1/

Get a cup of coffee.

In this thread, I& #39;ll help you understand why Warren Buffett& #39;s favorite holding period for stocks is forever.

Get a cup of coffee.

In this thread, I& #39;ll help you understand why Warren Buffett& #39;s favorite holding period for stocks is forever.

2/

Imagine you just became the proud father of a beautiful baby boy.

You are beside yourself with joy. You feel blessed.

Congrats!

Imagine you just became the proud father of a beautiful baby boy.

You are beside yourself with joy. You feel blessed.

Congrats!

3/

The first thing you do, of course, is climb the nearest mountain.

From this lofty perch, you introduce the people to their future king.

The first thing you do, of course, is climb the nearest mountain.

From this lofty perch, you introduce the people to their future king.

4/

The second thing is: you give your son a financial headstart.

You open a new @RobinhoodApp account.

You put $100K in it.

The plan is: you& #39;ll manage this account for the next 30 years. On your son& #39;s 30& #39;th birthday, you& #39;ll liquidate the account and give him the proceeds.

The second thing is: you give your son a financial headstart.

You open a new @RobinhoodApp account.

You put $100K in it.

The plan is: you& #39;ll manage this account for the next 30 years. On your son& #39;s 30& #39;th birthday, you& #39;ll liquidate the account and give him the proceeds.

5/

Let& #39;s say you know a wonderful company -- with excellent long term prospects, a long runway for growth, and a management team you trust.

So you put the entire $100K into this company& #39;s stock, and hold it for the next 30 years.

Let& #39;s say you know a wonderful company -- with excellent long term prospects, a long runway for growth, and a management team you trust.

So you put the entire $100K into this company& #39;s stock, and hold it for the next 30 years.

6/

As expected, the company does well over these 30 years.

The stock follows suit. It gives you a 10% annualized return during this time.

So, how much will your Robinhood account be worth on your son& #39;s 30& #39;th birthday?

That& #39;s easy: $100K*(1.1^30) -- or about $1.7M.

As expected, the company does well over these 30 years.

The stock follows suit. It gives you a 10% annualized return during this time.

So, how much will your Robinhood account be worth on your son& #39;s 30& #39;th birthday?

That& #39;s easy: $100K*(1.1^30) -- or about $1.7M.

7/

But remember: your plan is to *liquidate* the account and give your son the *proceeds*.

When you do this, your son won& #39;t get the full $1.7M.

Why? Because taxes.

(You may be king of the jungle, but you& #39;re not exempt from paying taxes.)

But remember: your plan is to *liquidate* the account and give your son the *proceeds*.

When you do this, your son won& #39;t get the full $1.7M.

Why? Because taxes.

(You may be king of the jungle, but you& #39;re not exempt from paying taxes.)

