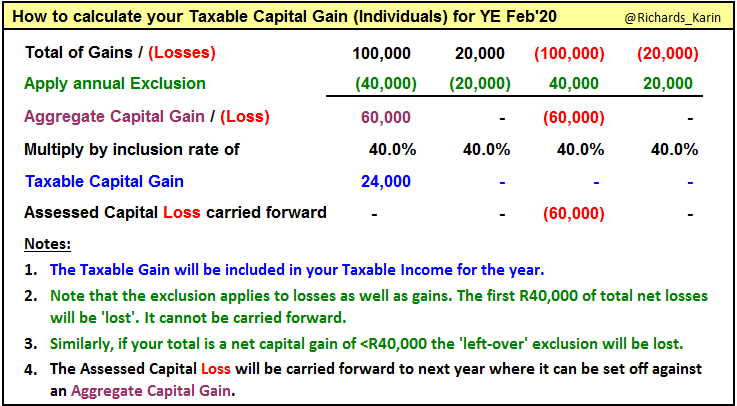

Capital Gains Tax Rules: Once you& #39;ve determined which share sales are of a capital nature, add all gains & net off losses to arrive at your Total of Gains (or Losses) for the year. Then follow the small guide below to determine how much will be taxable at your marginal tax rate.

CGT Rules: Note that the CGT & #39;deduction& #39; of R40,000 is in fact an exclusion. It applies to capital losses as well as gains. Hence if you have a net capital loss of <R40k for the year, it is excluded & cannot be carried forward to offset against gains in future years.

CGT: It is NB to understand how the CGT rules work (actually quite simple) and to plan your share sales so as to take full advantage of the CGT exclusion & lower tax rate. Nobody is saying sell (or hold) only for tax reasons, but do not waste one of the few remaining tax breaks.

Read on Twitter

Read on Twitter