Square& #39;s Cash App apparently is testing a lending product that enables users to borrow $20-200.

So --- Borrowing 20 bucks from an app doesn& #39;t sound like a big deal?

It does.

Hint: The $27 billion payday lending market.

Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://techcrunch.com/2020/08/12/square-cash-app-borrowing/">https://techcrunch.com/2020/08/1...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://techcrunch.com/2020/08/12/square-cash-app-borrowing/">https://techcrunch.com/2020/08/1...

So --- Borrowing 20 bucks from an app doesn& #39;t sound like a big deal?

It does.

Hint: The $27 billion payday lending market.

Thread

It should not be a surprise that Cash App& #39;s first lending product targets the (by many called predatory) payday lending market.

Recall @jack& #39;s comments on last Square call: "We& #39;re looking for the most critical financial services that people haven& #39;t had access to in the past"

Recall @jack& #39;s comments on last Square call: "We& #39;re looking for the most critical financial services that people haven& #39;t had access to in the past"

Much like Square& #39;s motto on the merchant side is to "empower small businesses", Cash App& #39;s product road map has been focused on democratizing consumer financial services, such as enabling users to purchase bitcoin (ie financial self-sovereignty), invest via fractional shares etc.

In the past, we& #39;ve documented the overlap of Cash App users with the large unbanked populations in the South of the US and that Cash App is "banking the unbanked".

Similar dynamics are true for alternative credit. Southern states have some of the highest APRs for payday loans.

Similar dynamics are true for alternative credit. Southern states have some of the highest APRs for payday loans.

A payday loan is an unsecured cash advance, normally for less than $1000 and 2 weeks (until next paycheck)

Borrowers only need a pay stub, ID and write a post-dated check that will be cashed after 2 weeks

The lender charges an initial fee and a fee for extension ("roll-over")

Borrowers only need a pay stub, ID and write a post-dated check that will be cashed after 2 weeks

The lender charges an initial fee and a fee for extension ("roll-over")

In 2017, there were 14,348 payday loan storefronts in the US

That& #39;s more than the 14,027 McDonalds locations in the US in the same year.

12 million Americans take out $27 billion in payday loans each year and pay over $4 billion in fees.

That& #39;s more than the 14,027 McDonalds locations in the US in the same year.

12 million Americans take out $27 billion in payday loans each year and pay over $4 billion in fees.

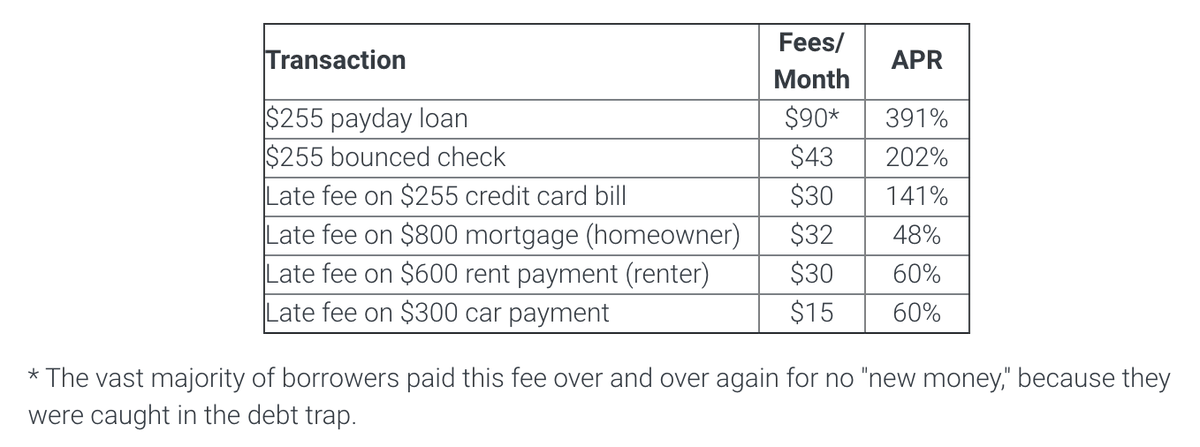

Fees range from $15-30+ per $100 borrowed, resulting in an average payday loan APR of 391% in the US.

