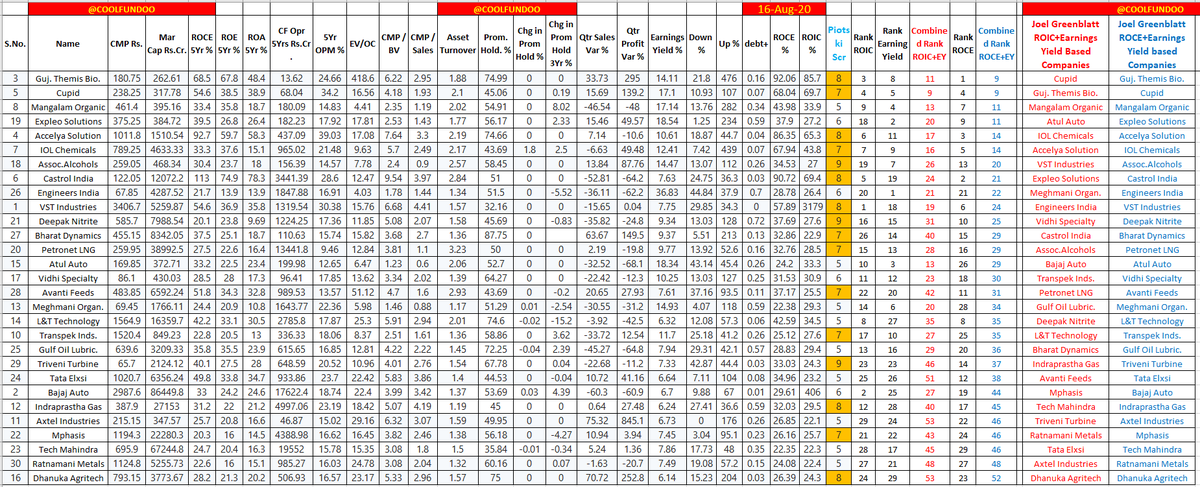

Joel Greenblatt& #39;s MAGIC FORMULA Screen for Indian Stocks with Additional filtering for Quality.

#Thread

4th Upd -16Aug2020

Added HOW TO USE Magic Formula & some more updates, so do read till end.

#MagicFormula #Stocks #Indianstocks #JoelGreenblatt

1

#Thread

4th Upd -16Aug2020

Added HOW TO USE Magic Formula & some more updates, so do read till end.

#MagicFormula #Stocks #Indianstocks #JoelGreenblatt

1

Magic formula =Good Stocks

@Attractive

Price

Higher Earnings Yield = Undervalued Stock

Higher ROIC/ROCE= Better Quality

Rank stocks on ROIC/ROCE (1 for Highest ROIC/ROCE)

Rank on Earning Yields (1 for Highest EY)

SUM the Ranks

RE-RANK on Combined score (1 for Lowest)

2

@Attractive

Price

Higher Earnings Yield = Undervalued Stock

Higher ROIC/ROCE= Better Quality

Rank stocks on ROIC/ROCE (1 for Highest ROIC/ROCE)

Rank on Earning Yields (1 for Highest EY)

SUM the Ranks

RE-RANK on Combined score (1 for Lowest)

2

Additonal Filtering -

Good ROCE/ROIC over a period of time. Min 22%.

Attractive Earnings Yield > 10YrGSec(5.85%).

Good Operating Cash Flow over a period of time.

Good Asset turnover ratio/Management Efficiency.

Stable Promoter holding.

3

Good ROCE/ROIC over a period of time. Min 22%.

Attractive Earnings Yield > 10YrGSec(5.85%).

Good Operating Cash Flow over a period of time.

Good Asset turnover ratio/Management Efficiency.

Stable Promoter holding.

3

Eliminated Financials & Utilities Stocks

Eliminated Stocks with too much fluctuation in Year on Year (YOY) Qrtrly Sales & Profit Growth(<-150% combined)

Took ROIC & ROCE & listed both rankings combined with Earnings Yield. Choose either as per your comfort.

Explanation -

4

Eliminated Stocks with too much fluctuation in Year on Year (YOY) Qrtrly Sales & Profit Growth(<-150% combined)

Took ROIC & ROCE & listed both rankings combined with Earnings Yield. Choose either as per your comfort.

Explanation -

4

ROIC = Net Operating Profit After Tax(NOPAT)/Invested Capital

= Return from Core Business

= Profitability relative to capital actually invested

ROCE = Net Operating Profit(EBIT)/Capital Employed

= Profitability relative to total capital employed

5

= Return from Core Business

= Profitability relative to capital actually invested

ROCE = Net Operating Profit(EBIT)/Capital Employed

= Profitability relative to total capital employed

5

Scope of ROCE is more extensive than ROIC.

ROCE is pre-tax measure while ROIC is post-tax measure.

Capital employed = Share capital + Reserves + Borrowings

Invested Capital = Capital employed - Non-operating assets (like Cash or Cash equivalents)

6

ROCE is pre-tax measure while ROIC is post-tax measure.

Capital employed = Share capital + Reserves + Borrowings

Invested Capital = Capital employed - Non-operating assets (like Cash or Cash equivalents)

6

Earnings Yield = Net Operating Profit(EBIT) / Enterprise value.

How to Use Magic Formula ?

As per Greenblatt - Invest in Top 30 with 2-3 positions each month over a year

Each year, Re-balance Portfolio

Re-balancing Explanation ->

7

How to Use Magic Formula ?

As per Greenblatt - Invest in Top 30 with 2-3 positions each month over a year

Each year, Re-balance Portfolio

Re-balancing Explanation ->

7

Sell off losers one week before the year-term ends (Tax-loss harvesting)

Sell off winners one week after the year mark (Long term gain Tax-harvesting)

Repeat for 5 - 10 yrs.

8

Sell off winners one week after the year mark (Long term gain Tax-harvesting)

Repeat for 5 - 10 yrs.

8

Please refer Previous Series Update in below link -

12Jul2020

https://twitter.com/Coolfundoo/status/1284374250267312128?s=20

9">https://twitter.com/Coolfundo...

12Jul2020

https://twitter.com/Coolfundoo/status/1284374250267312128?s=20

9">https://twitter.com/Coolfundo...

Google Drive Shared link of

JG Greenblatt Magic Formula - 16Aug2020 https://drive.google.com/file/d/1etz0zFyxCTOMBIQZAaw3v8DTZL0T1vm7/view?usp=sharing">https://drive.google.com/file/d/1e...

JG Greenblatt Magic Formula - 16Aug2020 https://drive.google.com/file/d/1etz0zFyxCTOMBIQZAaw3v8DTZL0T1vm7/view?usp=sharing">https://drive.google.com/file/d/1e...

Read on Twitter

Read on Twitter