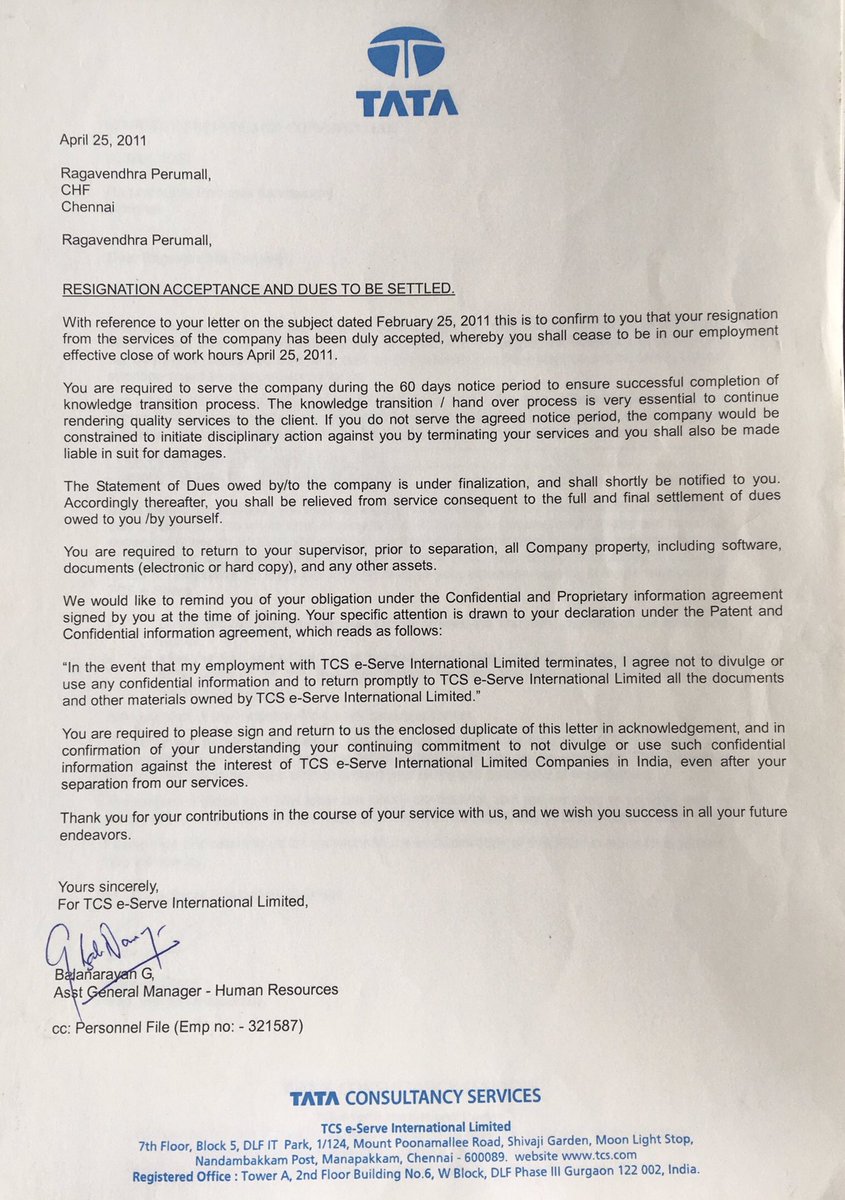

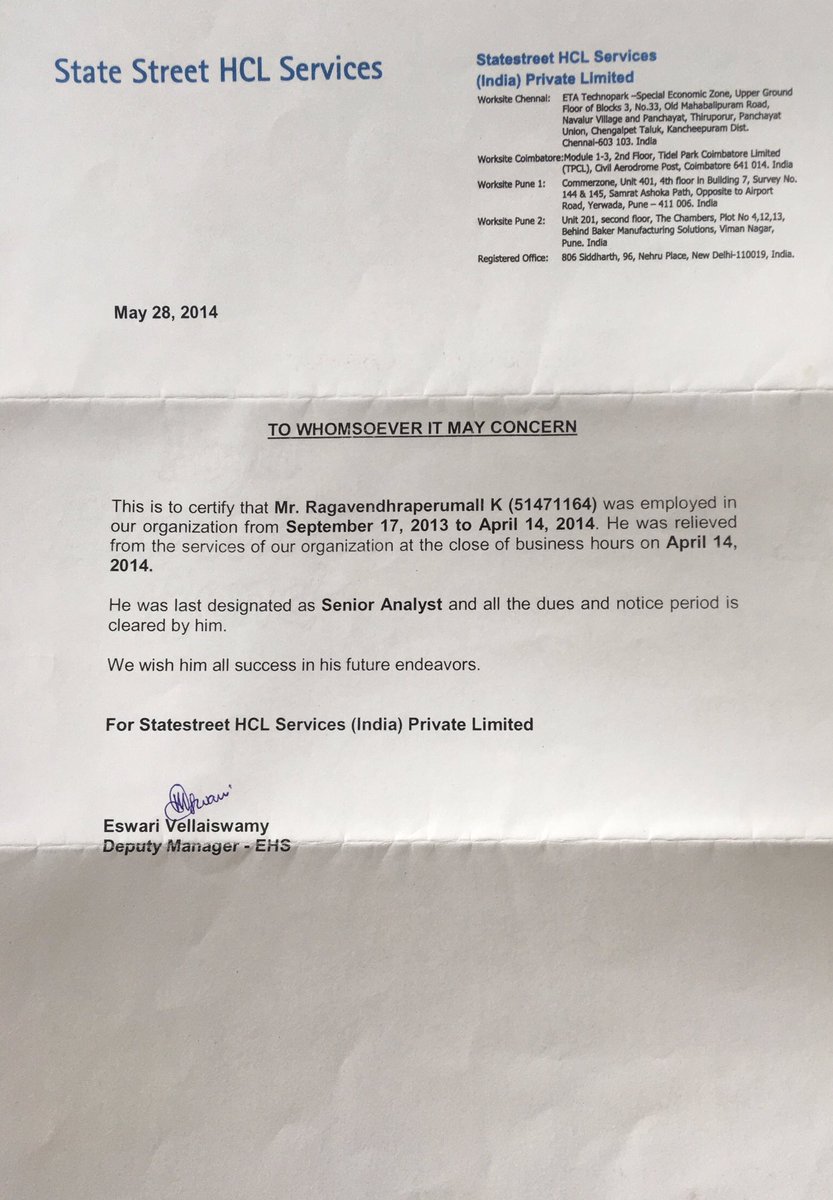

It’s been 10yrs since I resigned from #TCS as a Hedge fund analyst & 6 years from #StatestreetHCL to start my own business and become a full time investor.

Its been a thriller journey until now. I’m sharing some lessons for the aspirants who want to take the path.

Its been a thriller journey until now. I’m sharing some lessons for the aspirants who want to take the path.

To become a full time entrepreneur or investor first prepare mentally. Although you’re financially sound it takes the persistence to go the extra mile.

Like @elonmusk says becoming an entrepreneur is like eating glass.

Like @elonmusk says becoming an entrepreneur is like eating glass.

When I decided to Quit I had 90% of my friends, family member, advisors and well wishers tell me not to quit. So it’s up to what you know and how persistent you are in your goals. Others opinions are just opinions not facts about you.

Self belief the most important factor.

Self belief the most important factor.

If you have belief in yourself, you have to take a firm DECISION. Else you’ll be caught up in others vices. Now I pay taxes that’s equal to my full year salary package in #TCS. If I had listened to others I would have been caught in “Status Quo” and not challenged myself.

I fell for the planing fallacy - I thought business will be streamlined by 2 years but even now I’m learning daily and striving. So it may take a very long period to get to a mark before you make some success. Until then Run, if not walk or at-least crawl.

