*Thread on Life Insurance Industry & HDFC Life*

Current Life Insurance Industry in terms of total premium business is 4.6 Trillion, with current penetration of mere 2.7%.

Definitely there is huge potential in Life Insurance compare to other emerging countries (not China)

1/12

Current Life Insurance Industry in terms of total premium business is 4.6 Trillion, with current penetration of mere 2.7%.

Definitely there is huge potential in Life Insurance compare to other emerging countries (not China)

1/12

In Life Insurance there are 24 players. India is 10th largest in the world & 5th largest in Asia in terms of Life Insurance Business (Industry)

With low penetration, awareness & post COVID, this industry should grow leaps & bounds (pure insurance).

2/12

With low penetration, awareness & post COVID, this industry should grow leaps & bounds (pure insurance).

2/12

What these Insurance Organizations sell?

Savings & Protection Plans

Savings Plans are basically combination of "Investments & Insurance"

Eg. ULIP, Endowment Policies, Par & Non Par

Protection Plans are 100% insurance.

Eg. Term Insurance, Group & Annuity

3/12

Savings & Protection Plans

Savings Plans are basically combination of "Investments & Insurance"

Eg. ULIP, Endowment Policies, Par & Non Par

Protection Plans are 100% insurance.

Eg. Term Insurance, Group & Annuity

3/12

About HDFC Life ~

a young leading player in domestic life insurance, in Nov& #39;17 listed on NSE & BSE.

Products:

~ ULIP

~ Par & Non Par

~ Group Insurance

~ Annuity

~ Term Insurance

A diversified pdt mix with highest margins & returns ratios.

4/12

a young leading player in domestic life insurance, in Nov& #39;17 listed on NSE & BSE.

Products:

~ ULIP

~ Par & Non Par

~ Group Insurance

~ Annuity

~ Term Insurance

A diversified pdt mix with highest margins & returns ratios.

4/12

5/12

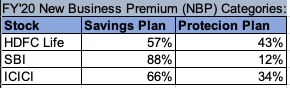

In Pvt Insurers, HDFC Life is leader in Protection Plans (Term & Annuity).

In last 5 years,

~ HDFC Life& #39;s Protection (Term & Annuity) grown from 21% to 43%

~ HDFC Life& #39;s Savings (ULIP & Others) de grown from 79% to 57%

V Good Indictor!

6/12

In last 5 years,

~ HDFC Life& #39;s Protection (Term & Annuity) grown from 21% to 43%

~ HDFC Life& #39;s Savings (ULIP & Others) de grown from 79% to 57%

V Good Indictor!

6/12

HDFC Life Subsidiaries ~

1. HDFC Pension

2. HDFC International & Re

(for details visit HDFC Life Website)

7/12

1. HDFC Pension

2. HDFC International & Re

(for details visit HDFC Life Website)

7/12

Look at HDFC Life& #39;s massive distribution network  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, in last few quarters, HDFC Life has grown their direct business, selling more policies directly than through channels, improvising on their margins.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, in last few quarters, HDFC Life has grown their direct business, selling more policies directly than through channels, improvising on their margins.

8/12

8/12

LY No. of Lives Insured by large pvt players

HDFC Life: 6.13 Cr

SBI Life: 0.9 Cr

ICICI Pru: 0.4 Cr

Does 80 C clause impact HDFC Life & Others, not really. As I mentioned above they are shifting from selling Savings Plans to hardcore Insurance ~ Term, Group & Annuity.

9/12

HDFC Life: 6.13 Cr

SBI Life: 0.9 Cr

ICICI Pru: 0.4 Cr

Does 80 C clause impact HDFC Life & Others, not really. As I mentioned above they are shifting from selling Savings Plans to hardcore Insurance ~ Term, Group & Annuity.

9/12

With improvement in life expectancy (by 2050, Indians life expectancy will be 75yrs ), Post COVID Awareness & Education this industry & HDFC Life should do well.

BTW ~ not a recommendation to buy this stock.

10/12

BTW ~ not a recommendation to buy this stock.

10/12

On Valuation, compare to SBI & ICICI Pru, HDFC Life does demands high PE of 90 and high PEV (Price to Embedded Value) of 4.7.

11/12

11/12

If you read tweet no. 6, v will understand why PE & PEV are high. HDFC Life is becoming a core Insurance Org.

Their focus is more on selling Protection plans than Savings.

12/12

Their focus is more on selling Protection plans than Savings.

12/12

If you are curious to know how their CEOs are paid annually:  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Leicht lächelndes Gesicht" aria-label="Emoji: Leicht lächelndes Gesicht">

HDFC Life: 4.88 Cr

ICICI Pru: 7.60 Cr

SBI Life: 0.50 Cr

End

HDFC Life: 4.88 Cr

ICICI Pru: 7.60 Cr

SBI Life: 0.50 Cr

End

Analyst says valuation at 600 is high, but if we have plans to hold for a decade, do we really need to care short term high valuation?

Disc: Invested

Read on Twitter

Read on Twitter

, in last few quarters, HDFC Life has grown their direct business, selling more policies directly than through channels, improvising on their margins. 8/12" title="Look at HDFC Life& #39;s massive distribution network https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, in last few quarters, HDFC Life has grown their direct business, selling more policies directly than through channels, improvising on their margins. 8/12" class="img-responsive" style="max-width:100%;"/>

, in last few quarters, HDFC Life has grown their direct business, selling more policies directly than through channels, improvising on their margins. 8/12" title="Look at HDFC Life& #39;s massive distribution network https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">, in last few quarters, HDFC Life has grown their direct business, selling more policies directly than through channels, improvising on their margins. 8/12" class="img-responsive" style="max-width:100%;"/>