8/

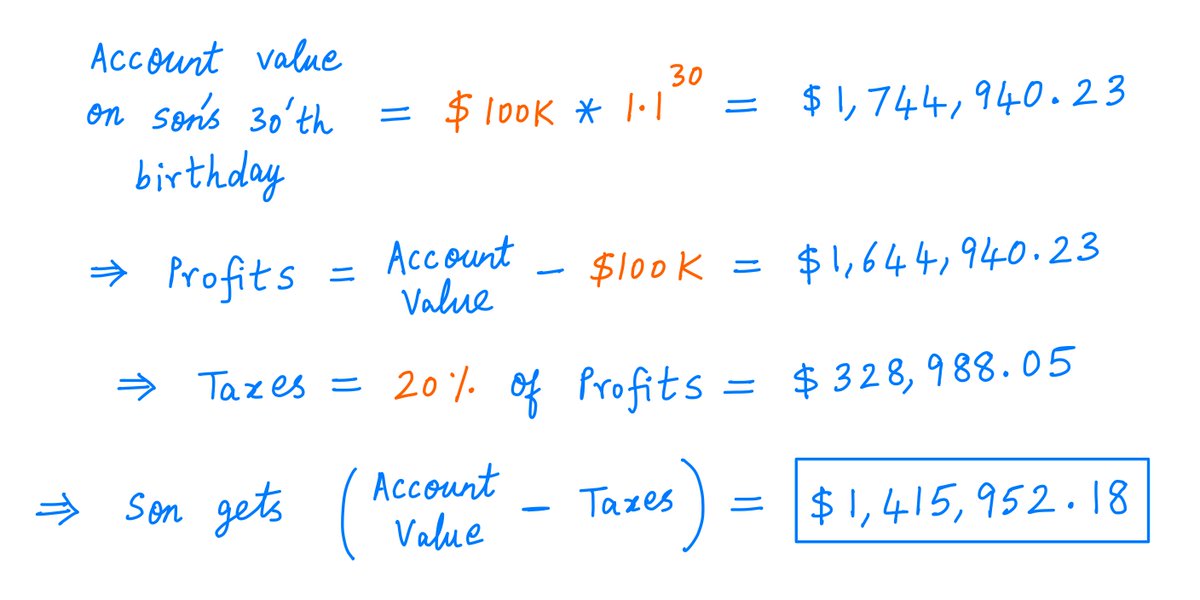

Let& #39;s say your tax rate is 20%.

After liquidating the account *and* paying taxes on the profits, how much money will your son actually end up getting?

That& #39;ll be about $1.4M, as this calculation shows:

Let& #39;s say your tax rate is 20%.

After liquidating the account *and* paying taxes on the profits, how much money will your son actually end up getting?

That& #39;ll be about $1.4M, as this calculation shows:

