What can you expect with the tokenomic changes for $ZIL that will be implemented by end Sept 2020?

A short thread below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

A short thread below

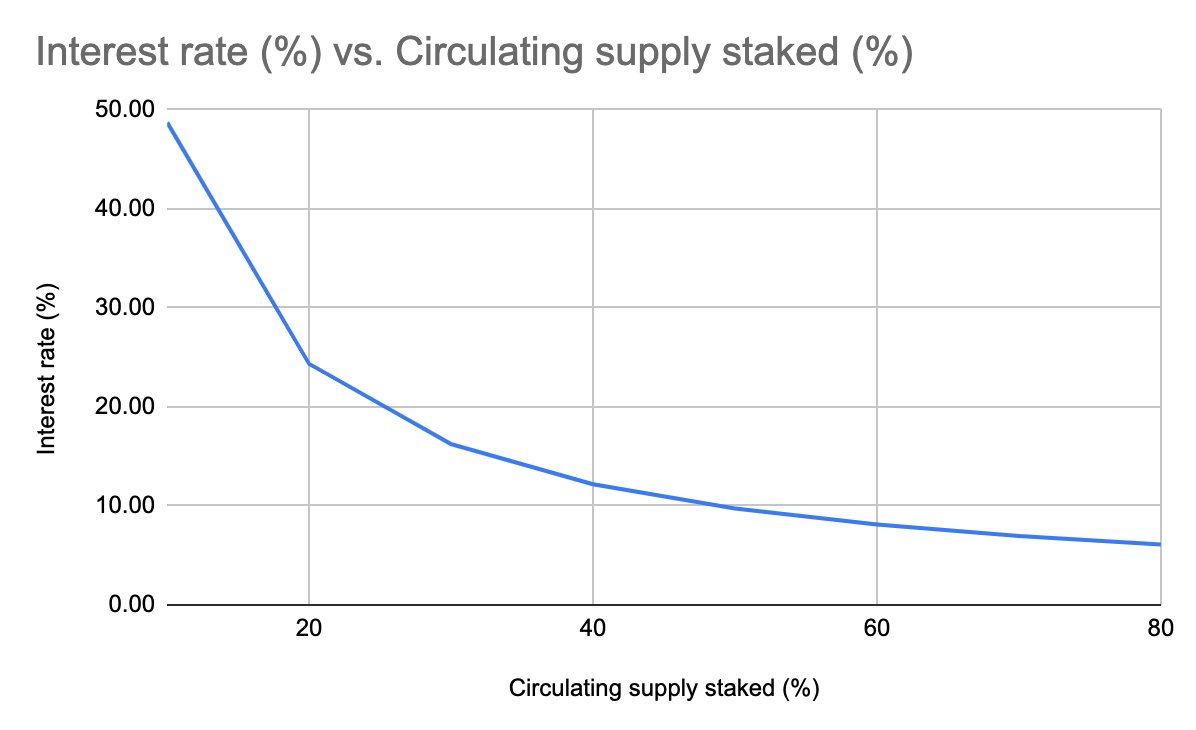

1/ With a very high APY (48%) at the start, we can fully expect many token hodlers to take advantage of the first-mover bonus and stake their $ZIL immediately. With the current competition in this space, we can expect APY stabilise at around ~10% range after the first month.

2/ Therefore, optimistically speaking roughly ~50% of circulating supply should be staked.

Do note that the @zilliqa reserves (~27% of circulating) continues to be soft-locked and will not be staked in the 1st year.

Hence, we can expect ~23% of circulating supply to float.

Do note that the @zilliqa reserves (~27% of circulating) continues to be soft-locked and will not be staked in the 1st year.

Hence, we can expect ~23% of circulating supply to float.

3/ Deviating a little. Here& #39;s the current % split of circulating supply:

- Binance = ~29.4%

- Zilliqa + Anquan = ~27%

- Other exchanges = ~9%

- Cold wallets = 34.6%

This allocation will probably shift dramatically as more token hodlers mirgrate their $ZIL to cold wallets.

- Binance = ~29.4%

- Zilliqa + Anquan = ~27%

- Other exchanges = ~9%

- Cold wallets = 34.6%

This allocation will probably shift dramatically as more token hodlers mirgrate their $ZIL to cold wallets.