Borrowers in Texas on average pay an astonishing 661% APR for payday loans.

See the map below for a state-by-state comparison.

Borrowers in Texas on average pay an astonishing 661% APR for payday loans.

See the map below for a state-by-state comparison.

To put these rates into perspective, the average payday loan APR of 391% is double the APR of a bounced check fee, nearly 3x the late fee for a credit card bill and over 6x the late fee on a car payment.

In part because 7 in 10 borrowers use payday loans for recurring expenses such as rent and utilities, 80% of payday loans are rolled over or followed by another loan within 14 days, leaving borrowers in debt traps.

Fore more, see this paper by the CFPB;

https://files.consumerfinance.gov/f/201403_cfpb_report_payday-lending.pdf">https://files.consumerfinance.gov/f/201403_...

Fore more, see this paper by the CFPB;

https://files.consumerfinance.gov/f/201403_cfpb_report_payday-lending.pdf">https://files.consumerfinance.gov/f/201403_...

Defaulting on a payday loan results in high overdraft fees in case the borrower’s bank accepts her post-dated check or trigger Non-Sufficient Fund (NSF) fees in case the check bounces back.

Americans paid an estimated $25 billion in overdraft fees in 2019.

Americans paid an estimated $25 billion in overdraft fees in 2019.

Let& #39;s compare Cash App and a typical payday (PD) loan.

Pricing:

PD: $15 per $100, for initial two weeks as well as extra $15 fee per additional 2 weeks extension.

Cash App: 5% flat fee -> $5 per $100, plus non-compounding 1.25% interest per additional 1 week extension.

Pricing:

PD: $15 per $100, for initial two weeks as well as extra $15 fee per additional 2 weeks extension.

Cash App: 5% flat fee -> $5 per $100, plus non-compounding 1.25% interest per additional 1 week extension.

For a $200 loan, a PD borrower has to pay back $230 after 2 week.

Cash App& #39;s loan term is 4 weeks not 2, so borrower has to pay back $210 after 4 weeks.

But with four roll-overs (8 extra weeks), a PD loan turned into $350 ($200+5*$30).

Cash App& #39;s loan term is 4 weeks not 2, so borrower has to pay back $210 after 4 weeks.

But with four roll-overs (8 extra weeks), a PD loan turned into $350 ($200+5*$30).

Meanwhile, a Cash App loan that is rolled-over for 8 weeks compounds to $230 ($200+$200*5%+8*$200*1.25%) -that& #39;s the same amount traditional payday borrowers must pay back after only 2 weeks, without any roll-overs.

Cash App is preventing borrowers to fall into deep debt traps.

Cash App is preventing borrowers to fall into deep debt traps.

With its this new product, Cash App provides consumers with a cheaper and more humane alternative to expensive payday loans.

Cash App does not have the high infrastructure costs and capital intensity as payday lenders and can leverage the digital Cash App platform..

Cash App does not have the high infrastructure costs and capital intensity as payday lenders and can leverage the digital Cash App platform..

.. to acquire users cheaply (for ~$20 while trad. banks pay up to $1500 per customer) and cross-sell them.

Cash App also should be able to leverage existing relationships with institutional investors built via Square Capital to sell off loans to mitigate balance sheet risk.

Cash App also should be able to leverage existing relationships with institutional investors built via Square Capital to sell off loans to mitigate balance sheet risk.

CashApp could not only penetrate the single-payment credit market but expand it by offering attractive short term cash advance to other parts of its 30 million MAUs who did not consider payday loans in the past.

It could impact the single payment credit market, beyond PD loans.

It could impact the single payment credit market, beyond PD loans.

Similar to how Square Capital solved the market for four/low five digit small business loan market which was not served well by banks, Cash App can reduce inefficiencies in the payday/pawn/overdraft market, which amounts to a total addressable market of $40 billion in revenues.

Read on Twitter

Read on Twitter