Decred has revolutionized several key components in Bitcoin to create a balanced system that contains symmetrical tradeoffs in risk between users, stakeholders, developers, and miners.

It& #39;s time for a Megathread to compare fragility in #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Decred.

https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Decred.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

It& #39;s time for a Megathread to compare fragility in #Bitcoin

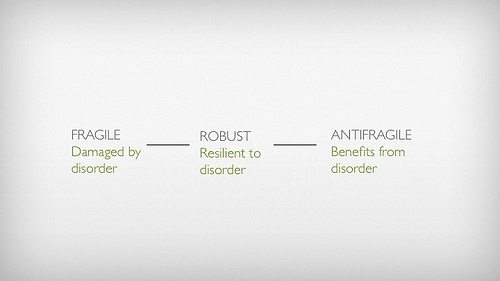

Fragility, robustness, and antifragility are qualities that exist on a spectrum known as the Triad.

The term "Antifragility" was coined by @nntaleb as he realized humans haven& #39;t created a name for those rare things that actually benefit from disorder.

The term "Antifragility" was coined by @nntaleb as he realized humans haven& #39;t created a name for those rare things that actually benefit from disorder.

To judge the inherent fragility of a given technology is to examine the continued existence of said technology through Time, also known as Lindy.

The best heuristic for future survival is, perhaps:

"To understand how something works, figure out how to break it." - @nntaleb

The best heuristic for future survival is, perhaps:

"To understand how something works, figure out how to break it." - @nntaleb

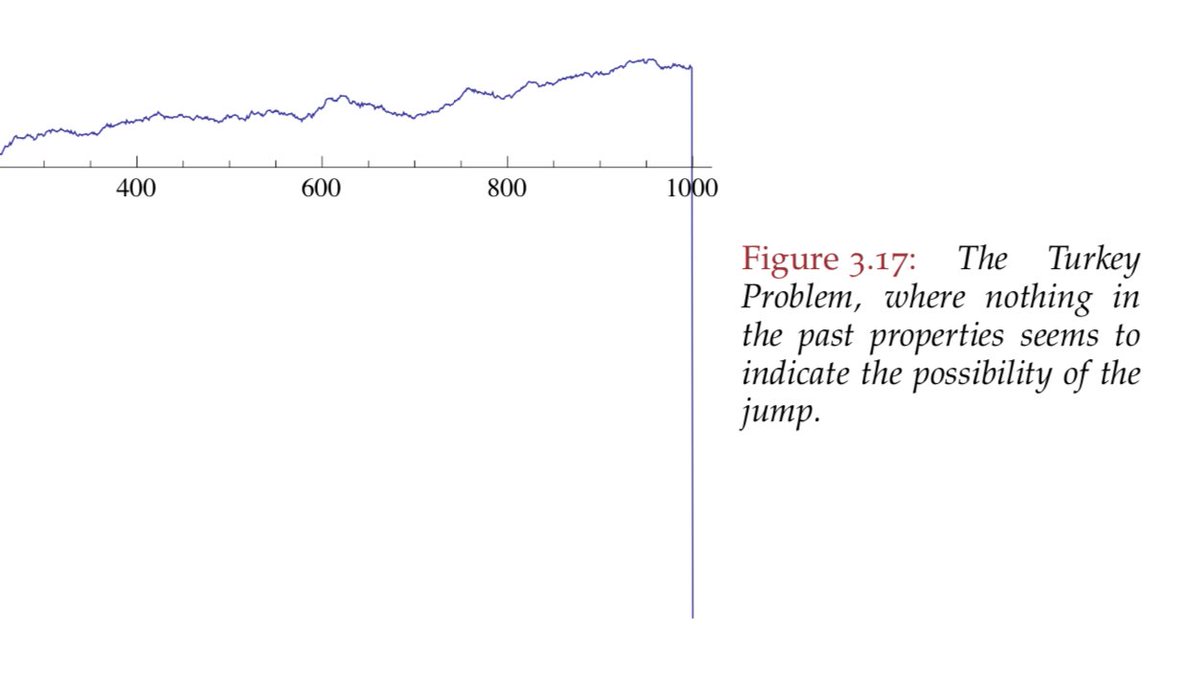

Tail risks help us to determine how to theoretically break something.

