The Future of Brick-and-Mortar Retail Real Estate

I found a brick-and-mortar retail property for sale near me. It& #39;s fairly cheap and not too much money. It& #39;s in a good location.

This spurred me to think through what the future of this type of real estate was in this crazy time.

I found a brick-and-mortar retail property for sale near me. It& #39;s fairly cheap and not too much money. It& #39;s in a good location.

This spurred me to think through what the future of this type of real estate was in this crazy time.

I welcome criticism of this analysis. Hope to learn something from y& #39;all.

Here we go:

Covid and E-commerce have been the twin horsemen of death for retail re, causing many demand shifts, listed below.

Here we go:

Covid and E-commerce have been the twin horsemen of death for retail re, causing many demand shifts, listed below.

1. Covid has reduced the demand for restaurants and other non-store brick and mortar retail. This should be temporary. We know that because this is not the world’s first pandemic. We had restaurants after the 1918 influenza pandemic.

2. E-commerce is a permanent demand shift away from brick-and-mortar retail. However;

A. There is still demand for brick-and-mortar experiences i.e product discovery or sampling even if there reduced demand for purchasing physical goods in person

A. There is still demand for brick-and-mortar experiences i.e product discovery or sampling even if there reduced demand for purchasing physical goods in person

B. Bonobos guide shops with samples (and map pricing) will create some demand.

C. There are 100s of other viable brick and mortar businesses that are undisrupted by e-commerce i.e. hair salons, spas, massage parlors, restaurants, bars, dry cleaners, laundromats, etc.

C. There are 100s of other viable brick and mortar businesses that are undisrupted by e-commerce i.e. hair salons, spas, massage parlors, restaurants, bars, dry cleaners, laundromats, etc.

3. The entertainment provided by the internet relative to brick-and-mortar retail is causing a permanent demand shift towards the internet. However;

A. Many people go crazy without in person interaction.

A. Many people go crazy without in person interaction.

B. Again, there are many activities that people demand that cannot be done online such as haircuts, massages, experiential dining, nail salons etc.

4. While we may not see a 100% transition to remote work, even for jobs where 100% of the work can be done remotely, we will see some movement towards it. If we get a hybrid model where everyone works together in the same place once a week, it will cause demand for brick-and-

mortar retail on those areas that are dominated by office worker foot-traffic to fall.

Some more thoughts about remote work: https://twitter.com/Molson_Hart/status/1223483275198574592">https://twitter.com/Molson_Ha...

Some more thoughts about remote work: https://twitter.com/Molson_Hart/status/1223483275198574592">https://twitter.com/Molson_Ha...

5. Cities all over the United States are experiencing a crime wave. While it’s politically controversial, the political will exists on both sides of the aisle to get this problem fixed, probably through tougher policing and more mass incarceration.

When this happens, we’ll see the plywood on brick-and-mortar come down.

6. Grocery is the next thing to get disrupted by e-commerce and grocery stores will slowly cease to be the dependable brick-and-mortar anchors that they’re thought of now.

6. Grocery is the next thing to get disrupted by e-commerce and grocery stores will slowly cease to be the dependable brick-and-mortar anchors that they’re thought of now.

Those were the demand shifts. Let& #39;s look at supply now.

1. Supply will come down in brick and mortar retail but it won’t be every other store, it will be entire malls or entire neighborhoods of shops closing.

1. Supply will come down in brick and mortar retail but it won’t be every other store, it will be entire malls or entire neighborhoods of shops closing.

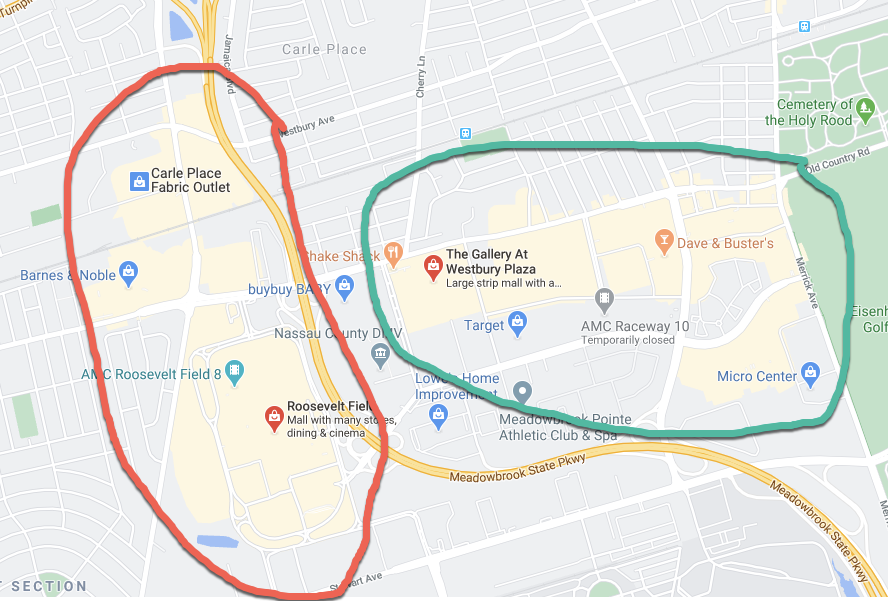

Either the red mall will close and become residential/industrial or the green mall will close. You won’t get a situation where 50% of each mall becomes vacant.

2. What survives? The most pleasant beautiful lindy stuff like tree lined streets and maybe malls in excellent locations.

Trend towards walkability continues.

Trend towards walkability continues.

3. With fewer people commuting, we will see more brick-and-mortar retail closer to where people live. Pretty mixed use developments will continue to pick up steam.

Summary and Action Plan

1. Brick-and-mortar retail is cheap (relatively) right now.

2. You& #39;ll do well if you buy in a brick-and-mortar neighborhood mall that survives

3. If you buy in a brick-and-mortar area that is dying, but can be converted to resi or industrial, you& #39;ll be ok

1. Brick-and-mortar retail is cheap (relatively) right now.

2. You& #39;ll do well if you buy in a brick-and-mortar neighborhood mall that survives

3. If you buy in a brick-and-mortar area that is dying, but can be converted to resi or industrial, you& #39;ll be ok

4. If you buy brick-and-mortar in office-worker heavy areas, you may have a long road ahead of you. I& #39;m not sure what& #39;s going to happen here, but I think in the long run you& #39;ll do all right but in short-term medium term, it& #39;s not good.

5. If you buy brick-and-mortar retail in/around dying malls in dying cities, good luck. You’re going to need it.

Welcome questions and criticism. I& #39;ve never purchased real estate in my life.

/thread

Welcome questions and criticism. I& #39;ve never purchased real estate in my life.

/thread

Read on Twitter

Read on Twitter