9/

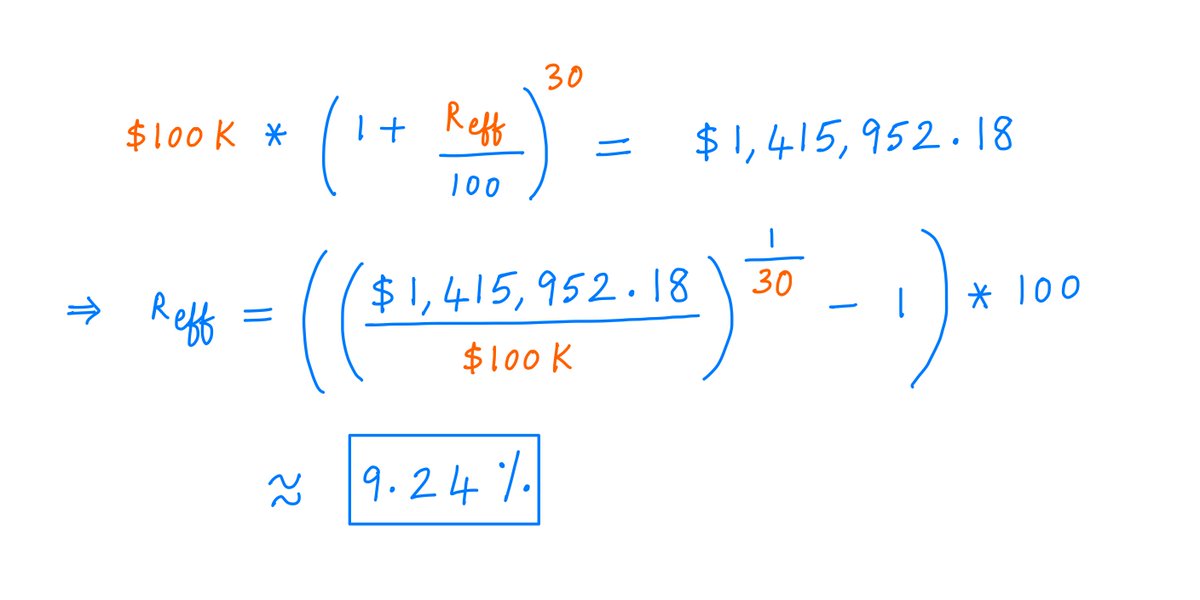

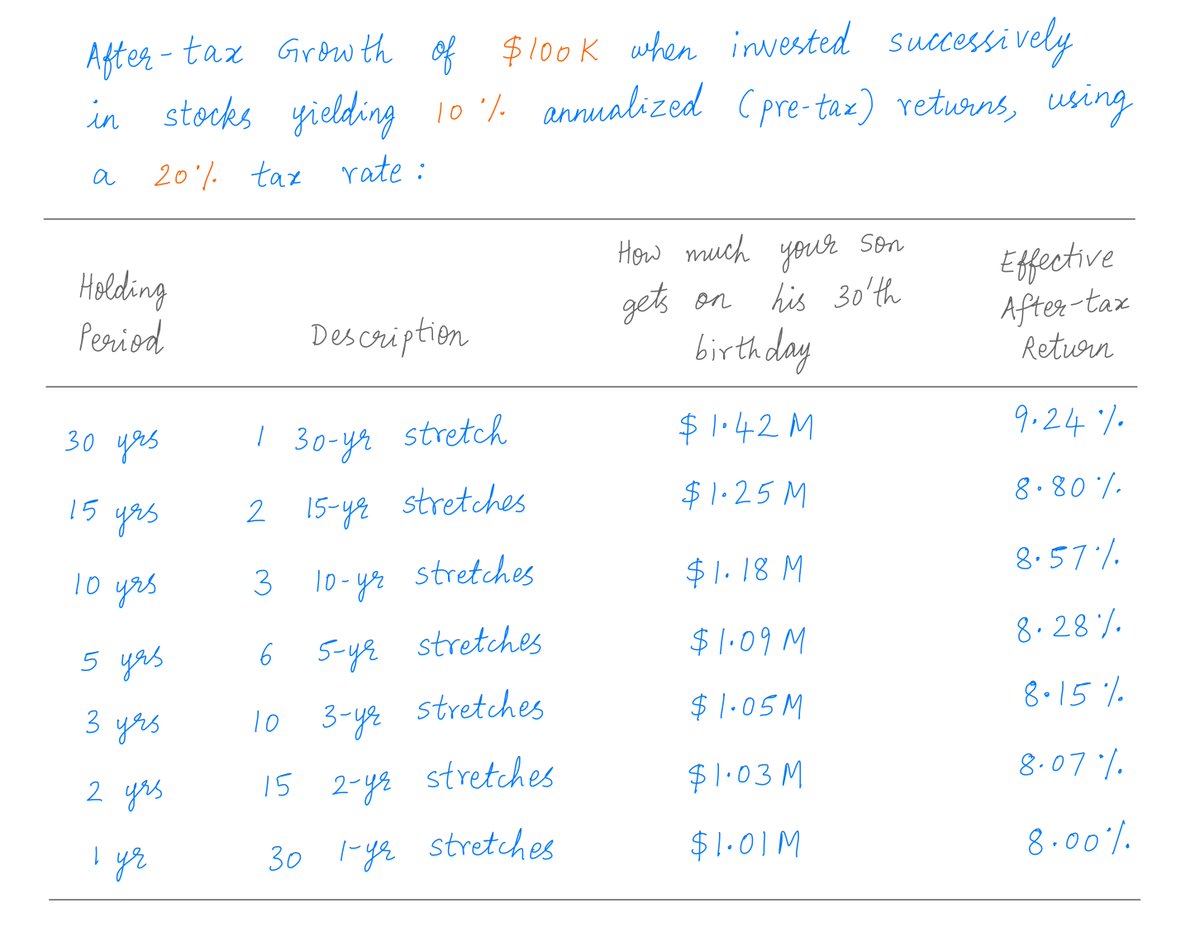

So, even though the *stock* returned 10% over 30 years, *your* effective after-tax return was only ~9.24% -- see pic below.

The difference is only ~0.76%, but that& #39;s ~$329K in dollar terms -- almost a quarter of what your son ended up getting.

So, even though the *stock* returned 10% over 30 years, *your* effective after-tax return was only ~9.24% -- see pic below.

The difference is only ~0.76%, but that& #39;s ~$329K in dollar terms -- almost a quarter of what your son ended up getting.

