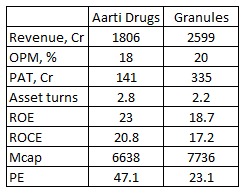

Granules asset turns and return ratios are dampened due to recent capacity addition. Lot of Capital is in progress.

Granules is in API and Formulation

While Aarti Drugs is in API and Speciality chemicals.

While Aarti Drugs is in API and Speciality chemicals.

As the capacity utilisation increases Granules ratios will catch up with Aarti. There is huge valuation gap between both.

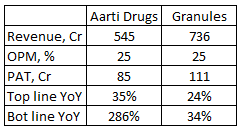

Debtor days

#AartuDrugs is 99 days

#Granules is 103 days

Inventory turnover

Aarti is 4.42, Granules is 3.26

Aarti is at lead here however FY19 Inventory turnover was very close.

#AartuDrugs is 99 days

#Granules is 103 days

Inventory turnover

Aarti is 4.42, Granules is 3.26

Aarti is at lead here however FY19 Inventory turnover was very close.

Debt to equity

Aarti is 0.6

Granules is 0.48

Granules is well capitalised here comparatively

Aarti is 0.6

Granules is 0.48

Granules is well capitalised here comparatively

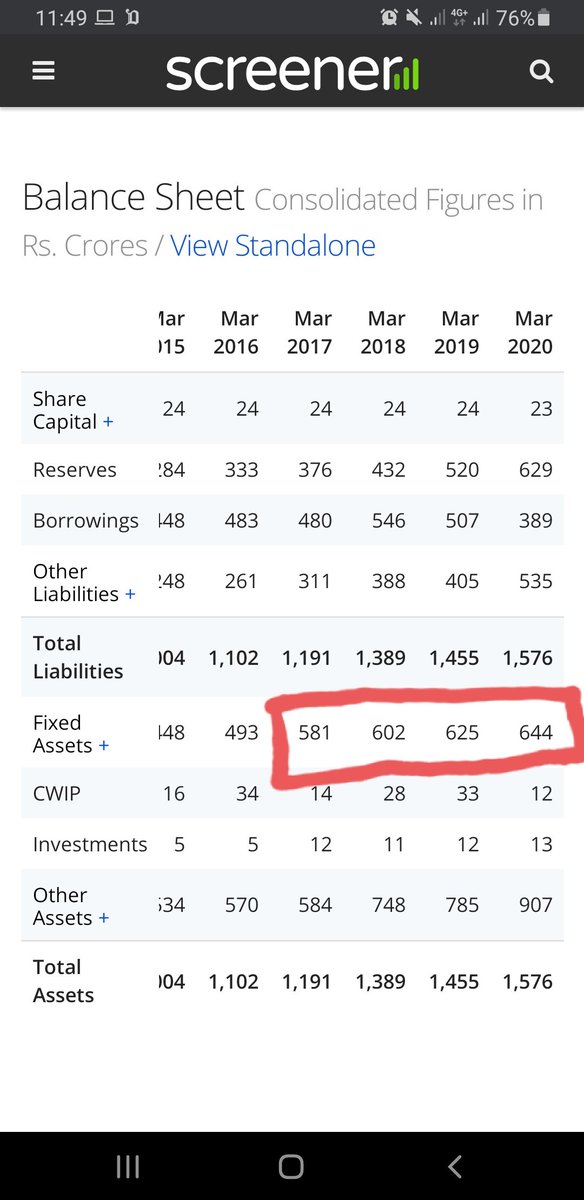

#AartiDrugs fixed assets are largely flat in last 4 years and no capital work in progress (CWIP). Where as #Granules doubled fixed assets in last 4 years and also huge CWIP

Read on Twitter

Read on Twitter