Stitch Fix is likely a $100b company within 10 years. Quick thread:

Stitch Fix owns a direct channel to recommend and ship products to 3.5m users (growing 20%/yr). Many are caught up in Pinduoduo’s "social commerce" model, but the real beauty is its ability to directly influence demand and thus optimize its operations and supply chain accordingly

Due to its understanding of exactly what customers want (aka what they will purchase) and direct influence over customer demand, Stitch Fix can essentially sell whatever products are best for its business*

*caveat that this should always align with what’s best for the customer

*caveat that this should always align with what’s best for the customer

Its also entirely built for mobile commerce. Shopping on mobile does not lend well to endless choice, and Stitch Fix& #39;s model is built around data science and pushing products. As its mobile business really ramps up, it will be able to generate meaningful ad revenue from suppliers

Stitch Fix is also extremely capital efficient. The core model has a negative cash conversion cycle as customers pay up front for boxes (and now a monthly sub). As the customer base gets larger, it gives even more leverage to stretch payables and reinvest in customer acquisition.

Stitch Fix recently expanded outside women& #39;s clothing into kids and men& #39;s. This expanded basket sizes being shipped to a household while also doubling the opportunity set to initially acquire one member of a household (from just moms to now either her kid(s) or her partner).

Eventually Stitch Fix could start ramping up product lines outside apparel in jewelry, home goods, and more. It already knows what customers want. This significantly increases it what it can recommend, the size of the market, ARPU, margins, order frequency, data collection, etc.

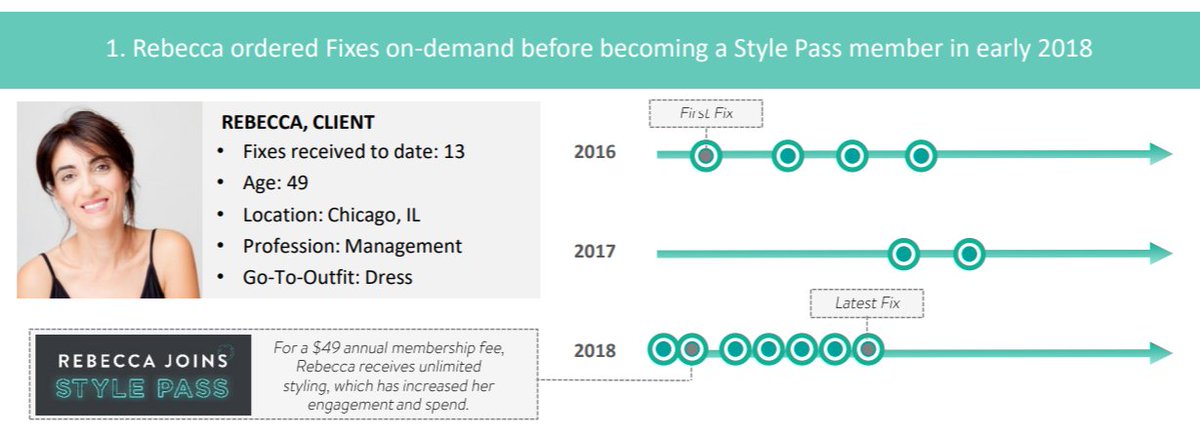

Stitch Fix& #39;s "Style Pass" is a $49/mo subscription that collects cash upfront while anchoring customers to making purchases. As it adds product types, it can start shipping clients more than just clothes, increasing revenue per order on the “fixed” shipping costs it’s incurring.

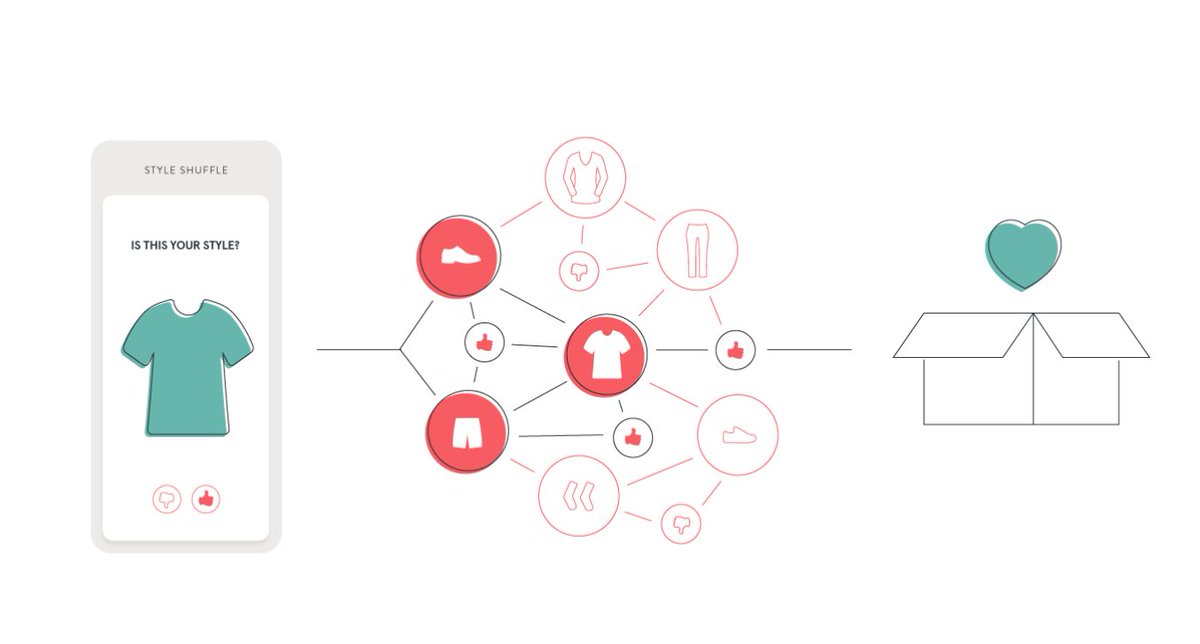

Stitch Fix has also experimented with games. Its most popular, a Tinder-like style game, was at one point played by over 75% of subscribers. Over time, other fun games are low hanging fruit to spur more interactions, increase retention, collect data, and nudge towards a purchase.