10/

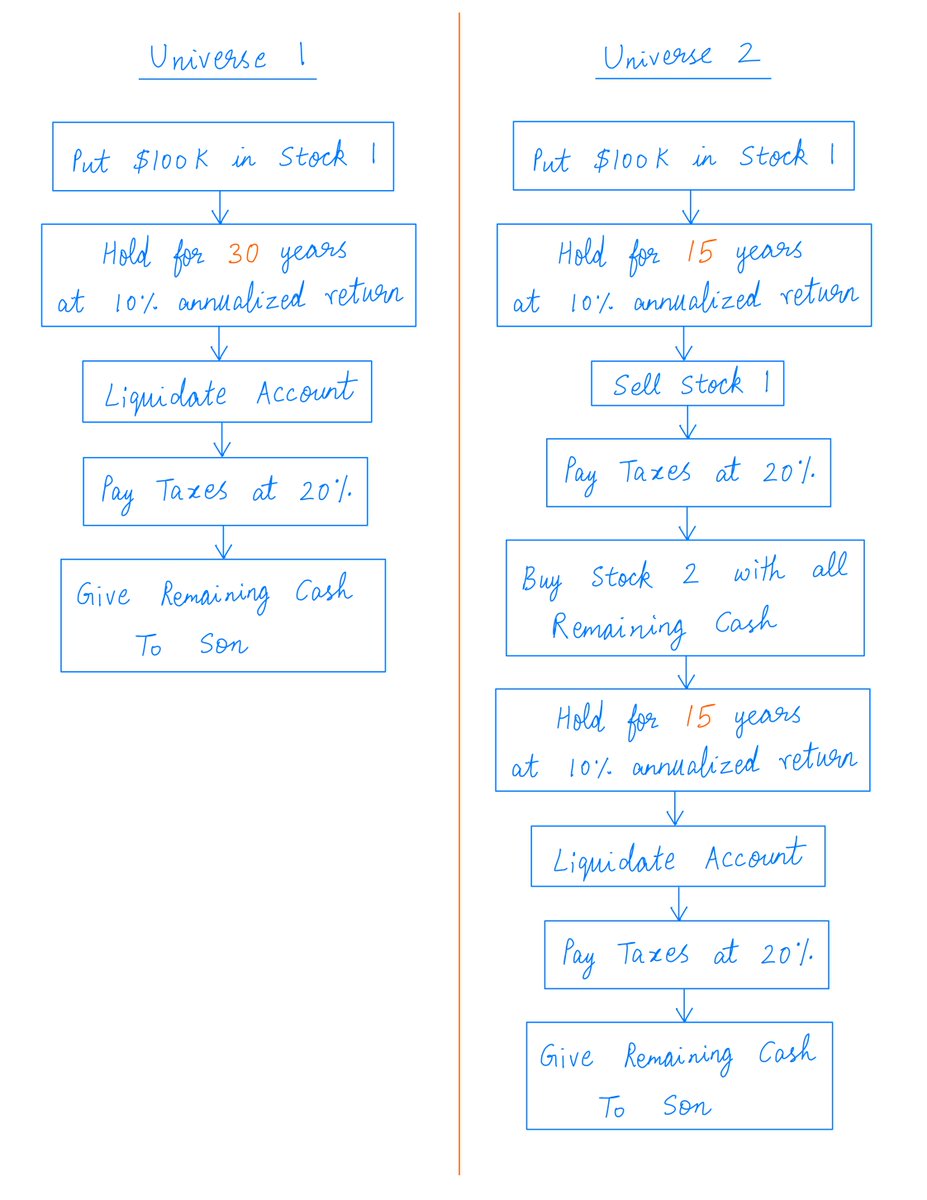

Now imagine an alternate universe.

In this universe, instead of keeping the $100K in 1 stock for 30 years, you do 2 stretches of 15 years each -- earning the same 10% annualized return throughout.

Pic:

Now imagine an alternate universe.

In this universe, instead of keeping the $100K in 1 stock for 30 years, you do 2 stretches of 15 years each -- earning the same 10% annualized return throughout.

Pic:

11/

The only difference between these two universes is your holding period: 30 years in Universe 1 and 15 years in Universe 2.

The shorter holding period in Universe 2 makes you pay taxes twice -- but on smaller profits each time.

The only difference between these two universes is your holding period: 30 years in Universe 1 and 15 years in Universe 2.

The shorter holding period in Universe 2 makes you pay taxes twice -- but on smaller profits each time.