Never quit your job without having a backup. I had a huge backup before I quit.I had 10 years of equity market experience along with savings from my job which gave me a cushion on the downside

It allowed me to take BIG RISKS when other were reluctant and in stocks that’s a must

It allowed me to take BIG RISKS when other were reluctant and in stocks that’s a must

I thought I should know everything before I start a business, but nothing is farther from the truth. I learned it’s all trial and error, Jeff Bezos says your should be able to make decisions with 70% of the information. That’s very true. Learn to calibrate as you go.

I assumed I could learn everything myself, that was another mistake to try to do everything myself. But that’s a misconception. That’s when I realised I should have 0 TOLERANCE for not learning from others, when this happened my learning curve peaked.

I made a mistake of asking advise from people who didn’t do what I am going to do, I realised that was a really bad mistake which only created a state of confusion and chaos. So that’s another learning. Don’t seek advice from a person who’s not done something you’re going to do.

Collaborating with the right people in a business is so vital. It’s like the chimps theory you will be like the 5 people who you’re around with most of the time.

If i find someone doing a better job than I’m doing I feel compelled to figure out and learn from them. No EGO !

If i find someone doing a better job than I’m doing I feel compelled to figure out and learn from them. No EGO !

I approached mentors in my journey to help me improve my investment process which was one of the best Decisions i took

To cut down you’re learning time it’s amazing to have mentors. It’s surprising how people are willing to help when you’re open minded and ready to listen & ask

To cut down you’re learning time it’s amazing to have mentors. It’s surprising how people are willing to help when you’re open minded and ready to listen & ask

My improvements in investing started when I cut down most of the group chats and started to focus on my process. Most Groups are NOISE. It’s the worst distraction. We assume we are accumulating knowledge,but mostly Junk. I avoid most groups and groups talk.

Most of Group messages are knowledge that expire and has very low shelf life. Focus on knowledge that doesn’t change

Instead of focusing on random facts in a business, think of demand and supply, Economies of scale and probabilities etc. Learn only knowledge that has high life.

Instead of focusing on random facts in a business, think of demand and supply, Economies of scale and probabilities etc. Learn only knowledge that has high life.

The cost I gave to this journey is people disliking you, Less time with family, out of comfort zone, people Ignoring you and people talk bad about you at your back. But in the long run everything is worth it. At start it hurts than like the Pavlov’s Dogs it gets Conditioned.

In any field if you need to master anything follow the Depth over breadth is my philosophy. Be it investing or business If I wanted to know something I started with books and went really deep inside.

Learned from #Joshwaitzkin’s Art of learning.

Learned from #Joshwaitzkin’s Art of learning.

Intelligence can be substituted with good habits to a certain extent. Habits of reading, having good people around you, listening, observing are vital to growth.

I learned that equally Mental habits too are very essential. Mental habits are your habitual thought process.

I learned that equally Mental habits too are very essential. Mental habits are your habitual thought process.

Have a very very long term approach and aspirations. I have planned for next 20 years. But it even thought it won’t go as per planned. Right from equity to business to people have a long term approach. Aspire for bigger tasks and bigger goals. I’ve never settled for less.

Independent thinking - It’s one of THE MOST important skill I have developed. Time and again i got reinforced by this. Although I made mistakes I learned so much because I had my own thought process.

If you’re investing based on others though process growth will never happen.

If you’re investing based on others though process growth will never happen.

Best way I learned apart from books is TOTAL IMMERSION - I took investment of a few big investors in Indian and devoted time to understand what was the thought process that went into it, Why did they invest ? What variables did they see ? How did they invest such big money ?

In the end it’s a journey. It’s my Inner scorecard, I decide everything within my control - Price i buy, business I choose , people i associate with, etc. ignore everything outside your control - What others think, What markets will do is never my concern or never was !!

Charlie munger, Warren Buffett has been the highest influences on my thought process and business. When you have exceptional mentors you can learn directly and from books. It’s the amount of active reading work you put in the process to extract more from it.

Read on Twitter

Read on Twitter