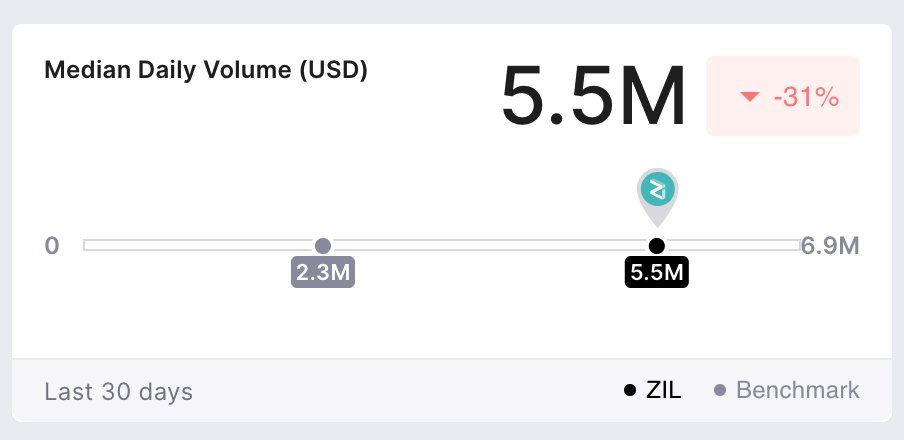

4/ With ~23% of circulating supply floating around (~3 billion $ZIL), we can apply MC = TH to calculate C. Let& #39;s assume H = 0.2 (meaning every $ZIL changes hands at least 5 times a year) and T= $2bil (extracted from $5.5 mil on-chain daily txn volume by @flipsidecrypto)...

5/ C = (2bil*0.2)/3bil = $0.13 at current T.

For perspective, $ZIL is currently trading ~$0.0216 on Binance.

We can expect T to increase when blocks are filled with staking and http://ZilSwap.io"> http://ZilSwap.io DEX txns aft. Q3, which both involves trading high vol. of $ZIL on-chain.

For perspective, $ZIL is currently trading ~$0.0216 on Binance.

We can expect T to increase when blocks are filled with staking and http://ZilSwap.io"> http://ZilSwap.io DEX txns aft. Q3, which both involves trading high vol. of $ZIL on-chain.

6/ And also, don& #39;t forget that in order to supply liquidity on ZilSwap DEX, you need to supply 50/50 of $ZIL/$XXX token in USD value. Therefore, this will "lock" up more $ZIL in LPs albeit it being not as sticky as staking, and hence potentially decreasing M further.

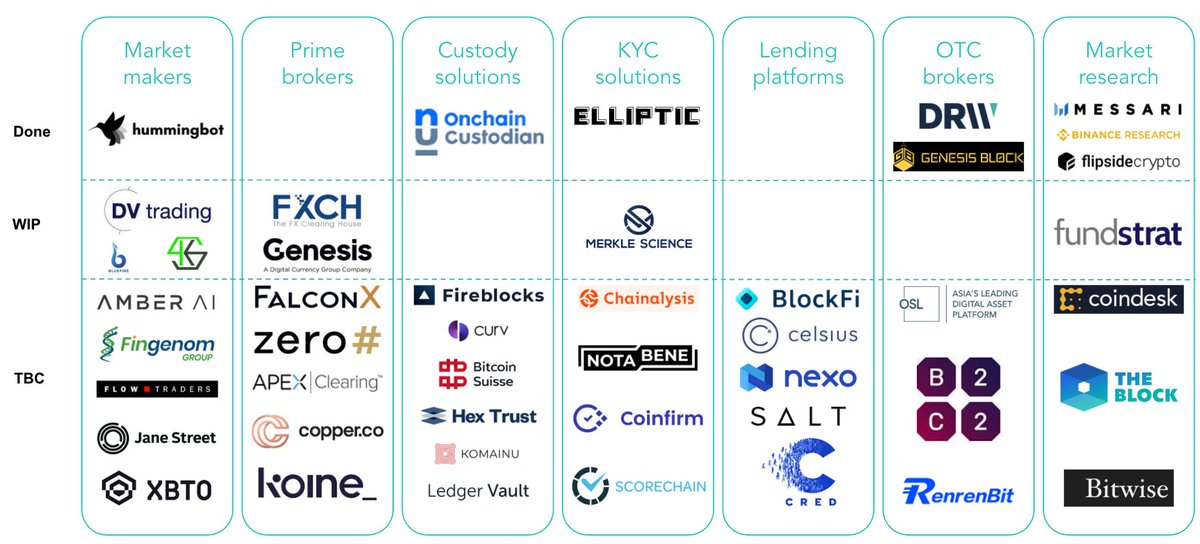

7/ More T increases can also be expected as the new Market Infra team led by Aurel continues to work on centralised lending and margin trading services for traders and hodlers alike.

8/ But, that& #39;s not all! With ZIP-9, all txns fees will be "burned", meaning they are recycled to the 0x0 (block rewards pool address), potentially decreasing M further.

For perspective, the sweet spot for net deflation of M is > 55% avg filled block (or 132TPS for ZRC2 tokens).

For perspective, the sweet spot for net deflation of M is > 55% avg filled block (or 132TPS for ZRC2 tokens).

Read on Twitter

Read on Twitter