12/

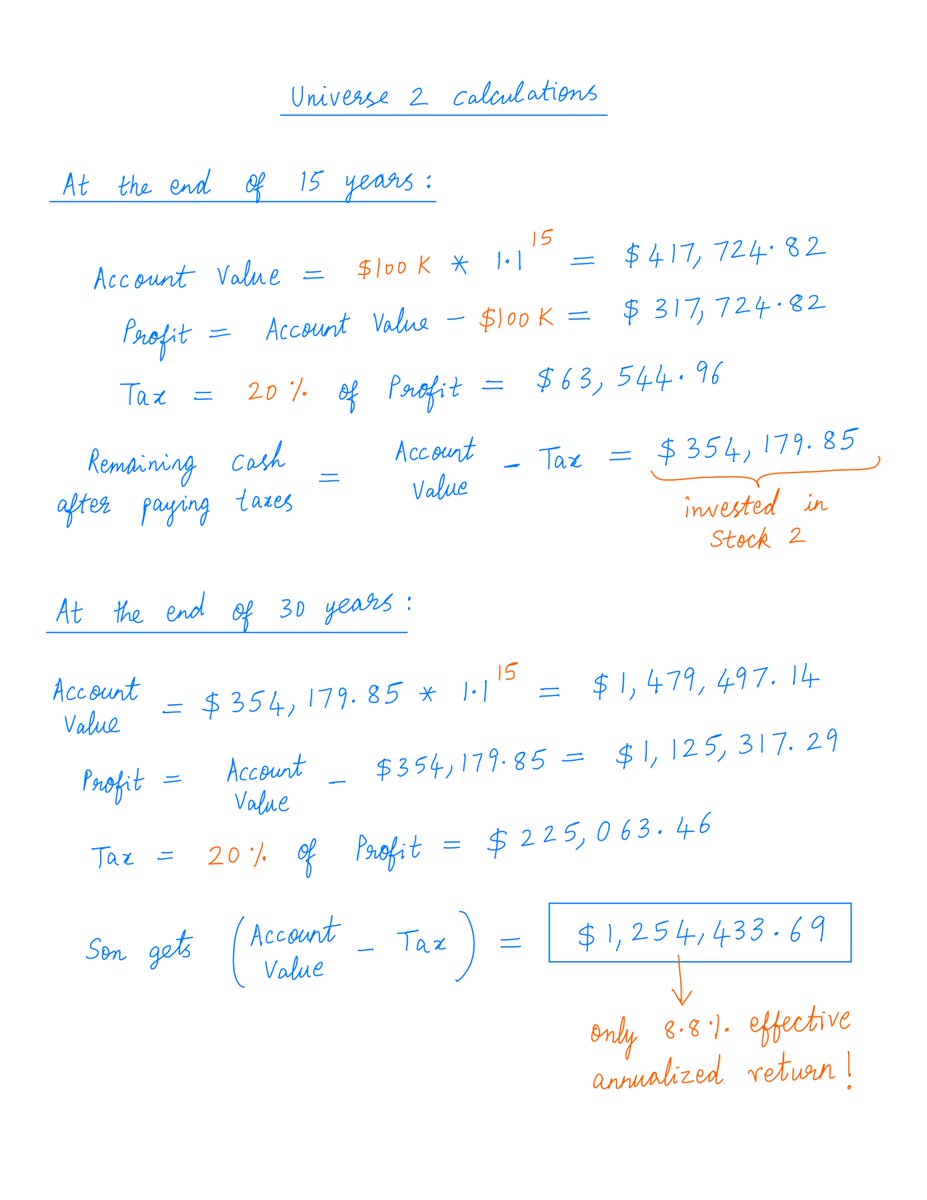

The question is: in which universe will your son end up with more money?

As we& #39;ve seen above, in Universe 1, your son ends up with ~$1.4M.

It turns out, in Universe 2, your son will only end up with ~$1.25M -- worse than Universe 1.

Calculations:

The question is: in which universe will your son end up with more money?

As we& #39;ve seen above, in Universe 1, your son ends up with ~$1.4M.

It turns out, in Universe 2, your son will only end up with ~$1.25M -- worse than Universe 1.

Calculations:

13/

Key lesson: If you hold stocks for shorter periods of time, you have to pay taxes more often, which will hurt your after-tax returns.

Extending the example above -- here& #39;s a table showing how much your son gets on this 30& #39;th birthday for various holding periods you choose:

Key lesson: If you hold stocks for shorter periods of time, you have to pay taxes more often, which will hurt your after-tax returns.

Extending the example above -- here& #39;s a table showing how much your son gets on this 30& #39;th birthday for various holding periods you choose:

14/

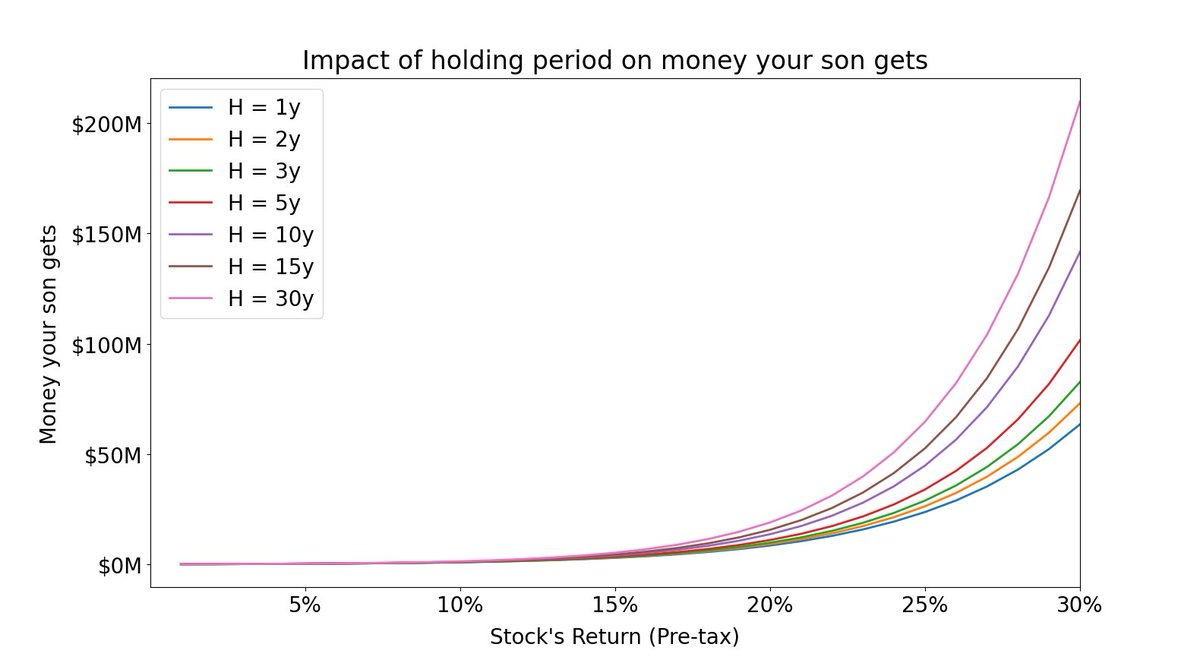

And here& #39;s a plot of the *after-tax* money your son gets vs the *pre-tax* return provided by your stocks -- for various holding periods (H).

Again, you see: longer holding periods produce better results.

No wonder Warren Buffett& #39;s favorite holding period is forever!

And here& #39;s a plot of the *after-tax* money your son gets vs the *pre-tax* return provided by your stocks -- for various holding periods (H).

Again, you see: longer holding periods produce better results.

No wonder Warren Buffett& #39;s favorite holding period is forever!

15/

Longer holding periods work better because they take advantage of *deferred taxes*.

Taxes, of course, are a fact of life. You can& #39;t get away from them.

But the next best thing you can do is *defer* them.

Longer holding periods work better because they take advantage of *deferred taxes*.

Taxes, of course, are a fact of life. You can& #39;t get away from them.

But the next best thing you can do is *defer* them.

16/

For example, suppose you invest $100K into a stock, and the stock doubles. Now your position is worth $200K.

But this $200K is not fully yours. The minute you try to cash it, the proverbial tax man will come knocking.

For example, suppose you invest $100K into a stock, and the stock doubles. Now your position is worth $200K.

But this $200K is not fully yours. The minute you try to cash it, the proverbial tax man will come knocking.

17/

At a 20% tax rate, the tax bill on your $100K profit will be $20K.

So, of the $200K in your brokerage account, only $180K is *truly* yours. You owe the remaining $20K to the government.

This $20K you owe is called a *deferred tax*.

At a 20% tax rate, the tax bill on your $100K profit will be $20K.

So, of the $200K in your brokerage account, only $180K is *truly* yours. You owe the remaining $20K to the government.

This $20K you owe is called a *deferred tax*.

18/

It& #39;s "deferred" because the $20K tax is *not* due right now. It comes due *only* when you sell your stock.

*Until* you sell, this $20K will remain invested in the stock -- right alongside the $180K of capital that& #39;s "truly" yours.

It& #39;s "deferred" because the $20K tax is *not* due right now. It comes due *only* when you sell your stock.

*Until* you sell, this $20K will remain invested in the stock -- right alongside the $180K of capital that& #39;s "truly" yours.

19/

This means, if you& #39;ve chosen the stock well, this $20K will grow over time -- same as the other $180K.

In effect, this $20K is a loan from the government. You have it invested in a stock. And you can leave it there -- growing -- for as long as you like before repaying it.

This means, if you& #39;ve chosen the stock well, this $20K will grow over time -- same as the other $180K.