Fat-Tailed: One very large extreme deviation is highly consequential; errors are terminal & ruin problems more acute.

Thin-Tailed: Low-probability events are much less consequential.

Markets have fat tails!

Fat-Tailed: One very large extreme deviation is highly consequential; errors are terminal & ruin problems more acute.

Thin-Tailed: Low-probability events are much less consequential.

Markets have fat tails!

In Taleb& #39;s words, markets exist in Extremestan:

Extremestan: Ruin is more likely to come from a single extreme event than from a series of bad episodes.

Mediocristan: For something bad to happen, it needs to come from a series of very unlikely events, not a single one.

Extremestan: Ruin is more likely to come from a single extreme event than from a series of bad episodes.

Mediocristan: For something bad to happen, it needs to come from a series of very unlikely events, not a single one.

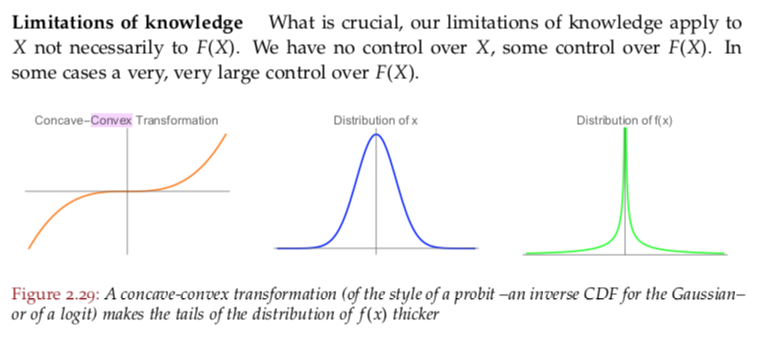

As @nntaleb beautifully elaborates in his latest technical installment, "Statistical Consequences of Fat Tails," our limitation of knowledge about a variable isn& #39;t the entire problem.

The problem is our exposure, F(X), to blowups in the variable at hand (X, Y, Z, etc.).

The problem is our exposure, F(X), to blowups in the variable at hand (X, Y, Z, etc.).

To summarize as succinctly as I can:

To mitigate "Black Swan" risk, we MUST focus on F(X); that is, we must focus on what happens when certain variables compute a value beyond what is historically visible.

What happens when X, Y, or Z, have a blowup?

What is F(X), F(Y) etc?

To mitigate "Black Swan" risk, we MUST focus on F(X); that is, we must focus on what happens when certain variables compute a value beyond what is historically visible.

What happens when X, Y, or Z, have a blowup?

What is F(X), F(Y) etc?

Back to our case at hand, what happens when certain variables go awry in #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">?

https://abs.twimg.com/hashflags... draggable="false" alt="">?

What happens when:

-Miner centralization occurs?

-Encryption is broken?

-Incentive models deteriorate?

-Decisions must be made quickly & efficiently to save the network?

What is F(X)?

What happens when:

-Miner centralization occurs?

-Encryption is broken?

-Incentive models deteriorate?

-Decisions must be made quickly & efficiently to save the network?

What is F(X)?

Before elaborating on the "What is F(X)?" conundrum as applied to Bitcoin and Decred, we must ponder the following:

"Thou shalt not become antifragile at the expense of others. Simply, Asymmetry in risk bearing leads to imbalances and, potentially, to systemic ruin" @nntaleb

"Thou shalt not become antifragile at the expense of others. Simply, Asymmetry in risk bearing leads to imbalances and, potentially, to systemic ruin" @nntaleb

Symmetry in risk bearing is also known as "skin in the game."

In Greek, "synkyndineo" means "taking risks together."

The latin equivalent is "compericlitor."

