1. A thread on the second order effects of a new Scottish currency. The SNP’s Sterlingization policy is so economically abysmal it is highly unlikely to see the light of day. It also precludes EU membership. Therefore, a new currency is the most likely option.

2. This creates a serious problem as all existing loan/insurance contracts will remain denominated in Sterling. This holds tremendous risk – Average household debt in Scotland is £55,000, there are 1 million mortgage holders, local authorities hold debts of £18 billion etc.

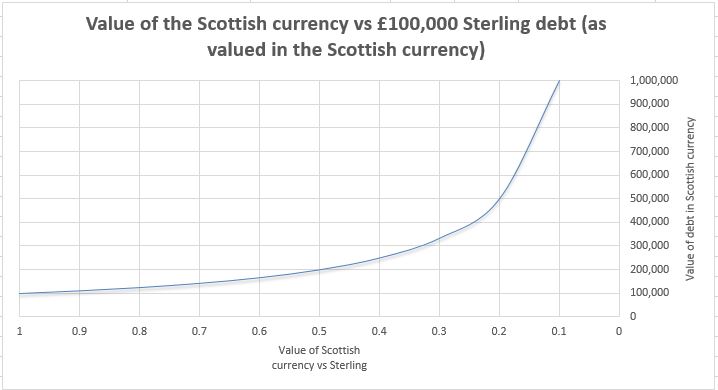

3. There is an asymmetry in this asset-liability mismatch that makes it especially risky. The value of Sterling debt when valued in the Scottish currency increases exponentially for every % decrease in the value of the Scottish currency vs Sterling. The following chart explains:

4. A 50% decrease in the Scottish currency would cause Sterling debt as valued in the Scottish currency to increase by 100%. If your income is solely in the Scottish currency & you hold Sterling debt then you are in trouble. This would be the clear majority of people in Scotland.

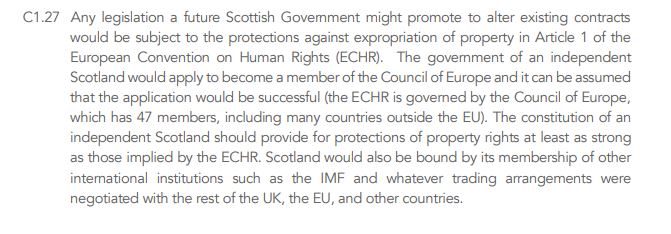

5. However, the SNP have conceded that forcibly converting all existing loans to a new currency is challengeable under the European Convention of Human Rights and therefore will not happen. From the SNP& #39;s Growth Commission Report: https://www.sustainablegrowthcommission.scot/report ">https://www.sustainablegrowthcommission.scot/report&qu...

6. But there is a more serious reason against forcibly converting all loans contracts into the new currency. It would cause economic chaos in the UK’s securitized asset market, which is the biggest securitized asset market in Europe.

7. 80% of UK mortgages are securitized with similar figures for other forms of debt (credit cards, car loans etc.). These loans are packaged up and the rights to their cash-flows sold to investors in the form of mortgage-backed securities and collateralized debt obligations.

8. Credit default swaps are then written against these instruments that payout if the loans underlying them suffer defaults. During the financial crisis, investors used credit default swaps to profit from the defaults on mortgages as the US housing market collapsed.

9. If the SNP forcibly converted all Sterling loans to a new currency, which then devalues, securitized asset investors are going to receive less than contractually promised, which would trigger defaults & writedowns in their asset valuation & then payouts in credit default swaps

10. Because Scottish loans are going to be spread across the entire asset class this means most securitized Sterling assets are affected. We could see mass dumping of any securitized Sterling asset which would then cause their collapse as an asset class.

11. This would have consequences for the issuing of Sterling loans in general as lenders will often rely on the demand for securitized loans to be willing to issue them to borrowers in the first place. Thus probably causing a UK-wide credit crunch.

12. As things stand, with loans staying in Sterling but borrowers being paid in the new Scottish currency, the effects will not be as severe. However if the new currency devalues by 25-30% then many borrowers will find themselves unable to repay their Sterling loans.

13. This will also make some investors very rich. This could be the UK’s Big Short. Expect credit default swaps on securitized assets to spike in the run-up to the referendum, explode should Scotland vote for secession & then payout over the first years of a separate Scotland.

14. Therefore, the establishment of a new Scottish currency is destined to cause huge problems for the UK’s securitization market and wider economy. When we talk of the problems that a separate Scotland will cause for the rest of the UK, this is one of the biggest.

Read on Twitter

Read on Twitter