In effect, this $20K is a loan from the government. You have it invested in a stock. And you can leave it there -- growing -- for as long as you like before repaying it.

20/

Part of the growth will be yours to keep. The rest will have to be paid back to the government -- but only at a time of *your* choosing.

Thus, deferred taxes have a "float-like" aspect. And we all know how much Buffett loves float!

Part of the growth will be yours to keep. The rest will have to be paid back to the government -- but only at a time of *your* choosing.

Thus, deferred taxes have a "float-like" aspect. And we all know how much Buffett loves float!

21/

The "float power" of deferred taxes works best when you hold stocks forever.

For example, Buffett bought Coca-Cola in 1988. As the stock rose, he& #39;s racked up billions in deferred taxes. But he& #39;s yet to pay a single cent -- because he hasn& #39;t sold a single share of Coca-Cola.

The "float power" of deferred taxes works best when you hold stocks forever.

For example, Buffett bought Coca-Cola in 1988. As the stock rose, he& #39;s racked up billions in deferred taxes. But he& #39;s yet to pay a single cent -- because he hasn& #39;t sold a single share of Coca-Cola.

22/

Another reason to prefer long holding periods: good investment ideas are hard to come by.

If you hold a stock for 1 year and then sell, what will you do with the money? You need another stock idea to put it into.

Another reason to prefer long holding periods: good investment ideas are hard to come by.

If you hold a stock for 1 year and then sell, what will you do with the money? You need another stock idea to put it into.

23/

And these stock ideas not only have to keep coming; they must also be really good.

For example, with a 1 year holding period at a 20% tax rate, you have to generate 18.75% pre-tax to get 15% after tax.

You& #39;re not just on a treadmill. The treadmill itself is on an incline.

And these stock ideas not only have to keep coming; they must also be really good.

For example, with a 1 year holding period at a 20% tax rate, you have to generate 18.75% pre-tax to get 15% after tax.

You& #39;re not just on a treadmill. The treadmill itself is on an incline.

24/

But if you hold on to stocks for a long time, you don& #39;t need very many investment ideas.

You can go for quality over quantity. You can improve your odds of success by researching a few ideas really deeply, and being very selective about what you invest in.

But if you hold on to stocks for a long time, you don& #39;t need very many investment ideas.

You can go for quality over quantity. You can improve your odds of success by researching a few ideas really deeply, and being very selective about what you invest in.

25/

So, what kind of ideas make the cut?

Well, to hold a stock for a long time, we should first make sure the company will continue to *exist* for that long.

That is, the company must enjoy some kind of protection against competitors -- what Buffett calls a "moat".

So, what kind of ideas make the cut?

Well, to hold a stock for a long time, we should first make sure the company will continue to *exist* for that long.

That is, the company must enjoy some kind of protection against competitors -- what Buffett calls a "moat".

26/

It also helps if the company has lots of reinvestment opportunities.

That is, the company should be able to repeatedly reinvest its earnings back into its own business -- to grow these very earnings, at high rates of return (ROIIC), for a long time to come.

It also helps if the company has lots of reinvestment opportunities.

That is, the company should be able to repeatedly reinvest its earnings back into its own business -- to grow these very earnings, at high rates of return (ROIIC), for a long time to come.

27/

These are the companies that have the power to grow your money year after year -- for a "snowball effect" over long holding periods.

These are the companies that have the power to grow your money year after year -- for a "snowball effect" over long holding periods.

28/

I want to stress: "long holding period" does not mean "never sell".

For example, if you come across new information and realize that you made a mistake investing in a stock, it& #39;s perfectly OK to sell.

Forever is Buffett& #39;s *favorite* holding period, not his *only* one.

I want to stress: "long holding period" does not mean "never sell".

For example, if you come across new information and realize that you made a mistake investing in a stock, it& #39;s perfectly OK to sell.

Forever is Buffett& #39;s *favorite* holding period, not his *only* one.

29/

This investing style -- holding stocks for a long time -- also goes by "Coffee Can Investing".

Contrast this to "Cigar Butt Investing" -- repeatedly buying stocks cheap and flipping them quickly for fair value.

Now you know why I say get a cup of coffee, not a cigar!

This investing style -- holding stocks for a long time -- also goes by "Coffee Can Investing".

Contrast this to "Cigar Butt Investing" -- repeatedly buying stocks cheap and flipping them quickly for fair value.

Now you know why I say get a cup of coffee, not a cigar!

Read on Twitter

Read on Twitter