In english, "risk-sharing" is called "compericlity" (another new term, courtesy of @nntaleb& #39;s work).

In Greek, "synkyndineo" means "taking risks together."

The latin equivalent is "compericlitor."

In english, "risk-sharing" is called "compericlity" (another new term, courtesy of @nntaleb& #39;s work).

Something that is compericlitous displays a balance of risk-sharing.

That which is incompericlitous has an imbalance where risk is transferred from one party to another (Principal & agent problem).

We can compare the compericlity of several processes in Bitcoin & Decred.

That which is incompericlitous has an imbalance where risk is transferred from one party to another (Principal & agent problem).

We can compare the compericlity of several processes in Bitcoin & Decred.

There are stark differences in symmetry of risk-bearing in Decred & Bitcoin.

It is these areas where F(X,Y,Z) is different between the two networks.

-PoW mining

-Code adaptability

-Development funding model

-Governance

It is these areas where F(X,Y,Z) is different between the two networks.

-PoW mining

-Code adaptability

-Development funding model

-Governance

The key point here is that F(X,Y,Z) for each network is at odds.

This is not to say that F(X,Y,Z) of Decred will always compute something that is immune to black swan blowups, but rather that the function itself is different from Bitcoin.

This is not to say that F(X,Y,Z) of Decred will always compute something that is immune to black swan blowups, but rather that the function itself is different from Bitcoin.

To dive deeper into F(X,Y,Z), we can examine the principal & agent problem to determine obvious examples.

Risk is transferred onto the Bitcoin network & users in the following instances. These activities can occur with relative impunity.

Risk is transferred onto the Bitcoin network & users in the following instances. These activities can occur with relative impunity.

In #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">:

https://abs.twimg.com/hashflags... draggable="false" alt="">:

-The network can be split, resulting in fragmentation of users.

-Decisions are made by subsets of developers without general consensus of users.

-Favorable development often lacks funding.

-PoW attacks can decimate the social contract (see Three Pillars theory).

-The network can be split, resulting in fragmentation of users.

-Decisions are made by subsets of developers without general consensus of users.

-Favorable development often lacks funding.

-PoW attacks can decimate the social contract (see Three Pillars theory).

In #Decred:

-PoW mining is reigned in by a vital PoS component.

-Code is adaptable without fragmentation of the network or danger to the consensus rules.

-Favorable development always finds funding.

-Governance is transparent and open to ALL.

-PoW mining is reigned in by a vital PoS component.

-Code is adaptable without fragmentation of the network or danger to the consensus rules.

-Favorable development always finds funding.

-Governance is transparent and open to ALL.

Where #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> is incompericlitous, #Decred is compericlitous.

https://abs.twimg.com/hashflags... draggable="false" alt=""> is incompericlitous, #Decred is compericlitous.

This suggestion is controversial, as it should be.

I can& #39;t be the judge, however; nobody can. Only time can reveal blowups. Only time can expose the true F(X,Y,Z) within Decred & Bitcoin respectively.

This suggestion is controversial, as it should be.

I can& #39;t be the judge, however; nobody can. Only time can reveal blowups. Only time can expose the true F(X,Y,Z) within Decred & Bitcoin respectively.