It’s impossible to have more products or ship faster than Amazon.

The beauty of non-intent purchases being made by Stitch Fix customers is that product selection and shipping speed doesn’t matter. It has a model that can realistically beat Amazon over time.

The beauty of non-intent purchases being made by Stitch Fix customers is that product selection and shipping speed doesn’t matter. It has a model that can realistically beat Amazon over time.

Stitch Fix is also founder led. CEO Katrina Lake is 38 years old and owns 16% of the company. She’s one of the smartest founders you’ll ever come across (the link below is a must listen) - someone you& #39;d want leading the company for the next 20-30 years.

http://investorfieldguide.com/katrina-lake-the-next-wave-of-e-commerce-invest-like-the-best-ep-187/">https://investorfieldguide.com/katrina-l...

http://investorfieldguide.com/katrina-lake-the-next-wave-of-e-commerce-invest-like-the-best-ep-187/">https://investorfieldguide.com/katrina-l...

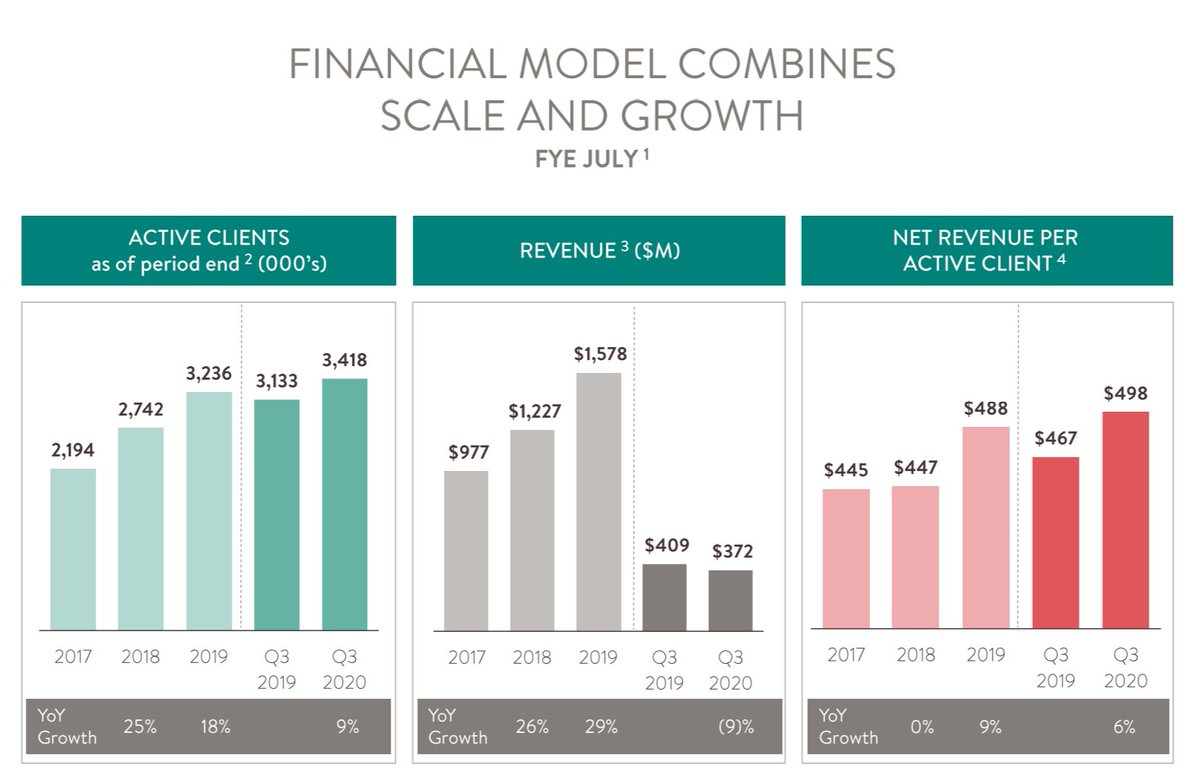

Stitch Fix trades at 1.4x its $1.7b LTM revenues

Ecomm likely grows 20%/yr over the next decade. As investors realize its strategic positioning and margin potential while growing ~25%/yr, we could see the multiple re-rate to 5-6x on $13-15b in 2029 revenue, or a $100b valuation.

Ecomm likely grows 20%/yr over the next decade. As investors realize its strategic positioning and margin potential while growing ~25%/yr, we could see the multiple re-rate to 5-6x on $13-15b in 2029 revenue, or a $100b valuation.

Forgot to include, but makeup has insane gross margins and feels perfect for Stitch Fix‘s distribution channel.

In the internet age, all that matters is owning customer demand at massive scale. SFIX is building this + now layering on subscription revenue. Will be fun to watch!

In the internet age, all that matters is owning customer demand at massive scale. SFIX is building this + now layering on subscription revenue. Will be fun to watch!

Read on Twitter

Read on Twitter