tencent’s history & portfoliohttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="It’s more impressive when you compare Tencent’s business segments to ENTIRE INDUSTRY-LEADING BUSINESSES in those segments.- Games bigger than Nintendo- Payments & biz services almost as big as $PYPL and 5x $SHOP- Small media ads biz bigger than the @nytimes https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>

" title="It’s more impressive when you compare Tencent’s business segments to ENTIRE INDUSTRY-LEADING BUSINESSES in those segments.- Games bigger than Nintendo- Payments & biz services almost as big as $PYPL and 5x $SHOP- Small media ads biz bigger than the @nytimes https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤯" title="Explodierender Kopf" aria-label="Emoji: Explodierender Kopf">" class="img-responsive" style="max-width:100%;"/>