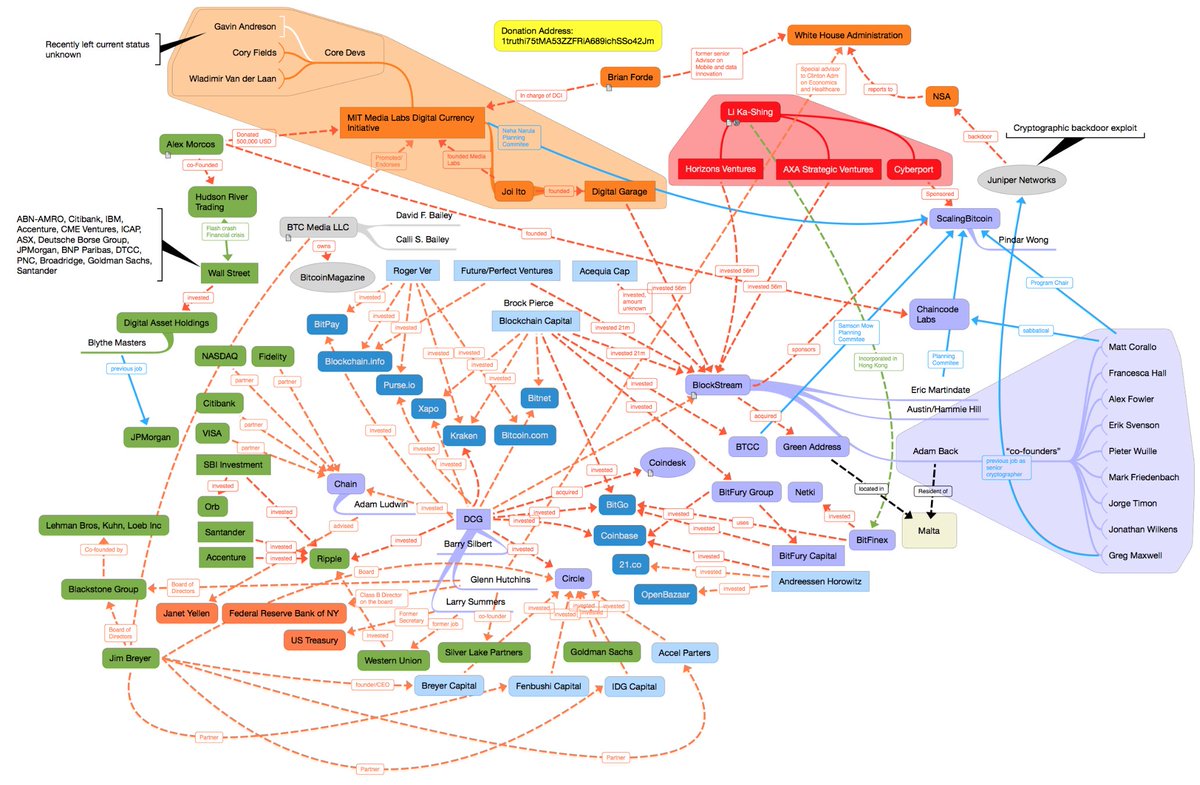

If you& #39;re not convinced that funding presents instances of risk-transfer in Bitcoin, I recommend further research into the parties of this infographic.

Source:

https://forum.bitcoin.com/download/file.php?id=601&sid=a4e873db5b87fc73d9a2d9685c10acfe&mode=view">https://forum.bitcoin.com/download/...

Source:

https://forum.bitcoin.com/download/file.php?id=601&sid=a4e873db5b87fc73d9a2d9685c10acfe&mode=view">https://forum.bitcoin.com/download/...

