1/ JUST READ opinion in latest lawsuit against #crypto exchanges/custodians over whether customers are owed forks/airdrops. As discussed on podcasts ( @APompliano, @PeterMcCormack, @stephanlivera, @PrestonPysh+others), these contracts tend to be 1-sided... https://law.justia.com/cases/california/court-of-appeal/2020/a157690.html">https://law.justia.com/cases/cal...

2/ ...& judges generally will uphold the contract to which parties agreed, so breach of contract & conversion claims not likely to win (& they aren& #39;t). This is why these 1-sided contracts are a prob for institutional investors who owe a #fiduciary obligation to their customers...

3/ ...a fiduciary asset manager who agrees to a vague, 1-sided contract will get sued by its clients for breach of fiduciary duty if something goes wrong (& if it& #39;s an #ERISA fund, that fiduciary has PERSONAL liability & will be sued personally, not just sued professionally)...

4/ ...this is EXACTLY why #Wyoming enacted clear & FAIR legal standards--fiduciaries need to know EXACTLY what they& #39;re getting, that rights will be protected & are enforceable in court. This hasn& #39;t been the case in CA, GA lawsuits to date. Wyoming& #39;s rules: https://docs.google.com/viewer?a=v&pid=sites&srcid=d3lvLmdvdnxiYW5raW5nfGd4OjU5MzQ5OGZlMWFkYTk1OWE">https://docs.google.com/viewer...

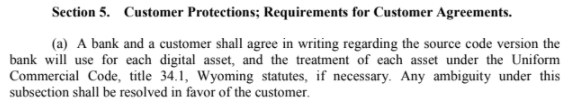

5/ ..2 EXAMPLES of why #Wyoming law is just better. Here& #39;s how Wyoming requires customer agreements to define the digital asset--must reference the source code version & all ambiguity is construed in favor of customer. So, your custodian can& #39;t just redefine #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> as B-cash...

https://abs.twimg.com/hashflags... draggable="false" alt=""> as B-cash...

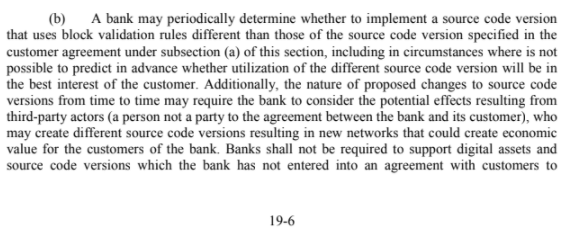

6/ ...if they wanted to (many customer agreements in use in industry today arguably wld permit this bc so vague). #Wyoming fork/airdrop rules take a property rights approach that& #39;s FAIR to customers w/o imposing undue burden on exchanges/custodians (p.19-6). @nic__carter has...

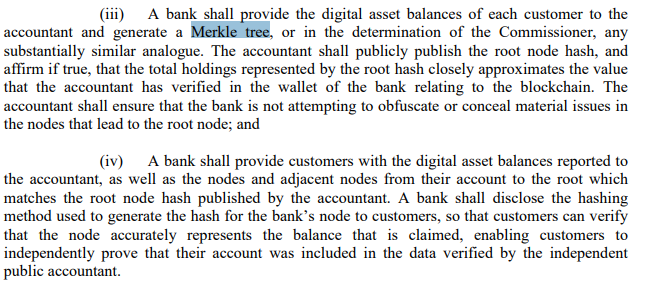

7/ ...analyzed #Wyoming laws, including its #proofofreserves requirements here: https://twitter.com/nic__carter/status/1117438831396048897?s=20">https://twitter.com/nic__cart...

8/ ...Yep, #Wyoming& #39;s rules actually reference "Merkle tree"  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">. Seriously, where else in the world would you see such a reference?!?!? As I& #39;ve said before, the #crypto companies that redomicile into Wyoming speak volumes abt their commitment to serving their customers instead...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">. Seriously, where else in the world would you see such a reference?!?!? As I& #39;ve said before, the #crypto companies that redomicile into Wyoming speak volumes abt their commitment to serving their customers instead...

9/ ...of treating them like counterparties. (Only #Wyoming offers custody as #bailment, which gives MUCH better customer protection esp in event of bankruptcy). #Wyoming law separates wheat from chaff among #crypto exchanges/custodians in the U.S. Time will prove this out. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤠" title="Cowboy hat face" aria-label="Emoji: Cowboy hat face">

Read on Twitter

Read on Twitter as B-cash..." title="5/ ..2 EXAMPLES of why #Wyoming law is just better. Here& #39;s how Wyoming requires customer agreements to define the digital asset--must reference the source code version & all ambiguity is construed in favor of customer. So, your custodian can& #39;t just redefine #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> as B-cash..." class="img-responsive" style="max-width:100%;"/>

as B-cash..." title="5/ ..2 EXAMPLES of why #Wyoming law is just better. Here& #39;s how Wyoming requires customer agreements to define the digital asset--must reference the source code version & all ambiguity is construed in favor of customer. So, your custodian can& #39;t just redefine #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> as B-cash..." class="img-responsive" style="max-width:100%;"/>

. Seriously, where else in the world would you see such a reference?!?!? As I& #39;ve said before, the #crypto companies that redomicile into Wyoming speak volumes abt their commitment to serving their customers instead..." title="8/ ...Yep, #Wyoming& #39;s rules actually reference "Merkle tree" https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">. Seriously, where else in the world would you see such a reference?!?!? As I& #39;ve said before, the #crypto companies that redomicile into Wyoming speak volumes abt their commitment to serving their customers instead..." class="img-responsive" style="max-width:100%;"/>

. Seriously, where else in the world would you see such a reference?!?!? As I& #39;ve said before, the #crypto companies that redomicile into Wyoming speak volumes abt their commitment to serving their customers instead..." title="8/ ...Yep, #Wyoming& #39;s rules actually reference "Merkle tree" https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">. Seriously, where else in the world would you see such a reference?!?!? As I& #39;ve said before, the #crypto companies that redomicile into Wyoming speak volumes abt their commitment to serving their customers instead..." class="img-responsive" style="max-width:100%;"/>