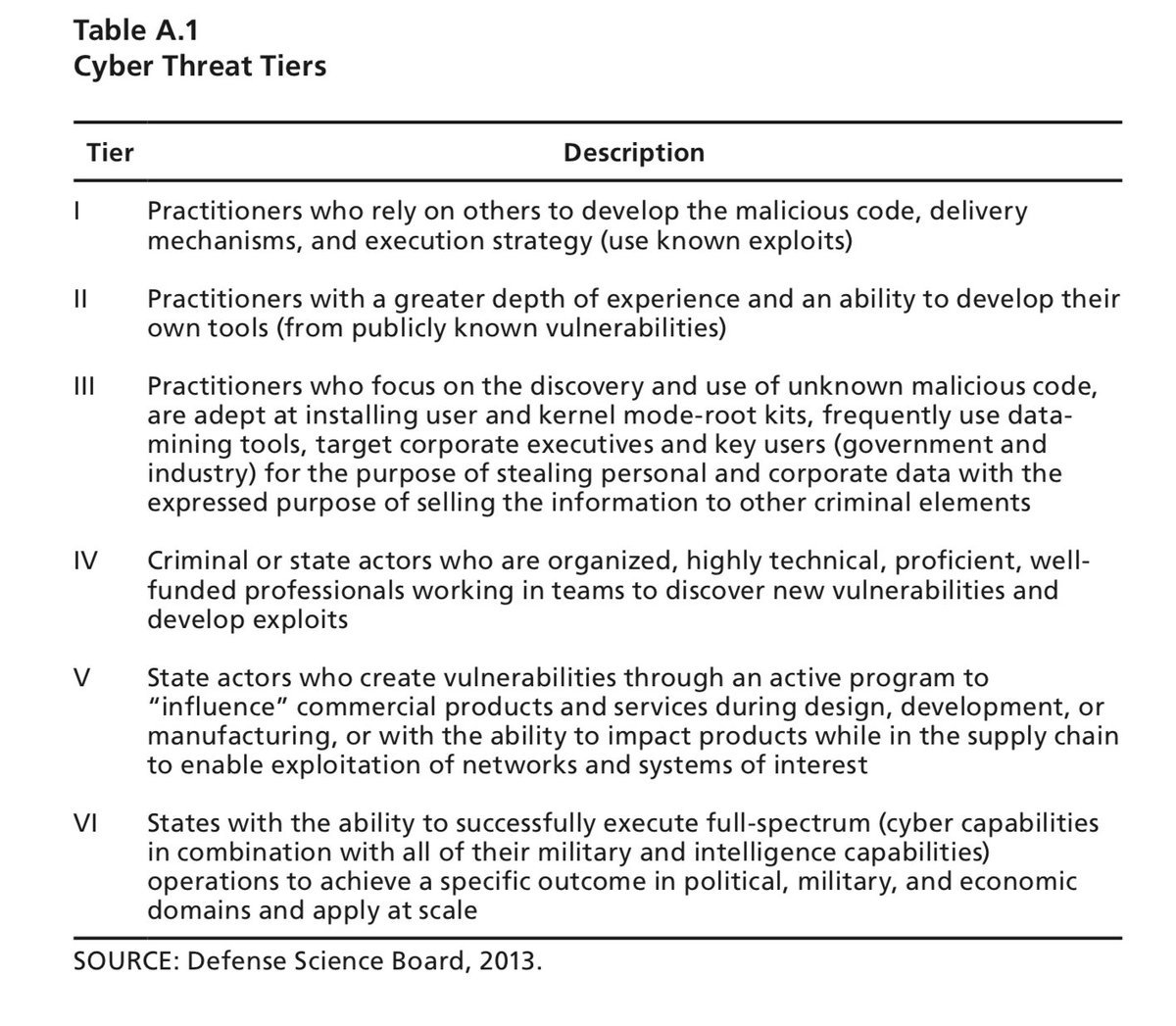

If you& #39;re not convinced about the problems of PoW centralization and what that could ultimately mean for Bitcoin, I recommend reading this report. Several attack vectors are outlined along with definitions of Bitcoin& #39;s opponents (Tier I - VI).

https://www.rand.org/pubs/research_reports/RR1231.html">https://www.rand.org/pubs/rese...

https://www.rand.org/pubs/research_reports/RR1231.html">https://www.rand.org/pubs/rese...

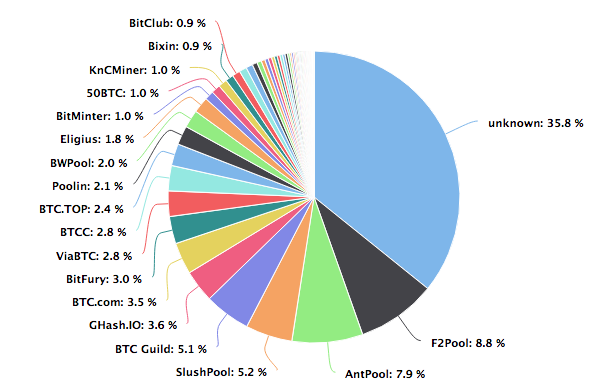

Further investigation of miner pool centralization is warranted to elucidate Bitcoin& #39;s exposure to PoW attacks.

As of today, roughly 13 pools equate to more than 50% of Bitcoin& #39;s hashrate.

https://btc.com/stats/pool?pool_mode=all">https://btc.com/stats/poo...

As of today, roughly 13 pools equate to more than 50% of Bitcoin& #39;s hashrate.

https://btc.com/stats/pool?pool_mode=all">https://btc.com/stats/poo...

Bitcoin has arguably been quite robust in its lifespan thus far. While that is promising, robustness is not by any means a guarantee.

The cypherpunk social contract behind Bitcoin transcends any one protocol. Permissionless digital scarcity is critical to progress, IMHO.

The cypherpunk social contract behind Bitcoin transcends any one protocol. Permissionless digital scarcity is critical to progress, IMHO.

Survival of the fittest will ensure that the inherent social contract behind Bitcoin & Decred lives on.

That which is antifragile, which gains from disorder, might only be the social contract itself.

That which is antifragile, which gains from disorder, might only be the social contract itself.

Together, #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> & #Decred, represent a contract between humans that is as antifragile as life itself (thanks to evolution).

https://abs.twimg.com/hashflags... draggable="false" alt=""> & #Decred, represent a contract between humans that is as antifragile as life itself (thanks to evolution).

The greater number of protocols we have to defend the cypherpunk social contract, the more resilient the contract becomes.

The greater number of protocols we have to defend the cypherpunk social contract, the more resilient the contract becomes.

Read on Twitter

Read on Twitter and #Decred. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" title="Decred has revolutionized several key components in Bitcoin to create a balanced system that contains symmetrical tradeoffs in risk between users, stakeholders, developers, and miners. It& #39;s time for a Megathread to compare fragility in #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Decred. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" class="img-responsive" style="max-width:100%;"/>

and #Decred. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" title="Decred has revolutionized several key components in Bitcoin to create a balanced system that contains symmetrical tradeoffs in risk between users, stakeholders, developers, and miners. It& #39;s time for a Megathread to compare fragility in #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Decred. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" class="img-responsive" style="max-width:100%;"/>

:-The network can be split, resulting in fragmentation of users.-Decisions are made by subsets of developers without general consensus of users.-Favorable development often lacks funding.-PoW attacks can decimate the social contract (see Three Pillars theory)." title="In #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">:-The network can be split, resulting in fragmentation of users.-Decisions are made by subsets of developers without general consensus of users.-Favorable development often lacks funding.-PoW attacks can decimate the social contract (see Three Pillars theory)." class="img-responsive" style="max-width:100%;"/>

:-The network can be split, resulting in fragmentation of users.-Decisions are made by subsets of developers without general consensus of users.-Favorable development often lacks funding.-PoW attacks can decimate the social contract (see Three Pillars theory)." title="In #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">:-The network can be split, resulting in fragmentation of users.-Decisions are made by subsets of developers without general consensus of users.-Favorable development often lacks funding.-PoW attacks can decimate the social contract (see Three Pillars theory)." class="img-responsive" style="max-width:100%;"/>

& #Decred, represent a contract between humans that is as antifragile as life itself (thanks to evolution). The greater number of protocols we have to defend the cypherpunk social contract, the more resilient the contract becomes." title="Together, #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> & #Decred, represent a contract between humans that is as antifragile as life itself (thanks to evolution). The greater number of protocols we have to defend the cypherpunk social contract, the more resilient the contract becomes." class="img-responsive" style="max-width:100%;"/>

& #Decred, represent a contract between humans that is as antifragile as life itself (thanks to evolution). The greater number of protocols we have to defend the cypherpunk social contract, the more resilient the contract becomes." title="Together, #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> & #Decred, represent a contract between humans that is as antifragile as life itself (thanks to evolution). The greater number of protocols we have to defend the cypherpunk social contract, the more resilient the contract becomes." class="img-responsive" style="max-width:100%;"/>